The 3 Best Entertainment Stocks Today

The entertainment industry is notoriously volatile. What was popular last year or today, may not demand the same attention in a year or a decade. It is a constantly transforming industry.

As such, it’s important for entertainment businesses to focus on not just short-term profits, but also the direction of the future.

Investors have many options to choose from in the entertainment industry. The best entertainment stocks have a combination of strong brands, growth potential, and competitive advantages.

Many also pay dividends to shareholders. You can see the entire list of consumer-cyclical dividend stocks here.

Below we highlight three of the best entertainment businesses that can stand the test of time.

Entertainment Stock #3: The Walt Disney Company (DIS)

The Disney name likely draws up images of its founder Walt Disney and his iconic character Mickey Mouse.

But this Burbank, California-based company is so much more than that. The following image shows Disney’s various media properties:

Source: Disney 2019 Investor Day

And keep in mind that this is only on the entertainment viewing side. In addition to media networks and studio entertainment, which contains some of the most iconic and beloved movies of all time, Disney operates theme parks, hotels and resorts, cruise lines and consumer merchandise.

Disney is an exceptionally well-rounded entertainment company, with an eye toward the future as it launches its own streaming service.

The company’s record has been superb in the last decade. Since the end of 2007, which takes into account the last recession, Disney has grown its earnings-per-share by an average compound rate north of 14% per annum.

Further, the dividend has grown at an even faster rate, as the payout ratio expanded slightly from 16% to 20%. Meanwhile, long-term shareholders have enjoyed returns of 13% per annum for over a decade now.

The share price has jumped up recently, now sitting around $130 or about 19% higher than it did to start the year. However, the stock could still be interesting.

The expectation is for the company to earn $6.90 or so in normalized earnings this year. If this metric were to grow by 7% annually, that would equate to the potential for $9.70 or so in earnings after five years.

A typical earnings multiple for the security has been in the 16 to 20 times earnings range. At 18 times earnings, this would imply the potential for a future price of about $175.

Add in $9 or so in dividends per share, and you come to an expected value of $184, keeping in mind that this is simply one possibility out of many. Against the current $130 price, this would imply the potential for 7% to 8% annual returns.

Certainly, this is not as impressive as the company’s past, but it is a reasonable starting baseline for a company that generates very strong profits and has plenty of growth opportunities ahead.

Entertainment Stock #2: CBS Corporation (CBS)

Finally, CBS is another company that has lasted the test of entertainment time. A good example being the latest 2019 Masters golf tournament, which CBS has broadcast for 64 consecutive years.

In addition to its namesake channel, CBS also has a host of other entertainment offerings. A sampling of the company’s various media properties can be seen in the image below:

Source: CBS Shareowner Resources

Since 2008, CBS has grown earnings-per-share by an average compound rate of about 10% per annum. Meanwhile, shareholders have seen total returns of roughly 7% per year, as the valuation has drifted lower.

Today shares trade at roughly 9 times expected earnings for this year. If CBS were able to grow its bottom line by 5% annually, this would imply a future earnings-per-share number of about $6.60 after five years. A “typical” multiple for the security has been in the 12 to 16 times earnings range.

Using 12 times earnings, this equates to the potential for a $79 share price in the next half-decade. While the current dividend is not especially robust, this might add $4 or so per share in cash payments for a total expected value of $83 or so, keeping in mind that this is merely a starting place.

Against the current share price around $52, this would imply the potential for 9% to 10% annual returns from this point.

Entertainment Stock #1: AT&T Inc. (T)

AT&T is the top entertainment stock, particularly because of its impressive dividend history. AT&T has increased its dividend for over 30 years in a row, earning the company a place on the exclusive list of Dividend Aristocrats.

In addition, AT&T has a high dividend yield of 6.4%.

Up until recently, AT&T was not really big in the entertainment space. Certainly mobile phones have become entertainment vehicles in their own right, but lately, AT&T has made much clearer entries into the space.

AT&T’s major moves into entertainment include the acquisition of DirecTV in 2015 and Time Warner, now known as WarnerMedia, in 2018.

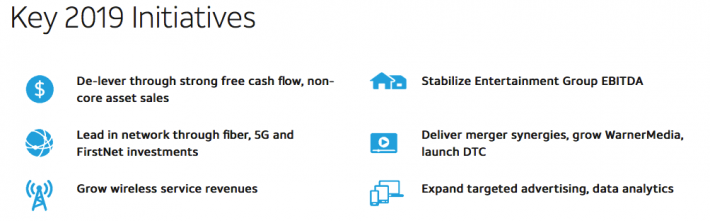

Some have suggested that the company’s debt load has become too large, but this is one of AT&T’s key initiatives for 2019:

Source: AT&T Investor Profile

In addition to deleveraging, the company is also working on holistically approaching its combined wireless, pay-TV and broadband businesses with direct-to-consumer relationships along with a newly formed advertising technology.

Since the end of 2007, AT&T has only grown its earnings-per-share by an average compound rate of 2.2% per year. However, the company’s well above average dividend yield has allowed investors to collect a solid income stream along the way.

Interestingly, as earnings growth has picked up lately, the share price has gone down materially. In the last two years, earnings-per-share are up 24%, and yet the share price has declined by over 24%. This has allowed for an even higher starting dividend yield and a P/E ratio below 10 times earnings.

If AT&T were to grow by 2% annually, this would mean the potential for $3.90 or so in earnings-per-share after five years. A “typical” multiple has been in the 12 to 15 times earnings range. At 12 times earnings, this would imply a future price of about $47.

In addition, the $0.51 quarterly dividend would add another $10 or so in cash per share, for a total value of about $57. Against the current price near $32, this implies the potential for 12% annualized returns.

Final Thoughts

In short, there’s a lot of hype in the entertainment space. It is easy to get caught up in the latest and greatest transformation of what people enjoy watching and interacting with.

However, from an investment return perspective, it’s often the enduring company that can add on new technology to its existing business model that offers consistent returns.

Think of Disney moving from movies to theme parks to toys, or its evolution of old films released in VHS, DVD and now streaming as examples.

The three entertainment stocks mentioned above have a few things in common. They have storied histories to go along with a continued adoption of the future.

Moreover, the securities remain reasonably priced, and all three pay dividends to shareholders.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more