The Cloud IPO Pipeline

Public equity investors in cloud stocks are watching developments from the private markets carefully—particularly as many of the private companies look at valuations in the public markets as a good time to issue shares.

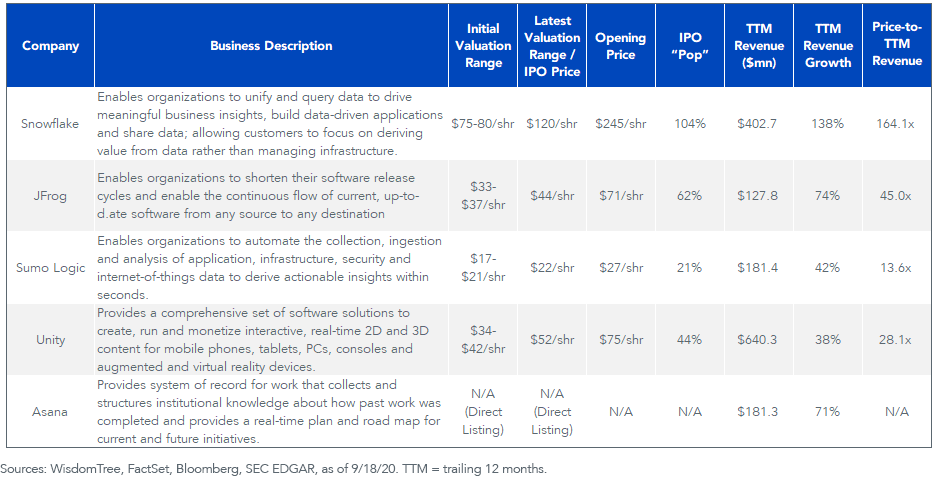

September and August 2020 have been active months for cloud computing initial public offerings (IPO). At the time of this writing, five companies have completed or are nearing the tail end of the IPO process.

Snowflake (SNOW), a cloud data warehouse provider, was the blockbuster IPO of the week ending September 18. The company priced its offering at $120 per share, raising $3.36bn and valuing the company at approximately $33.5bn.1 Notably, Snowflake’s IPO price was 50% above the midpoint of the initial range estimated just a week prior. The increase in price reflected mounting demand for the company’s public debut, including investments from Berkshire Hathaway and Salesforce.2 Snowflake began trading on September 16 at $245/share, about 100% above its IPO price! As of this writing, Snowflake is valued at 164x trailing 12-month (TTM) sales.

JFrog (FROG), Sumo Logic (SUMO) and Unity Software (U) began trading in the same week, but their newly listed shares experienced less of a “pop” than Snowflake’s.3

(Click on image to enlarge)

Given that the median public cloud company valuation is near a five-year high, the influx of IPOs is no surprise—raising capital at potentially premium valuations is attractive for private shareholders.

Bessemer Venture Partners has been tracking developments in the private markets in their Cloud 100 Benchmarks Report4 on an annual basis since 2016. Based on the previous Cloud 1005 lists, 33 of the 204 total private cloud companies have completed public offerings (this includes Snowflake, JFrog and Sumo Logic).

But did all the gains to investors in cloud stocks only accrue to private investors, and was it too late to buy once these companies hit the public markets?

Bessemer’s analysis shows that the IPO route has proven very accretive to public market shareholders—65% of public cloud companies’ current market capitalizations were captured in public markets, with only 35% created while private.

WisdomTree licensed the BVP Nasdaq Emerging Cloud Index from Nasdaq, which tracks the performance of public companies that meet Bessemer’s definition of a pure-play cloud computing company—complete with specific revenue growth thresholds and trading requirements. Companies must be publicly traded for three months before they are eligible for this cloud Index.

The private Cloud 100 list is interesting to watch because it gives a sense of developments in the private market. If these private firms decide to pursue IPOs, it is possible, but not guaranteed, that they could become candidates for inclusion in indexes as publicly traded cloud companies.

"The Cloud 100 has also delivered a meaningful portion of the public cloud software market capitalization, as measured by the BVP Nasdaq Emerging Cloud Index. Twenty-two of the EMCLOUD component companies are Cloud 100 graduates, contributing over $350 billion of market capitalization of the total $1.6 trillion.” –Mary D’Onofrio, Vice President at Bessemer Venture Partners

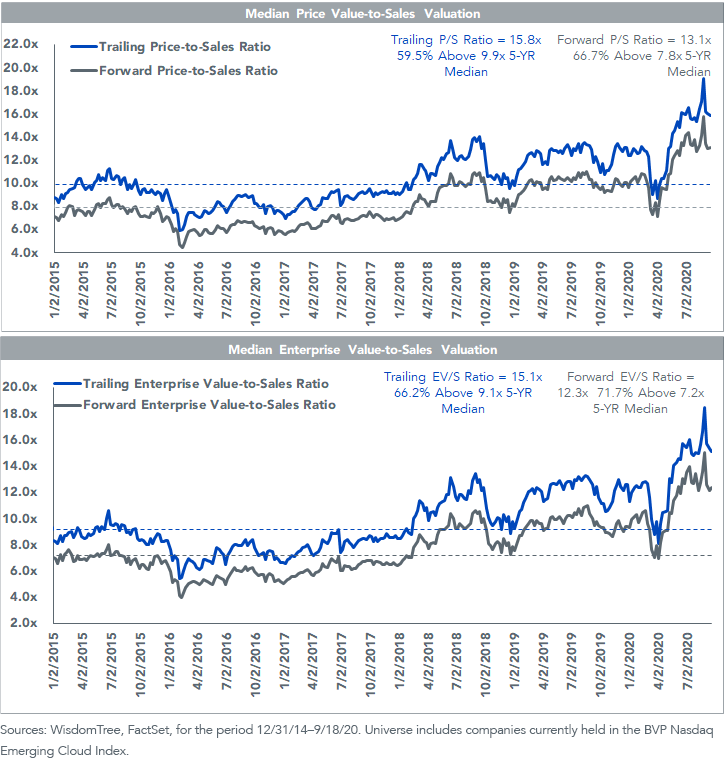

Public Cloud Valuations

Pure-play cloud stocks have notched record multiple expansions since the pandemic-induced trough of March 2020. Current valuations are approximately 60%–70% above their five-year medians.

Private cloud valuations are no different. According to Bessemer, the average valuation of the 2020 Cloud 100 List is $2.7bn, about 60% above the 2019 list’s average.

The rise in public valuations can at least partially be explained by the outsized growth of the cloud industry.

In the first two quarters of 2020, a significant majority of companies in the WisdomTree Cloud Computing Fund (WCLD) delivered higher-than-forecasted revenue growth. The median WCLD constituent generated approximately 27% top-line growth, about 10x the median rate of the Nasdaq 100 Index.6

Realized results, which have showcased the industry’s expansion and defensibility, help to justify a valuation premium; however, the greatest challenge is determining the expectations that are priced in at current multiples.

Valuations appear to reflect continued strength in top-line growth over at least the next 12 months. The median WCLD constituent is forecasted to deliver 20% revenue growth over the next 12 months, well above the 6% forecast for the Nasdaq 100 Index.7 Some may argue that the deceleration to 20% growth forecasted over the next 12 months from 30% over the trailing 12 months is a red flag, but that 10 percentage point gap between realized and forecasted growth has persisted for the last five years, perhaps because consensus estimates have proven too conservative.

Beyond forecasted top-line growth, it’s unclear what expectations may already be reflected in today’s multiples. Over the medium- to long-term horizon, three potential positive catalysts that are top of mind include: 1) broad profitability across the industry; 2) industry consolidation via M&A (mergers and acquisitions); and 3) broad capital return through dividends or buybacks.

Positioning for Growth in the Cloud Industry

With a full roster of IPOs, public markets have a full plate of cloud companies to digest—can they do it?

Positive performance for the IPOs launched the week of September 18 provides an initial indication of “yes.” History also suggests “yes,” and that there could be more launches before the end of 2020. Based on Bessemer’s Cloud 100 lists alone, there were 13 and 10 cloud IPOs in 2018 and 2019, respectively.

Importantly, Bessemer views the success of the recent IPOs as a favorable indicator.

“The performance of recent cloud IPOs, including Snowflake and JFrog, speaks to the incredible public market demand for cloud software, and we are bullish about the prospects for the cloud IPOs and direct listings in the backlog.” –Mary D’Onofrio, vice president at Bessemer Venture Partners.

Over the long term, we view growth of the public cloud universe, both in count and total market capitalization, as a positive development. We have high conviction that the application of cloud technology has hardly penetrated its total addressable market. Bessemer has predicted that cloud will become the underlying connectivity source of our global economy, leaving room for companies to enter new industry verticals and geographies.

As of this writing, the total market capitalization of publicly traded cloud companies, as measured by the BVP Emerging Cloud Index, stands at $1.6tn. Bessemer predicts that the public cloud benchmark will have reached $2tn by the release of the 2021 Cloud 100 list.

Investors can potentially position for the evolution of the cloud industry with the WisdomTree Cloud Computing Fund. WCLD seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted Index designed to measure the performance of emerging public companies.

1As of August 31, 2020, the WisdomTree Cloud Computing Fund (WCLD) did not hold Snowflake. WCLD seeks to track the performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index. The Index and, accordingly, WCLD require companies to meet a number of requirements for potential inclusion, including requirements around exchange listing, minimum volume, minimum capitalization and revenue growth.

2As of August 31, 2020, WCLD held 2.3% of its weight in Salesforce; it did not hold Berkshire Hathaway.

3As of August 31, 2020, WCLD did not hold JFrog, Sumo Logic, Unity or Asana.

4D'Onofrio, Mary. “The Cloud 100 2020 Benchmarks Report.” · Bessemer Venture Partners, 16, September. 2020

5“Cloud 100.” · Bessemer Venture Partners, www.bvp.com/cloud100.

6Sources: WisdomTree, FactSet, as of 9/18/20.

7Sources: WisdomTree, FactSet, as of 9/18/20.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more