The Bullish Case For Uber

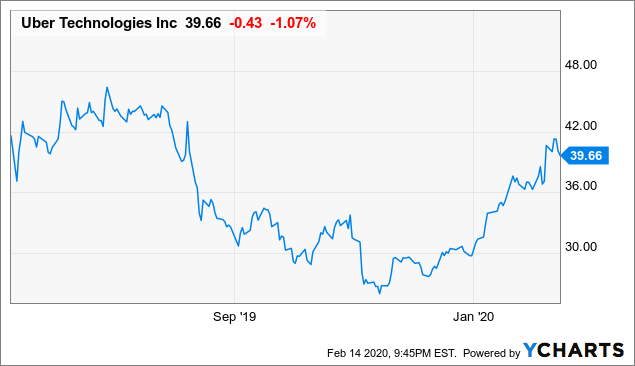

Uber (UBER) is a battleground stock, with both the bulls and the bears taking sanguine positions on the company. The bullish case is starting to look stronger recently, but the stock is still trading at its IPO price of $45.

While there are many things that could go wrong for investors in Uber, management is clearly taking steps in the right direction, and the upside potential in the stock could more than compensate for the risks.

Data by YCharts

The Most Important Thing

When analyzing a complex position such as Uber, it is important to understand the main factors that will drive returns going forward. Many times, a complicated investment thesis can be simplified in a single important question that needs to be answered.

In this particular case, it seems like there are two main visions of Uber. The bears say that the company has a broken business model and that it will never generate enough profitability to justify an investment in the stock, and the bulls say that Uber has a long runway for revenue growth and expanding profit margins in the years ahead.

Uber has reported big losses since going public, and the company made some major mistakes that hurt its public image under former CEO Travis Kalanick. But under the leadership of CEO Dara Khosrowshahi, Uber has delivered some clear progress in terms of repairing its reputation and improving financial performance.

The stock price is starting to reflect these improvements to some degree, but the battle between the bulls and the bears is far from being decided at this stage. If Uber proves to the market that it can generate and sustain attractive profitability over the long term, then the stock would deliver big gains from current levels.

On the other hand, management is explicitly stating that profitability will increase in the near term, and this is a double-edged sword. If the company fails to deliver in due time, this could produce big losses for investors.

Competitive Strengths

This brings us to the important issue of competitive advantages. At the end of the day, competitive advantages are the factors that allow a company to generate profits above the cost of capital and, even more important, to sustain and increase those profits over the years.

In this area, the network effect is a key factor to consider. The network effect basically means that the platform becomes more valuable as it gains more users over time, and this is a key source of competitive advantage for Uber.

Drivers need to go to the platforms that have more customers, and customers gravitate towards the larger platforms with more drivers, since this reduces waiting time and creates all kinds of efficiencies. This way, customers and drivers attract each other to the leading platforms in the business.

In addition to this, the size of the platform allows Uber to spread fixed costs on a large and growing revenue base, and wider geographic area coverage is obviously a major plus. Brand recognition and a deep rating system for drivers also create trust and safety.

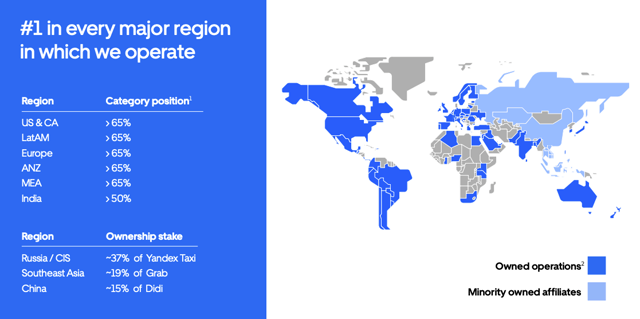

Uber is the top player in all of the main regions where it operates, and it owns valuable investments in private companies like Didi (DIDI) in China, Yandex taxi (YNDX) in Russia and GrabTaxi (GRAB) in Southeast Asia.

Source: Uber

Uber's closest competition in the US is clearly Lyft (LYFT), but Uber still has a considerable size advantage. For 2020, the company is expected to make almost $18 billion in revenue versus $4.6 billion in expected revenue for Lyft over the same year.

In a nutshell, being the largest player in the market could be a major source of competitive advantage for Uber, since the size of the platform is one of the most important success drivers in the industry.

Looking At The Evidence

It is one thing to say that the network effect can be a key profitability generator for Uber in the future and a very different thing to see evidence of improving profitability right now, since this can provide validation, or not, to the thesis.

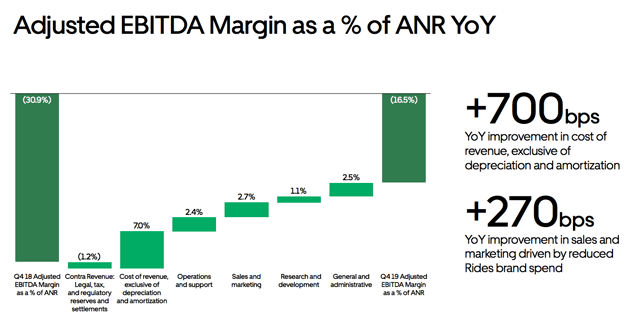

It is important to note that the company is making progress in terms of Adjusted EBITDA margins, and management has decided to accelerate its EBITDA profitability target from the full year 2021 to the fourth quarter of 2020.

Source: Uber

From the earnings conference call:

Our progress in 2019 and our 2020 plans gives me the confidence to challenge our teams to accelerate our EBITDA profitability target from full year 2021 to Q4 2020. It’s important to emphasize that we plan to achieve this profitably target assuming only modest improvements in the current competitive environment and without the assumption of any significant changes to our current portfolio businesses.

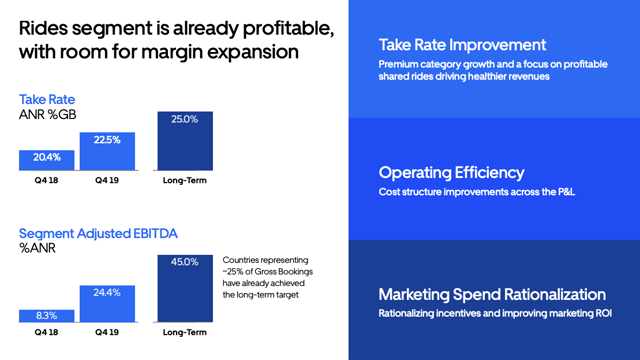

Over the long term, Uber is committed to achieving an overall company-adjusted EBITDA margin of 25%. Management expects Rides to produce an adjusted EBITDA margin of 45% with a 25% take rate and the Uber Eats business to deliver an adjusted EBITDA margin of 30% with a 15% take rate.

The company has already reached profitability in the rides segment, and management has ambitious plans to continue expanding profitability levels in this area in the years ahead.

Source: Uber

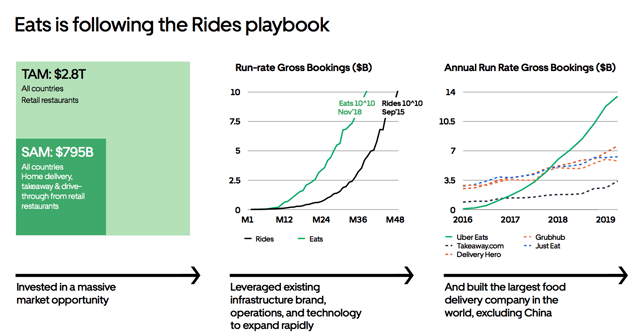

Uber is planning to follow with Uber Eats the same playbook as with Rides in order to increase profit margins via cost disciplines, increased efficiencies, and eliminating bookings that are empty calories.

Source: Uber

In the Freights segment, management is focused on "responsible expansion with a heavy focus on unit economics". Everything indicates that this segment will keep burning money in the near term, but the size of the losses should remain under control and the impact on overall company margins will be modest due to the relatively small size of Freights in comparison to Rides and Eats.

Starting in 2020, Uber will be disclosing adjusted net revenue guidance. The company expects adjusted net revenue of $16-17 billion in 2020, reflecting constant currency growth of 26-34% and reported growth of 24-32%.

In a nutshell, the company is already profitable in Rides, and while the Eats segment is far more competitive and challenging, it is not unreasonable to expect cost discipline to produce some results in this segment over the coming quarters.

A particularly encouraging sign is that management has committed to providing more disclosure and even accelerating profitability targets. This is indicating confidence and transparency from the leadership team.

Risk And Reward Going Forward

There are many things that could go wrong with Uber, and regulatory risk across multiple markets is a major consideration in this area.

The regulatory environment is evolving in a rather favorable way, and the discussion has moved away from the question of whether ride-sharing should exist to more nuanced questions around taxes, fees, and driver status. However, Uber will still have to face massive challenges and uncertainties on the regulatory front in the years ahead.

The ride-sharing industry is still very young, and competitive dynamics are just getting established. While Uber is a dominant player in this segment, price competition is quite intense, and this could limit profitability. The food delivery industry is even more challenging than ride-sharing, and Uber faces tough competition from players of all sizes in these markets, including some local players with aggressively low prices.

The issue of worker compensation is another important risk factor to keep in mind. The company has faced lots of complaints in this area, and regulations could always impose minimum pays per trip or similar requirements that would affect profitability levels for the business.

Those are just some of the many risk factors affecting Uber. The truth of the matter is that the bullish case requires the company to deliver profitability levels that it has never delivered before, and these kinds of bets always carry considerable risks.

However, the potential payoff is also quite attractive if things work out well. Uber is currently priced at a forward price-to-sales ratio of 3.8, with revenue expected to increase by 26.7% in 2020. This is a very reasonable valuation, which obviously incorporates the fact that Uber is losing money. If the company can, in fact, deliver on its profitability targets, the valuation levels could substantially increase from current levels.

The average price target among the analysts following the stock is $48.64. This implies an upside potential of 23% versus current levels, and it could easily turn out to be conservative if margins keep moving in the right direction.

The bullish thesis on Uber is quite risky, but there are two main factors that make me gravitate towards the bullish side. To begin with, it should be relatively easy for the company to make improvements in profitability over the middle term.

Industry conditions have been horrible in recent years, with different players spending crazy amounts of money to grab a share of the market, and Uber itself being a major overspender. It looks like industry conditions are not getting any worse, and perhaps even trending towards rationality. Since Uber has massively overspent in the past, it should be relatively easy for management to trim some fat without losing much muscle.

The fact that management is taking full ownership of Uber's target to increase profitability is also a big positive sign. The company has accelerated its goals, while also providing more disclosure and information to investors. Once these targets are established, the company cannot afford to miss or the stock price could get crushed, but it's good to see management being confident and committed in this crucial area.

The bullish case for Uber is risky and uncertain, but it is also offering a considerable chance of big gains for investors who are willing to take the risk.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in UBER over the next 72 hours.

Disclaimer: I wrote this article myself, and it expresses my ...

more