Stock Market Forecast: Earnings And Volatility Set To Continue In February

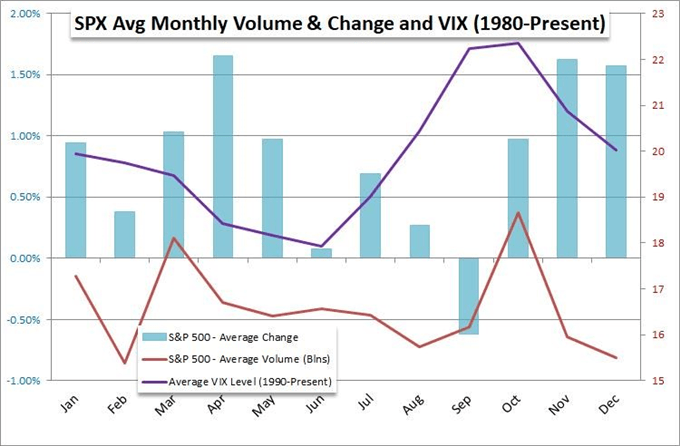

The US indices have reclaimed much, if not all, of the ground they forfeited in the dying days of January as market conditions return to normal amid a drawdown in rampant speculation from retail traders. While normality might usher in a gradual decline in volatility, history suggests the VIX may remain somewhat elevated in the month of February.

Source: Bloomberg, John Kicklighter

According to VIX data over the last thirty years, February might serve as transitionary month for volatility as the market emerges from the volatility-stricken months of Fall and Winter, into Spring where market activity then gradually declines into the Summer doldrums. With that in mind, wild swings in price action might continue in the weeks ahead but should become more measured as the year matures. Still, past performance is not indicative of future results and, as we saw just twelve months ago, anything can happen in the market.

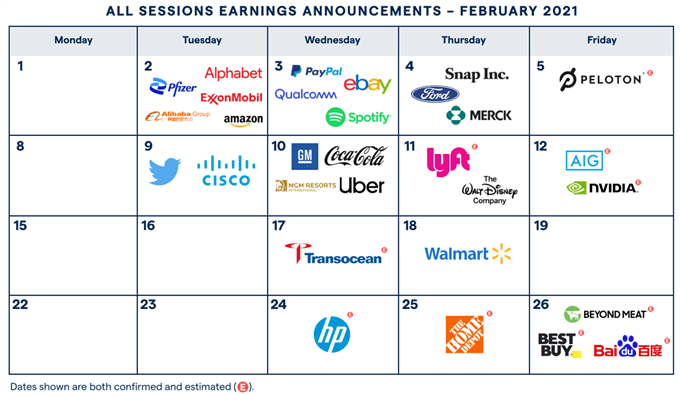

Regardless, the market will require developments to stoke volatility and the continuation of earnings season should serve as a consistent catalyst as February progresses. While the earnings of the big-ticket tech corporations have come and gone, many notable companies have yet to report. In addition to earnings, fiscal policy might play a role in stoking market volatility as the Biden administration considers an array of stimulus offerings.

Source: IG

Further, still, non-farm payrolls data is slated for release early Friday. Recent reports have missed forecasts but an optimistic ADP report earlier this week may throw prior notions out the window. Either way, the data release opens the door to a plethora of event-driven trading strategies.

Suffice it to say, US equities may continue to play off familiar fundamental themes in the month ahead, but history suggests volatility remains a threat and should be eyed closely.

Disclosure: See the full disclosure for DailyFX here.