Stock-Linked Executive Pay And Buybacks: A Destructive Combo

A new report from the Institute for Policy Studies finds that half of the 100 S&P 500 firms with the lowest median worker wage revised their pay rules in 2020, such that the median worker pay declined 2%, while CEO pay rose 29%. Sixteen of those companies lost money in 2020 while having the highest average CEO pay, at US$17.5 million. See Pandemic Pay Plunder: Low-Wage Workers Lost Hours, Jobs, and Lives. Their Employers Bent the Rules – to Pump up CEO Paychecks.

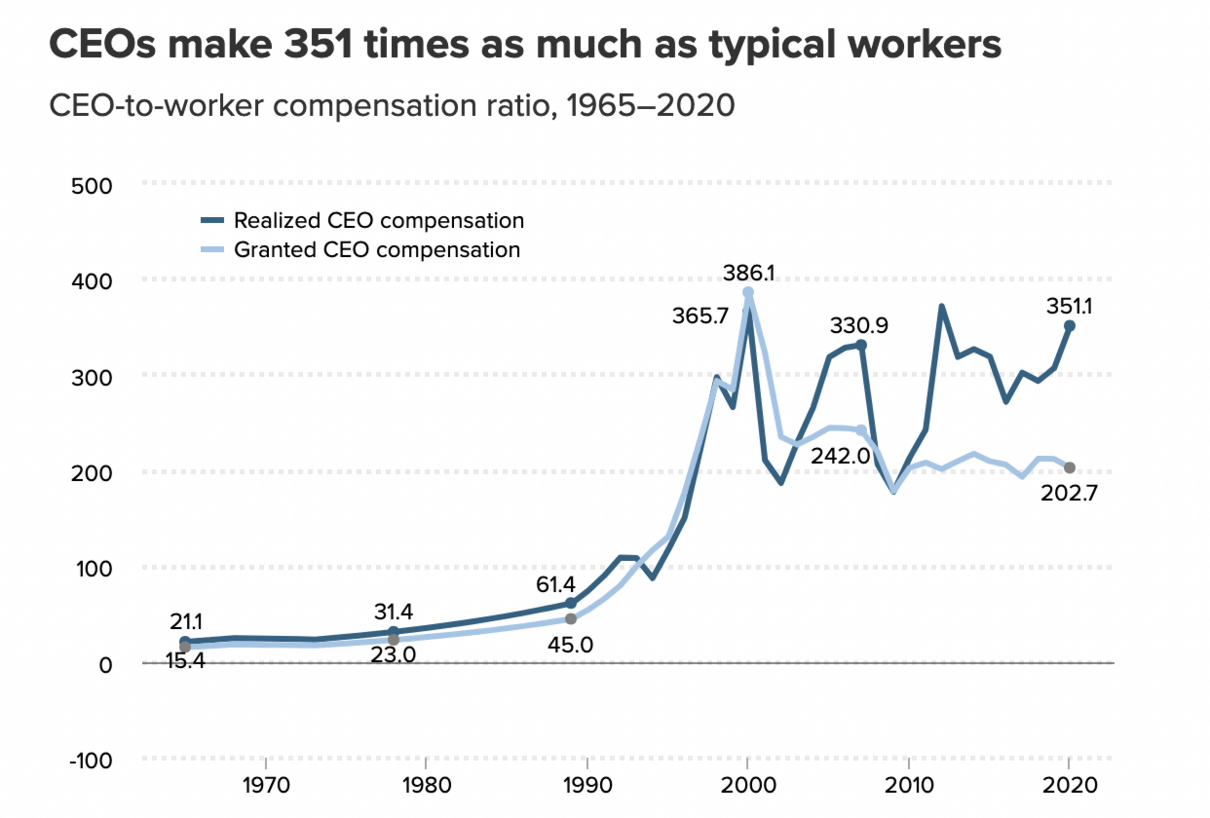

In the early 1990s, the largest shareholders pushed corporations to tie executive pay packages to stock performance. This was promoted as aligning operators with investors. It has since run to counter-productive extremes where company leadership is incentivized to boost near-term share prices through gimmicks (like share buybacks) at the expense of longer-term strength, stability, innovation, and productivity of the franchise, its workers, and the broader economy. The chart below, since 1965, shows the unsustainable pay disparity now inherent.

As a step towards redressing this problem, in 2017, US Securities law began requiring companies to disclose the ratio of CEO compensation to the median compensation of their employees. But gaming is rife, as explained in A Promising Start to the Challenge of Excessive CEO Pay:

The rule is a good start, but all that “flexibility” carries its own risks. Namely, the potential exists to game the system by, for example, outsourcing your lowest paid work, thus lowering your ratio without touching CEO pay. It also creates a different playing field for industries where salaries are relatively high, such as the technology industry, versus industries that rely on front line staff, such as retailers and grocery stores.

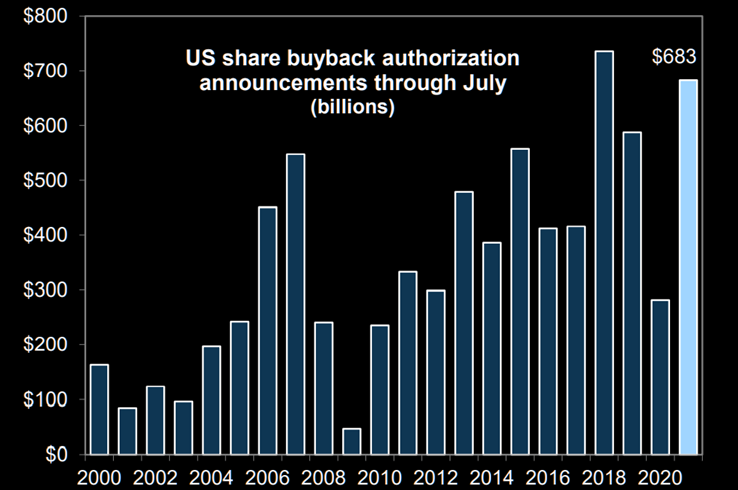

Meanwhile, as shown below since 2000 (courtesy of Lance Armstrong), share buybacks that boost share-linked pay packages are back near a record this year even as many businesses and workers face a highly uncertain future, now heavily indebted.

Re-banning share buybacks as the illegal market manipulation it was considered up until 1982 is a critical first step in redressing financially and socially destructive incentives. Yes, we can.

Disclosure: None.