The Donald's Blind Squirrel Nails An Acorn

It is said that even a blind squirrel occasionally finds an acorn, and so it goes with the Donald. Banging on his Twitter keyboard in the morning darkness, he drilled Jeff Bezos a new one---or at least that's what most people would call having their net worth lightened by about $2 billion:

I have stated my concerns with Amazon long before the Election. Unlike others, they pay little or no taxes to state & local governments, use our Postal System as their Delivery Boy (causing tremendous loss to the U.S.), and are putting many thousands of retailers out of business!

You can't get more accurate than that. Amazon (AMZN) is a monstrous predator enabled by the state, but Amazon's outrageous postal subsidy----a $1.46 gift card from the USPS stabled on each box----isn't the half of it.

The real crime here is that Amazon has been exempted from making a profit, and the culprit is the Federal Reserve's malignant regime of Bubble Finance. The latter has destroyed financial discipline entirely and turned the stock market into the greatest den of speculation in human history.

That's why Bezos can kill established businesses with impunity. The casino allows him to run a pernicious business model based on "price to destroy", rather than price for profit and a return on capital.

Needless to say, under a regime of sound money and honest capital markets Amazon would be a far more benign economic creature. That's because no real investors would value AMZN's money-loosing e-Commerce business at $540 billion----nor even a small fraction of that after 25-years of profitless growth.

As we observed a few weeks ago,

AMZN is allegedly a tech company owing to its cloud business (AWS). But that's exactly the skunk in the woodpile.

When you set aside AWS' sales and operating income during 2017, Amazon's e-Commerce business generated $160 billion of sales, but posted operating income of negative $200 million.

That's right. The monster of the retail midway posted no profit whatsoever last year!

And it's getting worse. During 2016 the e-Commerce business posted $1.1 billion of operating income on $124 billion of sales; and the year before that (2015) operating income was $2.6 billion on e-Commerce sales of $99 billion.

Stated differently, incremental annual sales of $61 billion over the past three years resulted in a $2.8 billion reduction in operating profit.

There you have it. As the third great bubble of this century has accelerated towards its blow-off top, the robo-machines and momo traders have turned absolutely rabid, thereby enabling Bezos to go flat-out berserk in pursuit of growth at any cost.

And why not. At the end of the mini-correction in February 2016 Amazon's market cap was $230 billion, but just 25 months later it was worth $775 billion at its March 12peak.

That staggering $545 billion gain in market cap had absolutely nothing to do with financial performance, of course. Operating free cash flow was a meager $6.4 billion during 2017 and had been $6.6 billion two years earlier.

That is to say, AMZN was valued at a frisky 35X free cash flow in early 2016 and a completely insane 121X a few weeks ago. The fact that Bezos' net worth exploded by $100 billion during that same 25 month interval perhaps explains why even the Donald found his acorn.

After all, incentivize an unusually aggressive capitalist entrepreneur with pure madness, and you will indeed get more of exactly that. There is simply no other way to describe Amazon's preposterous $700 billion valuation and the message that sends to the company's commander-in-chief.

To be sure, the talking heads try to pass off Amazon as some kind of latter-day technology powerhouse, but that doesn't wash. As we also recently explained, give its cloud business the most expansive PE multiple imaginable and you still have more than one-half trillion dollars of bottled air:

Even the undoubted prowess and growth capacity of its AWS cloud service doesn't come close to squaring the circle. In the year just ended, for example, its net income was about $3.2 billion at AMZN's 20% tax rate.

Needless to say, the cloud business' current super-hot growth rates mainly represent a one-time share capture from traditional standalone computer capacities. Accordingly, there is no reason to assign a crazy valuation multiple to a highly competitive business based on heavy-duty capital asset throw-weight, which will eventually bend to the single digit growth arc of the GDP.

So give it a 50X PE multiple and be done with it. That implies AWS is worth $160 billion, and the e-Commerce business is worth $540 billion.

Like we said, a market which is valuing at one-half trillion dollars a zero profit business that churns $160 billion per year of GDP anchored goods tells you all you need to know.

The point here is that Bubble Finance is truly pernicious, and in this case you have a veritable double-whammy. The thousands of closed retail stores and malls and the hundreds of thousands of lost jobs the Donald was complaining about this morning had their origin in the same monetary deformation.

To wit, America got fantastically over-stored in the first place owing to cheap debt and ultra-speculative equity markets that funded hundreds of new retail concepts and national rollouts. Indeed, it was a lethal combination: Fast-growing retail chains were awarded nosebleed PE multiples by the stock market, which, in turn, encouraged them to grow their stores bases even faster, thereby generating even more demand for debt financed square footage.

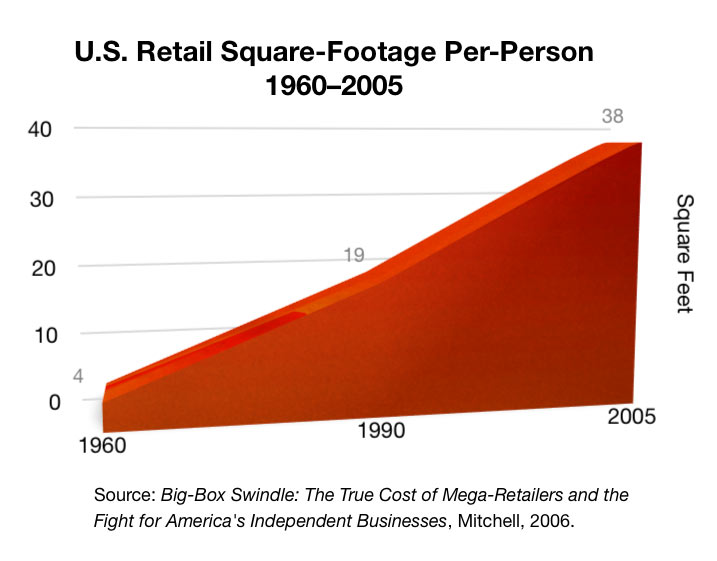

It is not by accident that the US has 5-15 times more retail space per capita than the rest of the developed world. For instance, Australia has 16 square feet per capita and the square footage per capita for UK, France and Germany are all in the single digits.

Needless to say, after all of this cheap-finance driven excess and mal-investment, Bezos now comes in with his half-trillion dollar e-Commerce sledge-hammer and pounds the chart below to smithereens.

In this context, we note that even the Fed heads admit to puzzlement as to why real final sales growth over the last 10 years has fallen to just 1.3% per annum or barely one-third of the historic trend. School marm Yellen, in fact, was always talking about the need for more education and training of the work force.

We'd suggest something a little less modern, however. About 150 years ago, the great French economist, Fredric Bastiat, demonstrated the folly of the "broken window fallacy" or the notion that destruction of capital assets was some kind of boon for growth because their replacement would generate demand for construction, materials and labor.

Obviously, today's central bankers have done old Bastiat one better. They first fund windows no one needs, and then make the economic felons who smash them fabulously rich from their mayhem.

Needless to say, Amazon is merely symptomatic of the manner in which the systematic falsification of financial asset prices by the Fed and other central banks has corrupted the economic and financial narrative.

For instance, you cannot have the sound on for more than 10 minutes when some talking head on bubblevision says not to worry because profits are booming.

Well, no they are not----save for round-tripping after the world's mini-recession of 2015-2016.

In fact, the data is now virtually complete and S&P 500 earnings for 2017 posted at $109 per share compared to $106 per share for the September 2014 LTM period more than three years ago. It goes without saying, of course, that earnings growth at $1 per year per share is not much growth at all, but that's not even the worst of it.

At the pre-crisis peak in June 2007, LTM earnings for the S&P 500 came in at $85 per share, meaning the peak-to-peak growth rate over the entire decade was just 2.5% per annum.

That's right. The market closed today at a 24.5X PE valuation on three years of flat earnings, and during what will soon be the 10th year of the weakest business expansion in history.

Moreover, the above doesn't represent some canky distortion unique to the S&P 500. The picture below is for all US corporations---public and private---and is presented on an aggregate dollar pre-tax basis in order to remove the impact of C-suite tax rate engineering and its persistent shrinkage of the share float via massive stock buybacks.

We'd call the trend flat on the decade and be done with it.

Way back in Q3 2006 when Goldilocks was the belle of the Wall Street ball the first time around, pre-tax corporate profits came in at an $1.655 trillion annual rate. With the aid of a magnifying glass you can perhaps see that the rate of $1.684 trillion for Q4 2107 was exactly 1.8% higher.

In a word, economic profits barely grew by 2% over that period, yet it still fostered 11 years of nearly continuous chatter on bubblevision about earnings being incredibly "strong" (except for the winter of 2008-2009, which apparently has now been air-brushed from the record).

So we are inclined to give the Donald a break. The blind squirrel in the Oval Office missed the biggest reason of all to attack Amazon, but he at least found the acorn.

That's a lot more than you can say for the endless parade of zombified portfolio managers who fill the airtime on bubblevision.

(Click on image to enlarge)