The Mustang EV Might Be Ford’s Ultimate Multiple Decompressor

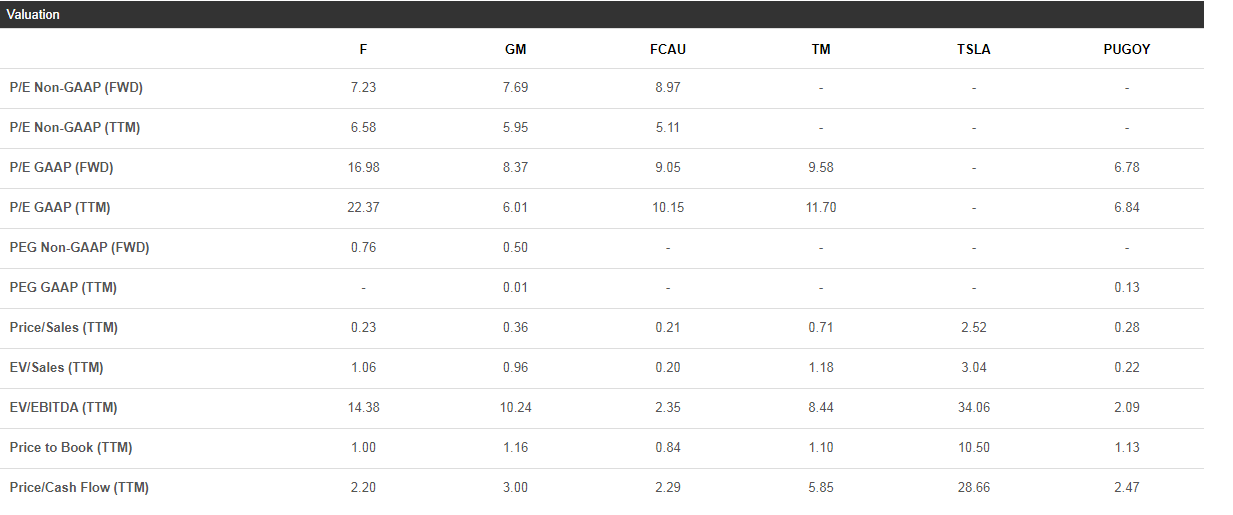

Compressed multiples in the auto industry seem like the new normal

The auto companies have been suffering from multiple compression.

(Click on image to enlarge)

(Source: Seeking Alpha)

Several factors might contribute to that phenomenon. We have macro scenarios like a possible recession and the trade war. Or, industry-related problems like the adoption of EVs and self-driving technology.

We might formulate a plausible hypothesis on this theme. The recession fears made investors react to the cyclical nature of the auto industry. Then, some macro indicators released during the last few weeks, coupled with the Phase One trade deal progress, helped to ease auto stocks. After that, Tesla (Nasdaq: TSLA) has performed well, while the others have lagged (only Fiat Chrysler (NYSE: FCAU) and Peugeot (OTCPK: PUGOY) come relatively close, but we might attribute it to the merger negotiation).

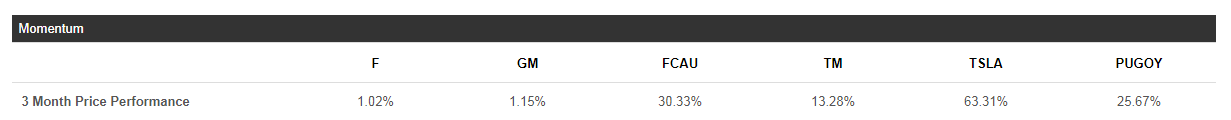

(Click on image to enlarge)

(Source: Seeking Alpha)

We might argue that the self-driving technology and electrification of the fleets are the main catalysts for the industry’s multiples, right now. The market is assuming that some of the traditional automakers will fall behind and, because it can’t forecast which, attributes a discount to all.

The Mustang Mach-E might be Ford’s game-changer

Ford’s (NYSE: F) electric SUV Mustang Mach-E is one of the main highlights of the LA Auto Show. Even Elon Musk seems enthused about it. The car has a sleek design, deeply inspired by the traditional Mustang model. Additionally, the car specs are also catchy, keeping the Mustang tradition of stretching into the sports side of the market.

From a marketing standpoint, the proposition is very interesting. Although Ford is risking a lot by putting its Mustang brand on the line, the truth is that the bold move may pay out handsomely. The Mustang insignia carries a lot of recognition among the American people, and looking at the first reactions, it seems like it might launch Ford in the right direction in the EV market.

Bloomberg chronicles lots of tension in the design phase of the product. However, it also transpired the huge determination by Ford’s management to make this model happen. Just the fact that they made it through makes you feel like the old Ford bureaucracy is a bit less stiffen and a lot more agile. It sure seems like a good sign.

More interesting, though, are the company’s claims that the car will sell in the mid-$30,000 at a profit. If they can pull this off, it will be a huge step in the right direction. Ford will be able to crack into the EV market and doing it at a profit. In the process, it will accumulate knowledge and experience that, eventually, might be used to electrify more mundane models.

The next one will be the top-selling F150 pickup. The company is leveraging its strongest models to make a dent in the EV market. In Bill Ford’s words:

“We are choosing to electrify our most iconic nameplate. And that has a couple of benefits. One is it galvanizes our internal team because if we’re going to electrify this and the F-150, they know that they better raise their game and make it perfect. It also signals to the world that we are dead serious about electrification.”

What will be the impact on Ford?

Right now, for investors, Ford is a traditional carmaker that operates in a cyclical industry, at a time when several analysts fear a recession. However, electric vehicles are now the growth segment of the auto industry.

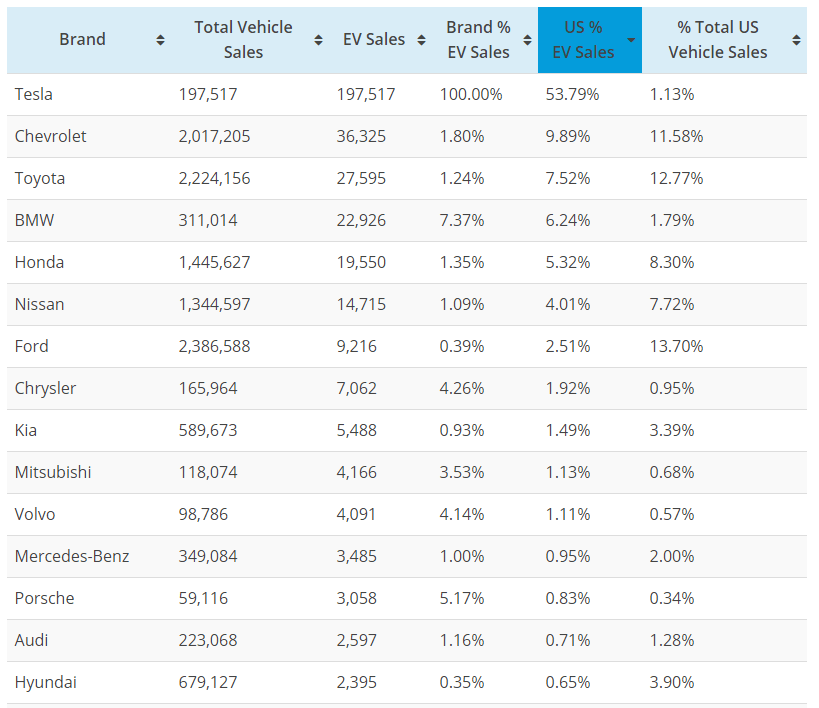

(Click on image to enlarge)

(Source: eei.org)

In 2018, Ford ranked just the 7th in the top 15 EV sales by brand, in the US. It has a lot of room to grow, and the new Mustang seems like a car capable of biting on the 53.79% of Tesla’s share.

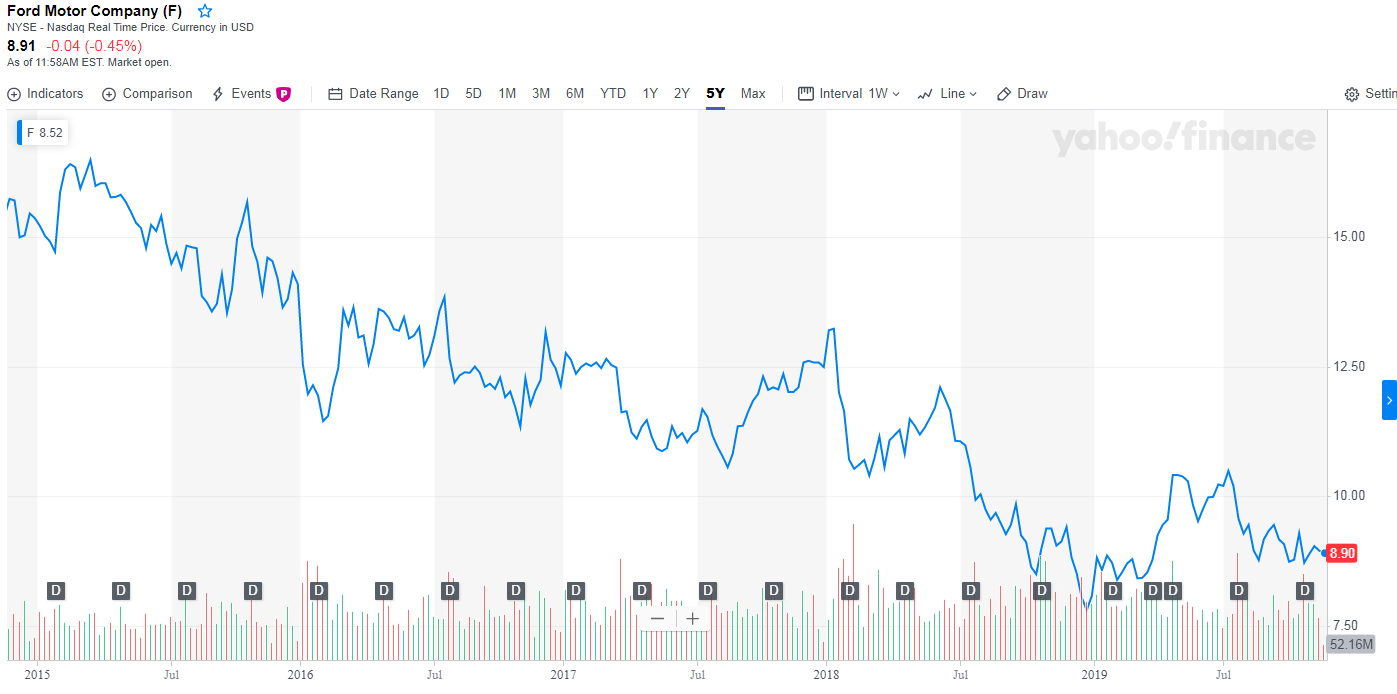

(Click on image to enlarge)

(Source: evadoption.com)

Therefore, if Ford delivers a Mustang Mach-E that resonates with the consumer and, on top of that, it is done at a profit, then we should expect the share price to appreciate.

(Click on image to enlarge)

(Source: Yahoo Finance)

The fact that Ford’s shares have been sliding down, during the last five years, gives it room to appreciate. Expectations have been running low. The company is trading at 7.3 times the 5-year average of the diluted EPS. That’s the archetype of a stock perceived as a value trap. However, now, we have a catalyst for the shares to move up.

(Click on image to enlarge)

(Source: Ford’s 2018 10K)

In my opinion, if the Mustang Mach-E can make a profitable dent into the EV market, we might see a change in the narrative on this stock. Having a breakthrough in the growth segment of the auto industry can only be good for a company whose shares been slowly deflating for the past five years. Just by having the 5-year earnings multiple reaching the double digits, we could see an appreciation of around 40% in the stock price. The likely downside? Probably, the shares sliding an extra ten to fifteen percent during the next twelve months. The risk/reward seems good with Mustang Mach-E.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in F over the next 72 hours.

This text expresses the views of the author as of the date indicated and ...

more