Ten Clean Energy Stocks For 2019: Still Party Time

2019 has become another blockbuster year for the Ten Clean Energy Stocks model portfolio and, to a lesser extent clean energy stocks and the broad stock market as well. I’m frankly surprised to see the party continuing. The continued spiking of the metaphorical punch bowl by the Federal Reserve with interest rate cuts certainly has a lot to do with it. I had expected those cuts to be both fewer and less effective.

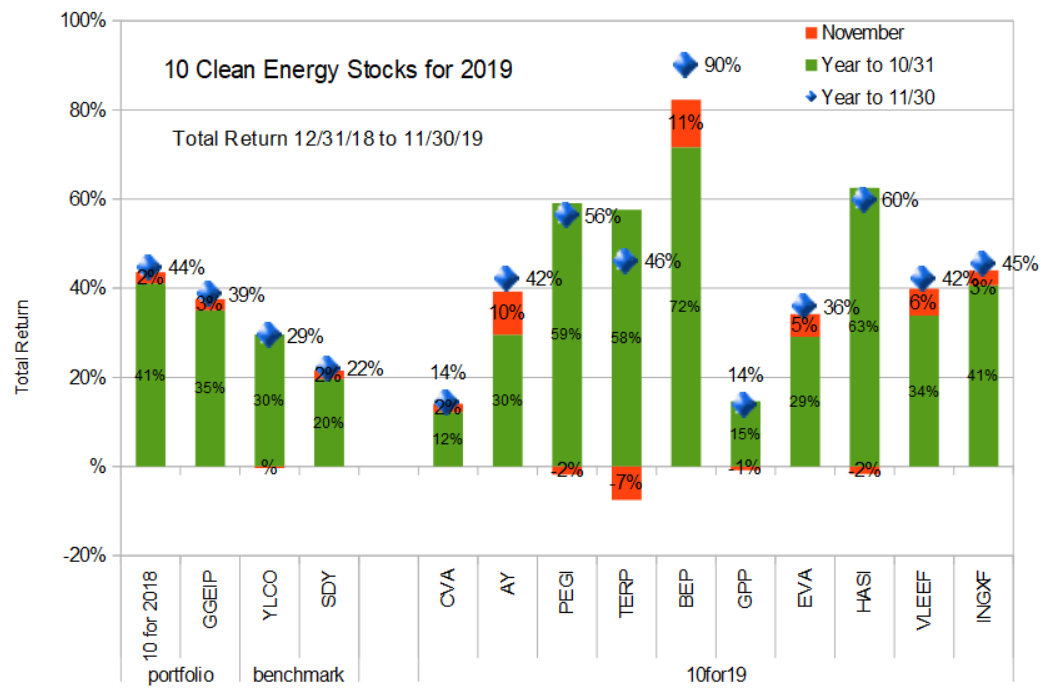

Which all goes to show that it’s always a good idea to hedge one’s bets in the stock market.At least in part because of this hedging, my real money Global Green Equity Income Portfolio GGEIP has somewhat underperformed the 10 Clean Energy Stocks model portfolio, up 38.5% and 44.5% for the year, respectively.Both remain well ahead of their benchmarks, however, with the clean energy income stock benchmark YLCO up 29.3% and the broad income stock benchmark SDY up a still-respectable 21.9%.

Will the party continue with a blowout Santa Claus rally? Only Santa knows, but I’m going to continue with caution in case he decides to show up with a lump of coal (have you seen coal stocks recently?) instead of nicer gifts.

(Click on image to enlarge)

Individual Stocks

Last month I warned,

Hannon Armstrong HASI, Terraform Power (TERP), and Brookfield Renewable Energy Partners (BEP) are all stocks in which readers should be considering taking some profits if they have not already. I continue to think these three stocks are all ripe for price corrections.

Terraform saw that price correction, down 10% on a secondary offering of 14.9 million shares of stock at approximately $16.84 a share. This is business as usual for Yieldcos, which sell shares when prices are high to finance the purchase of income-producing clean energy investments. As long as such investments can be had at prices that expand per share cash available for distribution, such secondary offerings are good for long term shareholders. I generally consider the one or two months following a secondary offering as the best time to invest in Yieldco stocks, although Terraform’s valuation even after the recent dip is not making me rush in with any buy orders. But it’s certainly less overvalued than last month.

Brookfield Renewable Energy Partners announced a stock distribution and the creation of a new corporation, Brookfield Renewable Corporation (BEPC). This will allow investors who are not able to invest in limited partnerships like BEP to also invest in the stock, which is designed to have identical distributions to BEP and will be exchangeable for BEP units. The stock price of BEP has been climbing since the announcement in anticipation of the new demand for shares from this new potential class of buyers. After the split, investors should not be surprised if BEP takes advantage of its new, lofty stock price to raise cash in its own secondary offering, bringing the stock price back down from its temporarily lofty level.

Although I think the formation of BEPC will be good for existing investors, I continue to trim my holdings of BEP in anticipation of such a decline.

French auto parts maker Valeo SA (FR.PA, VLEEF) reported strong 3rd quarter sales at the end of October, and the stock has been rising since. Sales were up 8% despite an ongoing contraction in auto sales overall. The company excellent performance is largely due to the start of production on projects including vehicle electrification, cameras, and lighting. All-in-all, the company’s plan to leverage its R&D efforts to get its products into more new vehicle models seems to be paying off.Barring a broad market sell-off, I would expect the stock to continue to advance. Given the large increases in most of the stocks in this year’s list, I am going to be searching for a large number of new stocks to add to the 2020 list as I drop the ones that have climbed the most since they are no longer offer compelling valuations. Unless it advances significantly more in December, Valeo seems likely to stay.

Another big winner was Atlantica Yield (AY). Investors generally liked the 3rd quarter earnings report and 1 cent increase in its quarterly dividend to $0.41 at the start of November. Revenue and Cash Available For Distribution (CAFD) continue to advance at a 6-7% rate through the company’s investment in new projects, such as the ATN Expansion 2 transmission project which it closed on during the quarter.

One thing I like about Atlantica compared to other Yieldcos is its diversification into electricity transmission and water. Owning both of these asset classes is rare in the industry, but transmission, in particular, is essential to the clean energy transition, and having expertise in different asset classes means that Atlantica can look at different types of investment opportunities when traditional Yieldco assets like solar and wind are relatively expensive. Because of its Spanish roots, Atlantica also has a more diverse geographic profile than other Yieldcos.

Conclusion

The year isn’t over, but I can confidently say that, at least as far as my stock picks go, it far exceeded my expectations. With all the price rises, I’m going to have trouble finding ten clean energy stocks that I think are good investments at the end of December.I’m seriously considering including one or two short positions in the portfolio, something I have done only once before, in 2008 when I include a short of First Solar (FSLR). It was a timely choice, since First Solar fell 50% that year, helped along by the financial crisis. Alternatively, given the new accessibility of options strategies for the small investor, perhaps I should include option hedging or positions in the portfolio.

What do readers think? Would a short, option hedging, or just sticking to long-only (with the continued caveat that readers should have a large allocation to cash or a hedging strategy) be the most useful to you in the Ten Clean Energy Stocks for 2020 model portfolio? Let me know in the comments.

Disclosure: Long PEGI, CVA, AY, TERP, BEP, EVA, GPP. INGXF, HASI, FR.PA/VLEEF, CWEN-A.

To answer your question, I'd like all of the above.