The Home Depot: Great Business, But The Stock Is Not A Buy Today

Home improvement giant Home Depot (HD) has had a very nice 2019 thus far. After plummeting from $213 to just $158 near the end of the year, the stock has rallied again to get back near its former highs.

In addition to its strong stock price gains, Home Depot rewards shareholders with impressive dividend increases. Home Depot is one of the highest dividend growth stocks in the Dow Jones Industrial Average. You can see the entire list of Dow 30 stocks here.

Click here to instantly download your free list of Dow Jones Industrial Average stocks, along with important investing metrics.

This article will discuss Home Depot’s recent events as well as the value proposition the stock offers, as determined by our Sure Analysis Research Database, where we rank stocks based upon total expected returns.

Home Depot’s expected total returns have come down in recent weeks simply due to the rally in the stock. However, we still find the company to be very attractive over the long-term and think investors should consider buying the stock on the next pullback.

Business Overview & Recent Events

The first Home Depot store opened in 1979 after founders Bernie Marcus and Arthur Blank were fired from their jobs at a local hardware store. The plan was to create a superstore that would offer a larger assortment than what was available at the time, with highly trained staff that could help customers with their varying needs.

Home Depot went public in 1981, raising just over $4 million in capital from the offering, which was listed on the NASDAQ stock exchange. Nearly 40 years after the IPO, Home Depot has grown to almost 2,300 stores in three countries.

(Click on image to enlarge)

Source: Investor presentation, page 4

Home Depot employs more than 400,000 people. Its store base is highly concentrated in the U.S., but it has just over 100 stores in Mexico, and nearly 200 stores in Canada as well. Annual revenue is in excess of $110 billion, and the stock’s market capitalization is $225 billion, making Home Depot one of the largest retailers in the country.

Home Depot reported Q4 earnings on 2/26/19 and results were excellent, capping yet another year of very strong growth. For the quarter, the company reported total revenue of $26.5 billion, representing a 10.9% increase over the same period a year ago. Comparable sales continued their trek higher as well, adding 3.2% on a global, consolidated basis, and 3.7% in the U.S.

The fourth quarter of 2018 consisted of 14 operating weeks, compared to the normal 13 operating weeks. This additional week added $1.7 billion of revenue, although this is not included in the comparable sales gain.

Traffic, as measured by customer transactions, rose 7.7% in Q4 to 394.8 million. In addition, the average ticket was up 2.5% to $65.59 from $64.00 in the prior year’s fourth quarter. These numbers help drive comparable sales higher and for the full year, they rose 2.7% and 4.2%, respectively, with the former number being much higher in Q4 thanks in part to the additional operating week.

Gross margins rose very slightly in Q4 year-over-year, adding 10bps to come in at 34% of revenue. Home Depot’s gross margins don’t move much given the enormous and varying assortment it carries. This has been true for years as gross margins have oscillated around the 34% mark, but haven’t really shown any improvement.

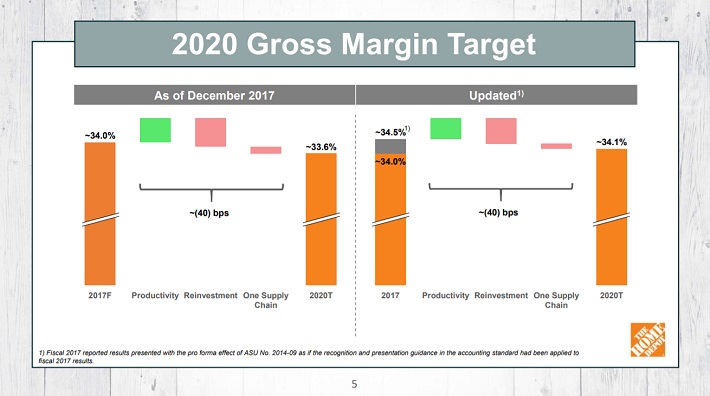

(Click on image to enlarge)

Source: Investor presentation, page 5

Part of that is by design, as seen in the slide above from a recent investor presentation. Home Depot has been investing in its store capabilities and in grabbing market share from the likes of Lowe’s (LOW) and others by investing in price. Essentially, that means Home Depot is reducing prices on certain items to become more competitive. This drives traffic and comparable sales, but at the expense of margins.

We don’t expect gross margins to drive any sort of meaningful gains in the coming years as the company’s strategy specifically limits margin expansion. While a lack of gross margin growth can be a headwind to earnings growth, it is clearly working for Home Depot, as the company continues to drive high rates of profit growth, in part thanks to this strategy.

Growth Prospects

The company’s stated goal for gross margins is 34.1% for fiscal 2020, and that number came in at 34% for Q4 of 2018, and 34.3% for the full year, implying margins are expected to remain relatively flat going forward.

Home Depot attempts to make up for this lack of gross margin expansion via expense leverage, wherein it looks to grow revenue more quickly than expenses, which helps drive profit gains. In Q4, SG&A costs, which includes things like back office support and store labor costs, increased 10.9%, which is exactly the same rate as revenue.

In other words, no expense leverage was achieved and this was true for the full year as well, as SG&A costs rose more quickly than revenue. Home Depot reckons it can achieve between 20bps and 80bps of expense leverage by the end of 2020, so it would appear there is some slightly margin expansion on the way.

Earnings for the fourth quarter came in at $2.3 billion, or $2.09 per diluted share. This compares very favorably to the prior year’s quarterly results at $1.8 billion and $1.52 per diluted share, respectively. The additional operating week added $0.21 to earnings-per-share in Q4 of 2018 so on an adjusted basis, the 38% gain in diluted earnings-per-share would have been more like 24%. However, this still represents an enormous amount of growth for a company that has been producing numbers like this for many years. Indeed, Home Depot’s ability to stack comparable sales and profit gains on top of prior years is remarkable.

Fourth quarter results also contain a $247 million pre-tax charge, or $184 million after tax, related to an impairment loss on certain trade names at Interline Brands, which is now the new Home Depot Pro business. This negatively impacted results by $0.16 per share in Q4 and for the full year.

Home Depot’s share count was also 3.9% lower year-over-year as measured by its average outstanding diluted shares for the fourth quarter. Home Depot has been buying back shares on a huge scale for years as it produces far more cash than it can use to invest in the business. This has been a steady tailwind to earnings-per-share growth and we expect that will remain the case for years to come.

(Click on image to enlarge)

Source: Investor presentation, page 18

Home Depot guided for the above for the full year of 2019. Total sales growth is expected to be 3.3% on comparable sales growth of 5.0%. The difference in the two numbers, which are generally very close to each other for this company, is because of the lack of an additional operating week.

Recall that fiscal 2018 contained an additional week that added ~1.7% to total revenue growth so that simply gets backed out of fiscal 2019 results. The number investors should focus on is the 5% comparable sales guidance, which is once again very strong.

The five net new stores will not be meaningful as that will represent a small fraction of the store base, but the company sees 14.4% operating margin for 2019. That compares to 14.6% on an adjusted basis for fiscal 2018, which excludes the $247 million impairment charge. Part of this small loss in operating margin is attributable to the investments the company is making via lower gross margins, but keep in mind that a 20 basis point change one way or the other will not materially change the company’s results.

Management guided for ~$10.03 in earnings-per-share, based upon another $5 billion being spent on share repurchases. That’s good for just over 2% of the float at today’s share price, so repurchases will once again be a small tailwind to earnings-per-share growth.

Home Depot’s recent growth has been nothing short of outstanding, although investors need to keep in mind this story is about revenue growth primarily.

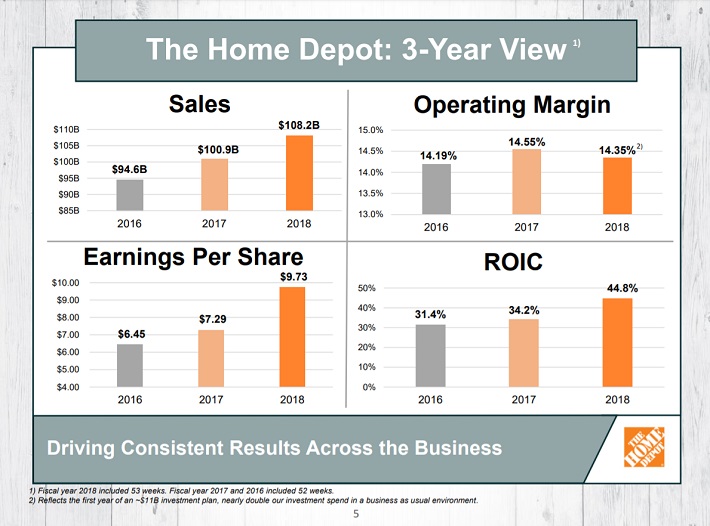

(Click on image to enlarge)

Source: Investor presentation, page 5

Sales rose 6.7% in 2017 and another 7.2% last year, with total revenue forecast to increase 3.3% in 2019. As mentioned, these results are skewed but if we adjust for the additional operating week in 2018, the company’s sales increases would all be in excess of 5% annually over this time frame.

Operating margins have remained essentially flat in this time period, as mentioned, because of the investments Home Depot has been making in its business to take market share. We expect this will continue in 2019 and beyond as management has been very upfront about its desire to continue building for the future, even if it comes at the expense of margins.

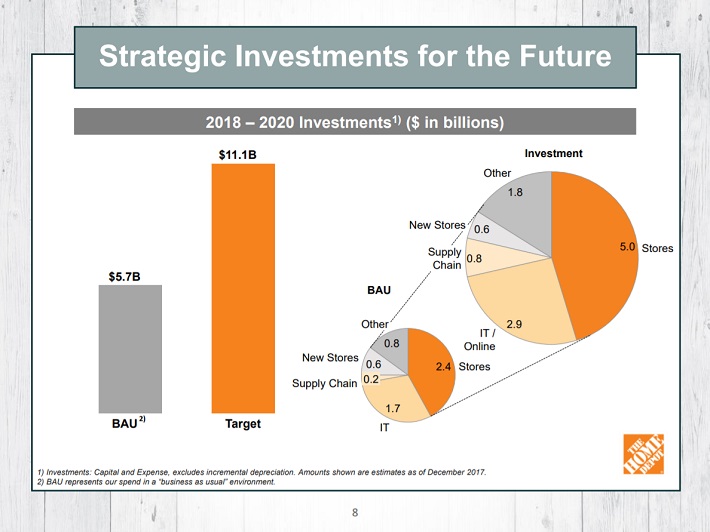

(Click on image to enlarge)

Source: Investor presentation, page 8

Indeed, this chart shows the amount of the investment the company is planning for the 2018 to 2020 period. There are business as usual, or BAU, investments that are always made, but Home Depot is building on that with incremental spending to support future growth. Namely, it is spending $5 billion in a three-year period just on improving the in-store experience.

The company is investing in things like its product assortment to drive traffic and higher average tickets, in-store pickup of online orders, and its associates in terms of training and knowledge building. It also continues to invest in building the Pro business, along with more targeted advertising using the significant customer data it possesses. Finally, Home Depot continues to build out its supply chain to increase speed-to-market, as well as lower unit costs.

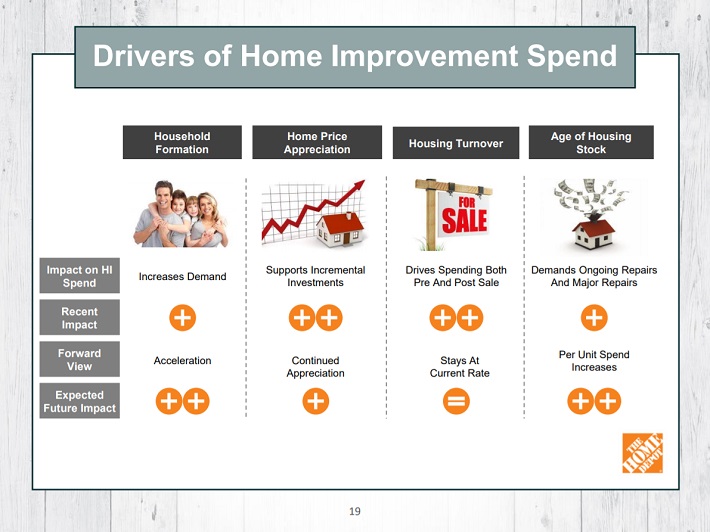

Another driver of future growth will be continued spending by homeowners on their properties.

(Click on image to enlarge)

Source: Investor presentation, page 18

Home Depot sees mostly supportive conditions for the housing market in the U.S. in the coming years, meaning that it should continue to see higher revenue numbers, which will drive earnings-per-share growth. Recent years’ revenue growth numbers correspond well to these drivers of home improvement spending, so we believe Home Depot will continue to grow earnings at high rates in the years to come.

Valuation & Expected Returns

In total, we think Home Depot can produce 8% earnings-per-share growth annually in the coming years. In the past five years, from 2014 actual results to 2019 expected earnings-per-share, Home Depot will have compounded earnings at an annual rate of more than 17%. We don’t see that sort of growth as sustainable but we do think 8% is a very reasonable target.

Growth will accrue mostly from higher revenue as the company continues to build out its store capabilities and assortment; this should continue to be a mid-single digit tailwind annually. Margins should essentially be flat in the coming years, as they have been, but there will also be a boost from share repurchases to help get Home Depot to 8% annual earnings growth.

In addition, the 2.7% dividend yield, which was recently raised by 32% to $1.36 per quarter, will add to total returns. We expect the dividend to continue to grow at strong rates in the coming years given that the payout ratio is just over half of earnings. As earnings continue to grow at strong rates, there is more room for further dividend increases.

Finally, the valuation will likely be a bit of a headwind for Home Depot given the recent rally in the stock. Shares trade for 20.3 times this year’s earnings today as the stock nears its former highs, and we see fair value at more like 18 times earnings, for a fair value price of $181 per share. That means shareholders will see a roughly 2% headwind to total returns as the valuation moderates over the coming years.

Home Depot should still produce positive total returns of approximately~8% annually in the years to come, despite the elevated valuation. Given all of this, we rate Home Depot a long-term buy, but would suggest investors interested in owning the stock wait for a pullback. We don’t see the need to chase the stock higher as there should be some moderation in the valuation down the road that will allow investors to buy at more favorable prices.

Final Thoughts

Home Depot is a premier retailer with an outstanding track record of growth. The company continues to invest in its stores and its people to support future growth, and the strategy has a decades-long track record of working to drive higher sales.

While margin expansion may not occur in the years to come, the combination of share buybacks and revenue expansion will be more than enough to generate EPS growth. Adding in the current dividend yield, along with strong growth prospects for the payout, makes Home Depot an attractive long-term holding.

The only potentially negative aspect of investing in Home Depot is the stock valuation, which remains at elevated levels. We suggest investors wait for a more favorable price before buying, specifically near our fair value price estimate of $181 per share.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more