The Face Of Deflation

In a recent article, I discussed some of the ways the Fed could brew some inflation. The reason for this action is the central banker's nightmare of deflation. But what does deflation look like, or rather, what is the face of deflation?

Deflation is both a monetary and psychological phenomenon. The monetary part of deflation means there is a reduction of outstanding money and credit. Since people are not in the habit of burning, literally, the cash in their wallets or blowing up other forms of money, the monetary component centers on the reduction of outstanding credit. It's not just that credit gets extinguished, if there is not new credit to replace old credit that condition becomes deflationary.

In a simplified example, if you had maxed out a credit card and needed cash to meet a minimum payment, you might secure another credit card and obtain a cash advance. If you were unable, the account may well go into default, suggesting a write-off for the issuing bank, which means a reduction of credit. The existence of that credit implied consumer power, portending demand for goods and services. Extinguishing that credit eliminates that consumer's power.

The psychological component centers on fear, a lack of confidence and an expectation of lower prices. Inflation means expansion, while deflation suggests contraction. There are other components that get brought into the psychology including:

- A focus on what people have versus what they want

- A focus on thrift

- Political discord

- Social polarization

In Japan, the face of deflation looks like a surge of purchases of cup noodles. Economic data in the Land of the Rising Sun shows spending on the noodles ($1.65 per cup) rose 26% in the first quarter compared to the same period the previous year. Moreover, it was the fourth straight quarter of double-digit growth. This spending increase accompanied a decrease in spending for utilities, education, recreation and transportation. The Japanese public showed great faith in their economic wizards who were unable to awaken the country from its multi-year economic stupor. There is consideration now being given to suspending the consumption tax increase slated for 2017. They may want something else but they're focused on what they have. More Ramen anyone?

Staying in Asia, the city-state of Singapore reported CPI declines in February and March, which ran their negative inflation trend to 17 months. The recent declines were attributable to oil-related products, automobile prices and a decline in property values. In response, the monetary authorities decided they wanted a weaker Singapore dollar. This is a country with a high standard of living that is generally considered to have a favorable business climate.

Remember the "forever" stamps? Well, the postal service just announced a decline in stamp prices for the first time in 97 years. I wonder what the Vegas odds would have been on this price decline.

The face of deflation also looks like people wanting to save more. The graphic shows how the American public has progressively saved more since a historical low in 2005. (Note: I do find the large drop in savings from December 2012 to January 2013 puzzling. The trend since the low, however, is up).

Economists were confused by the progressively increasing savings rate despite stronger employment growth. The theory was that higher employment should translate into higher spending and thus lower savings. Understanding the flaws in employment measurement, I am not surprised. The same could be said about Japan. Their unemployment rate is low compared to many countries and their standard of living remains high, and yet the deflationary environment is robbing their economy of its perceived potential. But this is just economic perception as the consumer is not only in deleveraging mode but also in the mode for saving for a rainy day.

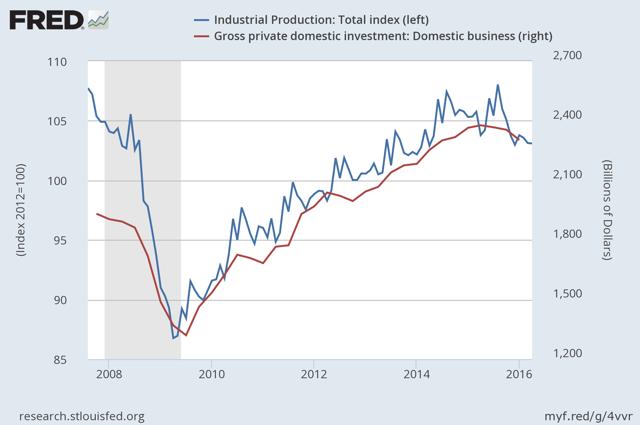

It's not just consumers but businesses that are retrenching. In March, industrial production fell for the seventh straight month. The decline in production mirrors domestic investment as noted in the graphic below. We know how much companies are spending on stock buybacks and there can be no better reflection of this than in this graphic.

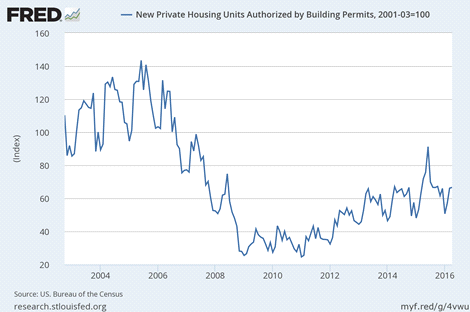

While it appears the real estate market has recovered, the foundation for future gains is not present. The graphic below shows housing permits relative to an index using March 2001 as the base. June 2005 was the high for the index and the current value is less than half that amount. If one argues that the 2005 level was not sustainable, the current value remains well below the base period.

Let's add qualitative measures of a deflationary psychology which manifest as political discord and social polarization or discontent.

- The doping scandal for Russian athletes is threatening to mar the upcoming Olympics in Rio. Doping has always been a concern, but now there is the real danger of an entire team or country being excluded. This scandal is on top of the current impeachment of the Brazilian president for corruption as well as concerns about the environmental factors in the host city. I wonder how many cities will say "no" to hosting the event after Rio.

- The American presidential election has proven most entertaining and now it appears the candidates leading their respective parties are among the most polarizing in history. I posited that the candidacies of Trump, Carson and Sanders expressed third party characteristics, though their success would be limited if they ran separate of the major parties. This is social polarization at its finest.

- Participation in two major youth sports, football and baseball, has fallen. While football participation has been linked to an increased attention to concussions, baseball's decline is harder to pinpoint, though MLB went to some pains to speed up the games. My perception also is that golf is not enjoying the popularity that it once did, based on the pace of golf course construction and discounts offered for playing around.

Some of these measures you don't see when talking about the economy. The point is to highlight other conditions that are present during a deflationary psychology. Inflation means expansion, while deflation means contraction. Credit is confidence and inflation is very difficult to produce without credit. Deflation is a lack of confidence leading to a lessened desire to issue or obtain credit. Structures like the European Union are bull market phenomenon, emphasizing harmony and accord. Now anger and discord generate discussion about Grexit and Brexit.

The world economy will need to progress through the "winter" portion of this cycle before emerging anew in the "spring" of the next cycle. Now the question is how long do I wait before buying stamps again?

Disclosure: None.