Tesla: Secret Sauce For Valuation, Strong Buy Rating

As you know we’ve been a bull on Tesla (Nasdaq:TSLA) with earnings numbers typically way ahead of the Street for a couple of years now. The latest earnings call gave us confirmation of some key fundamental drivers. There was enough wow factor on that call that you just don’t get from other companies out there.

Tesla Earnings Reaction: Gross Margins, Wow

I’m sure there’s going to be plenty of bears with a ton to say about the negatives of those huge gross margin numbers. That’s OK.

Our not-so-secret key metric for Tesla is gross margins. That’s the key for getting to an earnings number. And that earnings number is driving the stock price to places that people can’t understand.

Our earnings number is the type of number that hedge funds and institutions are using to value Tesla. The sell-side/brokers don’t use a realistic number. But based on the trajectory of deliveries and gross margins, someone modeling that trajectory correctly would be very pumped about what’s coming for 2021 EPS.

Gross margins continue to trend up. Not only that, Musk had some pretty ridiculously bullish comments on the call that CEOs just don’t say. I’ve been doing this forever and I listen to what companies so. It’s so key.

And companies just don’t say what Musk said on that earnings call. Here’s what he said:

“And in terms of margins, all of these margins are going to look pretty comically small when you factor in autonomy.”

Ridiculously bullish margin comment.

What that means is even though our gross margins are moving up nicely now on manufacturing efficiency, at some point these margins have jump-side potential.

Again, not many realize it. Everybody’s focused on deliveries. But earnings drive stock prices. What are you going to earn? This gross margin story is something special in stock market land and is propelling the (buy-side) EPS estimates which is driving the stock.

Buy side is the funds holding the shares. We don't see those numbers in the media. They are kept quiet by the hedge fund models so they can benefit on their own stock ownership positions.

Since I worked at big funds, SAC Capital, Morgan Stanley, JLF, our EPS models run like a buy side shop (not a broker/sell-sider). That's why we've been able to catch this move while others didn't.

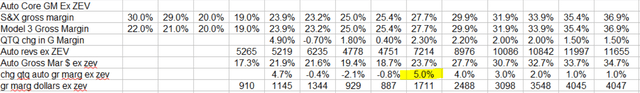

For the quarter, average selling prices excluding ZEV and leases were actually up despite all the talk about competition. Mix may have been up helping gross margins.

After the latest earnings we told (paywall) subscribers:

"Gross margins for auto jumped last quarter. Excluding ZEV credits auto gross margins were up 500bp from last quarter. Not year-over-year. From Q2. Oh my. Did that make you smile? It did me."

Source: Elazar Advisors Models With Data Pulled From Tesla Earnings Reports

A lot of Tesla’s costs are fixed, so as production ramps, margins should continue going up. When Model Y production ramps in the same facilities as Model 3, cost per unit should drop meaningfully for both. That's gross margin leverage.

I haven't included FSD's so-called-100% gross margins in my model because it's not so-additive to gross margins yet. But Musk’s “comical” comment where gross margins are headed, I posted above, I mean come on.

Tesla Model S. Image Credit

Once FSD (full self driving) ramps up, gross margins should expand significantly. It’s not clear when it will ramp to higher level driver-automation, but it should be huge for margins.

For now the gross margin boost is just coming from core manufacturing with out-year upside when FSD comes on strong. That gives you a picture of great now and maybe even better later for “our” key Tesla metric, gross margins.

When FSD rolls out its about software, since Tesla already has all of the sensors to make it work. You have to make a big investment up front to develop it, but once you have, there’s a so-called zero marginal cost to sell it. So when they release it for the public, sales will be so-called 100% margin. So-called so-nice.

I haven't been disappointed leaning on what Musk says since I've been following him, so I will continue to model highly influenced to what Musk expects. This has my model EPS 3x the Street for next year as has been the case for the last couple of years (full EPS model: paywall). My EPS have been way above the Street the last couple of years. That EPS potential has been the secret reason for the launch of this stock.

EV Market Tailwind

A lot been said about coming competition.

My first take is as other EV makers advertise, guess what, they will cause consumers to comparison shop a Tesla. So it’s going to be free advertising getting consumers into a "showroom."

The EV market is still in the early stages of exponential growth, with Tesla leading the way.

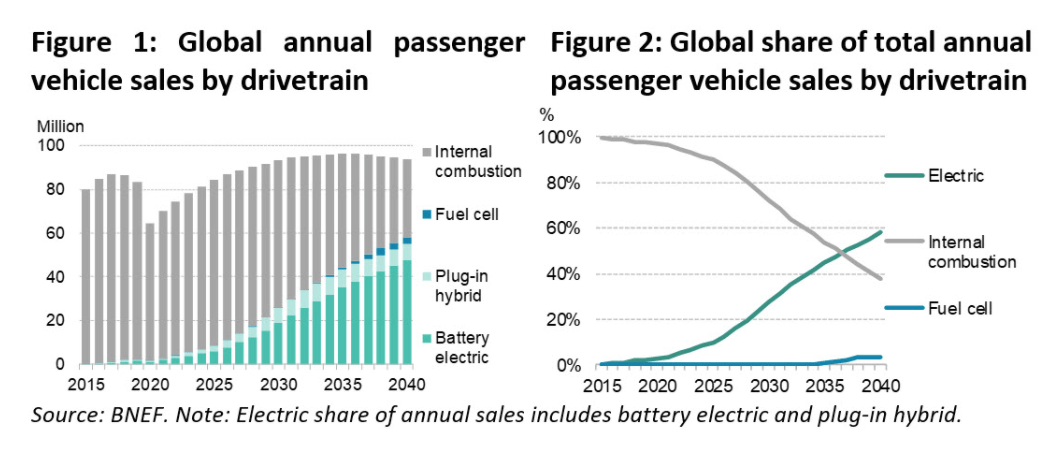

Bloomberg estimates EV sales will total around 1.7M in 2020, 26M in 2030 and 54M by 2040. That implies annual growth rates of about 31% for the next 10 years, and 19% until 2040. That gives visibility that besides Tesla’s dominance there’s EV sector tailwinds at its back.

For reference, the growth rate from 2015 to 2019 was around 47%.

Deloitte estimates total EV sales grow from 2.5 million in 2020 to 11.2 million in 2025 (35% annual growth rate) and then reach 31.1 million by 2030 (29% annual growth rate over ten years).

The growth rate estimates by Deloitte and Bloomberg for the next 10 years are similar.

Currently, around 93% of global EV sales occur in China (51%), US (15%) and Europe (27%), with Norway, Iceland, Netherlands, Sweden, Finland, UK, France and Germany the European countries with higher demands.

Deloitte estimates that by 2030, those numbers will be similar. Tesla already is established in these three key markets, and will surely take advantage of the growing demand.

Tesla Taking Market Share

Despite the EV market growing rapidly and new competition appearing, Tesla still managed to increase its market share in 2020. According to reports, the latest global sales numbers from Q1-Q3 2020, indicate Tesla captured 18% of the EV market worldwide, a 2% increase vs. the same period last year.

|

Manufacturer |

2020 Q1-Q3 Market Share |

2019 Q1-Q3 Market Share |

|

Tesla |

18% |

16% |

|

Volkswagen |

6% |

4% |

|

BYD |

6% |

12% |

|

BMW |

6% |

6% |

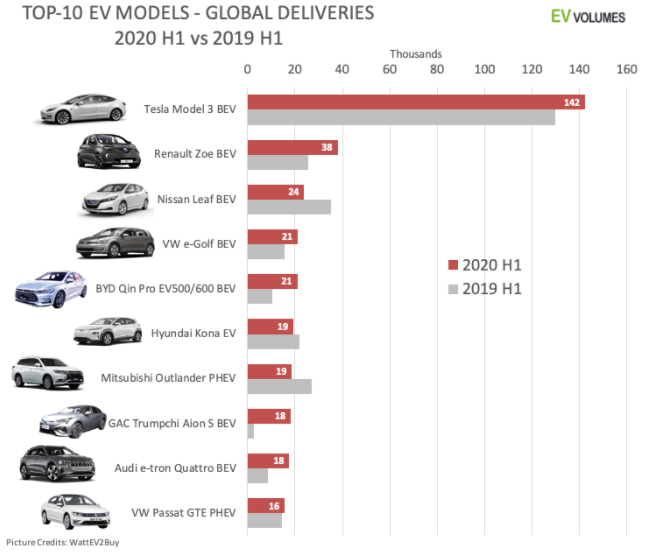

In the following chart, we can see how Tesla’s most popular car, the Model 3, fared vs. the competition in the first half of the year. It’s clear that in the EV space, Tesla blew away its competitors.

With total deliveries of around 142K, its sales were equal to those of the six next EVs on the list.

Tesla is not just gaining share in the EV market, they also are competing with other premium gas cars.

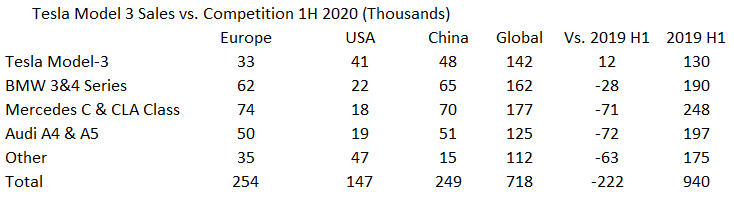

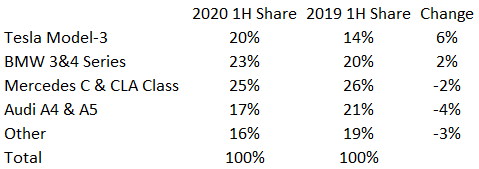

The Tesla Model 3 experienced a huge growth in sales in the first half of the year, while other popular traditional car sales declined.

In the first half of 2020, Tesla delivered 142K Model 3’s, an increase of 12K. Its main competitors on the other hand sold 234K less vehicles.

The Model 3 dominated the US market, but still lagged in Europe and China. These are two key markets, and as Tesla expands production in Berlin and China, they should be able to expand their sales reach.

Still they were the largest share gainers so far this year.

Source (Note: These are market shares of the top Model 3 competitors, not total EV shares.)

In terms of share, Tesla increased from 14% to 20%, a 6% rise.

It’s clear that Tesla, particularly the Model 3, has seen impressive sales numbers. If the company can expand production significantly, demand should be there.

ZEV Credits: A Free Money Bull Story

(Bears don't like free money I guess.)

One hidden benefit of Tesla gaining market share and selling more cars is related to ZEV credits. I’ve spoken about them in the past, and it’s one of the reasons I’m so bullish on Tesla.

Bears have a lot of negatives to say about ZEV credits. I’m OK with all that. I just care about earnings and ZEV credits is likely here to stay based on Tesla’s strength.

ZEV credit stands for Zero Emission Vehicle credit.

In 11 US states, regulations require a certain percentage of each manufacturer’s yearly sales must be made up of zero emissions vehicles. The way to measure this is ZEV credits. Similar regulations are in Europe.

Manufacturers earn ZEV credits when they sell zero emission vehicles in ZEV states. Not all vehicles are equal for ZEV credits in the US. Long-range vehicles generate more credits than short range vehicles.

Companies that don’t comply with these regulations have to pay a penalty.

Since every single Tesla is considered zero emission and long range, the company has accumulated and continues to accumulate a large piggy-bank of ZEV credits. However, they only need a portion of these to comply with the law. The rest can be sold to other auto-manufacturers that don’t have enough credits and want to avoid paying the fines.

The more vehicles Tesla delivers in these states, the more ZEV credit they accumulate and have for sale to competition. The company has sold ZEV credits for a significant amount of money over the years. In the first three quarters of 2020, Tesla generated almost 1.2Bn in revenue from selling these credits, a huge jump from last year.

You see these numbers (that bears hate) only increasing (below).

|

2020 Q1-Q3 |

2019 |

2018 |

2017 |

|

|

ZEV Credit Revenue (USD Million) |

1180 |

594 |

419 |

360 |

With Tesla’s lead, their ZEV piggy-bank is bulging and competitors are forced to pay Tesla so they don’t have to burden state-type penalties.

It was recently reported that Honda (NYSE:HMC) will be looking to buy European credits from Tesla. The report estimates that these credits could total around $100 million a year, which could further boost Tesla’s revenue.

Honda’s not alone ringing Tesla’s ZEV piggy-bank tellers.

Right now, regulations are present in just 11 US states and Europe. If more states or foreign countries adopt similar measures, or if the states with regulations impose stricter standards, Tesla will benefit. That's the trend.

We’ll see what is the end result with president and senate elections. If it swings Democrat there’s probably a greater chance of more money in Tesla’s ZEV multi-billion dollar piggy bank. With the triumph of Joe Biden, who favors green energy initiatives, it’s likely the US will see an expansion of these policies.

Bears believe ZEV credits as a source of revenue for Tesla is not sustainable. I disagree. The company has also said they expect ZEV credits to come down over time. I think that's conservatism because they are only jumping.

Whether you believe in climate change or not, the reality is that there's significant pressure to enact legislation to promote green energy and reduce pollution.

Major energy traders and hedge funds are betting that these incentives will continue to grow in the next few years. According to the report, numerous hedge funds have begun investing in carbon credits in the EU, with the expectation that its price will rise significantly in the coming years. Big investors see this as a long term thing.

These credits are a significant asset for Tesla and they will continue to grow. To catch up with Tesla, manufacturers would have to invest large sums of money and accept losses for many years. It’s a tough decision for OEMs to go "all-in" and accept big losses. That likely will have them continue buying credits from Tesla, basically handing them free money and funding Tesla’s growth.

To close, nothing wrong with free money.

Upcoming Competition

This year has been marked by the rise of EV makers. Up and comers like Tesla, Nio, Lucid and Nikola have garnered a lot of attention. However, Tesla’s still clearly in the lead.

Bloomberg analysis estimates there will be more than 500 EV models globally for 2022. Competition will be heating up, with new players like Lucid and Nio, and incumbents like Volkswagen (OTCPK:VLKAF) and Toyota (NYSE:TM).

Let's look at some of the upcoming models from the competition and how Tesla might match up.

Lucid Motors, with it’s Lucid Air vehicles, is looking to compete directly with the Tesla Model S. However, the first model, the Air Dream Edition, isn't expected before Q2 2021 at around $169.000.

Lucid Air. Image Credit

The most affordable version, the Lucid Air, isn't expected until 2022, with a price tag of around $70K (when taking into account government incentives). That’s still more than a year away.

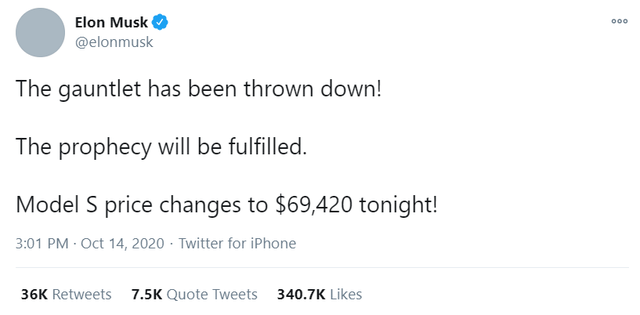

In response to Lucid’s announcement, CEO Elon Musk said Tesla would drop the Model S price to $69,420.

The Air Dream Edition will cost almost 100K more than the Model S, and the Air, with a similar price point, isn't expected for another two years. I’m not yet shaking.

Nio, the Chinese EV maker, currently only sells in Asia. However, they’re looking to expand into the European market by the second half of 2021. Its most affordable car, the ES6 SUV, is priced around $49,700. This is much more affordable than Tesla’s Model X, which sits around $81K, but similar to the upcoming Model Y at around $50K. In addition, the market will keep expanding in the following years with other new model releases such as Aspark Owl late 2020, Audi e-tron GT late 2020, Audi Q4 e-tron 2021, BMW i4 late 2021, Bollinger B1 2021, Bollinger B2 2021, Byton M-Byte Concept, Mid-2021, BMW iX3 2022 and BMW iNext late 2023.

Incumbents like Toyota and Volkswagen also are making significant investments to enter the battery electric vehicles.

Competition in the EV space will heat up. However, Tesla is not staying put. Their Model Y and Cyber Truck have generated a lot of excitement, and during this year's battery day, the company said it expects to produce a $25K EV by 2023.

Don’t forget EV competition is coming on but that may be the nail in the coffin to the ICE industry. That benefits Tesla.

With high demand for EVs, new competitors should not present big problems for Tesla. The company appears to have a big lead in terms of technology and performance, as well as strong consumer appeal. Also, most of the competitors are still in development phases. Once vehicle deliveries start, we’ll have more visibility. Getting to volume production isn’t just a decision. A lot needs to go right to deliver in quantity to the market. We'll see when we get there.

Model and Price Target

At the moment, our 2021 EPS estimates for Tesla are around $14.07 (full model:paywall). The Street’s at $4. If we’re right which way is the stock going?

Using a conservative PE of 55, that would give us a 12-month price target of around $744. I think if we're right on earnings the market could be ready to pay a higher PE. With current prices near $410 this gives us around 88% 12-month upside potential.

The EPS model is very conservative since it’s based on current trends. It does not include the additional revenue and expansion of margins from FSD. Once we have more visibility on it’s release, it could increase our EPS target significantly.

Also, I’m using a PE ratio of just 55. I use historical PEs, but Tesla doesn't have them. So I’m going with 55 to make sure that it’s the EPS/fundamentals and not just multiple expansion driving our opinion. If margins increase significantly I could change it to a 65 PE. But I’m not there yet. The market will probably want to pay much more though.

Conclusion

Despite the challenges that COVID-19 presented, Tesla has delivered amazing results.

Gross margins, our key metric for Tesla, were up big last quarter along with a Musk promise of a huge potential longer term. There are catalysts like the ramp up of Model Y, FSD deployment and ZEV credit expansion that can help drive the EPS potential which helps drive the stock higher.

Everything is lined up for us to be pumped about Tesla right now. Tesla should continue delivering great results and the fundamentals likely continue to drive the stock higher.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: All investments have many risks and can lose ...

more