Stocks Drop On August 9: One And Done Or More Pain To Come?

It was a sleepy summer week in the middle of August. Stocks were little changed with the S&P 500 slipping by a measly 46 basis points. If you were on vacation, no worries you didn’t miss much.

Of course, this week past resembled something more of a Casino, with the stock market plunging on Monday and working its way higher the rest of the week. It makes one wonder how you are supposed to invest in this market. Not easy. You have two choices, do nothing or sit in cash and wait. The one thing that almost always seems wrong is to react and get caught up in the moment.

Today was no different from the S&P 500 plunging at the start of the day only to rally back throughout the rest of the day.

(Click on image to enlarge)

Bonds and the dollar hardly moved today, which was a clear signal that whatever it was that bothering the equity market, wasn’t a big deal. It’s too hard to get worried when stocks are plunging as bond yields, and the dollar is unchanged.

(Click on image to enlarge)

That is what I explained in a premium video today, giving a checklist of things to check for daily, looking for confirmation signals. Let The Market Be Your Guide In Times Of Confusion

Anyway, the lack of confirmation today makes me believe that today’s sell-off was a one-off. The one minor concern I would have from today’s session is the look of the chart at the 2,935 level in the S&P 500. I will look at the scenario more this weekend.

Earnings

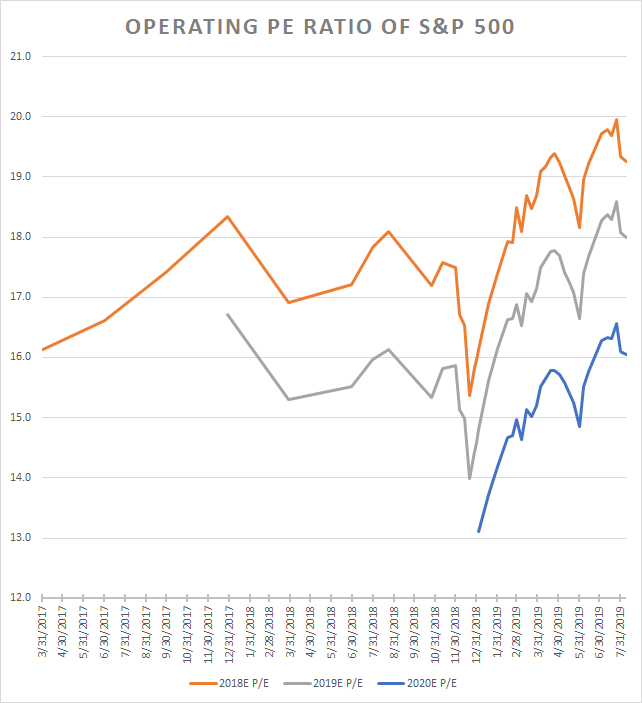

Not much was accomplished this week with the S&P 500 trading around 16.1 times 2020 earnings estimates of $181.84 per share, based on S&P Dow Jones estimates. Earnings estimates for 2020 did fall slightly again this week from $182.09 on July 31. Since the beginning of the year, earnings estimates for 2020 have dropped by about 6%, which is why the PE ratio continues to rise despite the equity market going nowhere.

(Click on image to enlarge)

Apple (AAPL)

Apple seems to be acting ok, despite rising tariff worries. Then again, the yuan has devalued some, so that should offset some of the cost to Apple. It will be interesting to see what the company sets the price for its new phones when they launch in September.

It seems like we are back to where we were throughout most of July, working our way higher to $209.

(Click on image to enlarge)

Shopify (SHOP)

Shop had a solid day and continues to find itself working its way higher towards $400.

(Click on image to enlarge)

Amazon (AMZN)

Amazon had a reasonably strong day holding on to support at $1800. I still think AMZN heads towards $1900.

(Click on image to enlarge)

Netflix (NFLX)

It looks like Netflix has broken free of a downtrend it has been in and retested that breakout today. Perhaps that sets up an increase back to $321.

(Click on image to enlarge)

Acadia (ACAD)

Acadia was powerful today in a weak tape and is it still on a path towards $31.

(Click on image to enlarge)

Disclosure: Michael Kramer and the clients Mott Capital own AAPL, ACAD, NFLX

Disclaimer: This article is my opinion and expresses my views. Those views can change at a moment's notice ...

more