The Global Financial End-Game

For those seeking a summary, here is the global financial endgame in fourteen points:

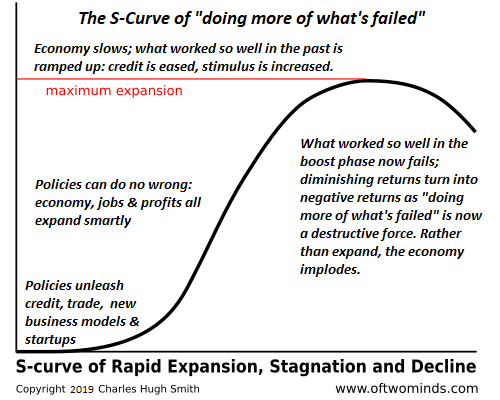

1. In the initial "boost phase" of credit expansion, credit-based capital ( i.e. debt-money) pours into expanding production and increasing productivity: new production facilities are built, new machine and software tools are purchased, etc. These investments greatly boost production of goods and services and are thus initially highly profitable.

2. As credit continues to expand, competitors can easily borrow the capital needed to push into every profitable sector. Expanding production leads to overcapacity, falling profit margins and stagnant wages across the entire economy.

Resources (oil, copper, etc.) may command higher prices, raising the input costs of production and the price the consumer pays. These higher prices are negative in that they reduce disposable income while creating no added value.

3. As investing in material production yields diminishing returns, capital flows into financial speculation, i.e. financialization, which generates profits from rapidly expanding credit and leverage that is backed by either phantom collateral or claims against risky counterparties or future productivity.

In other words, financialization is untethered from the real economy of producing goods and services.

4. Initially, financialization generates enormous profits as credit and leverage are extended first to the creditworthy borrowers and then to marginal borrowers.

5. The rapid expansion of credit and leverage far outpace the expansion of productive assets. Fast-expanding debt-money (i.e. borrowed money) must chase a limited pool of productive assets/income streams, inflating asset bubbles.

6. These asset bubbles create phantom collateral which is then leveraged into even greater credit expansion. The housing bubble and home-equity extraction are prime examples of theis dynamic.

7. The speculative credit-based bubble implodes, revealing the collateral as phantom and removing the foundation of future borrowing. Borrowers' assets vanish but their debt remains to be paid.

8. Since financialization extended credit to marginal borrowers (households, enterprises, governments), much of the outstanding debt is impaired: it cannot and will not be paid back. That leaves the lenders and their enabling Central Banks/States three choices:

A. The debt must be paid with vastly depreciated currency to preserve the appearance that it has been paid back.

B. The debt must be refinanced to preserve the illusion that it can and will be paid back at some later date.

C. The debt must be renounced, written down or written off and any remaining collateral liquidated.

9. Since wages have long been stagnant and the bubble-era debt must still be serviced, there is little non-speculative surplus income to drive more consumption.

10. In a desperate attempt to rekindle another cycle of credit/collateral expansion, Central Banks lower the yield on cash capital (savings) to near-zero and unleash wave after wave of essentially "free money" credit into the banking sector.

11. Since wages remain stagnant and creditworthy borrowers are scarce, banks have few places to make safe loans. The lower-risk strategy is to use the central bank funds to speculate in "risk-on" assets such as stocks, corporate bonds and real estate.

12. In a low-growth economy burdened with overcapacity in virtually every sector, all this debt-money is once again chasing a limited pool of productive assets/income streams.

13. This drives returns to near-zero while at the same time increasing the risk that the resulting asset bubbles will once again implode.

14. As a result, total credit owed remain high even as wages remain stagnant, along with the rest of the real economy. Credit growth falls, along with the velocity of money, as the central bank-issued credit (and the gains from the latest central-bank inflated asset bubbles) pools up in investment banks, hedge funds, and corporations.

The net result: an over-indebted, overcapacity global economy cannot generate real expansion. It can only generate speculative asset bubbles that will implode, destroying the latest round of phantom collateral.

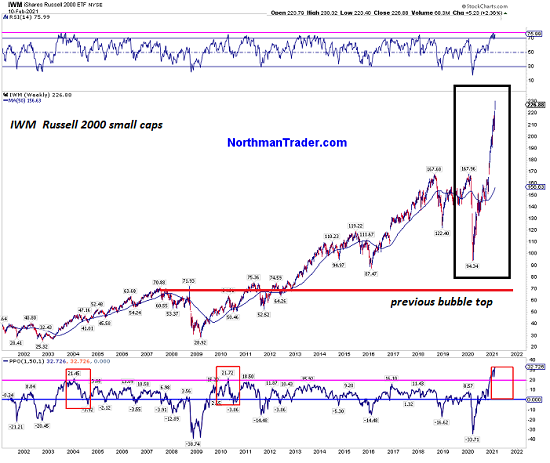

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Disclosures: None.

Giving us a summary of recent history in this format is quite a way to go. I like it, but I wish it were wrong. But it is correct, although the motivations may have been different, the actions seem to be as described. The really nasty part of an "endgame" is that it reaches an end.

I am reminded of the close of that book from the Sixties,"On the Beach", where the declaration says: This Is The Way The World Ends, NOT With A Bang, But A Whimper."

So is there an escape? I am certainly not one for giving up, or groveling in fear, but it seems that somehow the captains have sailed us into an area full of rock shoals. Who holds the map to get out of the mess??