The 3 Top Stocks For Dividends Every Calendar Month

When trying to construct a portfolio that will support financial independence – the ability to retire if you want to and live entirely from passive income – it is very helpful to be receiving dividend checks each month.

Creating a portfolio that generates dividends in every calendar month means investors will not have to go without income in certain months while they wait for the next quarterly, semi-annual, or annual dividend check.

Instead, investors will receive cash flow each month. While many stocks pay quarterly dividends, they do not all abide by the same schedule. This article explores three stocks that pay quarterly dividends but do so on varying schedules so that an investor who owns all three will receive one dividend payment in each calendar month.

Even better, all three stocks have high dividend yields above 5%.

The most obvious and simple way to create a monthly passive income stream is to invest in monthly dividend stocks. While this could work, it also severely restricts your potential investment universe and therefore your ability to select high returning stocks. Furthermore, it may cause you to take on excessive risk and even suffer dividend cuts as you seek to achieve diversification within such a restricted pool of stocks.

We believe a far better way of achieving a monthly dividend cash flow stream is by diversifying across dividend-paying stocks that issue their payouts in complementary quarters such that dividend checks pour in during each month of the year. This way, investors can invest across a much larger universe of stocks while still reaping the benefits of receiving monthly dividends.

In the rest of this article, we will highlight our top three picks that will combine to provide a fairly stable and diversified stream of monthly dividends alongside strong total return potential.

January/April/July/October: Seagate Technology plc (STX)

- Dividend Yield: 5.3%

Seagate Technology pays its dividend in the months of January, April, July, and October at a current forward yield of 5.3%. It provides data storage technology and solutions in Singapore, the United States, the Netherlands, and internationally. It manufactures and distributes hard disk drives, solid-state drives (SSDs), and storage subsystems.

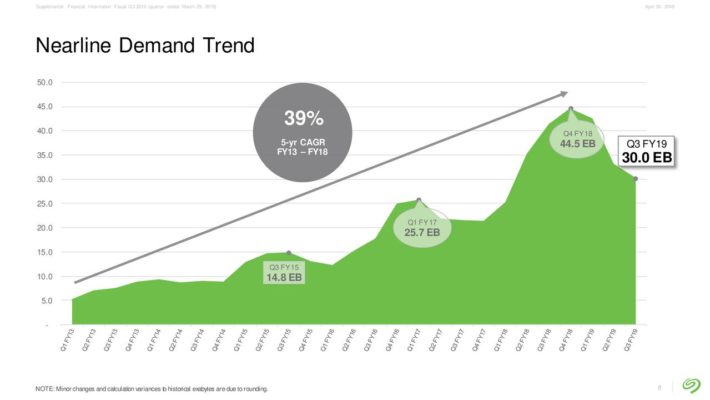

Seagate Technologies’ strong earnings growth over the past year was driven by lower operating expenses as well as demand growth for storage products. Over the last five years, demand for Nearline HDDs, an intermediate type of data storage that makes up roughly half of Seagate Technologies’ HDD sales, rose by 35% annually.

We believe that this strong growth should continue, thanks to tailwinds from the explosive growth in the IoT, big data, automotive driving, and cloud computing. These should all lead to rapid growth in data storage demand, thereby boosting the entire data storage industry.

Source: Investor presentation, page 8

As one of the largest data storage companies in the world, the company benefits from economies of scale as well as the oligopoly state of its industry. While demand for its products is cyclical, the dividend is well covered due to the conservative 50% payout ratio.

Combining this with the strong growth prospects that come with the rapidly growing long-term demand for data storage leads us to believe that the dividend is pretty safe and the company as a whole could generate double-digit annualized total returns moving forward.

February/May/August/November: AbbVie Inc. (ABBV)

- Dividend Yield: 6.2%

AbbVie Inc. pays out quarterly dividends in the months of February, May, August, and November, rounding out our monthly dividend portfolio. It is a biotechnology giant focused on developing and commercializing drugs for immunology, oncology, and virology and was spun off by Abbott Laboratories in 2013.

With sales of $30 billion annually and a market capitalization of $105 billion, the company enjoys economies of scale that give it a competitive advantage in developing and producing new drugs, which in turn give it significant intellectual property competitive advantages.

Its current blockbuster drug – Humira – has played a major role in driving strong earnings per share growth for the company. While Humira’s protection from the competition will likely expire sometime around 2023, the company still has plenty of time to bring its healthy pipeline of next-generation drugs to market to offset any losses to cash flow.

Source: Investor presentation, page 4

The company also recently acquired Allergan (AGN), which it believes will give them numerous opportunities for synergies, growth, and increased product diversification. In the long run, we believe the deal is a net positive for the company and ultimately makes their dividend and its growth prospects safer.

Given the expected 2019 payout ratio of just 48.7%, the recession-resistant and competitive advantage-rich business model, strong dividend growth momentum (the payout has grown from $0.80 per share in 2013 to $4.28 per share in 2019 and 21.75% CAGR over the past 5 years), and the forward dividend yield of ~6%, we view AbbVie stock as our top dividend growth pick for this portfolio.

March/June/September/December: Imperial Brands (IMBBY)

- Dividend Yield: 9.6%

Imperial Brands plc pays out quarterly dividends in the months of March, June, September, and December at a very attractive forward yield of 9.6%. It is a tobacco product manufacturing and distribution company that was founded in 1901 and is today headquartered in the United Kingdom. The company manufactures and sells a variety of tobacco products, including cigarettes, tobaccos, cigars, rolling papers, and tubes.

Source: Investor presentation, page 17

While Imperial Brands is struggling with the declining smoking rate in developed economies like the United States (leading to a 3.6% volume decline in fiscal 2018 and 4.5% decline in the first half of fiscal 2019), the company still managed to outperform the broader industry for the year. The company hopes that future growth will be fueled by its next-generation product line, including vapor and heated tobacco products, and is also pursuing an aggressive cost reduction program, targeting up to $2.6 billion in cost savings over the next few years.

Imperial Brands has a fairly high level of debt, which has eroded its interest coverage ratio. To battle this and declining volumes in its core business, the company recently announced that it will slow its dividend growth and instead focus cash resources on share buybacks, deleveraging, and investing in its new product lines. Despite the news of slowing dividend growth, the current yield of nearly 10% supported by a proven and recession-resistant business model makes for a very attractive addition to a dividend portfolio.

Final Thoughts

These three stocks pay us an average dividend yield of 7% along with fairly strong safety as well as attractive growth prospects while also providing us with a fairly consistent dividend check every month of the year.

They also enjoy broad diversification across the tobacco, technology, and biopharmaceutical sectors. As this article illustrates, it is very possible to build a diversified and attractive monthly income stream without necessarily just investing in monthly dividend stocks, many of which are highly risky.

Sure Dividend would like to thank David Morris for providing the inspiration for this article..

Disclaimer: Sure Dividend is published as an information service. It includes ...

more