Take Two: Elevate Credit Looks Ready For IPO

Elevate Credit (NYSE:ELVT) filed an S-1/A with the SEC, providing the details of its upcoming IPO. The company intends to offer 7.7 million shares, with an additional 1.155 million shares as an overallotment option for underwriters, at a marketed price range of $12 to $14. The underwriters for the IPO include: UBS Investment Bank, Credit Suisse, Jefferies, William Blair and Stifel.

Assuming Elevate prices at the mid-point of its price range, it would have a market cap value of $467.4M and trade at a price/sales multiple of 0.80x.

We previewed the deal on our IPO Insights Platform.

Business overview

Elevate Credit Inc. offers online credit services to non-prime borrowers in the U.S. and the U.K., which include people whose credit scores are below 700. The company reports that an estimated 170 million people in the two countries are non-prime borrowers. It reports that it has served more than 1.6 million customers by lending them $4 billion. Elevate lends to borrowers with credit scores between 575 to 625 and plans to provide lending to borrowers with even lower credit scores as it expands.

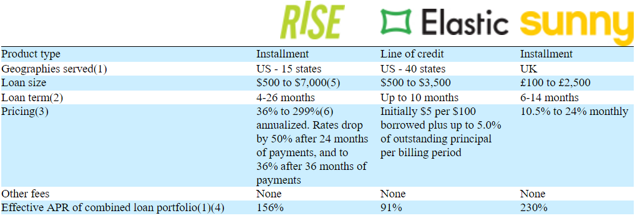

Elevate online products include: Rise, Elastic, and Sunny. The average weighted APR for RISE is 160 percent, which is significantly lower than the 500% APR payday loan, that is the traditional route for non-prime borrowers in need of cash. RISE loans are reduced to 50% after 24 months and to a fixed APR rate of 36% after 36 months.

(Click on image to enlarge)

(S-1/A)

The company is based in Fort Worth, Texas and has 400 employees to date. The company has received investments from: Sequoia Capital and Technology Crossover, among others.

Executive management team

Kenneth E. Rees is the chief executive officer and chairman of Elevate Credit. He has served in those roles since 2014. He previously served as CEO of Think Finance Inc., the predecessor of Elevate. Think Finance has faced legal problems for allegations of unlawfully collecting debt. Elevate was spun off of Think Finance in 2014. Rees holds a Master of Business Administration in statistics and finance from the University of Chicago and a Bachelor of Arts in mathematics from Reed College.

Jason Harvison serves as chief operating officer and on the board. He was previously the COO and board member of Think Finance. Harvison holds a Bachelor of Business Administration in finance from Texas A&M University.

Financial highlights

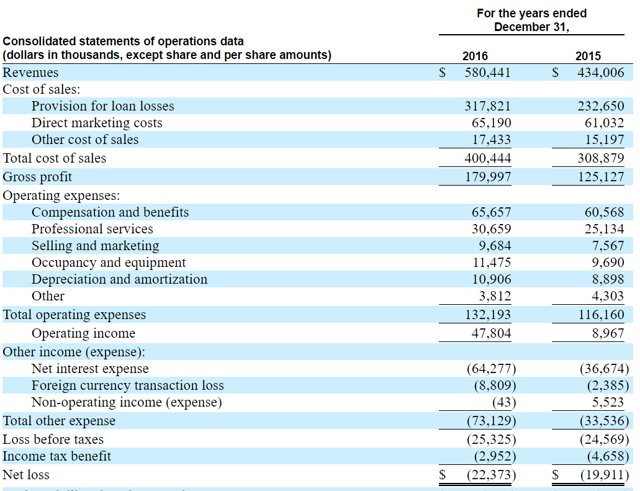

Revenue increased from $434.0M in 2015, to $580.4M, in 2016, a 34% increase. Operating income was $9M and $47.8M in 2015 and 2016 respectively. The company has not yet reported profits and generated a net loss of $19.9M and $22.4M in 2015 and 2016, respectively. As of December 31, 2016, Elevate had $68.5M in cash and cash equivalents and $571.6M in total liabilities.

(Click on image to enlarge)

(S-1/A)

A particular note that provisions for loan losses increased from 53.6% in 2015 to 54.7% in 2016. Loan loss provisions are accounted for as expenses, set aside in case of uncollected loans and loan payments. See conclusion for further discussion.

Competitors

Similar lending companies have struggled to become profitable and grow business. Competitors include Lending Club (NYSE:LC), a peer-to-peer lending company that went public in 2014, and OnDeck Capital (NYSE:ONDK). Assuming Elevate prices at the mid-point of its price range, it would trade at a price/sales multiple of 0.80x, well below that of Lending Club, On Deck Capital, and the average for the consumer finance industry.

|

TKR |

Market Cap |

Price/Sales Ratio |

|

ELVT |

$467.4M |

0.8x |

|

LC |

$2.18B |

1.79x |

|

ONDK |

$360.89M |

1.23x |

|

Industry Average |

$3.02B |

2.01x |

(Fidelity)

Conclusion: Avoid This Puppy

Poor performance of similar companies like Lending Club and OnDeck Capital make us very cautious on Elevate Credit.

Lending money to poor credits is an area that does not excite us. As described above, very high loan loss provisions relative to revenues highlights the riskiness of this business.

However, Elevate targets a currently underserved part of the market, and has proved successful at increasing revenue and growing customer base.

We recommend investors avoid this IPO.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours

Disclaimer: I wrote this article myself, and it expresses my own ...

more