The Coinbase Direct Listing: A Crypto Signal

This is a broad macro piece on my thoughts around Coinbase. I am not nearly as knowledgeable on crypto as many others, and I have linked to more in-depth work below for those that want a deeper dive!

The Coinbase Direct Listing

Coinbase went public *sometime* today through a direct listing, similar to Roblox, Spotify, and Slack.

Image Source: Upsplash

This is a big deal, for several reasons

- It’s a socialization of crypto at a level that we haven’t seen before.

- If the SEC is letting them list, that means that there is some level of acceptance for crypto of the top of the regulatory hierarchy.

- For that reason, Coinbase is more of a signal of crypto normalization versus purely a company listing – some people have compared this as a moment similar to the Google IPO

There a few different ways to think about Coinbase [network effects + liquidity]

- A Bitcoin exposure

- An exchange

Also, some key points:

- The Market Mechanics: Coinbase makes money when crypto goes up or when there is market volatility – which is fine for a growing crypto market, but could be tested in volatile times.

- Coinbase is not Bitcoin: It’s not just Bitcoin – the company is diversifying away from pure Bitcoin exposure (~44% of transaction revenue in 2020) and they continue to add more crypto assets to the platform.

- The Moat: 90% (!!) of customers found them organically – they spend very little on sales and marketing.

An Overview: The Crypto Space

The total estimate worth of crypto companies is ~$500bn with a total crypto market cap of $2T (data from Dan Held). There is a lot of money flowing into the space right now.

- Blockchain.com: Just raised $300M at a $5.2B valuation

- Fireblocks: Just raised $133M

- PayPal: Curv was acquired by PayPal for a rumored $500M

- BitPanda: Just raised at a $1.2B valuation

- Anchorage: Just raised $80M

I think that the crypto space is just really beginning to get the recognition it likely deserves. For that reason, we will see continued growth of the above. That’s great for crypto, and good for Coinbase if they can hang onto their market share. But in a growing market, nothing is really promised – and Coinbase could fall behind as the smaller, scrappier shops begin to innovate behind the scenes.

A Bitcoin Exposure

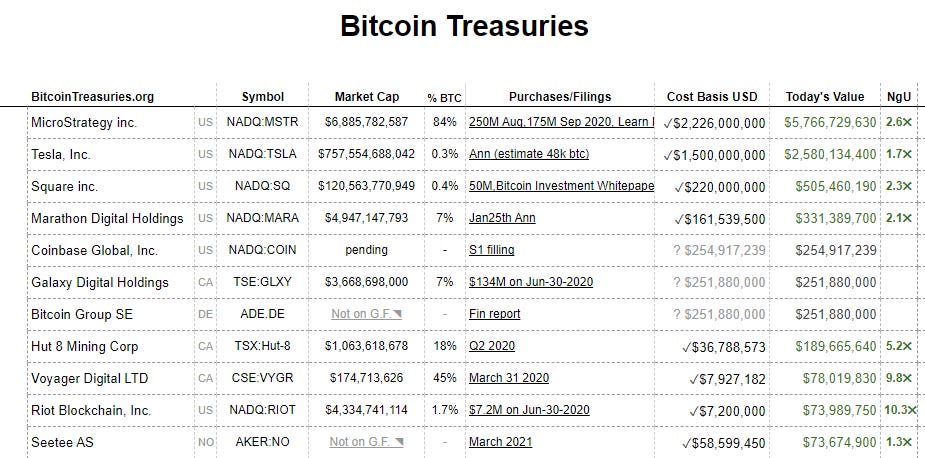

Outside of the pure crypto market, there are a lot of publicly traded companies that now own Bitcoin, the most recent one notably being Tesla. The two have begun to trade in tandem – but several other companies (mostly MSTR) have outsized exposure to BTC. This makes these companies somewhat of a proxy trade to BTC.

(Click on image to enlarge)

With Microstrategy, 84% of their market cap is bitcoin – meaning that $0.84 of each $1 goes to Bitcoin when you purchase a MSTR share. It’s a relatively expensive way to own Bitcoin, but gives optionality to investors who might want a more “hedged” way to invest in crypto. A similar trade could happen with Coinbase.

- Coinbase as a crypto tool: Some investors could see Coinbase as an indirect way to invest in the crypto market. The two definitely move together, with most of Coinbase recent revenue driven by the crypto bull run and volatility. Right now they store ~12% of the market cap of crypto assets.

- A Tool for the Uncertain: The direct listing could be a way for the crypto-uncertain to get first hand exposure to the market, which could be bullish for Coinbase in the long run. It’s definitely one the most accessible component of the market right now.

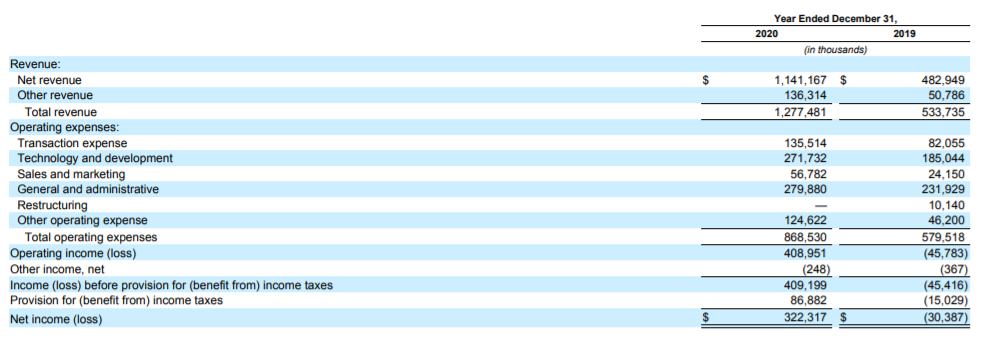

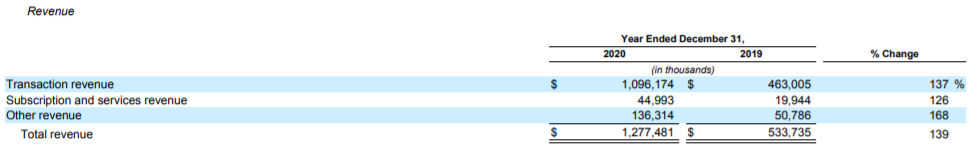

Q1 2021 Data

Coinbase had:

- ~$1.8bn in revenue (~60% more than all of 2020)

- ~$1.1bn in adj EBITDA

- $730-800mn in net income

Their user base is very large – 56mn users is bigger than most banks, besides JPM. Coinbase is set up to a lot of volume this year – potentially more than the other exchanges. Their revenue is broken out into 3 segments:

- Transactional revenue: based off trading volume and driven by a 142% increase this year (this is where ~80-90% of their revenue comes from)

- Bitcoin and Ethereum trading drove ~56% of their total trading volume

- Subscription revenue: custody and staking fees (driven by number of customers and value of crypto) – this grew 126% in 2020, showing some room to the upside (and allowing them to diversify away from transactions)

- Other Revenue: selling treasuries of BTC and ETH

(Click on image to enlarge)

(Click on image to enlarge)

But the current issue with Coinbase is the fees. Equity markets are mature and relatively efficient, and pricing reflects that. Once some of the incumbents begin to trade crypto, some of the success that Coinbase is experiencing with its numbers (specifically, transaction revenue) could begin to compress as the race to the bottom begins.

Fees and the Race to the Bottom

Coinbase does currently make most of its money through trading fees. Coinbase is currently an average fee of ~0.5% – for comparison, Binance is ~0.10%. As highlighted above, most of Coinbase’s revenue comes from transactions and a lot of that revenue comes from retail investors. This is volatile exposure, as the retail investor is quite fickle.

- Matching Competitors: If Coinbase has to match Binance, that’s going to result in a profit compression.

- More Institutional exposure: If they have more institutional customers, fees will compress even more.

- The Retail Investor: The retail investor moves with crypto cycles, as we saw in 2017. If another bear market happens, that could be bearish for Coinbase.

Any amount of fee reduction will obviously bite into their profit. But if they have to match the OG exchanges, it could get pretty painful.

- For comparison, ICE and Nasdaq made ~0.01% on each dollar of their trades. That’s lower than Binance – and much lower than Coinbase.

- Because of this Coinbase was able to generate 0.75x more in revenue versus Nasdaq – but adjusting for the change in fee (if one day Coinbase has to match the exchanges)

- Now: Coinbase trading volume of $335bn x 0.5% = ~$1.7bn in revenue

- Matching Nasdaq: Coinbase trading volume of $335bn x 0.01% = ~$33.5mn in revenue

That’s a huge difference in profitability. Coinbase likely has more time until that happens (they’ve built themselves quite the moat) but in a price taking market like exchanges, they don’t have a lot of room to keep fees high which is a longer term concern.

Technical Risks

I think Coinbase going public could create some security concerns for Bitcoin and other crytos. Coinbase highlights in the S1 that

- Disruptions, hacks, splits in the underlying network also known as “forks”, attacks by malicious actors who control a significant portion of the networks’ hash rate such as double spend or 51% attacks, or other similar incidents affecting the Bitcoin or Ethereum blockchain networks;

- hard “forks” resulting in the creation of and divergence into multiple separate networks, such as Bitcoin Cash and Ethereum Classic;

There is fork risk – “ The effect of such a fork would be the existence of two parallel versions of the Bitcoin, Ethereum or other blockchain protocol network, as applicable, running simultaneously, but with each split network’s crypto asset lacking interchangeability.” This creates two issues:

- Security risk: Double-spending, splitting of mining power (which creates vulnerability) as well as business risk to Coinbase from the impact

- Asset valuation risk: This is where the lack of centralization is actually a bad thing – because there is no central governing body, there is no key decision maker determining the “nomenclature of forked crypto assets”. That could wipe out asset value, and result in a lot of angry Coinbase customers.

Valuation: The $100bn Question

Coinbase is expected to debut at a $100bn market cap. That will be higher than most U.S. exchanges, which is interesting. Does that mean the exchanges are undervalued? Or is this just really bullish for crypto?

This $100bn valuation prices it higher than both NDAQ and ICE. This is tough.

Coinbase is tied to the cryptomarket, for better or worse. That means they have tremendous upside, but could also struggle if the cryptomarket struggles. A lot of analysis points to investor sentiment as the most important multiple – and I agree. They are likely to trade well north of any fintech/exchange competitors.

- The run rate of $750m of income would be ~$3bn in income for 2021. At an estimated 261m shares oustanding that would give them a 21.9x forward P/E ratio, assuming they price off of the reference price of $250/share (they likely won’t). If they go off to $100bn, that’s a 33.5x P/E ratio (higher than incumbents), but really not terribly drastic in the froth market we live in.

- If we assume $7bn in revenue (annualized from ~$1.8bn Q1), the $250 reference price would place them at 9x sales, and 14x sales at $100bn. However, they are likely to run away here – I wouldn’t be surprised if they go up to a $150bn market cap, which would be 21.4x sales.

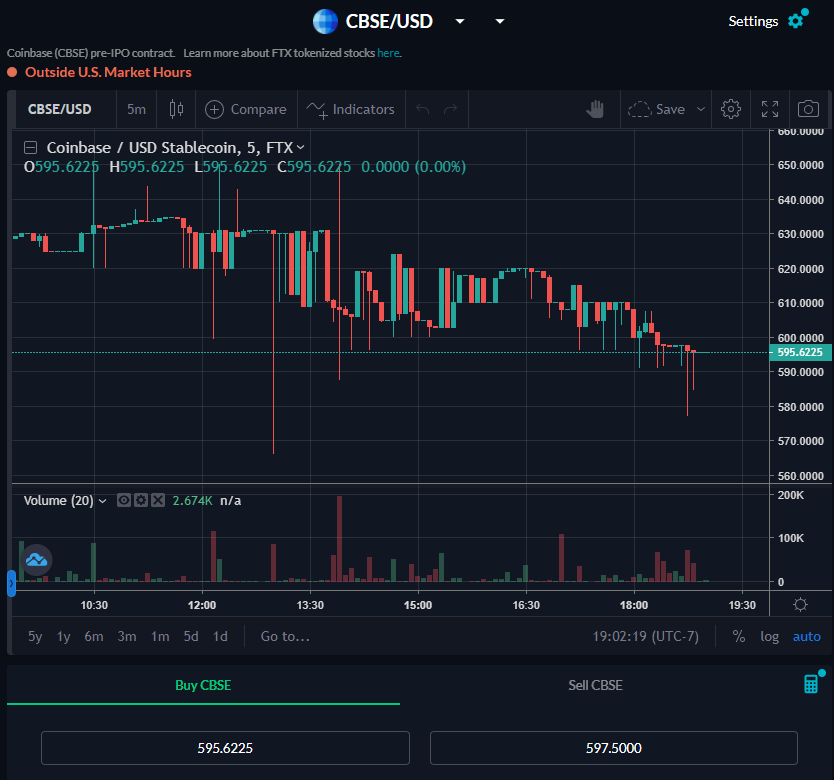

CBSE is pricing them much higher – around a $144bn market value. For many reasons, I struggle with some aspects of valuation in the current market environment.

I think Coinbase is going to price off rocket ships.

(Click on image to enlarge)

Dogecoins movement over the past few days alone (even though Coinbase doesn’t trade it) is enough of a signal of what the market expects out of crypto.

Conclusion: This is about Crypto

I think Coinbase is just the beginning for crypto. Does that make it a good investment? Maybe not. Is it a signal? Yes. Coinbase allows for accessibility, creates demand, and allows others in the crypto space to build.

As Jill Carlson said, “Coinbase is a growing business, in a growing industry, centered around a growing asset class.” The biggest thing about the Coinbase is that it is a signal to the broad market that crypto is real – and that it is here today.

Today is an interesting day because there are bank earnings and Fed chairs are speaking. It feels like a clash of two worlds –although Bitcoin and crypto are increasingly gaining adoption, the rate of adoption isn’t as fast as some would think. Coinbase is likely to change that.

There are some long term headwinds – technical risks like forks, fee compression – but Coinbase going public is a good thing for crypto signaling to the world.

Disclaimer: These views are not investment advice, and should not be interpreted as such. These views are my own, and do not represent my employer. Trading has risk. Big risk. Make sure that you can ...

more