The Top 3 Dividend Paying Spin-Off Stocks Today

This is a guest contribution by Rich Howe, CFA. Rich monitors the stock spin-off market at Stock Spin-Off Investing.

Legendary investor Peter Lynch, wrote in his investing classic One Up on Wall Street:

“Spin-offs often result in astoundingly lucrative investments.”

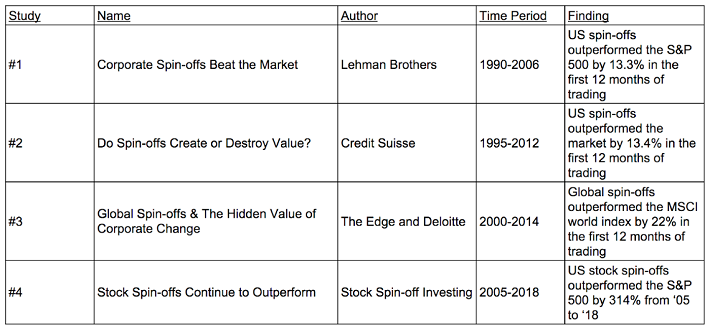

Mr. Lynch wrote his book back in 1989, but lucky for us, stock spin-offs continue to outperform the broader market today. Study after study confirms this stock market anomaly.

Select Stock Spin-off Studies Show Significant Outperformance

Links to the four studies from the image above are below:

- Corporate Spin-offs Beat the Market

- Do Spin-offs Create or Destroy Value?

- Global Spin-offs & The Hidden Value of Corporate Change

- Stock Spin-offs Continue to Outperform

The evidence shows that spin-offs outperform…But what exactly is a spin-off?

A spin-off occurs when a publicly traded company separates part of its business into a second public company and distributes its shares in the new business on a pro-rata basis to existing investors. Spin-offs occur because management thinks their business is undervalued by the market, and believes (with good reason) splitting the business up into a simpler structure will force investors to re-value the spin-off and parent more inline with comparable companies. Let’s walk through an example to see how the spin-off process works in practice.

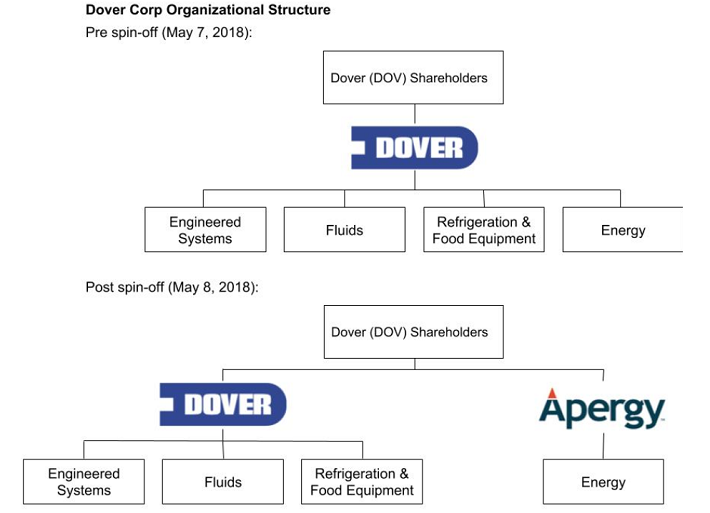

Spin-Off Example:Dover

On May 8, 2018, Dover (DOV), a Dividend King and conglomerate manufacturer of industrial products, spun off its energy business, Apergy(APY), into an independent public company and distributed its shares to existing Dover shareholders.

Source: Stock Spin-off Investing

The distribution ratio was 1:2 which means that for every 2 shares of Dover owned, an investor would receive 1 share in the new company, Apergy. Prior to the spin-off, assuming an investor owns 1,000 share of DOV. After the spin-off, that same investor would own 1000 shares of DOV, and also, 500 shares of APY.

Why Do Spin-Offs Outperform?

Usually stock spin-offs begin trading at a low valuation. This occurs for a couple reasons:

Reason 1: Spin-offs are distributed to investors (not sold like in an IPO) and so there is very little publicity regarding the new company. Generally, no or few analyst cover the stock and so it is not marketed to institutional investors. Further, the spin-off is usually much smaller than the parent company, and oftentimes, institutional investors are prohibited from owning shares in the spin-off. Let me explain. If a large cap mutual fund manager owns a large cap company which distributes a small cap spin-off, that mutual fund manager’s investment mandate prevents the manager from holding the spin-off. For these reasons, many investors sell their shares in the spin-off regardless of price or underlying value.

Reason 2: The management team of the new spin-off has very little incentive to promote the company initially. In fact, the management team is incentivize to not promote the stock. Why? Because management stock options are usually priced based on the first couple weeks of trading. The lower the stock trades initially, the greater value potential the options have.

And despite a very low initial valuation, spin-off companies tend to perform well. Why? Because “capitalism, with all its drawbacks, actually works” as Joel Greenblatt, famous spin-off investor, once wrote.

Bureaucracy shrinks and entrepreneurial forces are unleashed. “The combination of accountability, responsibility, and more direct incentives take their natural course,” according to Greenblatt.

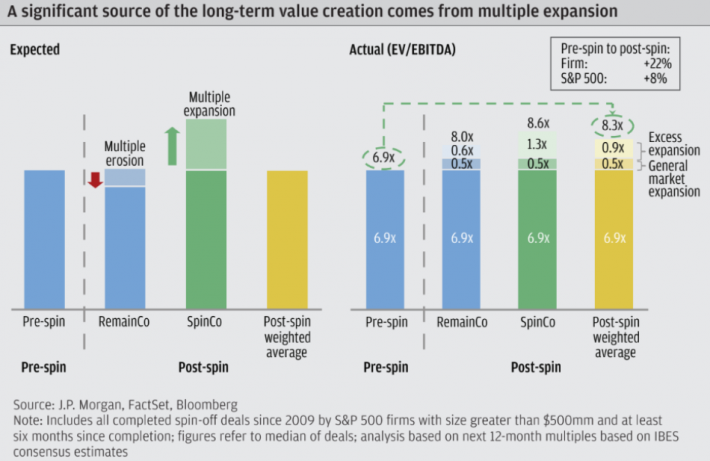

The combination of a low initial valuation and strong operating performance generally leads to a higher valuation and strong stock performance. J.P. Morgan looked at U.S spin-offs from 2009 to 2015 and found that the average valuation for spin-offs, on average, increased from 6.9x EBITDA to 8.6x EBITDA.

Source: J.P. Morgan

We’ve established that stock spin-offs outperform. And if you are reading Sure Dividend, you know that dividend paying stocks have historically outperformed.

Combining the two factors can give investors the chance to generate capital gains from spin-off alpha while also collecting dividend income. An example is Abbott’s 2014 spin-off of its pharmaceutical division, Abbvie (ABBV). Since the spin-off, ABBV has generated a total return of 232.0%, outperforming the S&P 500 by 110.1%. During that period, Abbvie grew its quarterly dividend by 140%. Its current indicated dividend yield is ~4.2%.

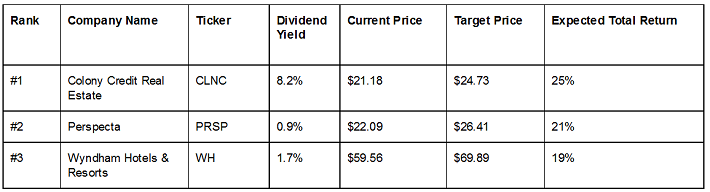

Let’s review the top 3 dividend paying stocks today for investors interested in spin-offs.

Dividend Paying Spin-Off #3:Wyndham Hotels & Resorts

- Ticker: WH

- Share Price: $59.56

- Market Capitalization: $5.9BN

- Enterprise Value: $8.0BN

- Dividend Yield: 1.7%

Spin-off Background: On June 1, 2018, Wyndham Destinations (WYND), a timeshare company, spun out its franchise business into a new publicly traded company called Wyndham Hotel Group (WH).

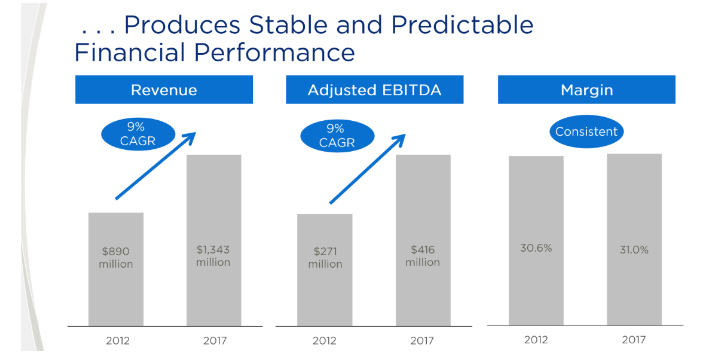

Business Overview: Wyndham Hotel Group (Wyndham) is in the business of licensing its hotel brands to hotel owners to help them attract guests. In addition, WH manages hotel properties on behalf of third-party owners. The benefit of WH’s business model is that it is asset-light and driven by fee income which drives consistent earnings and cash flow growth.

Source: Wyndham Hotel Group Investor Relations

Wyndham’s brands are well-know and cater to value oriented guests. While Wyndham’s typical guest is a leisure traveler, its industry-leading scale and presence in major, secondary and tertiary cities also attracts business travelers. Over 1,300 hotels affiliated with Wyndham brands are located on interstate and highway roadsides, catering to value-oriented guests seeking quality accommodations in convenient locations.

Source: Wyndham Hotel Group Investor Relations

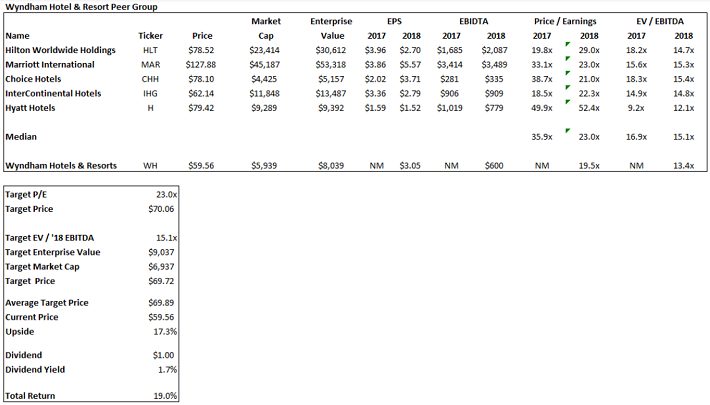

Given Wyndham’s strong brands and attractive business model, it is well positioned to continue to grow. Despite strong fundamentals, Wyndham trades at a discount to peers (often the case with spin-offs). On an Enterprise Value to 2018 EBITDA basis, WH trades at 13.4x multiple while peers trade at 15.1x. On Price to 2018 EPS basis, WH trades at 19.5x while peers trade at 23.0x. We believe WH should trade at parity with peers which implies a ~$70 share price and ~17% upside. Including a $1.00 dividend (1.7% yield), and WH should generate a ~19% total return over the next twelve months.

Source: Author’s Analysis

Dividend Paying Spin-Off #2:Perspecta

- Ticker: PRSP

- Share Price: $22.09

- Market Capitalization: $3.6BN

- Enterprise Value: $6.3BN

- Dividend Yield: 0.9%

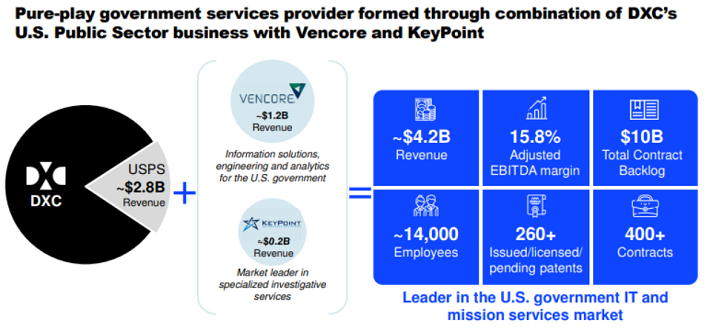

Spin-off Background:On June 1, 2018, DXC Technologies (DXC), an IT services company, spun out its government services business into a new publicly traded company and merged it with two private equity owned government service companies. The new company is called Perspecta (PRSP).

Business Overview:Perspecta is comprised of three divisions:

(1) DXC’s legacy U.S. public sector business (USPS). Examples of services performed:

- Operating and maintaining the Navy’s IT network

- Medicare claims processing and fraud detection

- Incorporation of cloud capabilities into legacy government systems

(2) Vencore, formerly a private equity owned portfolio company. Examples of services performed:

- Cybersecurity services

- Big data analytics

(3) KeyPoint, formerly a private equity owned portfolio company. Examples of services performed:

- Investigative services (background checks)

Source: Perspecta Investor Relations

Perspecta will benefit from a stable outlook for government spending. Overall spending within the public sector market is expected to growth 1.5% and 2.0% annually between 2017 and 2022 according to Deltek, Inc, a firm specializing in serving government focused firms. Further, the state and local government markets are anticipated to grow between 3.5% and 4.0% annually between 2018 and 2023 largely driven by demand for complex multi-year IT programs that require high levels of subject matter and regulatory expertise.

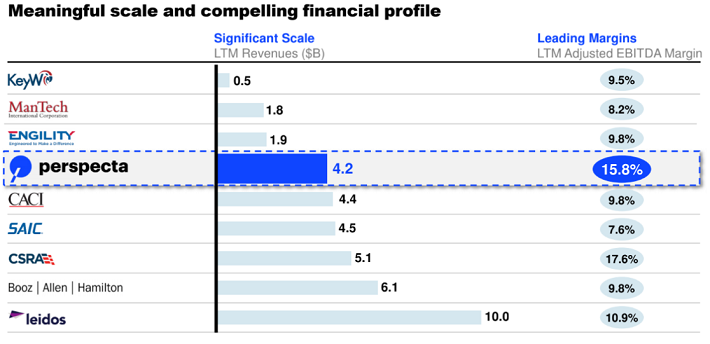

Perspecta has significant scale and is focused on fixed priced contracts which allow it to generate industry leading margins.

Source: Perspecta Investor Relations

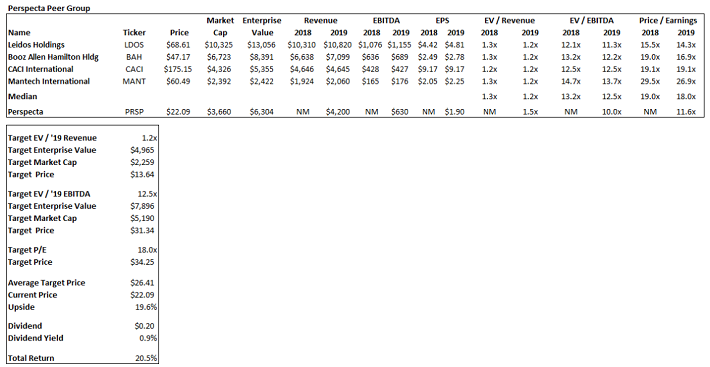

Despite these strengths, Perspecta trades at a discount to peers on most metrics. On an Enterprise Value to 2019 Revenue basis, PRSP trades at 1.5x multiple while peers trade at 1.2x. On an Enterprise Value to 2019 EBITDA basis, PRSP trades at 10.0x multiple while peers trade at 12.5x. On Price to 2019 EPS basis, PRSP trades at 11.6x while peers trade at 18.0x. We believe PRSP should trade at parity with peers which implies a ~$26.42 share price and ~19.6% upside. Including a $0.20 dividend (0.9% yield), and PRSP should generate a 20.5% total return over the next twelve months.

Source: Author’s Analysis

Dividend Paying Spin-Off #1:Colony Credit Real Estate

- Ticker: CLNC

- Share Price: $21.18

- Market Capitalization: $2.7BN

- Enterprise Value: $7.3BN

- Dividend Yield: 8.2%

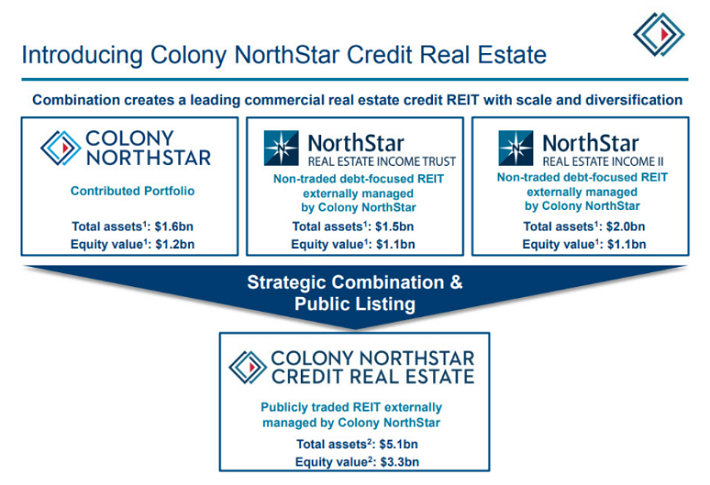

Spin-off Background: On February 1, 2018, Colony Capital Operating Company, a leading real estate investment management, spun off $1.6BN of real estate assets and merged it with the Northstar Real Estate Income Trust ($1.5BN of assets) and the North Star Real Estate Income II ($2.0BN of assets). The spin-off is named Colony Credit Real Estate (CLNC).

Source: Colony Credit Investor Relations

Business Overview: Colony Credit Real Estate is a CRE real estate investment trust (REIT) focused on originating, acquiring, financing and managing a diversified portfolio consisting primarily of commercial real estate loans in the United States.

Source: Colony Credit Investor Relations

CLNC’s business model is to make loans (primarily floating rate) and other investments that generate yield. On average, those investments generate yields ranging from ~5.0% to ~14.0% depending on their seniority and credit quality. CLNC uses equity and debt (debt to equity ratio is currently 157%) to fund those loans at an average cost of debt of 4.1%. Investors benefit from the net interest margin that is generated and then paid out to investors.

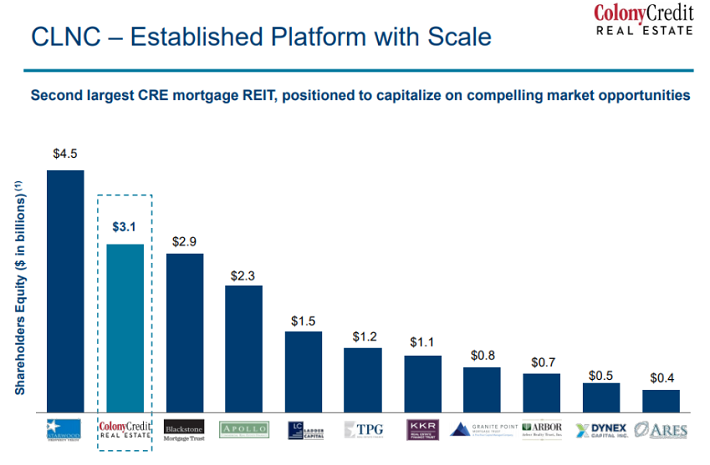

The commercial real estate lending outlook is strong driven by a combination of near term maturities, strong CRE transaction volumes, and lower supply from traditional lenders. CLNC, as the second largest mortgage REIT, is well positioned to benefit from that growth.

Source: Colony Credit Investor Relations

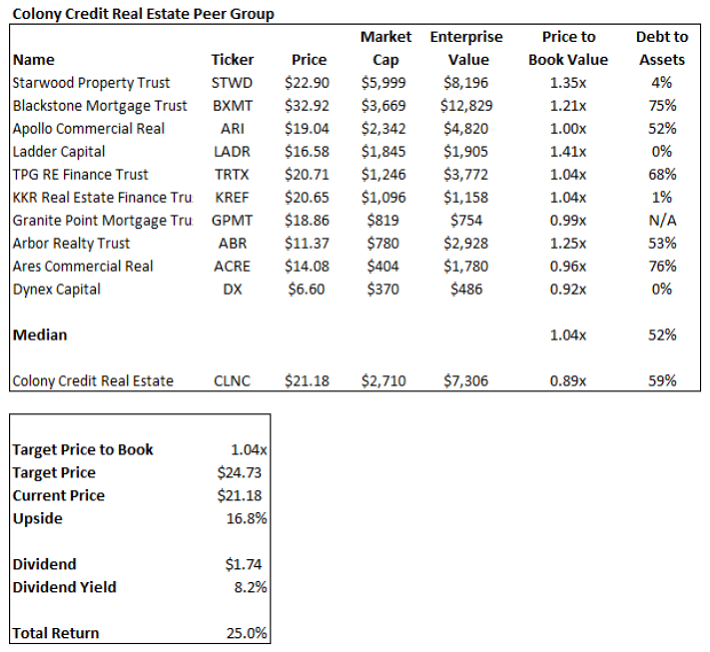

Despite these strengths, CLNC trades at a discount to its peers on the most relevant valuation metric for CRE REITs, price to book. CLNC trades at 0.89x while peers trade at 1.04x. Assuming that valuation gap closes within a year, CLNC would trade at $24.73, implying ~17% upside. Including a $1.74 dividend (8.2% yield), and CLNC should generate a ~25% return over the next twelve months.

Source: Author’s Analysis

Final Thoughts

Investing in dividend paying stock spin-offs can be a great way for investors to generate impressive total returns while also collecting current income. CLNC, PRSP, and WH are all positioned to generate solid total returns in the year ahead while providing meaningful current income.

Note: Stock prices are as of 8/1/2018

If you are interested in additional dividend paying stock spin-offs, click here to download a list of all dividend paying spin-off stocks.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more