The 10 Best Dividend Stocks Now

It is no secret that we recommend investors focus on the highest-quality dividend growth stocks. One of our favorite places to look for the best dividend stocks is the list of Dividend Aristocrats, an exclusive group of 64 stocks in the S&P 500 with at least 25 consecutive years of annual dividend increases.

But there are many high-quality dividend stocks to be found outside the Dividend Aristocrats. Investors can find strong investment opportunities in the U.S. and around the world, and in every market sector. What matters is that investors select companies with durable competitive advantages and future growth potential.

To help with the search, we reached out to several authors of popular investing websites for their individual recommendations. The following list represents these contributors’ favorite dividend stocks for 2020, in no particular order.

The 10 Best Dividend Stocks Now

Best Dividend Stock #10: Altria Group, Inc. (MO)

This best dividend stock selection is from the Dividend Growth Investor.

Altria Group, Inc. manufactures and sells cigarettes, smokeless products, and wine in the United States.

Altria is a dividend king, which has rewarded shareholders with a raise for the past 50 years in a row. Between 2008 and 2018, Altria managed to boost its earnings per share from $1.45 to $3.68. Altria is expected to generate $4.22/share in adjusted earnings per share in 2019 and $4.44/share in 2020.

There are a lot of reasons to like Altria. The products are branded and addictive and the market for tobacco products is in the hands of a few major players with Altria holding a dominant position. There is some threat of future legislation banning the sale of tobacco products or making it uneconomical. Governments take in a ton of money by heavily taxing tobacco products. It is hard to find another scapegoat that can be taxed so heavily.

The other factor to consider is that while the number of smokers is expected to be decreasing over time, so far the increase in prices has more than offset the drop in consumers. Alternative tobacco products can threaten cigarettes but also serve as a gateway to traditional products too.

Over the past decade, Altria has managed to more than double its dividend from $1.22/share in 2008 to $3.28/share in 2019. Altria raised its dividend in August 2019 by 5% to $0.84 per share.

Management has stated its target for Altria’s dividend payout ratio of approximately 80% of its adjusted diluted earnings per share. That hasn’t stopped it from more than doubling earnings per share over the past decade.

Currently, the stock is attractively valued at 11.90 times forward earnings has a safe dividend and yields 7.3%. I believe that the dividend is defensible and can grow over time above the rate of inflation.

About this best dividend stock selection’s author: Dividend Growth Investor is a private investor who has been covering dividend growth stocks since 2008.

Best Dividend Stock #9: Cheesecake Factory Inc. (CAKE)

This best dividend stock selection is from Lyn Alden.

With a market capitalization below $2 billion, a dividend yield of 3.7%, and consecutive annual dividend increases since the inception of the dividend in 2012, Cheesecake Factory Inc (CAKE) is worth a serious look.

Chart Source: F.A.S.T Graphs

The company operates The Cheesecake Factory chain of over 200 large upscale casual restaurants. Most of these are located in the United States, but the company has been licensing new locations to a small group of developers in the Middle East and Asia as well.

This summer, they acquired Fox Restaurant Concepts, which is a successful incubator of new restaurant brands. Fox’s leading brand, North Italia, is an upscale casual Italian restaurant chain with 20+ locations, which the newly-combined company believes they can scale to 200+ nationwide. North Italia is particularly interesting because its restaurants currently have 35% cash-on-cash returns compared to 20-25% typical returns for The Cheesecake Factory locations, partly due to North Italia’s extensive wine and drink menu.

Cheesecake Factory Inc normally operates with a very strong balance sheet. They increased leverage a bit to buy Fox Restaurant Concepts, but they still maintain strong liquidity and plan to pay down that debt over time. With debt levels of around 3x net income, it’s still quite a reasonable balance sheet as is.

The company faces two key risks. The first is that many of the company’s locations are near malls, which is no longer a strong industry. A mitigation for this, however, is that the restaurants are often destinations in and of themselves and have external entrances, and therefore can be successful even if mall traffic diminishes. The second key risk is that the restaurant industry has faced rising labor costs in recent years, which is putting pressure on margins, although North Italia may help the company protect its overall margins.

Overall, I believe that Cheesecake Factory Inc, especially with Fox Restaurant Concepts as its new source of growth and diversification, offers a compelling blend of stability, yield, and long-run upside potential, with the nationwide expansion of North Italia being a particularly interesting catalyst to watch.

About this best dividend stock selection’s author: Lyn is the founder of Lyn Alden Investment Strategy, where she focuses on value investing with a macro overlay. Check out her free investment newsletter, which comes out every 6 weeks and includes market updates and her full portfolio list.

Best Dividend Stock #8: Bank OZK (OZK)

This best dividend stock selection is from Dividend Stocks Rock.

My selection is Bank OZK (OZK) which was once a stock market darling…until it declared an unexpected charge-off in 2018.

The small bank that sees big has a strong reputation in the savings and loan banking industries. OZK is well-positioned to benefit from the U.S. economic tailwind. I trust the man behind the bank. George Gleason II has been Chairman of the Board, Chief Executive Officer and President of OZK since 1979. He’s the beautiful mind behind this growth story, and I don’t think it will end today.

Finally, its Real Estate Specialties Group is a loan growth machine. OZK is leaving the crowded loan activities to focus on Real Estate specialties. As the construction industry remains healthy, RESG should have solid results going forward. I particularly appreciate its strong dividend growth policy. With a yield of around 3.5%, OZK is now an interesting pick if you are patient.

Once you lose the market’s love, it is hard to get it back. OZK posted solid results on January 16th as it beat both EPS and revenue growth expectations. Net loans outstanding of $17.5B increased 2.4% from $17.1B in Q4 2018, and total deposits of $18.5B were up 3.0% from $17.9B.

The company showed strong credit portfolio management as well. Net charge-offs to average total loans of 0.12% increased from 0.07% a year earlier while nonperforming loans to total loans decreased to 0.15% vs. 0.23% a year earlier. Unfortunately, this wasn’t enough to satisfy the analysts. Nonetheless, OZK remains a strong buy at Dividend Stocks Rock.

Financial firms such as Raymond James and SunTrust noted challenges ahead for the bank. Analysts are concerned about slow loan growth pressured by elevated payoffs. The market expects a slowdown in many lending segments as fear of a recession continues to be among the discussed topics.

At least OZK management expects its most important growth vector, their Real Estate Specialties Group, to keep their loans increasing during 2020. Considering the low-interest-rate environment, the appetite for large Real Estate projects remains very high.

About this best dividend stock selection’s author: Many people fail to reach a happy retirement because they make bad investment decisions. Through a made-simple investing strategy, DSR gives you clarity and confidence to invest your money and retire stress-free. You can follow Mike, a passionate investor and former private banker at Dividend Stocks Rock.

Best Dividend Stock #7: Intact Financials (IFCZF)

This best dividend stock selection is from Dividend Earner.

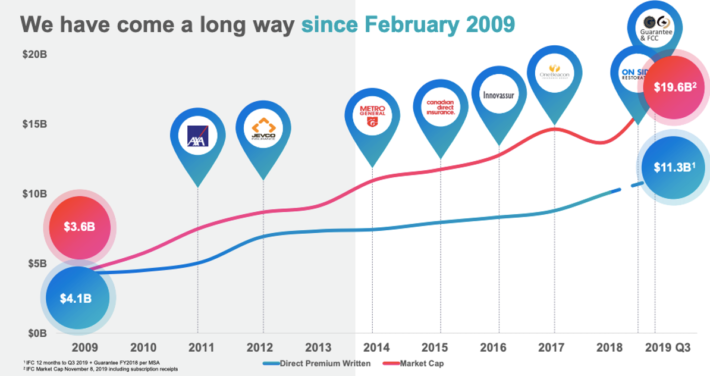

The property and casualty insurance tends to be overlooked in the financial sector but Intact Financials (IFCZF) stands out. Companies either grow organically or through acquisitions, the latter is challenging as you need to integrate the company into your business but Intact has gotten good at it over the past 10 years.

See for yourself the string of acquisitions Intact has done.

Business quality aside, Intact Financial got on my radar due to its Chowder Score, reaching the Dividend Achiever status and, consequently, its historical dividend growth. Unlike other companies with good dividend growth, both the revenue and dividend growth are following each other closely.

The 10-year CAGR dividend growth is 8.49% and the CAGR revenue growth is 9.88%. The company is able to execute acquisitions without impacting the revenue growth and still increase their dividend.

The stock has appreciated a fair amount this past year but I believe there is still room to grow through acquisitions and as such it trades at a higher premium than other insurance stocks. Weather-related incidents have increased in the past years and so have the rates to be insured.

The casualty insurance business is bound to grow and will be needed by businesses. While Intact makes an acquisition per year, even if it were to skip a year, you have an OK dividend yield of 2.00% to lean on. Disclaimer: Dividend Earner has a position in IFC – see the full portfolio.

Editor’s note: Investors should be aware that IFCZF is a thinly-traded stock with very low average daily volume.

About this best dividend stock selection’s author: Dividend Earner is a DIY investor with a $1M portfolio who invests and shares his strategy on solid dividend growth stocks. See the portfolio with all investment accounts here.

Best Dividend Stock #6: Pepsico (PEP)

This best dividend stock selection is from Shailesh Kumar of Value Stock Guide.

Recommending any stock in today’s frothy market is difficult. The specter of a possible recession right around the corner is still present. In such situations, what can a value investor do when tasked to find his favorite dividend stock today?

We look for ideas that exhibit the following 3 qualities:

- The demand for its products should be relatively inelastic in the times of economic stress

- The company is well run and managed

- The company is committed to enhancing shareholder value through increasing dividend payments

PepsiCo (PEP) fits the bill. As part of the unofficial duopoly in the U.S. (and more or less the world) soft drinks market, the company enjoys a superior Return on Invested Capital of 29.0% and Net Margins of 18.8%. Earnings per share have grown 15.4% in the past 5 years and the dividend has grown 7.8% average in the last 5 years.

Dividend investors will appreciate a nice 2.6% dividend yield to start with and a sustainable dividend growth that the company is able to keep up with the current payout ratio at 42.7%.

From a value perspective, the shares are not cheap today. A trailing 16.5 P/E ratio is not terribly expensive but not in the value range. However, as legendary value investor Warren Buffett often says, sometimes you want a wonderful company at a fair price. PepsiCo is certainly that, and it comes with a close to 30% margin of safety at today’s prices (based on DCF analysis in Stock Rover).

About this best dividend stock selection’s author: Shailesh Kumar runs the value investing blog Value Stock Guide. You can get his latest book on Amazon here.

Best Dividend Stock #5: Magellan Aerospace (MALJF)

This best dividend stock selection is from Hashtag Investing.

A little bit of a flyer here (pun intended). When many think of a great dividend earning Canadian company they would typically instantly think of the large blue-chip bank, insurance or energy stocks that are household names. Magellan Aerospace Corporation (MALJF) is likely a company you’ve never heard of. Neither did I until I did a little bit of digging into this diamond in the rough.

Magellan Aerospace, as its name implies, is an aerospace company that specializes in a variety of products including jet engines, defense aircraft, and helicopters, satellites and rockets as well as production of metal castings used in the aerospace industry. The aerospace industry as a whole has some interesting prospects for the future.

Firstly, with increasingly funding going towards space related expeditions (SpaceEx, the new U.S Space Force), aerospace technology could see higher demands over the next 10 years. Secondly, aerospace technology also plays a part in defense-related products. With the world appearing to demonstrate more geopolitical tensions, aerospace-related stocks could be a good hedge for any future events.

Currently sitting with a 3% dividend yield, Magellan has been consistently increasing its dividend payout consistently over the past 7 years. Currently, it has a lower P/E ratio of 9.31 with an EPS of 1.51. The company has also been profitable with a growing EPS of each year for the past 5 years. This is a good indicator that earnings are continually growing to increase dividend payouts in future years. Unlike other companies in the aerospace industry, Magellan Aerospace Corporation has a strong balance sheet and is priced pretty fairly as of today’s date.

About this best dividend stock selection’s author: Hashtag Investing is quickly growing to become the highest quality online community of stock investors. Members are able to share in real-time forums and group chat rooms in order to learn, share and improve their stock investing knowledge.

Editor’s Note: The next two analysts independently picked the same stock.

Best Dividend Stock #4: AbbVie Inc. (ABBV)

This best dividend stock selection is from Josh Arnold.

AbbVie, a drug maker that specializes in virology, immunology, and oncology products, is one of the best dividend stocks in the market. The company possesses a strong product portfolio, which is currently led by Humira, and a pipeline of acquired and developed products to help with future growth. While Humira faces patent expiration globally in the next few years, AbbVie is developing a replacement, as well as a slate of other products to help curb the inevitable decline in revenue that will come with patent expiration.

AbbVie’s acquisition of Allergan is another way it is boosting future growth to offset lost Humira revenue, and the current deal price – which is based in part on AbbVie’s share price – is just 12 times Allergan’s projected 2020 earnings. This deal will be accretive to AbbVie almost immediately and help diversify the combined company’s revenue stream over time.

AbbVie – even without the benefit of Allergan – should see ~5.5% earnings-per-share growth annually in the coming years as its margins continue to improve, it buys back its own shares, and sees slightly higher revenue over time. Humira is still a blockbuster worth billions of dollars per year, so the company has ample time to replace that lost revenue. This level of earnings growth, combined with a reasonable payout ratio that is right at half of earnings-per-share, means AbbVie can keep its very impressive dividend increase streak alive for many years to come.

With a current yield of ~5%, a very safe payout that is well-covered, earnings growth potential, an attractive pipeline, and a favorably-priced acquisition, AbbVie has a unique combination of current yield, dividend growth, earnings growth, and value. AbbVie, therefore, is certainly one of the best dividend stocks in the market today.

About this best dividend stock selection’s author: Josh Arnold is an independent equity analyst and a prolific writer on the subject of dividend stocks. His work can be seen here on Sure Dividend, as well as other financial sites such as Seeking Alpha.

Best Dividend Stock #3: AbbVie Inc. (ABBV)

This best dividend stock selection is from Nick McCullum of Sure Dividend.

My favorite dividend stock today is AbbVie. AbbVie is a biopharmaceutical company headquartered in Chicago, Illinois. The company was spun-off from Abbott Laboratories in 2013, and since then has grown to generate annual revenues of $33 billion. AbbVie currently trades with a market capitalization of $140 billion.

The primary reason why AbbVie’s stock is intriguing at current levels is its valuation. The company expects to generate adjusted earnings-per-share of $9.61 to $9.71 in the current fiscal year. Using the midpoint of this guidance band ($9.66), AbbVie is currently trading at a price-to-earnings ratio of 9.8.

Why is AbbVie’s valuation so low? The company’s earnings multiple has been pessimistically small ever since its spin-off from Abbott in 2013, largely because of AbbVie’s high reliance on a single product. More specifically, AbbVie generates more than half of its revenue from the blockbuster drug Humira, whose patents are beginning to expire – which will reduce its sales moving forward.

Fortunately, AbbVie made significant progress in diversifying its product line last summer when it announced the acquisition of Allergan (AGN). Here are the terms of the transaction:

“Under the terms of the Transaction Agreement, Allergan Shareholders will receive 0.8660 AbbVie Shares and $120.30 in cash for each Allergan share that they hold, for a total consideration of $188.24 per Allergan Share. The transaction represents a 45% premium to the closing price of Allergan’s Shares on June 24, 2019.”

After this transaction closes, the contribution of Humira to AbbVie’s total revenues and profits will be much smaller relative to the overall business. It seems likely that the company’s valuation multiple will rise in response due to the lowered risk profile of this stock as an investment.

About this best dividend stock selection’s author: Nick joined Sure Dividend in late 2016 and, among other tasks, is responsible for writing investment research, and maintaining industry-leading client support. Nick was born and raised in Eastern Canada and graduated at the top of his class from the University of New Brunswick. He enjoys reading, running, and cycling. Nick has passed Level 2 of the CFA program.

Best Dividend Stock #2: United Parcel Service (UPS)

This best dividend stock selection is from Bob Ciura of Sure Dividend.

United Parcel Service is a global logistics and package delivery giant that offers services including transportation, distribution, ground freight, ocean freight, insurance, and financing. Its operations are split into three segments: U.S. Domestic Package, International Package, and Supply Chain & Freight.

UPS is an attractive dividend stock to buy and hold for the long-term, as the company possesses durable competitive advantages with growth potential. UPS is an industry giant, with a market capitalization of nearly $90 billion. It essentially operates in a duopoly, with FedEx (FDX) as its major competitor. While there are fears of Amazon (AMZN) building its own logistics platform, it is also a customer of UPS.

And, even with Amazon entering the fray, the industry remains healthy enough for UPS to capture its fair share of growth. This is thanks in large part to the e-commerce industry, which is growing at a high rate and shows no signs of slowing down.

UPS reported another strong earnings report for the fourth quarter and 2019. For the quarter the company generated revenue of $20.57 billion, representing a 3.6% increase compared to Q4 2018, driven by strong average daily volume growth during the peak holiday season. Adjusted net income equaled $1.84 billion compared to $1.69 billion prior, while adjusted earnings-per-share came in at $2.11 increased 8.8% year-over-year.

For the year, UPS generated $74.1 billion in revenue, a 3.1% year-over-year increase, driven by strong volume growth in the United States. Adjusted earnings-per-share totaled $7.53, up 4.0% for the year. UPS expects 2020 to be another year of growth. The company expects full-year adjusted earnings-per-share in a range of $7.76 to $8.06. At the midpoint of guidance, UPS expects adjusted EPS to increase by 5% for 2020.

UPS is also an attractive value and income stock. Shares trade for a very reasonable 2020 price-to-earnings ratio of 13.3x. Over the past decade shares of UPS have traded with an average P/E ratio about 18x earnings. While we believe a moderate premium is warranted for the quality of the business, we are comfortable with 16x earnings as a fair value baseline. As a result, the stock appears undervalued.

UPS currently yields 3.7%, and since it has paid the same dividend rate for the past 4 quarters, another dividend hike is likely to come soon. With all this in mind, I consider UPS to be a very appealing mix of growth, value, and income.

About this best dividend stock selection’s author: Bob Ciura has worked at Sure Dividend since October 2016. He oversees all content for Sure Dividend and its partner sites. Prior to joining Sure Dividend, Bob was an independent equity analyst publishing his research with various outlets including The Motley Fool and Seeking Alpha. Bob received a Bachelor’s degree in Finance from DePaul University and an MBA with a concentration in Investments from the University of Notre Dame.

Best Dividend Stock #1: Walgreens Boots Alliance (WBA)

This best dividend stock selection is from Ben Reynolds of Sure Dividend.

Walgreens Boots Alliance (WBA) is the largest retail pharmacy in the United States and Europe. Walgreens operates ~18,750 stores in 11 countries and has a presence in 25 countries total through various equity investments.

The company was founded in Chicago, Illinois in 1901. It has grown to generate $137 billion in revenue in its last fiscal year and currently has a $47.5 billion market cap. Moreover, Walgreens is a Dividend Aristocrat thanks to its impressive streak of 44 consecutive years of dividend increases.

Walgreens stock stands out today because of its unusual mix of quality and high expected total returns. We expect total returns of around 14% annually over the next five years from Walgreens at current prices. We expect these annual returns to come from the following sources:

- Dividend yield of 3.4%

- Expected per-share growth rate of 5.0%

- Valuation multiple expansion of 6.2%

Valuation multiple expansion is likely to be Walgreen stock’s biggest return driver moving forward because the security looks significantly undervalued today. Walgreens stock is trading for just 8.9x its expected fiscal 2020 adjusted earnings-per-share. For comparison, the stock has historically traded for a price-to-earnings ratio in the 15 to 16 range on average over the last decade. The strong valuation multiple expansion returns above are based on a fair price-to-earnings ratio of just 12 going forward.

Dividend investors can lock in a solid 3.4% dividend yield with Walgreens at current prices. Moreover, the dividend has a high likelihood of increasing in the future based on the company’s reasonable payout ratio of ~30% of adjusted earnings combined with management’s clear prioritization of increasing dividends. This makes Walgreens a compelling buy and long-term hold while waiting for the valuation multiple to reach some semblance of fair value.

Disclosure: I am long WBA

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. ...

more