Stopping On The Stairs, Or?

The State of the Market

From my perch, the current state of the market is a good news/bad news situation. On the good news side of the ledger, there is the market's uptrend, favorable seasonality, the fact that end-of-year window dressing is a thing, and a little something called TINA (There Is No Alternative). I opined on Wednesday that this combination is likely the reason for the market's recent slow grind higher. But I also warned that a pullback/correction/sloppy period should not be surprising at this stage of the game.

While I don't think the bulls will come under serious attack here, there are a few items to place in the bad news column. These include the overbought condition, the overly happy state of investor sentiment (see this week's IPOs), uncertainty over the state of the next stimulus package, and any/all headlines relating to the surge in COVID cases/hospitalizations/deaths.

On the latter item, I found it disturbing to learn that Wednesday was one of the deadliest days in U.S. history. According to Johns Hopkins, more than 3,000 Americans succumbed to the virus that day. To put this number into perspective, more Americans died in the U.S. on that day than the attacks on Pearl Harbor and 9/11. In fact, MSNBC tells us that four of the top 10 deadliest days in our country's history have occurred, wait for it... this month.

However, the stock market tends to be a cold-hearted beast and continues to look ahead to "shots in the arms" and a return to economic normalcy.

Yet at the same time, we must remember that meaningful advances in the market tend to mirror a staircase. Market rallies are also often referred to as "two steps forward and one step back" affairs. And my take is it appears the market is experiencing some sort of pause in what has can be described as a joyride to the upside since the beginning of November.

The question, of course, is if stocks will simply "rest" on the stairs a bit here or if we will see a "step back" in the near-term. We shall see. In either case, with inoculations against COVID beginning, investors of all shapes and sizes are justified in discounting better days ahead. But as is usually the case, there will be hiccups along the way.

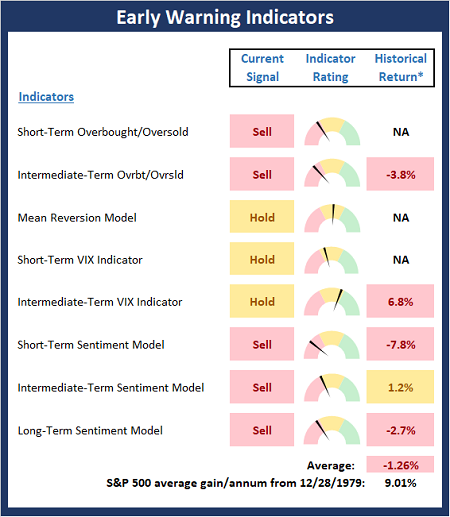

Now let's take a look at what our Early Warning indicator board tells us about the near-term outlook...

The State of the "Early Warning" Indicators

A quick glance at the Early Warning board says it all. The lack of any green on the board means the table has been set nicely for the bears and as a result, the indices have started to slip this week. But just because the table is set doesn't mean there is going to be a feast. My guess is the dip buyers - many of which may have a case of performance anxiety - will become active before the bears can inflict too much damage.

(Click on image to enlarge)

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

Stochastic Review

To be sure, playing the mean reversion game can be tricky. For example, take a look at the chart below. It appears that the stochastic indicator has broken down this week, which for many traders, is a sell signal. If we go back in time, the last time the stochastic broke below the upper bound, the moving average, and to a lower-low, stocks moved down a bit - much like the "one step back" idea discussed above. However, the time before that in late July, the stochastic break resulted in more of a pause on the stairs.

So, for me, a stochastic signal isn't necessarily a reason to take action. No, I view these events as more of a yellow flag or an indication that it's time to pause buying and wait for signs that the next leg up is about to begin.

S&P 500 - Daily

(Click on image to enlarge)

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more