The 10 Best Infrastructure Stocks Today

Upgrading the nation’s infrastructure is a pressing need in the United States. U.S. infrastructure—which includes things like highways, bridges, railroads, and more—is in dire need of investment.

As a result, it is possible that a major upgrade of U.S. infrastructure is imminent. In April, President Trump along with leaders in Congress agreed to pursue a $2 trillion infrastructure plan. If it eventually passes, such an ambitious plan could amount to huge business opportunities.

Naturally, investors might want to know which companies would benefit from a massive investment in U.S. infrastructure.

You can view a preview of our infrastructure stocks spreadsheet below:

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio | Beta |

|---|---|---|---|---|---|---|---|

| ACM | AECOM | 36.69 | 0.0 | 5,783 | 21.1 | 0.0 | 1.07 |

| ADP | Automatic Data Processing, Inc. | 168.48 | 1.8 | 71,812 | 38.0 | 68.2 | 1.07 |

| AEP | American Electric Power Co., Inc. | 88.80 | 3.0 | 43,809 | 22.2 | 65.7 | 0.10 |

| ALX | Alexander's, Inc. | 369.42 | 4.8 | 1,898 | 34.9 | 169.2 | 0.37 |

| AM | Antero Midstream Corp. | 9.22 | 6.0 | 4,581 | 31.5 | 188.4 | 1.03 |

| AMT | American Tower Corp. | 211.63 | 1.6 | 92,228 | 69.4 | 109.7 | 0.34 |

| ANDX | Andeavor Logistics LP | 32.17 | 12.8 | 7,901 | 12.6 | 160.2 | 1.04 |

| APA | Apache Corp. | 24.36 | 4.1 | 9,059 | -60.1 | -249.6 | 1.31 |

| AST | Asterias Biotherapeutics, Inc. | 0.94 | 0.0 | 52 | -2.5 | 0.0 | |

| AT | Atlantic Power Corp. | 2.41 | 0.0 | 259 | 9.0 | 0.0 | 0.64 |

The stocks in the table were derived from four infrastructure ETFs: the iShares U.S. Infrastructure ETF (IFRA); the iShares Global Infrastructure ETF (IGF); the SPDR S&P Global Infrastructure ETF (GII); and the ProShares DJ Brookfield Global Infrastructure ETF (TOLZ).

These ETFs include stocks from a variety of industries that support the building and maintenance of infrastructure assets. Industry groups include electric and water utilities, energy infrastructure such as oil and gas pipelines and energy production firms, steel producers, manufacturers of construction machinery, and even regional banks that finance these companies.

In addition to the Excel spreadsheet above, this article covers our top 10 best infrastructure stock buys today, as ranked using expected total returns from the Sure Analysis Research Database.

The following 10 stocks all have expected annual returns above 10%, making them potential buys for dividend growth investors. One of the stocks has a particularly long record of dividend growth, placing it on the list of Dividend Aristocrats, a group of stocks with 25+ consecutive years of dividend increases.

You can download an Excel spreadsheet of all 57 (with metrics that matter) by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

The table of contents below allows for easy navigation.

Table of Contents

- Arcelor Mittal (MT)

- Magellan Midstream Partners (MMP)

- KeyCorp. (KEY)

- Caterpillar Inc. (CAT)

- Holly Energy Partners (HEP)

- Macquarie Infrastructure Corp. (MIC)

- Genesis Energy LP (GEL)

- MPLX LP (MPLX)

- Apache Corp. (APA)

- EQM Midstream Partners (EQM)

Infrastructure Stock #10: Arcelor Mittal (MT)

- Expected Returns: 13.6%

Arcelor Mittal is a giant steel company. It would benefit from an infrastructure spending plan, as steel would surely be used heavily in an upgrade of the nation’s infrastructure assets. ArcelorMittal was founded in 1976 as a steel producer. It has grown rapidly since through a series of acquisitions.

Today, the company has a global presence. ArcelorMittal is headquartered in Luxembourg, and produces nearly $77 billion in annual revenue.

ArcelorMittal is one of the largest steel producers in the world and serves automotive, rail, and construction customers, among others, meaning it would benefit highly from higher infrastructure spending. This is especially true because Arcelor Mittal swung to a $447 million net loss in the most recent quarter, compared with a $1.9 billion profit in the year-ago period.

Revenue declined 4% year-over-year, and the company cut its forecast for global steel demand. As ArcelorMittal is responsible for roughly 6% of the world’s steel production, a major infrastructure spending bill would give the company a much-needed boost.

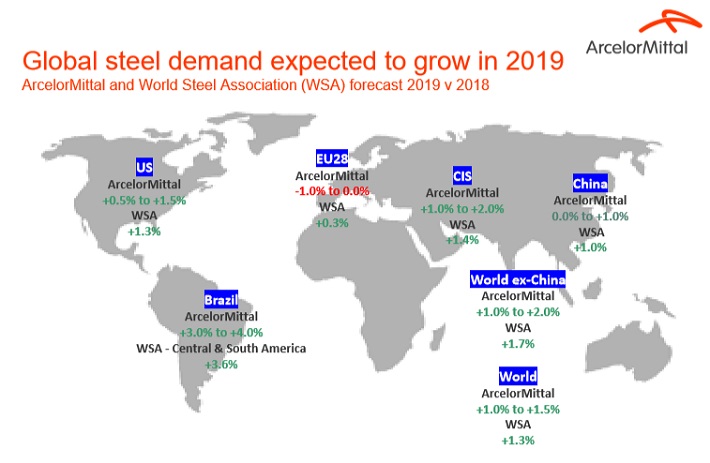

ArcelorMittal still expects global steel demand to grow in 2019.

Source: Investor Presentation

Furthermore, ArcelorMittal aims to return to profitability with cost cuts and asset sales, including $2 billion in divestments over the next two years. This will also help the company reduce debt.

ArcelorMittal’s earnings history is extremely volatile as steelmakers are highly cyclical stocks. ArcelorMittal has seen boom and bust cycles in the past decade. Due to the aforementioned headwinds, we have lowered our earnings-per-share estimate for this year from $4.50 to $2.35. We expect annual EPS growth of 10.1% through 2024, as the company executes its turnaround plan and benefits from global economic growth.

Still, the current P/E ratio of 6.3x is below our fair value estimate of 7.0x, meaning expansion of the P/E ratio could add 2.1% per year to shareholder returns through 2024. ArcelorMittal stock also has a 1.4% dividend yield, leading to total expected returns of 13.6% per year over the next five years.

Infrastructure Stock #9: Magellan Midstream Partners (MMP)

- Expected Returns: 14.2%

Like Holly Energy Partners, Magellan is also an energy MLP. Magellan could specifically benefit from a major infrastructure spending bill, because it has the longest pipeline system of refined products, which is linked to nearly half of the total U.S. refining capacity. This segment generates 59% of its total operating income while the transportation and storage of crude oil generates 34% of its operating income.

Source: Investor Presentation

MMP has a fee-based model; only ~10% of its operating income depends on commodity prices. MMP has a market capitalization of $15 billion.

MMP recently reported second-quarter financial results. Distributable cash flow (DCF), a non-GAAP financial measure that represents the amount of cash generated during the period that is available to pay distributions, was $314.8 million for the second quarter, up 18% compared with $266.6 million in the 2018 second quarter.

Thanks to favorable commodity prices and positive trends in crude oil pipeline shipments, management raised its annual DCF guidance, from $1.18 billion to $1.22 billion. It expects a distribution coverage ratio around 1.3.

The competitive advantage of MMP comes from its fee-based model, its great scale and its discipline to invest only in high-return projects. All these facts are testaments to the strength of its business model and its great discipline to invest only in high-return projects. We expect 5% annual DCF-per-unit growth over the next five years.

In addition, Magellan has a high yield of 6.1%. The company recently increased its distribution for the 69th time since its initial public offering in 2001. The new distribution payout is 6% higher than the same quarterly payout last year. As a result, Magellan is an attractive MLP for the combination of high yield and high distribution growth.

Including valuation expansion, we expect MMP to generate total returns of 14.2% per year over the next five years.

Infrastructure Stock #8: KeyCorp (KEY)

- Expected Returns: 14.3%

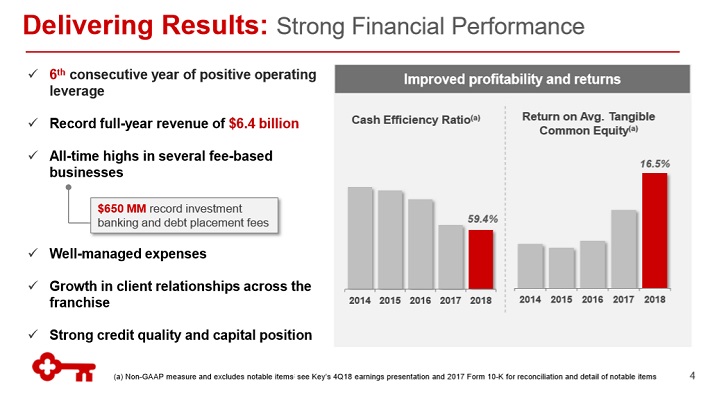

KeyCorp is a regional bank that could benefit from a major infrastructure plan, as it finances a number of companies involved in building the nation’s infrastructure. Headquartered in Cleveland, Ohio, KeyCorp has been in business for 190 years and is now one of the nation’s largest bank-based financial services companies, with almost $145 billion in assets.

The company operates in 15 states with over 1,400 ATMs and 1,100 full service branches. KeyCorp works in personal, small business, commercial, and corporate banking along with wealth management. The $17 billion market cap company employs over 17,600 people. KeyCorp has racked up several years of impressive financial results.

Source: Annual Meeting

On July 23 KeyCorp reported second-quarter 2019 results. For the quarter, income from continuing operations came in at $403 million, representing a 4.4% improvement compared to the previous quarter, but a 13.1% decline compared to the same quarter last year. Meanwhile, earnings-per-share equaled $0.40 compared to $0.44 in the year ago period, representing a 9.1% year-over-year decline. Share repurchases softened the decline somewhat.

KeyCorp’s key metrics were down across the board, with return of assets falling to 1.19% from 1.41% a year ago, the company’s Common Equity Tier 1 ratio dropping to 9.60% from 10.13% and the net interest margin declining 13 basis points to 3.06%. However, book value per share increased from $13.29 to $15.07.

KeyCorp is a shareholder-friendly company, because it returns a lot of cash directly to shareholders. Beginning in the third quarter of 2019, KeyCorp plans to increase its dividend 9% from $0.17 to $0.185. In addition, the company intends on repurchasing up to $1 billion worth of stock during the next four quarters.

KeyCorp has a high dividend yield of 4.3%. In addition, future returns will be supplemented by EPS growth, which we expect at 5% per year through 2024. Lastly, the stock appears to be undervalued. Shares of KeyCorp trade for a price-to-earnings ratio of 9.4x, compared with our fair value P/E of 12.0.

As a result, valuation expansion could fuel annual returns of ~5% per year over the next five years, resulting in total expected returns above 14% through 2024.

Infrastructure Stock #7: Caterpillar Inc. (CAT)

- Expected Returns: 15%

Caterpillar is an obvious choice for this list, as it is the largest heavy machinery company in the United States. Caterpillar manufactures heavy machinery used in the construction and mining industries. The company also manufactures ancillary industrial products such as diesel engines and gas turbines. Caterpillar generates annual revenue of $58 billion.

Caterpillar has performed well to start 2019. In the most recent quarter, the company reported revenue of $14.4 billion, representing a 3% increase compared to the prior year’s quarter. This growth was driven by an 11% increase in Resource Industries and a 5% improvement in Construction Industries, which were partly offset by a 4% decline in the Energy & Transportation segment. Earnings-per-share came in at $2.83, compared to $2.82 in the second quarter of 2018.

Caterpillar also updated its 2019 outlook. The company kept its earnings-per-share outlook the same at $12.06 to $13.06, although Caterpillar now expects results to come in at the lower end of this range.

Caterpillar’s most important future growth catalyst is the continued growth of the global economy. Steady GDP growth in the U.S. and around the world will naturally result in higher demand for heavy machinery. An infrastructure spending plan would provide a significant boost to Caterpillar’s core construction business.

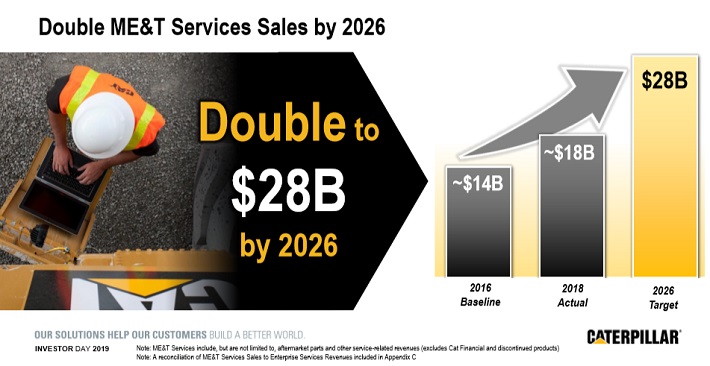

Caterpillar’s services business is a very compelling growth catalyst. Caterpillar expects to double its Machine, Energy & Transportation services sales to about $28 billion by 2026, from about $14 billion in 2016.

Source: Investor Day

Caterpillar’s strong growth has allowed the company to raise its dividend at a high rate over the past several years.

Caterpillar recently increased its quarterly dividend by 20% and also expects to increase the dividend over the next four years by at least a high-single digit percentage rate. Caterpillar has increased its dividend for 25 consecutive years, qualifying the stock as a Dividend Aristocrat.

We believe Caterpillar’s dividend is safe.

With a forecast dividend payout ratio of 29% for 2019, Caterpillar’s dividend is secure barring a deep and protracted recession. Absent a significant economic downturn, Caterpillar stock could generate impressive returns, due to a combination of dividends, earnings growth, and an expanding P/E ratio.

Caterpillar is expected to produce EPS of $12.25 for 2019. The stock has a P/E ratio of 10.1x, which we feel is far too low for a high-quality Dividend Aristocrat. Our fair value estimate is a P/E of 14.0x, meaning an expanding P/E ratio could boost annual returns by 6.7% per year through 2024. Caterpillar has expected EPS growth of 5% per year and a 3.3% dividend yield, leading to 15% annual returns over the next five years.

Infrastructure Stock #6: Holly Energy Partners (HEP)

- Expected Returns: 15%

Holly Energy Partners is an oil and gas Master Limited Partnership, or MLP. The company operates its own crude oil and petroleum pipelines and storage terminals in ten U.S. states, including Texas, Nevada and Washington. HEP also has refinery facilities in Utah and Kansas. HEP was founded in 2004 by HollyFrontier (HFC) and generates revenue by charging customers a fee for transporting and storing petroleum products.

Source: Investor Presentation

Holly reported second-quarter financial results on July 31. Distributable cash flow was $67.5 million for the quarter, an increase of $2.3 million, or 3.5% compared to the second quarter of 2018. The company saw strong volume growth in its Permian Basin operations and in the Rockies.

Holly Energy has increased its distribution to investors for 59 consecutive quarters, including a recent 1.9% increase. However, the sustainability of the distribution is a significant question for investors, as Holly reported a distribution coverage ratio of just 0.99x in the most recent quarter.

This means that the company did not generate enough distributable cash flow to cover its distribution in full last quarter. A distribution coverage ratio below 1.0x is not sustainable over the long-term, meaning the company will need to grow DCF above its distribution in the near future.

We think Holly can accomplish this. Thanks to a series of growth projects, such as a truck loading rack in Orla, Texas, we expect the MLP to grow its distributable cash flow per share by at least 4% per year over the next five years.

We expect annual DCF-per-unit growth of 4% through 2024, and the stock has a very high yield of 9.7%. We also view the stock as slightly undervalued, and that an expanding valuation multiple could boost annual returns by ~1.3% per year. Overall, we expect annual returns of 15% per year over the next five years.

Infrastructure Stock #5: Macquarie Infrastructure (MIC)

- Expected Returns: 16.2%

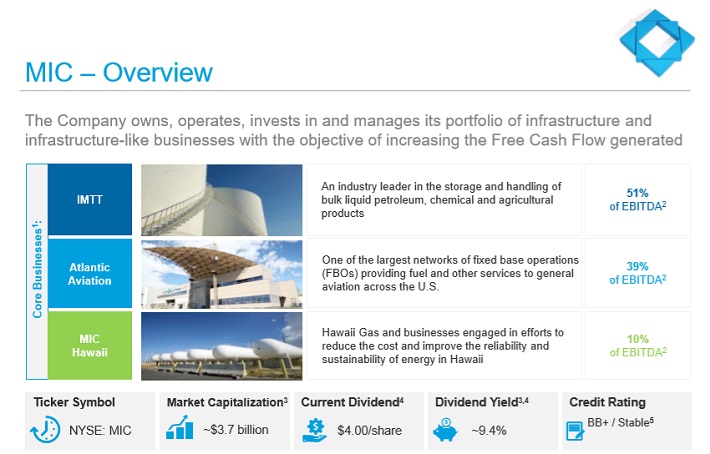

Macquarie is a perfect fit for this list, as it is a fund that invests in infrastructure businesses such as airport services, gas production & distribution, and bulk liquid terminals. Macquarie Infrastructure was founded in 2004, and is currently valued at $3.5 billion.

Source: Investor Presentation

Macquarie International holds a portfolio of asset-heavy businesses. Its terminals, gas distribution centers, and other businesses are relatively similar to those of many MLPs. Macquarie Infrastructure has been able to grow its cash flows considerably over the last couple of years, both on an absolute basis as well as on a per-share basis, despite the fact that the share count rose substantially. Between 2009 and 2018, the company achieved a cash flow-per-share growth rate of 11.4%.

Macquarie Infrastructure’s largest business is Atlantic Aviation, which contributes about 50% of the company’s total revenues. Atlantic Aviation provides airport services such as fueling, deicing, baggage services. It provides its services for business aircraft, military aircraft, commercial & cargo aircraft, and more.

None of Macquarie Infrastructure’s units are high-growth businesses, but all provide necessary elements of infrastructure and produce reliable cash flows. The majority of the cash flow growth in the past several years was derived through acquisitions, which were highly accretive in the past. As a result, Macquarie is optimally positioned to benefit from a major infrastructure spending plan.

Macquarie has a current dividend yield of 10%, and the stock appears to be undervalued. An expanding valuation could add approximately 4.2% to its annual returns. We also expect 2% annual growth for Macquarie, leading to total expected returns of 16.2% per year over the next five years.

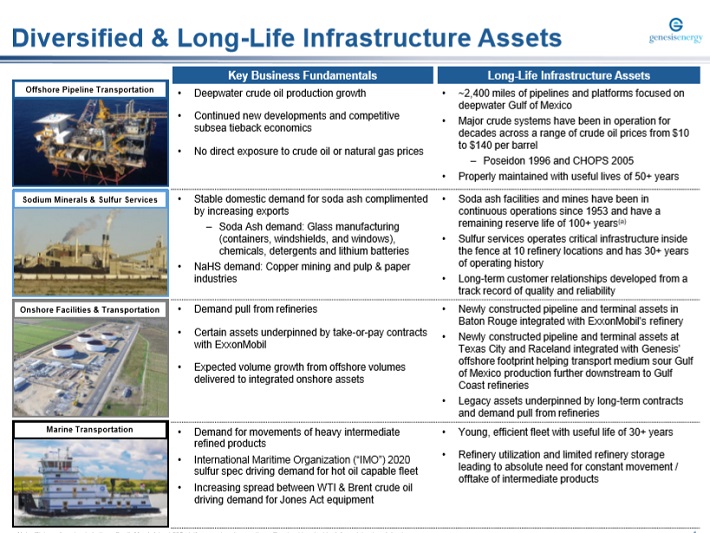

Infrastructure Stock #4: Genesis Energy LP (GEL)

- Expected Returns: 18%

Genesis is an energy infrastructure MLP. It generates roughly 42% of its operating income from offshore pipeline transportation, 36% from sodium minerals and sulfur services, 16% from onshore facilities and 6% from marine transportation. It has a market capitalization of $2.7 billion.

Source: Investor Presentation

Genesis Energy has had a difficult past few years, culminating with a 31% distribution cut in late 2017. Nevertheless, the distribution cut will probably prove to be a turning point for the stock. Thanks to the distribution cut, Genesis Energy now intends to reduce its leverage ratio from 5.1x to about 4.0x by the end of next year. Moreover, U.S. oil production has reached record levels and is expected by Energy Information Administration to keep posting new all-time highs in the upcoming years.

This growth could be accelerated by a major infrastructure spending bill, as machinery and new infrastructure would require oil. This oil boom will be prominent in the Gulf of Mexico, where Genesis Energy generates a great portion of its earnings thanks to the services it provides to deep-water oil producers. We expect 3% annual DCF growth for Genesis over the next five years.

In addition, the stock appears to be undervalued. With a price-to-EBITDA ratio below 4.0x, compared with our fair value estimate of 5.0x, the stock could see a ~5.1% annual tailwind from a rising valuation multiple.

And while investors never want to see a dividend cut, Genesis has returned to distribution growth, with five distribution hikes since the cut. Genesis has a current yield of 9.9%, leading to total expected returns of 18% per year through 2024.

Infrastructure Stock #3: MPLX LP (MPLX)

- Expected Returns: 19%

MPLX is an energy infrastructure company that was formed by the Marathon Petroleum Corporation (MPC) in 2012. The business operates in two segments: Logistics and Storage – which relates to crude oil and refined petroleum products – and Gathering and Processing – which relates to natural gas and natural gas liquids (NGLs). The company generated $2.7 billion in distributable cash flow in 2018

MPLX has exciting growth prospects going forward, due to its exposure to natural gas. In the last decade, natural gas has overtaken coal as the leading source of electricity generation in the U.S. Building pipelines requires years of approvals and ongoing regulation.

As such, the incumbent positions enjoy “toll-booth” type business models, with a good portion of their revenue fixed via fee-based and “take or pay” agreements. MPLX in particular has a strong position in the Marcellus/Utica region, with long-term contracts from Marathon. We are forecasting 3.5% annual DCF growth moving forward.

Plus, higher infrastructure investments in the U.S. will naturally lead to higher demand for natural resources, and MPLX is in prime position to capitalize on this increased demand.

Source: Investor Presentation

Acquisitions will further boost MPLX’s growth. On July 30th, MPLX closed on its acquisition of Andeavor Logistics LP in a unit-for-unit exchange. On a pro-forma basis, MPLX will have adjusted EBITDA of $5.3 billion and distributable cash flow of $4.1 billion per year. The combined entity will have a distribution coverage ratio of 1.4x, with a manageable leverage ratio of 4.0x and an investment-grade credit rating.

MPLX has a current yield of 9.3%, and we expect the company to generate 3.5% annual DCF growth. In addition to a 6.2% annual boost from valuation expansion, our total return estimate is 19% per year for MPLX stock through 2024.

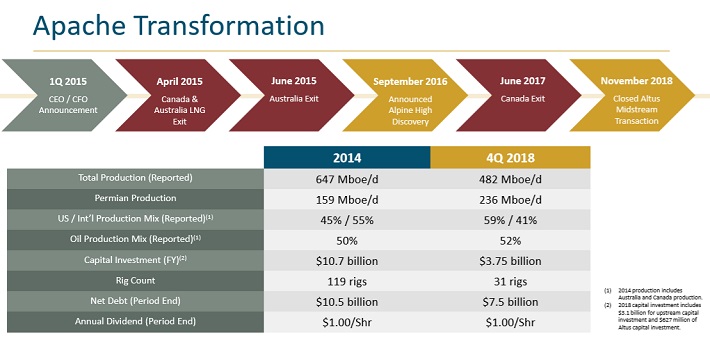

Infrastructure Stock #2: Apache Corp. (APA)

- Expected Returns: 21.1%

Apache is an oil and gas production company. Apache explores and produces crude oil, natural gas and natural gas liquids (NGLs) in the U.S., Egypt and the North Sea. It has a market capitalization of $9 billion. In 2018, Apache produced about 395,000 barrels of oil equivalent per day (excluding non-controlling interest). In this period, oil, natural gas, and NGLs comprised 80%, 13% and 7%, respectively, of the total revenue of the company.

Apache has undergone a major transformation in the past several years.

Source: Annual Meeting

In November, Apache teamed up with Kayne Anderson Acquisition and formed Altus Midstream, an entity that will be funding future midstream investment needs at Alpine High, an area with promising growth prospects. Apache expects to grow its output at Alpine High from 44,000 barrels per day in 2018 to 160,000-180,000 barrels per day by 2020. Apache owns 71% of Altus Midstream.

Apache reported a net loss of $360 million, or $0.96 per share in the most recent quarter, as the company is highly sensitive to the price of oil, which has trended lower in recent months. However, the company expects robust production over the course of 2019.

For Permian Basin oil, Apache expects third-quarter production to be 94,000 to 98,000 barrels of oil equivalents per day and fourth-quarter production to be 100,000 to 105,000 BOE per day. At Alpine High, Apache expects third-quarter production to be between 70,000 to 75,000 BOE per day, and over 100,000 BOE in the fourth quarter.

Higher production is expected to fuel strong EPS growth through 2024, which we expect at approximately 27.5% annually over the next five years. Apache is an investment for those who want to benefit from booming U.S. shale oil production. U.S. shale oil output currently stands at an all-time high and is expected to continue posting new records for years. Apache is following this trend, with significant output growth expected in the upcoming years.

However, the stock appears overvalued. Apache stock is trading at a 2019 P/E ratio of 23x, compared with our fair value estimate of 13.2x, which is equal to its 10-year average P/E ratio. Contraction of the P/E ratio could reduce annual returns by 10.5% per year.

Still, the contribution of expected EPS growth and the 4.1% dividend yield still results in a strong expected rate of return, of 21.1% per year over the next five years.

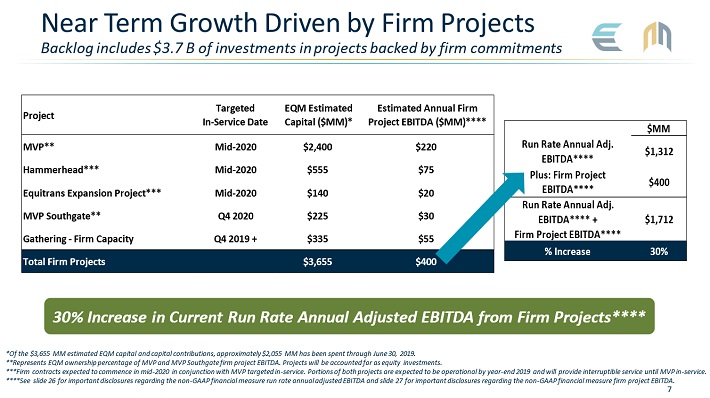

Infrastructure Stock #1: EQM Midstream Partners (EQM)

- Expected Returns: 25.4%

Taking the top spot on the list if EQM, an energy midstream company with a very high expected return. EQM Midstream Partners LP is a growth-oriented limited partnership that owns and operates midstream assets in the Appalachian Basin.

It is one of the largest gatherers of natural gas in the U.S. and offers midstream services to producers, utilities and other customers. It enjoys reliable cash flows thanks to its long-term contracts with its customers and trades with a market capitalization of $7 billion.

On July 30th, EQM Midstream reported second-quarter financial results. The MLP grew its revenues by 8.4% year over year, thanks to higher contracted transmission and gathering capacity. Revenue beat analyst expectations by nearly $7 million, but second quarter earnings-per-share of $0.62 missed expectations by $0.37 per share.

However, the company expects adjusted EBITDA of at least $1.3 billion for 2019. EQM has an aggressive growth plan moving forward, supported by a large project backlog.

Source: Earnings Slides

Management also guides for annual distribution growth of 6%, along with a long-term distribution coverage ratio of 1.2x and a manageable leverage ratio of 3.5x to 4.0x.

Acquisitions will help EQM reach its growth targets. On April 10, EQM Midstream completed the acquisition of a 60% interest in Eureka Midstream and a 100% interest in Homet Midstream for $1.03 billion. The company funded the acquisition with $1.2 billion of newly issued perpetual convertible preferred units. Eureka Midstream assets include a 190-mile gathering pipeline system in Ohio and West Virginia that services dry Utica and wet Marcellus production. The Homet pipeline is a 15-mile gathering system in West Virginia, which connects to the Eureka pipeline.

We expect 8.4% annual cash-flow-per-share growth for EQM over the next five years. In addition, the stock is undervalued. The 2019 P/E ratio of 7.3x is below our fair value estimate of 9.0x. A return to our fair value estimate could fuel 4.3% annual returns over the next five years.

In addition, EQM stock has a 12.7% dividend yield, leading to total annual returns above 25% per year through 2024.

Final Thoughts

The 10 stocks on this list are derived from a variety of industries, such as oil and gas, steel, energy infrastructure, investment in infrastructure assets, and even the financial services industry. But what they all have in common is that they stand to benefit from a massive infrastructure spending plan.

U.S. infrastructure, including roads, bridges, airports, and more are in dire need of a major face-lift. These stocks could benefit from higher demand for oil, gas, steel, and financial servicing activity. The 10 stocks on this list all pay dividends, and have expected returns in excess of 10% annually, making them attractive stock picks to capitalize on infrastructure spending.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more