Stocks Catching Cold Or Something Worse?

You knew it was coming. No, not the Coronavirus. Rather an excuse du jour to create some selling. After an impressive joyride to the upside, which saw the S&P 500 surge +15.3% from the close of October 2, 2019, and the high seen on January 17, 2020, the stock market had become overbought, sentiment had become overly optimistic, the macro theme was well established, and lots of folks thought there was only one way the market could go from here. As in onward and upward in a fashion seen in 2013 and 2017.

In short, bullish complacency had set in.

As is usually the case when the market gets THIS overbought and sentiment becomes THIS bullish, something comes out of the woodwork to cause the fast-money crowd to rediscover their sell programs. In this case, it was the fear of the Coronavirus, the dive in oil, falling interest rates, and, of course, a new take on an old theme - the trade war.

Students of market history recall that stocks stumbled a bit 17 years ago when the severe acute respiratory syndrome (SARS) posed both a health and economic threat to the globe.

Until Friday, the U.S. stock market had basically shrugged off the reports that the Coronavirus was wreaking havoc in China. But now that there are a handful of cases here in the U.S., traders have taken notice.

Stocks Are Worried About...

From the stock market's perspective, the key concern on the Coronavirus front has to do with the potential impact on global economic growth. China's economic growth in particular. Given that the outbreak is occurring during the Lunar New Year, China's equivalent to the Christmas/Hanukkah holiday season, where Chinese traditionally travel to the town of their birth and that serious travel restrictions have been put in place, the thinking is that China's GDP is going to be impacted.

My take is that unless this thing gets scary, the U.S. consumer will likely go on about their business and the U.S. economy won't take much of a hit. The big assumption here is that a meaningful outbreak does not occur in the U.S. However if we've learned anything since the Financial Crisis, it is that John Q Public can and will stop spending at the drop of a hat if things get scary. So, if the number of cases in the U.S. doesn't explode in the next couple of weeks, the current decline in the stock market will probably be temporary. But if this thing spreads quickly, all bets are off.

Rates and Oil

Then there is the dueling problem of declining rates and oil prices. Market logic suggests both are indications that folks are indeed worried - at least in the short-term - about the economy.

Yet at the same time, it is important to remember that (a) the stock market rally was overdue for a rest and (b) traders may be concerned about headline risk going forward and want to lock in some of January's gains.

Traders Know What To Do

So, if you are a trader, what do you do with this situation? You take profits, that's what. You put some cash on the sidelines. As Paul Tudor Jones told CNBC last week, as a trader, he wouldn't be long the stock market for the next couple of weeks. And from a trading point of view, this certainly makes sense.

Remember, our "Early Warning Board" had been acting like a third-grader in the back of the class that knows the answer to the teacher's question and desperately wants to be called on to give it. I.E. Yellow caution flags have been out on the track for some time now. As such, a pullback, a correction, or at the very least, a sloppy period to consolidate some of the market's big gains seen over the last four months is to be expected.

Yet at the same time, my sense is there is a lot of money that needs/wants to get into the stock market. As I mentioned last week, there are lots of folks looking for an opportunity to put money to work but have been sitting on their hands due to the market's relentless march higher.

A New Front in the Trade War?

Finally, while not on anybody's radar this morning, it is important to remember that the White House seems bent on opening a new front in its trade war. This time, they have Europe in their sights. And if tariffs start to be bandied about here, well, we all know what to expect from the stock market.

The combination of all the above appears to be creating a flight to safety, which explains the recent dive in interest rates.

So, my questions of the day include, does the current pullback that began on Friday have legs? Will this bout with a virus cause the stock market to become seriously ill? Or will this turn out to be just a flu bug that runs its course in a matter of days?

We shall see. But for the record, for anyone looking for a "dip" to buy, this is it. Yes, even if things get nasty on the virus front and stocks start to dive in earnest. Remember, there is no such thing as a "healthy/constructive" pullback when it is happening!

Weekly Market Model Review

Since it's the start of a new week, it's now time to put aside my subjective view of the action and to review the "state" of our indicator boards. Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

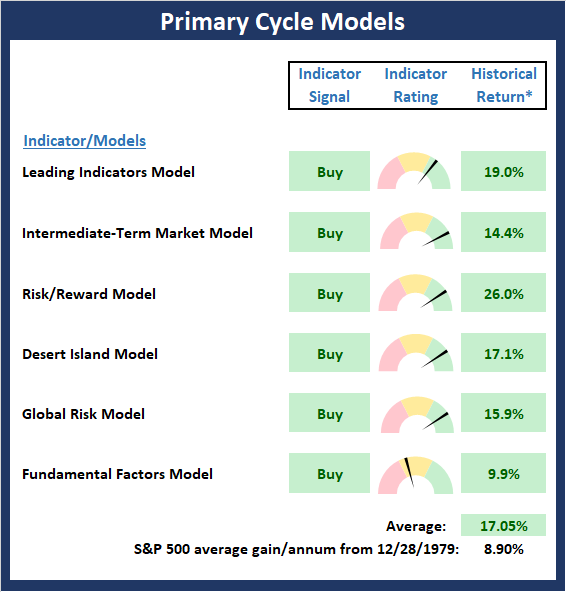

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There is one change to report on the Primary Cycle board this week as the Leading Indicator Model upticked from neutral to positive. This board is an important reminder of the market's big-picture backdrop. While things can change quickly in this game, the bottom line is that all of my favorite models designed to help me stay in tune with the primary market cycle are green.

(Click on image to enlarge)

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Fundamental Backdrop

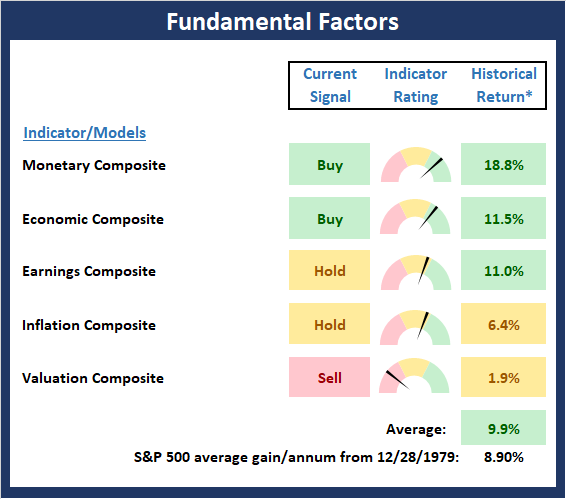

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

Once again, there was no movement on the Fundamental Factors board. Sure, the Coronavirus could be a game-changer if it causes global growth to slow. But for now, rates are low, the economy is looking Goldilocks-like, earnings are rising, and inflation isn't a concern. As for valuation, well, in my experience, they don't matter until they do - and THEN they matter a lot. So, unless there is a reason to question the growth theme, the Fundamental board suggest we continue to buy the dips and give the bulls the benefit of any doubt.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Trend

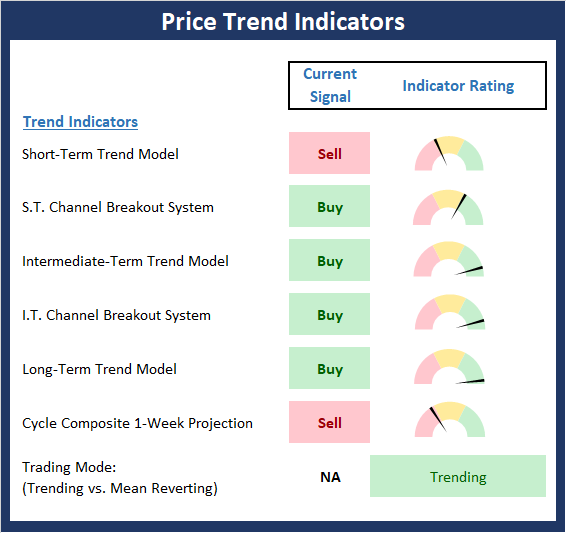

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

With a couple of fresh worries causing traders to lock in gains and/or stand aside until more is known about the health threat, it isn't surprising to see stocks come off their highs. At the present time, the state of the tape remains positive from the intermediate- and longer-term perspectives. Obviously, we will have to monitor the action closely in the coming days/weeks and monitor important support zones.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of Internal Momentum

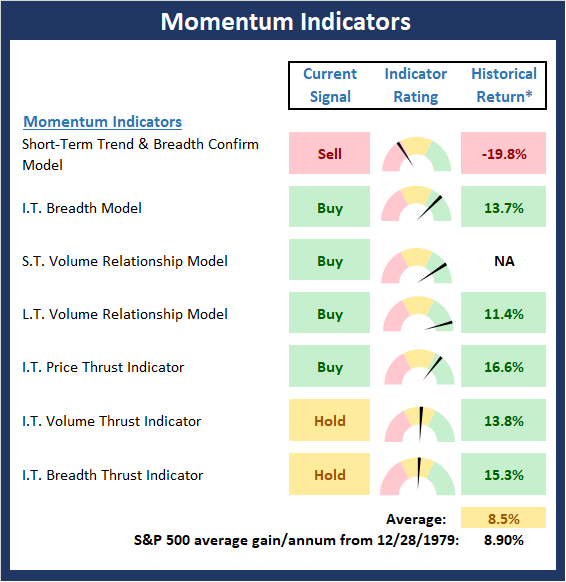

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

Not surprisingly, the Momentum board deterioration this week. One indicator - the Short-Term Trend & Breadth Confirm Model - downticked from positive to negative. And the Intermediate-Term Breadth Thrust Indicators slipped back to neutral from positive. My stance is that unless we start to see weakness in the intermediate-term indicators, that the current pullback is likely to remain in the "garden variety pullback" (3% - 5%) category.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way".

The Early Warning board did a nice job alerting us to the fact that the table had been set up for the bears to enjoy some time in the spotlight. As I wrote last week, "Although the bulls are clearly large and in charge here, a few days of sloppy action - including a scary down day or two - would go a long way towards making the current bull leg sustainable. As such, dip buyers should continue to stand at the ready with their shopping lists in hand." I think this stance continues to make sense.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more