Tesla: Q4 Strong, Still Big Upside

The delivery news coming out all point positive for Tesla (Nasdaq: TSLA). Tesla did a great job of keeping quiet intra-quarter last quarter and just delivering. I think there's a good chance of the same this quarter.

Delivery News Coming In Good

It was reported that China registrations jumped.

The Netherlands also apparently saw a huge jump.

And what about the US?

Electrek is seeing big US demand as consumers race to get the end of tax credits before year-end.

They featured a Florida dealer that was sold out of cars.

Elon Musk responded to that dealer saying "End of year delivery is intense!" End of quarter intensity is no surprise but I think it's driven by demand.

Deliveries To Drive Q4

Three of Tesla's biggest markets appear to be surging as mentioned above.

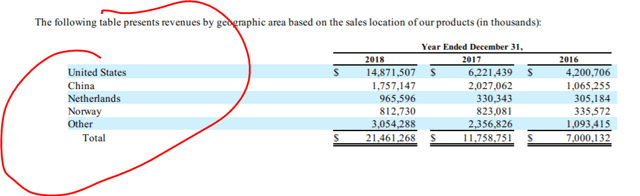

(Click on image to enlarge)

Above you have Tesla's 10K. The news of demand surging is coming from their biggest markets.

You have the US, Europe and China. They are each big. The Netherlands is now the largest European market and it's surging.

Remember too that Tesla usually has a huge push toward the end of the quarter. So these reports coming in now are confirmation of their typical end of quarter charge.

We can make this more complicated but demand sounds like it's on fire. That's Q4.

But It's Not About Q4

Q4 isn't even the quarter that I'm excited about.

We wrote in November that we expect big upside led by a big earnings ramp in 2020.

We recently wrote that it's all about the 2020's volume production ramp. China's production is starting now but will be big in 2020. I think their production will be cheaper per car than they did in the US. We pointed out then that Tesla hinted to that on the Q3 earnings call:

"I think just for now, it's safe to assume that it's (Shanghai) roughly in line with the margins that you see coming out of the Fremont facility."

It's "safe to assume...inline" means to me that China's margins should be higher than the company's margin mix in 2020. So you have volume production in 2020 at potentially higher margins.

We also pointed out then that gross margins were likely going to hold up as ASPs stopped dropping.

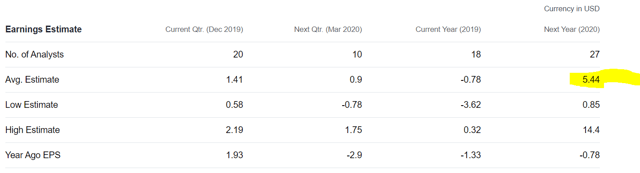

I think the Street is too low for next year.

(Click on image to enlarge)

Source

Earnings drive stocks. The combination of volumes ramping at higher gross margins levers operating expenses and can drive big EPS. EPS drive stock prices.

And You're Seeing It In The Stock Price

(Click on image to enlarge)

This stock's not going nuts for nothing. If Q4 beats, look out because I think you have a pile of institutional investors that we're hoping to get in for that 2020 build.

Tesla has been doing a much better job of investor relations and not letting the cat out of the bag. They did not give away their good Q3 ahead of reporting it. Musk stayed mum in Q3. So far he's been mum in Q4 but I didn't like that he let off some steam on shorts with the recent stock move. But at least he's not giving away the quarter in Q3 and Q4. That's much better for the stock performance. That creates surprise which allows the stock to jump.

The company also prepared the Street for a weak margin quarter in Q4 thanks to China being in the early stages of the ramp. Early stages are usually much lower margins until the volumes move up.

So faster-money institutions were probably waiting for 2020 or the fourth quarter to pass.

But now with the demand surge, I think that's why institutions have to move those planned purchases ahead to be there for Q4 and 2020.

Conclusion

Q4 demand sounds very strong. I don't hear any pockets of weakness. I focus on earnings and trends. Stocks trade on earnings. It sounds simplistic but that's why I do it. Earnings are coming based on this huge volume build in 2020. But a positive Q4 surprise could front-run all the big money waiting for it and force institutions to have to buy now.

Ready to Nail Tech Earnings? Start your free trial today.

Disclaimer: Stocks reported by Elazar Advisors, LLC are ...

more