Tesla – Great Cars, Perhaps Great Company But Very Scary Stock

Tesla (TSLA) makes great automobiles, and although that is not all that they do, the Tesla automobile generates most of their revenues. That may not always be the case, but it is today. According to Zacks Investment Research, Tesla’s automotive segment generated 93.7% of 2019 revenues. Moreover, Tesla commands approximately 60% market share of all electrical vehicles in the United States.

The company’s second segment, energy generation, and storage made up a mere 6.3% of Tesla’s total sales. Drilling down a little further, Zacks also reports that the company’s flagship Model 3 accounts for about half of Tesla’s electric vehicle market. However, the company currently produces and sells 3 fully electric vehicles. The flagship Model 3 sedan, Model X sport utility vehicle (SUV), and the Model S sedan. The company has also previewed a future product lineup which includes the Model Y, Cyber Truck, Semi Truck, and Roadster.

In addition to their automobiles, Tesla also makes different kinds of technology such as self-driving software (already included in some EV models), charging stations, and battery development. Additionally, the company is operating a growing business in solar and energy storage.

In summary, Tesla is clearly defining the electric vehicle market in the United States. But not only are Tesla automobiles green, I would also say they are flat out fun. Although I am not yet ready to invest in a new car, I did have the occasion to test drive the Model S last week. Frankly, before I go on, I must admit to one of my most ardent vices – fast cars. However, the Tesla Model S has completely redefined what the words “fast car” means.

There is no car that I have ever driven or ridden in that even compares to the acceleration of a Tesla Model S. The car goes from 0 to 60 mph in a stunning 2.3 seconds. Words like exhilaration do not even begin to describe what that feels like. In summary, the Tesla Model S is so scary fast that it almost made me blackout. Handling was also an out of this world experience. According to the Tesla salesman, it is impossible to flip a Tesla Model S. I do not know if that is true or not, but I can tell you the car felt incredibly stable. Candidly, the Model S’s handling was orders of magnitude beyond the performance of my BMW, which I have always considered an awesome handling automobile. Simply stated, the Tesla Model S puts it to shame.

Tesla Great Company Scary Stock

As a result of my recent experience with the Tesla Model S shared above, it has become very easy for me to see why so many people are so exuberantly enthusiastic about Tesla’s stock. But, although there is much to love about their automobiles, and even the recent progress the company has made regarding profitability, the current price of their common stock is frankly insane. And I am not the only one that thinks so.

A recent headline on Seeking Alpha stated: “J.P. Morgan doubles down on bearish Tesla thesis.” To quote analyst Ryan Brinkman: “Tesla shares are in our view and by virtually every conventional metric not only overvalued but dramatically so.” Also, J.P. Morgan did lift their target price to $90 from $80 per share. However, that represents an 86% downside from the current price. I agree with J.P. Morgan, and what follows is a review of Tesla’s valuation based on – as J.P. Morgan put it – several conventional metrics.

Tesla’s Valuation By The Numbers

In my experience, one of the most difficult messages that can be delivered to investors is suggesting that a favorite stock that is performing well is overvalued. Candidly, investors simply do not want to hear that message. Perhaps even more to the point, because the stock has performed so well, that represents all the evidence they need, that all is well. In truth, markets will significantly misappraise the value of a stock over or under from time to time.

That is an undeniable truth, and I want to be clear that I am not denying that Tesla has had an incredible run over the last year and a half. Moreover, I am not just talking about the price, Tesla’s earnings and cash flows have also had an incredible run. Unfortunately, Tesla’s recent strong operating performance simply does not justify the company’s lofty valuation. And here I might add, this assessment includes the normal and often temporary rise in price that happens when a company initially becomes included in the S&P 500 as Tesla is.

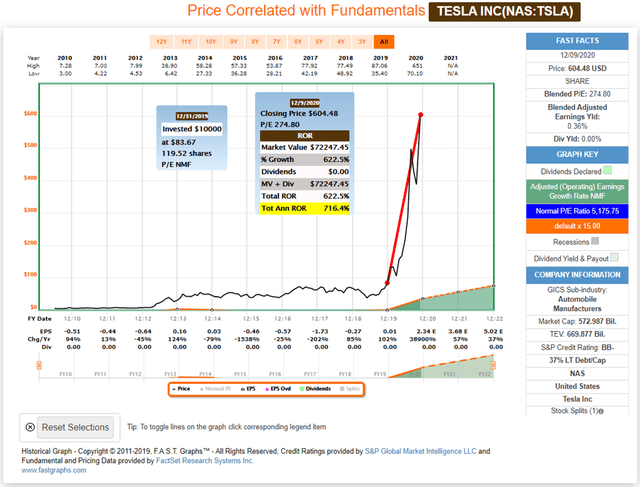

Tesla Blended P/E Ratio

Tesla currently trades at a blended P/E ratio of 274.80. To put that into perspective, that is an earnings yield of only .36%. In other words, if you owned 100% of Tesla and the company paid you all its current earnings, you would only be making a return of .36%. Nevertheless, Tesla’s stock price did rise from $83.67 on December 31, $2019 to $604.48 on December 9, 2020, that is a 622.5% gain for this year so far. Later in the video, I will show how earnings growth did provide some justification for that massive increase over the short run. However, the seminal question is whether (or not) that growth surge is long-term sustainable? Common sense suggests that it is not.

(Source FAST Graphs)

Importantly, in addition to lofty valuation, sensible investors should also consider the quality and makeup of Tesla’s recent earnings improvements. In a recent Morningstar Analyst Note by David Whiston, Updated Oct 22, 2020, Tesla’s third-quarter earnings were reported as follows:

“Tesla reported a good third quarter with adjusted diluted EPS of $0.76 beating the Refinitiv consensus of $0.57 and up from $0.37 in the third quarter 2019.”

At first glance, these numbers look very impressive. However, an article in the publication Driving on September 29, 2020, titled “Motor Mouth: Tesla’s real business model needs a reality check” pointed out the following concerning information:

“Yes, I know the Teslarati are celebrating yet another quarter of profitability — its fourth in a row, the electric vehicle media machine never forgets to remind us — but the fact remains that Tesla has never made money on the cars it sells. Judged only by how much money it makes retailing Model S, X, Y and 3s compared with how much money the company has spent to produce those cars, Tesla is still in the red. In fact, the only reason it can now claim seven quarters of profitability — besides the last four, Tesla was in the “green” for Q3 and Q4 of 2018 as well the third quarter of 2016 — is because of all the money it generates from something called zero-emission vehicle (ZEV) credits.”

Zacks Investment Research added this additional commentary on ZEV credits:

“Tesla’s excessive reliance on credit sales remain a concern. Importantly, revenues from regulatory credit sales have been outpacing the GAAP income over the trailing four quarters. In the absence of $397 million worth of regulatory credit sales during the last reported quarter, Tesla would have posted a net loss of $66 million. Over the past two quarters, Tesla posted a net GAAP income of $435 million. Without the regulatory credit sales, the firm would have incurred a loss to the tune of $390 million.”

To summarize and “bottom-line” this information, Tesla has yet to make money selling automobiles. I believe they will someday, but as previously stated, that is not today. What all this suggests is that there is risk with Tesla and its current lofty valuation that investors should at least be cognizant of.

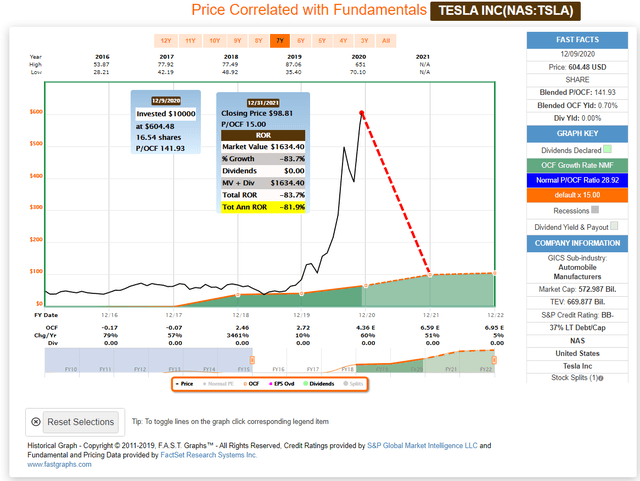

Tesla Blended Price To Operating Cash Flow

Although I am a believer in utilizing all the valuation metrics at my disposal, one of my true favorites is valuation based on operating cash flow. As the old saying goes “earnings are optional, but cash is cash.” In other words, earnings can be manipulated, but cash is simply counted. With that said, Tesla also appears significantly overvalued based on operating cash flow. Moreover, valuing Tesla based on cash flow provides a valuation reference of $98.81 (see pop-up’s below) that is at least in the ballpark of JP Morgan’s fair value estimate of $90.

(Source FAST Graphs)

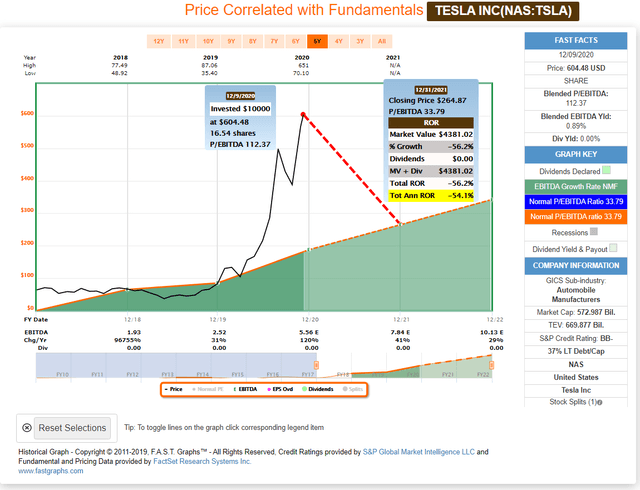

Tesla Normal Price to EBITDA

Another metric that I find quite useful is to evaluate a company based on its normal price to EBITDA. Keeping in mind that this following example represents the EBITDA multiple of 33.79 that the market has “most commonly applied” since the beginning of 2018, Tesla trading at a current blended P/E of 112.37 appears significantly overvalued. Here I would also add that I like valuing a business based on EBITDA because even though it is an earnings metric, it is in my view closer to cash flow than earnings. In other words, it is earnings before interest, taxes, depreciation, and amortization – which is pretty darn close to simple cash flow.

(Source FAST Graphs)

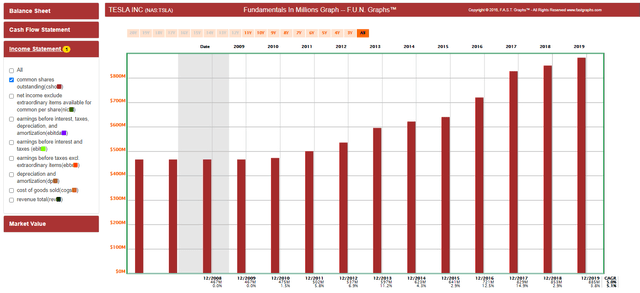

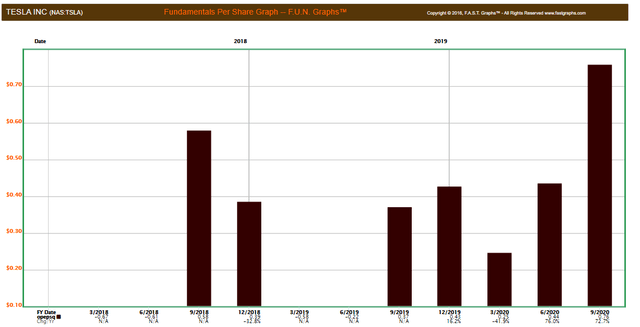

Tesla Consistently Diluting Shareholders

In addition to valuation risks, current and prospective Tesla shareholders should also be aware of the amount of dilution that the company has historically and is currently participating in. Common shares outstanding have increased at a compound annual growth rate of 5% from 467 million shares in 2008 to 885 million shares through December 2019.

(Source FAST Graphs)

By September 2020, Tesla’s common shares outstanding have further increased to 948 million shares.

(Source FAST Graphs)

Furthermore, on Tuesday, December 8, 2020, Tesla announced up to a $5 billion additional capital raise. One thing that perhaps softens the dilution is the fact that many analysts consider these capital raises smart moves given the extremely high valuation that Tesla is selling their shares at. Additionally, the $5 billion capital raise will be an “at-the-market” offering. An article in Business Insider explained it as follows:

“An “at-the-market” share offering is different from a traditional equity share offering. Rather than selling a specific lot of shares at a pre-determined price in one fell swoop, an “at-the-market” offering allows Tesla to, at its discretion, sell bits and pieces of its stock directly into the market to raise up to $5 billion.

The at-the-market offering will allow Tesla to take advantage of recent volatility in its stock price and is beneficial in the sense that the offering could lead to less dilution than a traditional offering if Tesla is able to sell shares at favorable prices.

Tesla is not required to sell all or any of the $5 billion worth of shares, and the company will likely have at least a year to execute the offering before it expires.”

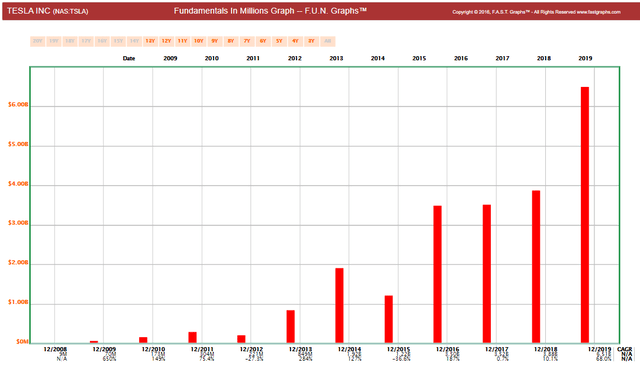

Therefore, and to summarize, Tesla has been raising a lot of capital even though they are diluting shareholders, they are selling their shares at extremely high prices. As a result, they are raising a lot of money they can utilize to continue to develop and grow their business. Tesla’s cash balance at the end of 2019 was $6.51 billion.

(Source FAST Graphs)

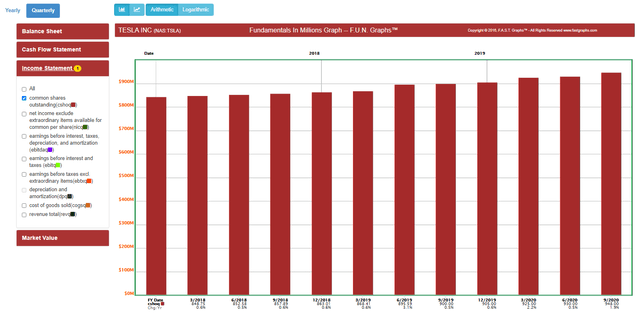

Fast forward through the end of the 3rd quarter of September 2020 and Tesla’s cash balance stands at $14,705,000,000. In short, Tesla has many plans and opportunities to grow, add, and expand their businesses in the future. Most importantly, currently they also clearly have the cash resources available to fund their many initiatives. Nevertheless, I do believe that Tesla does have to find a way to profitably sell their automobiles without relying on ZEV credits as discussed above. Tesla is finally making some money. However, their record remains spotty and inconsistent as evidenced by the operating earnings results the company has generated over the last 12 operating quarters as seen below:

(Source FAST Graphs)

FAST Graphs Analyze Out Loud Video: Tesla By The Numbers

Video length 00:16:53

Summary and Conclusions

I do want to be clear that I consider Tesla to be a great company founded by and run by a smart, aggressive, and even impressive founder and CEO Elon Musk. Moreover, I do believe that Tesla has a long and bright future ahead of itself. Consequently, I would love the opportunity to someday become a passionate long-term investor in this great company. However, as Mr. Valuation, it is crystal clear to me and many others, that Tesla is currently trading at valuations that are not supported by the fundamentals.

Nevertheless, the stock has had and continues to have tremendous momentum since the middle of 2019. Frankly, that could continue for some time into the future. On the other hand, value investors – and all other investors for that matter – should be cognizant and fearful of becoming “greater fool investors.” This simply means being willing to foolishly pay more (in Tesla’s case much more) for a stock than it is worth solely on the basis that a fool greater than you will come along and pay you more.

I do believe that Tesla is a great growth story and will prove that over time. However, I also believe and recognize that you can pay too much to buy growth, which is where I believe Tesla shares currently sit. To restate what I posited in the article title: “Tesla Great Cars, Perhaps Great Company but Very Scary Stock.” My test drive of the Tesla car was exhilarating, breathtaking, and incomparable to any car I had driven before. Nevertheless, I do not want my stock price ride to mirror that experience. Someday, I believe I will get my chance to invest in this great company. As a value-oriented investor, I am confident that day will come, and I am willing to be patient enough to wait for it no matter how long it takes.

Disclosure: No position.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks ...

more