Tesla: Short Squeeze Of The Century

Tesla: Short Squeeze Of The Century

Tesla (TSLA) is often referred to as the “short of the century”. However, little credence is given to the possibility of Tesla becoming the short squeeze of the century instead. And despite being one of the best performing stocks in America over the last 8 years Tesla remains the most heavily shorted company in the U.S. today.

Source: MarketWatch.com

Tesla’s share price has increased by 1,665% since the company’s stock IPOed at $17 in 2010. Yet, the amount of money actively betting against this company seems to grow in perpetuity over time. Currently, there are over 38 million shares sold short in Tesla’s stock out of 170 million shares outstanding. This means that roughly 22% of all outstanding shares are sold short right now. Moreover, out of the 125 million float (shares available for trade) a staggering 30% are short positions. This means that short sellers are currently wagering an unprecedented $11.5 billion against the controversial company right now.

TSLA Short Interest data by YCharts

But what if Tesla demonstrates to investors that it can indeed operate as a profitable enterprise on a global scale? In this case, a combination of increased buy interest coupled with a frenzy to close out short positions could create a significant short squeeze that would likely catapult Tesla’s stock much higher from here.

What the Bearish Argument is Predicated On

The bearish argument is predicated on several assumptions, without which the negative thesis effectively falls apart.

1. Tesla has never been profitable and it never will be profitable– Not to pick threads but Tesla had produced 2 quarterly profits throughout its relatively short history as a publically traded company. More importantly, just because the company has not shown strong profit potential in recent years does not mean it will remain unprofitable indefinitely.

In fact, many market participants, and company insiders believe the company will be profitable relatively soon, possibly as soon as next quarter by some accounts. Personally, I believe mid-2019 is a more realistic timeline.

2. Elon Musk cannot be trusted – Many people negative on Tesla despise the company’s CEO, despite Elon arguably being one of the greatest visionaries of our time. This could be because despite over promising and under delivering many times Tesla’s stock remains highly valued.

3. The Model 3 will never be produced at a profit– With negative gross margins once again this quarter I understand why some people think the Model 3 is a manufacturing disaster. However, most people are aware of the various bottlenecks, setbacks, mistakes, and other issues that have continued to plague the Model 3 segment.

The important thing is that production is improving and scaling at an impressive pace. Production of the Model 3 vehicle grew 4-fold QoQ, and is likely to expand at a similar pace this quarter as well. Also, suppliers are now seeing orders consistent with 5,000 Model 3 in Q3production according to a research firm. Naturally, it is difficult to create significant profitability during a ramp up in production, but once production stabilizes at around 5K profitability should be the next step.

Source: Tesla.com

Tesla's more established vehicles (Model S/X) produce 25% gross margins, and the company in general had delivered 25% GMs for several years prior to the Model 3 launch. Therefore, it plausible that once the automation advantage takes off and economies of scale kick in Model 3 will get to the 25% gross margin figure as well.

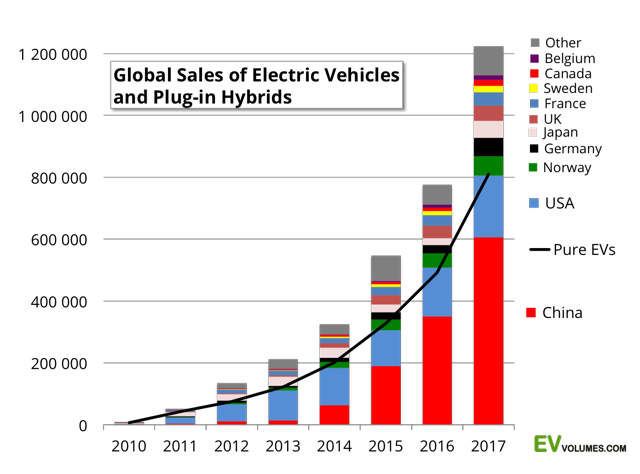

4. The competition will eat Tesla’s lunch– Many people are talking about upcoming completion to Tesla from Jaguar, Audi, Porsche, and others. It is true, many traditional automakers have 100% EVs in their pipelines. But the EV segment is growing at such a rapid pace (6-fold, 2013-2017) that the upcoming EV models will be competing with all commercial vehicles and not just Tesla. And yes, this means cannibalizing sales for traditional automakers as well.

Source: EV-Volumes.com

Moreover, Tesla should remain the leader in the 100% EV performance segment because of its significant first mover advantage, the company’s multidimensional competitive edge, economies of scale in batteries and extensively automated production, and its ability to innovate on a level beyond traditional automakers.

5. Tesla won’t be able to secure capital in the future– If the past has shown us anything it’s that Tesla can secure capital on favorable terms, because the company has been able to achieve this time after time. Will there come a time when the capital markets start to say NO to Tesla? Perhaps, but there is no evidence that this scenario is inevitable. Furthermore, if the company becomes profitable by the end of this year as some, including the company’s CEO suggest Tesla may not need to tap markets for more capital (outside of future CapEx).

6. The stock is grossly overvalued– It is true, Tesla’s stock is valued much like a fast-growing technology company rather than an automaker. But that’s because the company is not just an automaker, it’s a Silicon Valley startup that does things very differently. And that means it has the potential to do things much better than the status quo dictates.

TSLA Market Cap data by YCharts

The market believes Tesla is worth $50 billion, and the company has the potential to be worth significantly more a few years from now. Therefore, the “overvaluation” of Tesla is a subjective notion. Some see the company as being overvalued, some see it as being fairly valued, and many believe the company will be worth significantly more a few years from now.

7. Tesla has no place to produce the Model Y, and other future models- It’s true, Fremont is packed, so the Model Y will require a new factory most likely. My take is that once Model 3 production ramps up to 5K next quarter and achieves better profitability Tesla will announce plans to build a new factory with another super aggressive timeline.

8. Tesla is the new Enron– Some people go as far as comparing Tesla to Enron. Personally, I find this comparison ill informed, and misleading. There is no evidence that Tesla is involved in any wrong doing. Moreover, the business models of the two companies are vastly different and share few similar characteristics. Enron was basically a fraudulent energy trading company, whereas Tesla is a manufacturing company that creates some of the most innovative products in the world.

Tsunami of Hurt

The bottom line is that betting against Tesla is nothing new. This company has been the victim of shorts attacking it for one reason or the next since it went public.

Source: Bantennews.co.id

Since the percentage of shares short has remained at about 20% throughout Tesla’s existence and the market cap of the company has increased from about $1.7 billion to over $50 billion Tesla short sellers have lost around $10 billion over the past 8 years.

Tsunami of Hurt 2.0?

In 2012 Elon Musk warned investors of betting against Tesla and said that a “Tsunami of hurt” was coming. 12 months later the stock was up by 461%.

I am not suggesting Tesla’s stock will surge by anything close to 461% any time soon, but losses are likely to be much worse dollar wise for investors if the tsunami of hurt 2.0 ever arrives.

In 2011 Tesla’s market cap was tiny compared to today. We’re talking about $2-3 billion, nothing close to the $50 billion of today. Therefore, the dollar amount worth of short interest was roughly $500 million in 2011, now it’s about 23 x times higher, at $11.5 billion.

Elon's Explicit Warning

Elon Musk recently issued another not so subtle warning to short sellers. Tesla’s CEO said that a “next level short burn of the century” was coming to those currently shorting Tesla’s stock. Whether a major squeeze actually occurs remains to be seen but if Tesla actually reports a profit, or even shows significantly improved financial momentum in the second half of this year a significant short squeeze seems very plausible if not inevitable.

Tesla’s financials substantially improving would catch a lot of short sellers off balance, and as the rush to cover occurs the stock could surge substantially. Remember that Volkswagen short squeeze in 2008? Yes, the one that took the shares from 200 Euros to over 1,000 in a matter of days, briefly making VW the world’s most valuable publically traded company? Well, that’s what can happen when investors get caught off guard shorting a large cap stock in mass.

I am not implying that Tesla’s stock will quintuple in the near future, however, I am convinced that once the company shows its capacity to become profitable in the second half of this year, intense buy interest coupled with a frenzied scramble to buy back shares to close out short positions will create a short squeeze of epic proportions in Tesla’s stock.

The Bottom Line

The company is already beginning to illustrate significant improvements in some of its profitability metrics. Gross margins have improved notably over the past several quarters. More specifically since Model 3 production began Tesla’s automotive sales gross margin has gone from 15.4% in Q3 2017, to 16.9% in Q4 2017, to 18.4% in Q1 2018. There are other encouraging signs like decreased CapEx spending and more which point to the company being on the right path towards profitability.

To become profitable the company needs gross margins to improve to roughly 25%. Tesla has stated that in Q1 of this year the Model S and X vehicles were yielding a gross margin of slightly above 25%. Also, Tesla had averaged roughly 25% GMs for several years prior to the costly and heavily automated Model 3 launch. Therefore, once automation and cost issues pertaining to Model 3 production are resolved the company’s overall gross margin could be close to 25% by mid-2019. Moreover, once the company is producing over 5K Model 3s per week Tesla’s economies of scale will kick in and the company should be able to improve efficiency and profitability even further.

The phenomenon of improving fundamentals throughout the next 6-12 months could spark what may very well become "the short squeeze of the century" in Tesla’s stock. With over 38 million shares short worth roughly $11.5 billion the short tsunami 2.0 could become epic, if it occurs. And all it would require in theory is for Tesla to demonstrate the company is capable of deriving a net income from all those revenues. Therefore, I would exercise caution about shorting Tesla's stock right now.

Disclosure: I am long Tesla.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any ...

more

Very feeble argumentation, such as #Tesla has been profitable for 2 quarters or Tesla is a Silicon Valley startup, so it has" the potential to do things much better than the status quo dictates"

The truest of your statement, is that yes, there is a possibility of a short squeeze, which would be advantageous to shareholders in the short term and would certainly hurt the short side. But it wouldn’t, in any case, invalidate skeptics’ worries about the company, nor would it suddenly improve Tesla’s dire financial situation, nor improve its amazingly unproductive factory.

Your analysis is based on hubris, not facts and certainly not numbers, such as the debt level of Tesla, the losses every quarter, and their implication on Tesla’s potential to invest in a new factory or simply not go broke.

When you mention a number, such as 25 % gross margin, you do not for a moment question it, or compare the way Tesla calculates gross margin vs the rest of the car industry.

You base your projections on nothing, such as “I believe Tesla will be profitable in mid-2019”. Care to share your simulation model?

Elon Musk cannot be trusted. Absolutely. He refuses to rename Autopilot, a misleading brand and false advertising claim. Almost all his financial & production numbers projections end up being wrong. The $TSLA Shareholder's newsletter is a lie vs 10-Q. He already said in 2012 that Tesla would never need to ever raise another funding round, and we know what happened since. He has a board which is composed of friends and family. He had Tesla purchase SolarCity, a great deal for him and his cousins, a horrible deal for Tesla shareholders.

A few facts:

-Tesla is hemorrhaging money on 45+k Model 3;

- Tesla is hemorrhaging senior executives;

- Tesla is losing money at a fast pace;

-Tesla has no superiority in “extensively automated production”, contrary to what you write, against all facts: productions numbers almost always come up short, Musk himself acknowledging too much automation, loss per can, need to move from 5x2 shifts per week to 7x3 shifts per week, and so forth;

- ZEV credit will end within 2 years, which will be a huge competitive advantage for new entrants, unless laws are changed;

- The demand for S and X is low;

- It is strictly impossible for Tesla to begin producing Y & trucks soon.

- Anecdotal evidence, which would need to be checked, is that Tesla is totally overwhelmed by support, can’t sell its customer base spare parts as needed, and even loses service requests. That’s a great way to alienate Tesla supporters or champions in the course of a few years.

- The automobile industry is not a pure tech industry. Yes, Tesla benefits from a first mover advantage. But it’s probably not that significant since an electric car is much simpler to build than a traditional car, since most of the competition has decades of experience building vehicles, and since Tesla has not built a competitive advantage with a superior battery technology.

This is an article about an upcoming short squeeze in TSLA, not about all the material you mentioned. Remember, I write about what I want to cover, not about what you would like me to. Also, I write articles on specific topics not decorations about "everything"...

Having said that, feel free to visit my page on SA, seekingalpha.com/.../articles#regular_articles I have covered just about all the points you made extensively in past articles. And I will release 2019 model earnings soon, thanks for the idea.

You seem to only focus on present and past events, with little to no insight into the future, like most other bears. This is the main reason behind continuous loss of money from your camp.

Impressive comments.