Stocks Surge To, And Close At Record Highs, What Now Bears?

The S&P 500 rose by 55 basis points today, pushing the S&P 500 to close at a new all-time high of 3,039. We can see on the chart that the index rose to around 3,040, and just stopped rising. The natural course of action by the S&P 500 should be a retest of today’s breakout. So we can watch for that, and I’d like to see that retest happen sooner than later.

(Click on image to enlarge)

Alphabet (GOOGL)

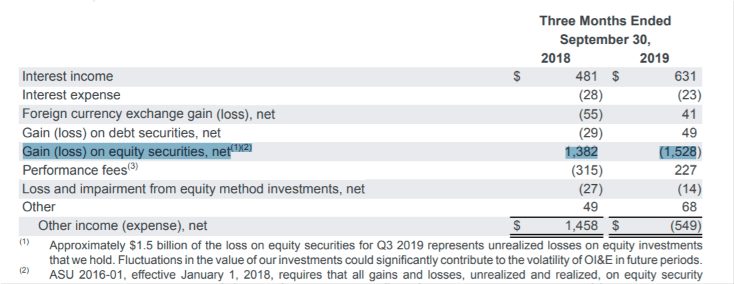

Alphabet reported results, and the earnings seem confusing. It looks like a big miss on the bottom line, but if you dig through the report, you can see that those traders at the Google Hedge Fund unit, of course, I’m joking, didn’t have a good third quarter. The loss is due to a $1.5 billion loss on investments, which resulted in a decline in other expenses of $549 million. If you adjust for those investment losses, according to my math, you will get an earnings beat. Perhaps, during the conference call, the company can explain that a bit, and then tomorrow, once the algo’s clear out, the stock can trade higher. The results look fine.

Hey anybody, know any good traders out there? 😛

If the stock can clear $1,300, then it could be on the verge of a big break out.

(Click on image to enlarge)

SNAP (SNAP)

SNAP may be breaking out of the falling wedge, and that means that the stock could rise towards $15.50

(Click on image to enlarge)

Roku (ROKU)

Roku is back to resistance around $150. I don’t think this rally will last.

(Click on image to enlarge)

Apple (AAPL)

Apple seems overbought now, look at that RSI. I don’t see how this can continue to rise at this pace. The stock needs to cool-off. Unfortunately, it may not happen until after results.

(Click on image to enlarge)

Beyond Meat (BYND)

Beyond Meat is falling after results to around $98. The results look strong from several metrics. It just too bad that the company has a market cap of $5.95 billion on full-year revenue guidance of $270 million at the mid-point. I wish all of my stocks traded with that kind of multiple. That is crazy, I’m sorry. Play this at your own risk. I don’t see how this doesn’t keep trading lower.

(Click on image to enlarge)

Disclosure: MICHAEL KRAMER AND THE CLIENTS OF MOTT CAPITAL OWN GOOGL

Disclaimer: This article is my opinion and expresses my views. Those views can change at a moment's notice when the ...

more