Stock Market Movements And Real Rates

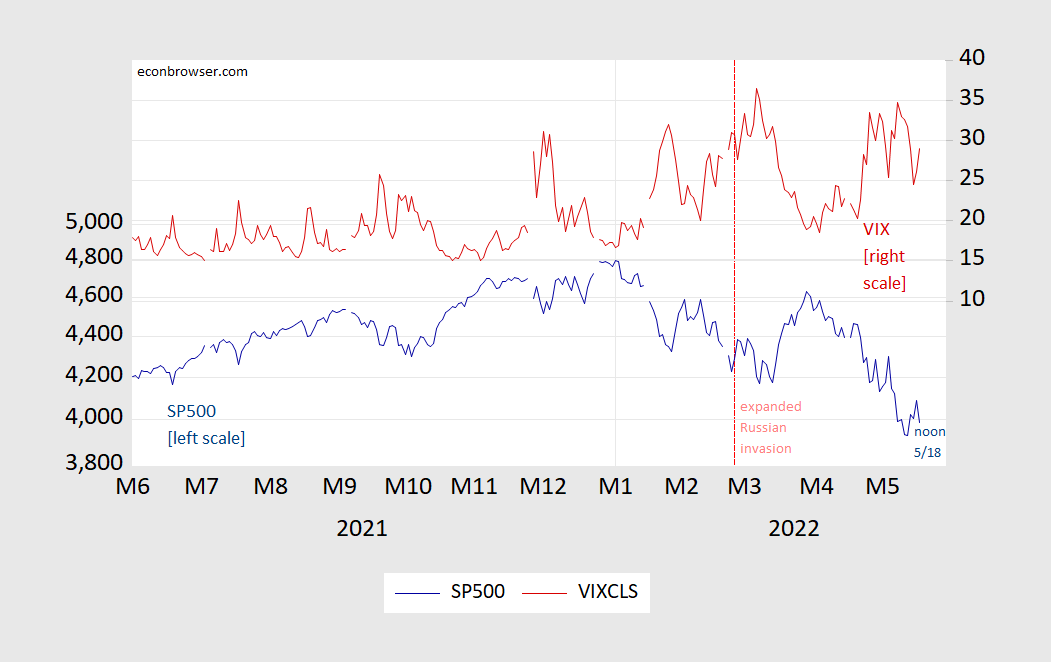

Over the last 9 months, the S&P500 has seemingly peaked and is now declining. Risk, discounting or something else?

Figure 1: S&P 500 index (blue, left log scale), and VIX (red, right scale). 5/18 observation as of noon, ET. Source: FRED.

How much further to go? Who knows, but an asset pricing framework can help think about the important factors. Stock prices should be the present discounted value of the stream of dividends expected over the future. Of course, most of the things of interest are unobservable — what’s the market’s expectations of dividends, what’s the rate to discount by (which is composed of the risk-free rate and the equity risk premium), and are there bubbles. Assume no bubbles – then the making another assumption about dividends and earnings, one gets the price-earnings ratio as an interesting variable.

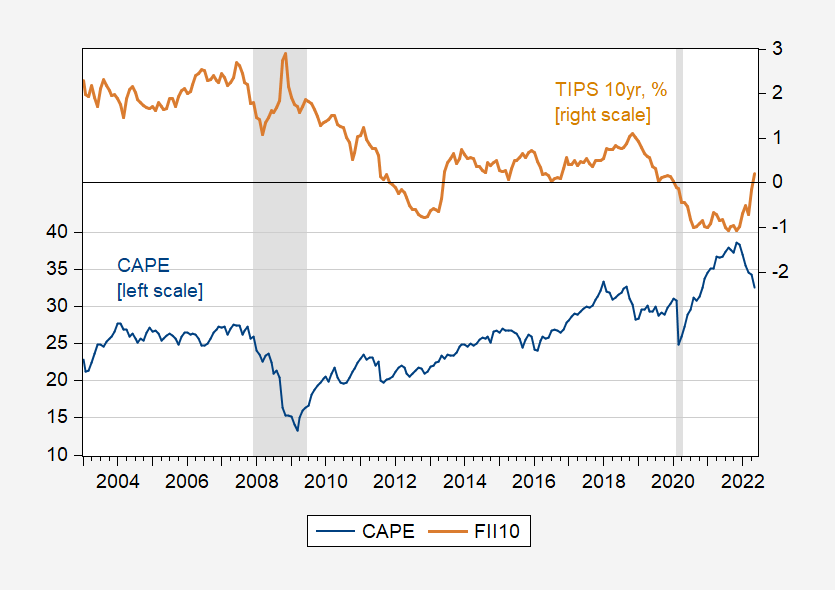

Here’s Shiller’s cyclically adjusted price-earnings ratio, plotted against the real 10-year yield (TIPS):

Figure 2: Shiller cyclically adjusted price-earnings ratio (CAPE) (blue, left scale), TIPS 10 year, % (brown, right scale). NBER defined recession dates peak-to-trough shaded gray. Source: Shiller, Treasury via FRED, NBER.

As long as the trajectory of expected real rates continue to move upwards, then CAPE is likely to continue to fall, even holding risk appetite and the path of expected earnings constant. (Note CAPE is still high, but much lower than the value of 43.8 recorded in January 2000.)

Disclosure: None.