Stock Market & Economy Recap - Sunday, Aug. 8

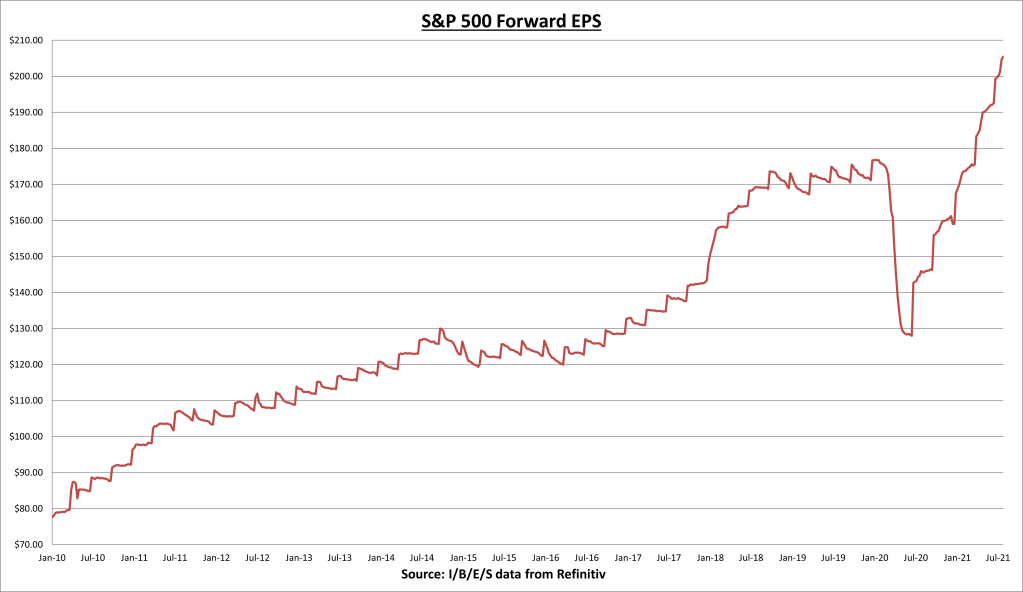

S&P 500 Earnings Update

S&P 500 earnings per share (EPS) increased to $205.41 this week. The forward EPS is now +29.17% year-to-date. Q2 earnings scorecard so far: 89% have reported, 87% have beaten estimates, and results have come in a combined +16.4% above expectations with a +93.1% growth rate.

The S&P 500 index increased +0.94% this week, for another record.

S&P 500 price to earnings (PE) ratio is now at 21.6.

The S&P 500 earnings yield is now 4.63%, compared to the 10-year Treasury bond rate of 1.29%. The equity risk premium remains a healthy 3.34%.

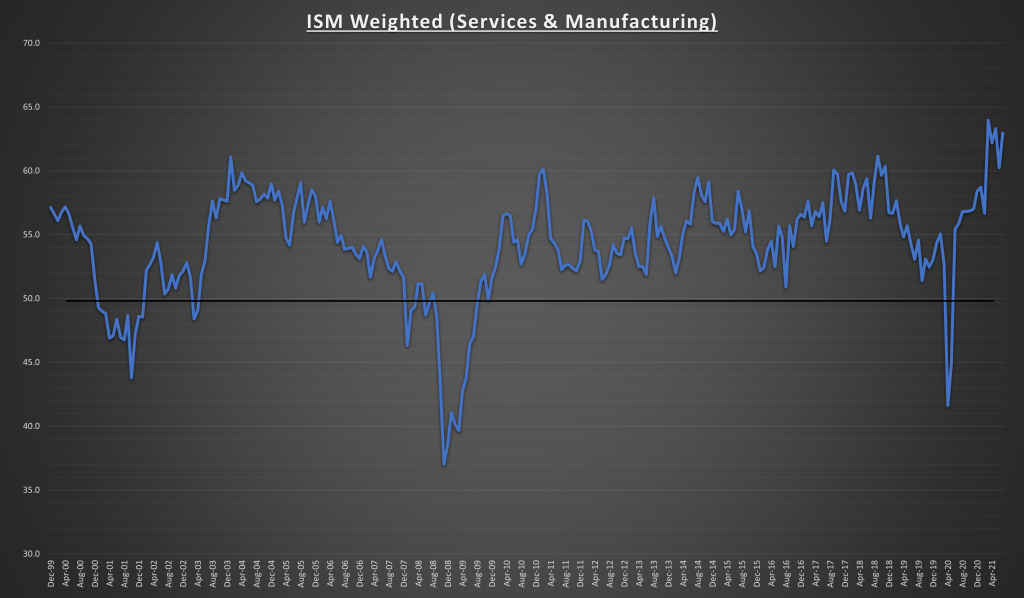

Economic Data Review

The ISM Manufacturing PMI (Purchasing Managers Index) came in at 59.5 for July, down modestly from June (60.6) but still well in expansion territory for the 14th consecutive month. 17 of the 18 manufacturing industries reported growth in July.

New orders remain strong, while 73.8% of manufacturing purchasing managers reported paying higher prices for input materials (down from 84.8% last month). The prices index (chart above) came in at 85.7, down from the record high last month. The manufacturing sector is still booming despite the supply chain constraints.

The ISM Services PMI (Purchasing Managers Index) for July came in at a record high of 64.1. New orders increased to 63.7 (from 62.1 in June) despite the continued struggle with labor, input shortages, & inflation.

Prices paid for materials and service related input costs increased to a record high. So even though costs showed a modest monthly decline in the manufacturing sector, there was no such relief for the services sector.

The weighted ISM PMI (which takes into account the approximate weight of the services and manufacturing sectors in today’s economy) now comes in at 63. This equates to an approximate annualized economic growth rate of 5.1%.

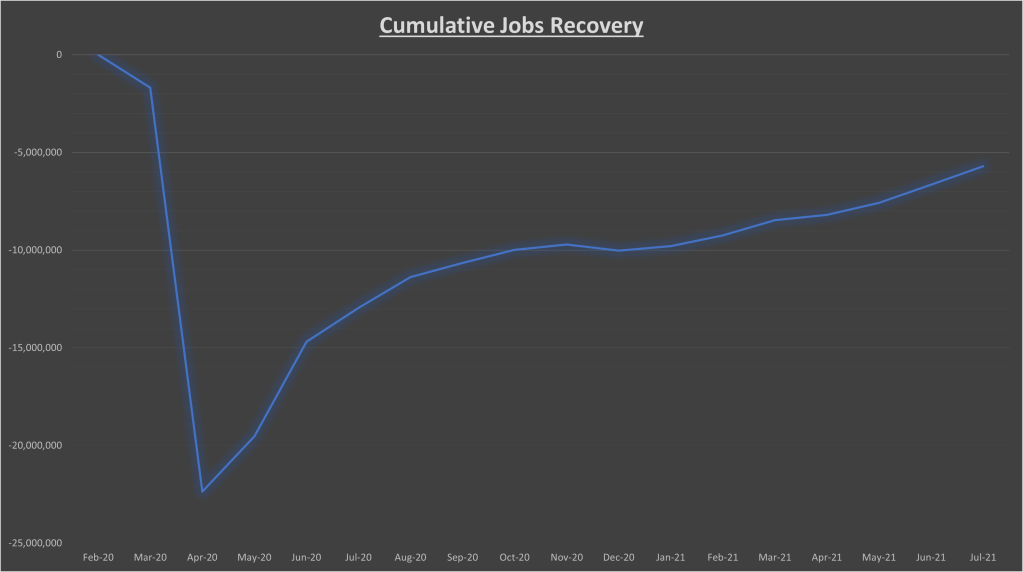

The BLS employment report showed +943 thousand net jobs were created in July. June was revised up from +850 thousand to +938 thousand, and May was revised up from +583 thousand to +614 thousand, for a total of +119 thousand additional net jobs higher than previously reported.

Total private payrolls increased +703 thousand, led by +380 thousand net jobs gained in the leisure and hospitality sector. Average weekly hours remained the same at 34.8. Average hourly wages increased +0.4%, from $30.43 to $30.54, and wages are +4% higher than they were at this time last year.

We have now recovered 74.5% of the COVID-19 recession job losses, but still remain with a net 5.7 million jobs below the prior peak. We have been able to gain an average of +617 thousand jobs per month this year.

If this trend continues, we could expect a full jobs recovery by April. But barring a serious setback on the virus fight, I think we could see jobs growth increase at a faster pace. In any case, it looks like net jobs could surpass its prior peak sometime in the first half of 2022.

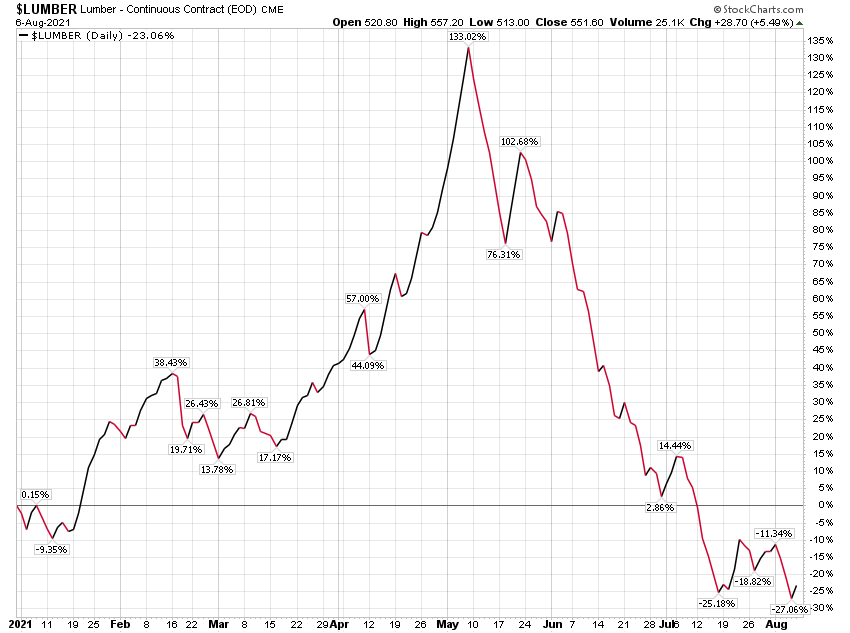

Chart of the Week

What a wild ride it has been for lumber prices this year. Due to shortages and a spike in demand, lumber shot up +133% in a matter of months. In response to high prices, companies found a way to increase production dramatically. Lumber went from being up +133% for the year, to being down -27%. It’s one of only a few commodities that are lower for the year.

Summary

This week's economic data confirms that the economy is booming despite all of the COVID-19-related challenges. Just imagine what the growth rate could have been.

I predicted we could see some softness in the manufacturing sector, while the services sector would pick up the slack. So far, the manufacturing sector remains fairly strong, while the services sector is breaking records. Since services make up approximately 70% to 75% of today's economy, that bodes well for the future. Yet there's still no relief in sight for inflation. Next week we get the CPI report, and hopefully we can get a pullback in the annualized growth rate.

Earnings remain stellar, although we saw a minor pullback in the 2022 and 2023 estimates for the first time in awhile. 2022 and 2023 earnings growth projections are now below +10%. Which may validate some of the peak growth concerns. Valuations are still attractive on the stock market as a whole, even though there are pockets of the market that are egregiously overvalued. Valuations are important, but they are by no means a market timing tool.

Next Week

For economic data, we have some Fed voting members speaking on Monday, the NFIB small business optimism index on Tuesday, the Consumer Price Index (CPI) measure of inflation on Wednesday, and the Producer Price Index on Thursday. For earnings, there are 16 S&P 500 companies reporting. I’ll be paying attention to the Trade Desk (TTD) on Monday and eBay Inc. (EBAY) on Tuesday.

I/B/E/S data is courtesy of Refinitiv.

Disclaimer: None.