The Insanity Of This Week's Decline

I understand that many people have never seen anything like this. Except for Black Monday in 1987 I have never seen anything like it. That bloodbath struck so fast there was nothing to do but ride it out. However, riding it out proved to be the smartest thing to do since the market closed up for the year 10 weeks later.

I quite understand that many people want to sell everything and go to cash. I spoke with three dear friends who also happen to be clients yesterday who asked if they should do just that. I answered the only way I reasonably could:

I quite understand the fear that this could all go to zero. It will not. I will sell everything for any client that asks me to but I have told them unless they need all their investment funds to live on "this year", that they ride out the storm. It is a bit late, not in time, but in dollars, to be panicking now.

And why? Did any of us sell the home we live in when housing prices plummeted in 2007, 2008, and into 2009? We hated seeing it, we feared it might go on forever, and we wished it would recover. And it did.

Unless you are regularly withdrawing from your portfolio for funds to live on, then your portfolio is like your home. It will recover. Unlike our home, it will pay us dividends while we wait.

Will Carnival Cruise Lines (NYSE: CCL), a personal holding of mine, cut its dividend? I imagine it will. Their revenue will plunge this quarter and next. When -- not if -- when the current iteration of the coronavirus is conquered by the best minds in healthcare around the globe, relieved people who have been wanting to take a cruise will rush to do so.

My greatest benefit of being a history/world affairs speaker on various cruise lines is in some of the people I meet. Every one of them is now disappointed they cannot travel. They can't wait until they can get back at sea. They are willing to place deposits right now, today, to ensure that happens.

Will Carnival's stock decline even further? Possibly. Will Carnival go out of business? I doubt it. The company will simply accelerate their standard maintenance and refurbishment/upgrade schedules during the time when they cannot carry passengers. That interruption would have come sooner or later anyway. Coronavirus just forced it to come sooner.

Will the stock rebound once they carry passengers again? I think it will. In that case, why ever would I sell it here? If I had money, I would be selectively buying, not selling. If I have no funds now, I would wait for the recovery. It will recover.

Another example: will the disruption of travel harm the hotel and airline industries? Of course, it will. Many of them will cut their dividends and slash expenses to the bone. But once the fear subsides in the face of effective treatment protocols and a vaccine for prevention, both industries will roar ahead. I own the preferred shares of a hotel company. I paid less than par, $23, a few months ago. I have a huge loss -- which I am not taking. Those preferred shares are now trading at $11. Why?

Is this overreaction so severe that current sellers are certain the company will go bankrupt? Because bankruptcy is the only reason a going concern will not have the obligation to pay dividends on its preferred shares. They may decide not to pay "today" so they can conserve cash, but because this is a "cumulative" preferred the company must pay all dividends in arrears before they can pay a single penny in dividends on their common shares.

When that happens the preferred stock will no doubt rise closer to par, in this case, $25.

Finally, for all those who lament, "If only I could have bought XYZ 20 years ago!" here is your chance. Exxon Mobil (NYSE: XOM) is just one of many companies selling at the same price it sold for 20 years ago. You can buy Exxon today for exactly what it sold for on July 17, 2000. The difference is that there have been eight dividend increases since that time.

Exxon will most certainly not do well this quarter or next. Thanks to the egos and mistakes of two autocratic rulers in Russia and Saudi Arabia, the world is now awash with what Exxon finds, produces, refines and sells. With supply increasing and demand simultaneously decreasing, the obvious must occur and did. The price of oil plunged more than 30%. Enjoy it while we can. It will not stay there the moment airlines and cruise lines start carrying passengers and depositing them at cruise or flight-end in various hotels.

What am I doing at this time when I am already almost fully invested?

I can best answer that with a brief version of what I sent to a special client late last night.

1) I am selling, at a loss, many smaller tech stars that worked well in a bull market, then trading them straight across for Survivors like Exxon, TOTAL (NYSE: TOT), Texas Pacific Land (NYSE: TPL), and Disney (NYSE: DIS) -- all of which in this mindless panic have fallen the same % or more as the lesser quality firms.

When the carnage ends, and it will, I want to own the top companies in each sector I favor. They are the ones that will rebound first and fastest.

(2) I waited to sell my balanced fund and equity mutual funds later than I should have. I had the orders all lined up in a dozen block trades the day the market went up 1200 points, so I decided to hang in there. That was, in retrospect, a mistake.

But having now sold, at a loss, I have raised extra cash (though far less than I would have if I had sold them 3 weeks ago.) The things I will buy have declined even further than those funds declined. With that cash, I can selectively begin nibbling at what I consider the best quality rebound choices and place the rest in income funds or stocks that specialize in the safest approach. Sometimes these will be "alternatives" -- i.e., they have little or no relationship to the stock indexes. The panic sellers have forced these down to prices that provide more income per dollar than the issuers ever expected to see.

(3) Finally, I am placing market hedges in my and my clients' portfolios. These are ETFs that short the major indexes. They must be watched carefully so I can close them as the markets haltingly rebound. Fortunately, they enjoy great liquidity and move in a very orderly way.

At this point, I do not aim for a 100% hedge. That would mean I would keep the portfolio exactly where it is today, but only as of today. My favored holdings, as well as these short ETFs, fluctuate. The ETFs rise as the market falls, but that is a double-edged sword; they also fall as the market rises. I use the ones that offer 2x leverage and place more than one trailing stop so when the market does rise, I stair-step out of these positions.

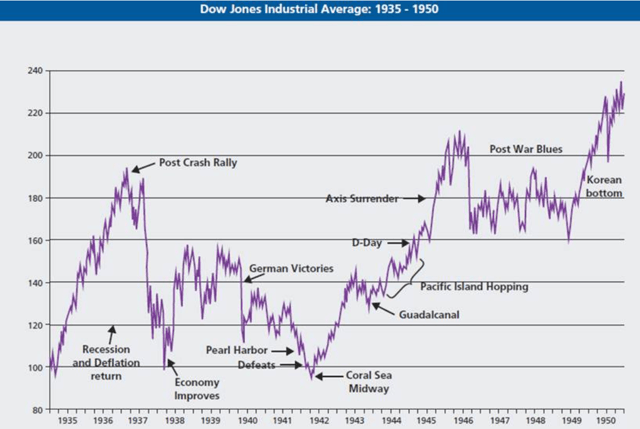

Can I guarantee the market will not go to zero? No. But even in times of existential peril, like the darkest days of WWII, the US markets have always come back after the crisis is past. The lowest point for the Dow in the 20th century was 92.92, during but not before the conclusion of the battle of Midway when defeat would have meant a very real existential crisis.

(Click on image to enlarge)

One of the topics I speak on is the battle for Midway, which hinged on brave men interpreting their orders "loosely" enough, as Americans often will, to surprise and defeat an enemy lying in wait to surprise the Americans.

No, I won't stretch that into a weak analogy for today. But somebody, somewhere, maybe in a less well-known corner of the globe, is going to find a treatment and perhaps someone else a vaccine for the current problem -- the one that is a bigger problem than the stock market.

By the way, the Dow began that year of 1942 at 112.77, then collapsed to 92.92, a 17.6% decline. By the end of the year, it had risen to 119.40, a 28.5% rise from the low point and a 7.6% rise for the year.

Right now, I am trying to position my clients and myself so that we stop the bleeding and come out of this owning the highest quality firms at a price we will be very happy about.

Also right now, I would be quite happy to see even a 7.6% rise in the market for 2020. How about you?

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I encourage you to do your own due diligence on issues I discuss to see if they ...

more