The Prospects For IBM And Dell In 2021

As we head into 2021, identifying value in the stock market is more than a challenge. The best performing sector during one period often turns into the worst in the next. In 2020, the leading sector of the stock market has been technology, hands down.

Anyone holding shares in the leading technology companies at the end of 2019 experienced lots of indigestion from mid-February through late March 2020. If they held on and bought more shares, the results were nothing short of a home run. The global pandemic set the stage for extraordinary earnings growth as it allowed communication, working, shopping, and entertainment during lockdowns and social distancing.

The virus expanded the addressable market for technology companies as technotards, like me, had to get with the program or risk contact with the outside world. The pace of earnings growth pushed stocks like Apple (AAPL), Alphabet (GOOG), Facebook (FB), Amazon (AMZN), and others to incredible heights.

It is a challenge for these companies to continue the earnings growth pace to support share the price appreciation experienced in 2020. Meanwhile, the market cap growth and overall wealth of the leading technology companies created new problems for the coming year.

International Business Machines Corporation (IBM - Get Rating) and Dell Technologies (DELL - Get Rating) are also technology companies. IBM and DELL are not expensive stocks. Meanwhile, as we move into 2021, these two companies could be the best bet as technology will continue to provide cutting edge solutions. At their share prices at the end of 2020, IBM and DELL offer something lacking in the technology sector, value.

Tech was the bullish bomb in 2020

The tech-heavy Nasdaq closed 2019 at 8,972.60; at the end of last week, with one week to go in 2020, the composite was trading at the 12,804.73 level, 42.7% higher.

Big tech led the bullish charge this year as:

- APPL moved from $73.41 to $131.97 or 79.8% higher

- AMZN rallied from $1847.84 on December 31, 2019, to $3,172.69 on December 24, 2020, a gain of 71.7%.

- GOOG rose from $1337.02 to $1738.85 or 30.1%

- FB shares increased from $205.25 to $267.40 or 30.3%.

All of these companies were already trading at sky-high valuations at the end of 2019. The total market cap of the four stood at almost $5.8 trillion. Apple’s market cap was north of $2 trillion, Amazons’ was over $1.5 trillion, Google’s was nearly $1.2 trillion, and Facebook was worth over a cool three-quarters of a billion.

As we move into 2021, many tech leaders could find themselves in the crosshairs of regulators and politicians. The US and European systems encourage growth and profits but punish dominance and anti-competitive behaviors. Moreover, in a world where access to data provides advantages, the sheer size and market penetration of the leading companies make them targets. Many legislators favor breaking up the most prominent companies into small parts to foster competition and avoid predatory dominance.

Litigation and a more aggressive regulatory environment could increase costs and weigh on profits for the tech leaders in 2021 and beyond, but that will not stop the innovation that comes from the sector. Two companies with small market caps that have been around for a long time could continue to rally in the coming year even if the high-flyers in the trillionaires club stumble.

IBM could shine next year- Value with a capital V

IBM has been around for over a century; all of the leading technology companies date back to the late 1970s in AAPL’s case, 1990s in GOOG and AMZN’s cases, and after the turn of this century, in FB’s.

IBM provides a broad range of integrated technology solutions and services worldwide. The company stands on the cutting edge in blockchain and AI platforms and development. IBM consistently reports profits.

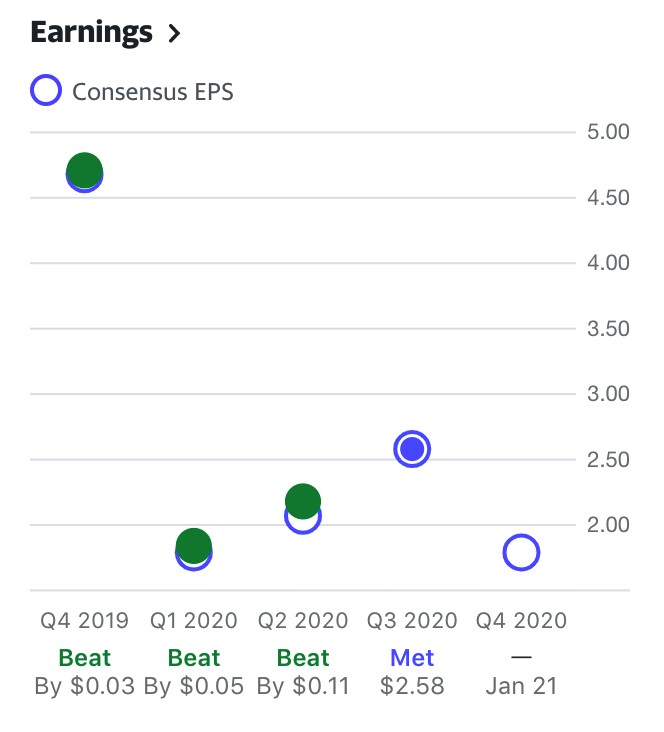

Source: Yahoo Finance

Over the past four quarters, IBM has met or exceeded consensus EPS forecasts. The market expects the company to earn $1.79 per share in Q4 2020.

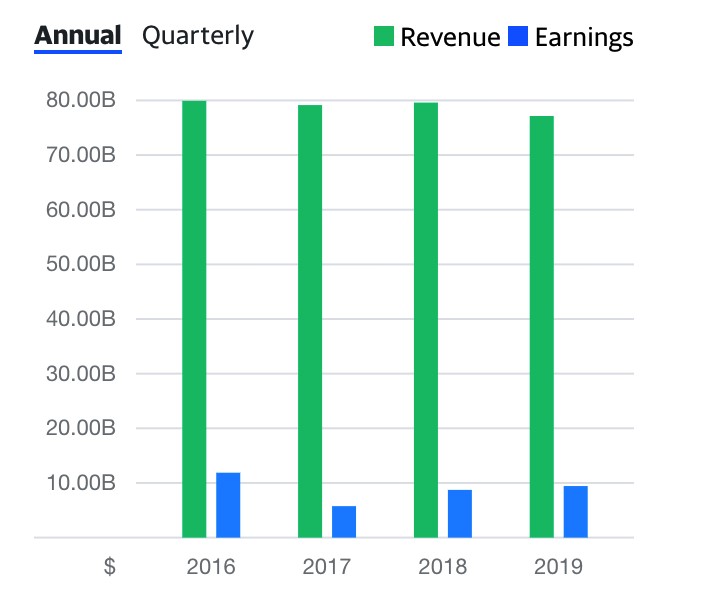

Source: Yahoo Finance

The chart shows that revenues and earnings have been steady over the past four years. IBM was trading at just below the $125 level on December 24. A survey of sixteen analysts on Yahoo Finance has an average price target of $137.13 for IBM, with forecasts ranging from $115 to $165. Many Wall Street companies rate the shares buy or outperform.

Meanwhile, of the group of AAPL, AMZN, GOOG, and FB, only Apple pays its shareholders a dividend. As of December 24, AAPL’s yield was around the 0.62% level. IBM pays its shareholders $6.52 per share, translating to a 5.2% on December 24. IBM’s market cap was just over $111 billion, putting the company off the regulatory and political radar. The stock is trading at a price to earnings ratio of under fifteen times earnings, which is a sign of value.

Source: Barchart

The strong financial indicators have not helped IBM post a gain on the year. The stock closed 2019 at $134.04. At the $124.69 level, IBM offers value with a capital V going into 2021.

Dell’s earnings trajectory is impressive

DELL designs, develops, manufactures, markets, sells, and supports IT hardware, software, and services solutions worldwide. The company has been around since 1984.

Source: Yahoo Finance

The earnings trajectory over the past three quarters has been impressive, beating EPS estimates consistently. The consensus forecast for Q4 is for DELL to earn $2.13 per share.

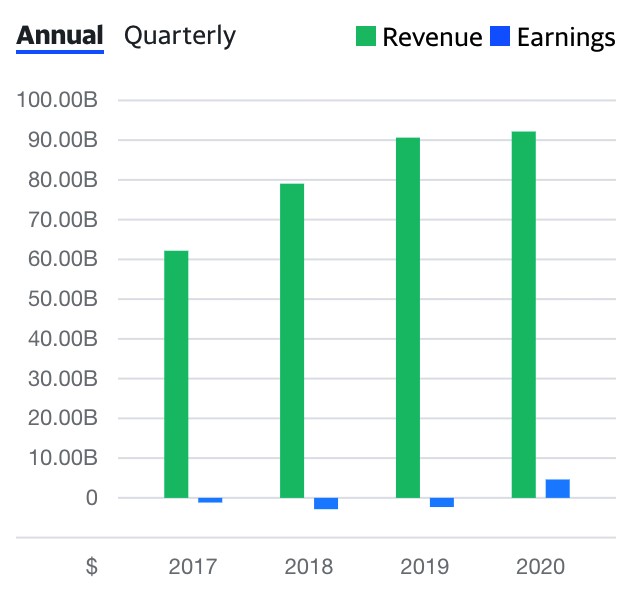

Source: Yahoo Finance

Revenues have grown from 2017 through 2019 and have been consistent in 2020. DELL is a profitable company with a market cap just above $54.5 billion.

Source: Barchart

DELL shares closed 2019 at $51.39 and were trading at the $72.99 level on December 24, a rise of 42%. The earnings growth and market cap could lead to more share appreciation in 2021

Think traditional for 2021- IBM and DELL will not experience the same political pressures as the technology leaders

Innovation through technology will continue in 2021. The leading companies in the sector could experience a challenging landscape regarding regulation and challenges because of their size and access to data. Those challenges could weigh on earnings and share appreciation in the coming year.

IBM and DELL are traditional businesses that are likely to fly below the government’s radar. The two companies’ combined market cap is under $170 billion, which is a far cry from the technology leaders.

Technology will continue to change our lives over the coming years. When looking for value in the sector, IBM and DELL could offer investors more stability and growth as we move into the new year.

Disclaimer: Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided ...

more