The Fed Just Cannot Rest In Raising Interest Rates

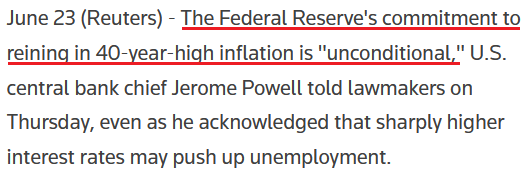

With Fed Chairman Jerome Powell capping off his two-day Congressional hearing on Jun. 23, he reiterated his pledge to combat inflation. He said:

“We really need to restore price stability... because without that we're not going to be able to have a sustained period of maximum employment where the benefits are spread very widely. It's something that we need to do, we must do."

As a result, Powell realizes that persistent periods of unanchored inflation are much worse than an impending recession.

Please see below:

Source: Reuters

In addition, he added:

"We don't have precision tools, so there is a risk that unemployment would move up, from what is historically a low level though. A labor market with 4.1% or 4.3% unemployment is still a very strong labor market."

Powell on the Prowl

Thus, Powel is laser-focused on curbing inflation. Remember, I warned on numerous occasions that letting inflation rage would be the worst long-term outcome for the U.S. economy. In a nutshell: turning dovish would hurt the U.S. dollar and embolden commodity traders to bid up prices even more.

As a result, Powell must follow through with his hawkish threats or the progress will reverse and he’ll be back to square one. However, he sounds like a man who realizes that fighting inflation is the only plausible path forward. Moreover, a rising unemployment rate won’t be enough to deter future rate hikes.

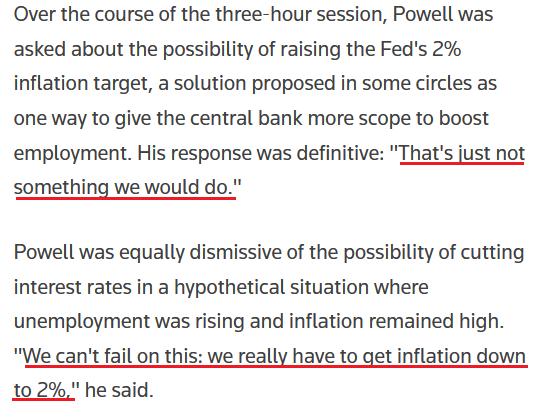

Please see below:

Source: Reuters

Supporting the argument, Fed Governor Michelle Bowman said on Jun. 23:

“The inflation data show that, after moderating slightly for a short time, price increases for motor vehicles have picked up again, energy prices rose sharply in May, and prices for food have risen more than 10 percent from a year ago.”

She added:

“One important factor that we often point to in driving today's spending decisions and inflation outlook are expectations of future inflation (…). If expectations move significantly above our 2 percent goal, it would make it more difficult to change people's perceptions about the duration of high inflation and potentially more difficult to get inflation under control.

“As we see surveys like the Michigan survey report higher longer-term inflation expectations, we need to pay close attention and continue to use our tools to address inflation before these indicators rise further or expectations of higher inflation become entrenched.”

As a result, Bowman expects rate hikes of “at least” 75 and 50 basis points at the next “few” FOMC meetings.

Please see below:

Source: U.S. Fed

As it relates to her second point, remember what I wrote on Jun. 16 following the FOMC meeting?

The most important quote of the press conference occurred when Powell was asked: does 3.8%-4% [federal funds rate] get the job done and break the back of inflation?

He responded:

“I think we’ll know when we get there. You would have positive real rates and inflation coming down. I think you would have positive real rates across the curve.”

Thus, Powell confirmed what I’ve been warning about for months: the Fed needs higher real yields to curb inflation.

The fundamentals of the day were clear:

- The FOMC increased its median rate hike projection to ~14 in 2022.

- Powell wants higher real interest rates.

- Letting inflation rage is “not an option.”

- The FOMC “widely” wants “a modestly restrictive” policy by the end of 2022.

Therefore, while I’ve stated this many times throughout 2021 and 2022, the PMs’ medium-term fundamental outlooks continue to worsen.

Thus, while Powell and Bowman delivered another dose of reality to the financial markets on Jun. 23, it was commodities’ turn to suffer. In contrast, the general stock market rallied and short-term interest rates declined.

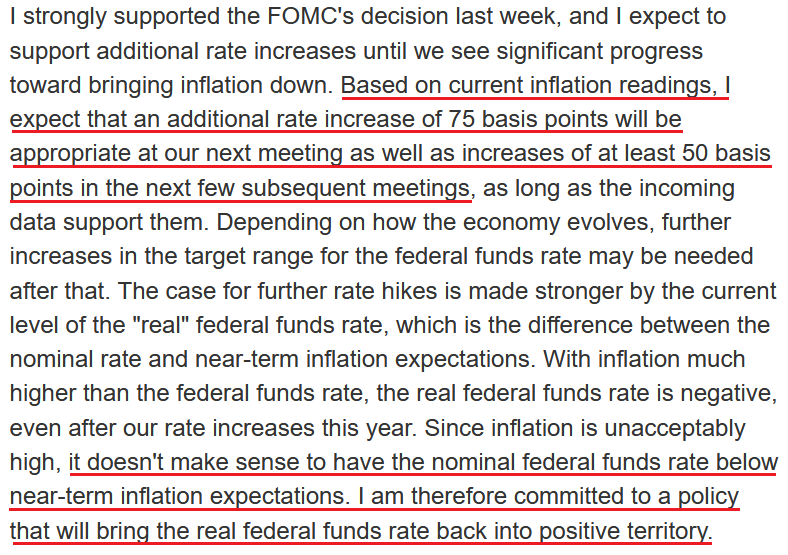

However, billionaire hedge fund manager Bill Ackman – who has sounded the alarm on inflation for months – wrote on Jun. 23:

“Despite [Fed officials’] coordinated commentary, the bond market has ignored these statements leading to a massive decline in short-term rates since the Fed meeting. A prediction: the Fed is serious. Powell and the governors care about the American people, our economy, and their legacy.”

“Powell does not want to be known as a worse chair than Arthur Burns. The Fed will raise rates 75 bps or more in July and 50 bps or more in subsequent meetings and won’t pause until it is clear and convincing that inflation is headed back to 2%. [Federal funds rate] FF of 5% or more next year is in the cards.”

As a result, Ackman shares our view that a dovish pivot would be extremely harmful to the U.S. economy. Sure, it may provide the financial markets with a short-term sugar high. However, the long-term consequences of unaffordable food, housing, gasoline, and other basic necessities would lead to social unrest. Therefore, investors don’t realize they’re not the most important variables in this equation.

Please see below:

Take Stock

With the ‘bad news is good news’ crew out in full force on Jun. 23, the general stock market rallied. Moreover, the NASDAQ Composite outperformed, as weaker economic prospects crushed commodities and increased the appeal of high-multiple growth stocks. Moreover, the positioning shift was spurred by a weak PMI print.

For example, S&P Global released its U.S. Composite PMI on Jun. 23. The headline index declined from 53.6 in May to 51.2 in June. Moreover, while output is still expanding, the report stated:

“The decline in the index reading signaled further easing in the rate of expansion in business activity to a pace notably slower than March’s recent peak. Although service providers continued to indicate a rise in output, it was the weakest increase for five months.”

Moreover:

“Weaker demand conditions, often linked to the rising cost of living and falling confidence, led to the first contraction in new orders since July 2020.”

However, while the prospect of more rate hikes has rattled U.S. businesses, inflation remains extremely problematic. As a result, the Fed’s catch-22 is on full display, and Powell has rightfully determined that actively reducing inflation is the lesser of two evils.

Please see below:

Source: S&P Global

To that point, while old habits die hard, I warned on May 25 that the post-GFC crowd doesn’t realize this time is different. I wrote:

A decade of dovish pivots has left a generation of investors believing that the central bank is all talk and no action. However, with inflation at levels unseen in 40+ years, Powell is not out of ammunition, and the Fed pivot crowd should suffer profound disappointment as the drama unfolds.

The bottom line? We’ve officially entered the monetary version of The Boy Who Cried Wolf. With Fed officials running to the rescue each time the financial markets show signs of stress, investors are programmed to ignore their hawkish threats. However, while these post-GFC pivots occurred with inflation perched near 2%, investors are so steadfast in their belief that they ignore the climactic consequences of unanchored inflation.

Furthermore, little has changed. Despite six rate hikes (25 basis point increments) and more on the way, the consensus continues to await a dovish pivot. Therefore, the Cboe Volatility Index (VIX) still hasn’t cracked 40, and the S&P 500’s 20%+ drawdown has been relatively orderly. However, while oversold conditions made a case for a short-term rally, the medium-term outlook is much more ominous.

For example, Morgan Stanley’s Chief U.S. Equity Strategist Mike Wilson told clients on Jun. 21: “With our view for lower multiples and earnings now more consensus, the markets are more fairly priced. However, it does not price the risk of a recession, in our view, which is 15-20% lower, or roughly 3,000 [for the S&P 500]. The bear market will not be over until recession arrives or the risk of one is extinguished.”

As such, with Wilson reducing his medium-term target from 3,400 to 3,000, he again cited investors’ complacency.

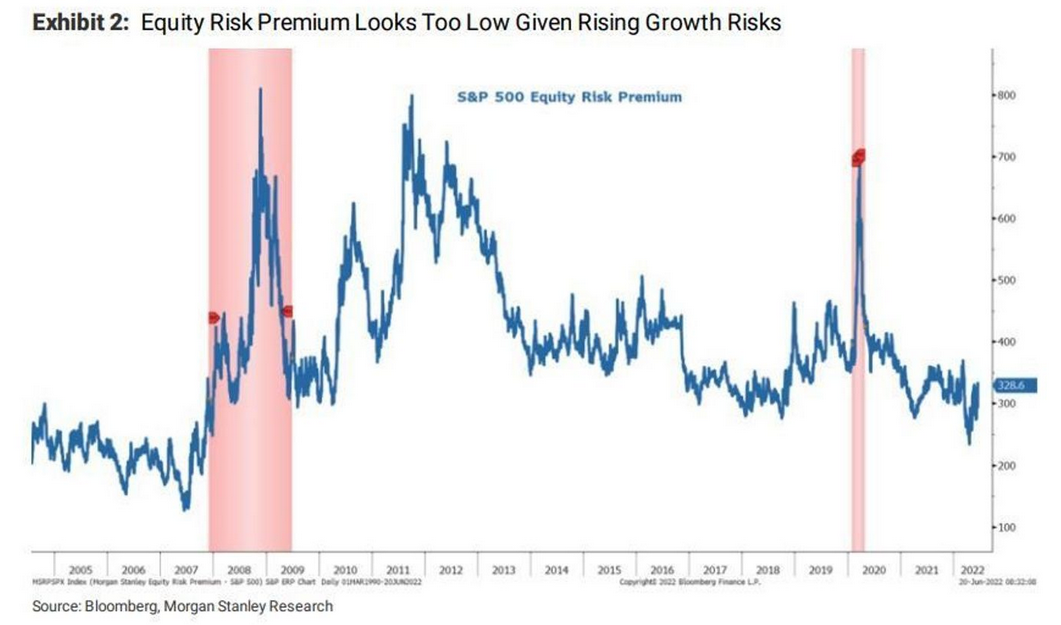

Please see below:

To explain, the blue line above tracks the S&P 500’s equity risk premium (ERP). In a nutshell: a higher ERP and lower stock prices should coincide with periods of high uncertainty to compensate investors for the increased risks. However, if you analyze the right side of the chart, you can see that the ERP remains relatively low.

In contrast, the pink vertical bars highlight the material spikes that occurred in 2008 and 2020 during their respective crises. As a result, with no real fear in the market, the true panic should materialize as the Fed’s rate hike cycle continues.

The Bottom Line

The Fed has to choose between supporting Americans and curbing inflation or supporting the financial markets and uplifting asset prices. Moreover, while investors are used to the latter, Powell made it clear that a higher unemployment rate won’t derail his quest to harness inflation. Unfortunately, it’s his only option, as short-term economic pain is preferable to long-term devastation.

Therefore, while investors hope that weakening data points will change his tune, turning dovish will only push stock and commodity prices higher and re-ignite inflation’s flames. As such, Powell’s acceptance of reality should push the S&P 500 and the PMs to lower lows in the coming months.

In conclusion, the PMs declined on Jun. 23, as economically-sensitive commodities felt the Fed’s wrath. Moreover, while the U.S. 10-Year Treasury yield has fallen recently, so has the U.S. 10-Year breakeven inflation rate. As a result, the U.S. 10-Year real yield ended the Jun. 23 sessions at 0.59%. Moreover, with Powell and Bowman telling us they want higher real yields, this realization is profoundly bearish for the PMs.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more