Stock Futures Muted Despite Upbeat Jobs Data

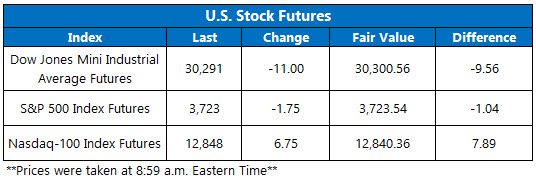

It's the final trading day of the year, and futures on the Dow Jones Industrial Average (DJI) and S&P 500 Index (SPX) are modestly lower this morning, despite better-than-expected weekly jobless claims data. Initial claims totaled 787,000 last week, which is lower than the anticipated 828,000. Meanwhile, Nasdaq-100 Index (NDX) futures are just above fair value, with all three benchmarks on track for weekly wins as well as yearly gains, posting quite the rebound from their March lows.

5 THINGS YOU NEED TO KNOW TODAY

- The Cboe Options Exchange (CBOE) saw more than 1.4 million call contracts traded on Wednesday, and 699,654 put contracts. The single-session equity put/call ratio rose to 0.47 and the 21-day moving average stayed at 0.42.

- Celsius Holdings, Inc. (Nasdaq: CELH) is surging, up 11.5% before the bell, following news that the stock will join the S&P SmallCap 600 on Jan. 7. On track for a fresh 12-year high, the equity is up 95.6% in the last three months alone.

- Tribune Publishing Company (Nasdaq: TPCO) is up 9.5% in electronic trading after Alden Global Capital offered to buy its remaining shares for $14.25 per share. The firm already owns a 32% stake in Tribune and says it is not interested in selling the shares to another party. TPCO is looking to surpass its year-to-date breakeven at the open.

- The shares of MicroStrategy Incorporated (Nasdaq: MSTR) are up 0.5% in pre-market trading, looking to continue its recent rally as bitcoin increases in value -- yesterday hitting a record high. MicroStrategy acquired $650 million in bitcoin and has made more than $1 billion in bitcoin purchases this year. Year-to-date, MSTR is up 173.4%.

- Apart from this morning's weekly jobless claims, it's a quiet end to the year in terms of economic data.

EUROPEAN MARKETS FINISH NEW YEAR'S EVE SESSION LOWER

Asian markets were mostly higher the day before New Year’s after data from China’s National Bureau of Statistics showed factory activity expanded in December. The European Union (EU) also struck an investment deal with China, which will give the bloc greater access to its markets going forward. In response, the country’s Shanghai Composite rose 1.7%, while Hong Kong’s Hang Seng added 0.3%. Elsewhere, Japan’s Nikkei and South Korea’s Kospi were closed for the holiday.

Meanwhile, European stocks finished the holiday-shortened session lower, marking the end of a year that was headlined by COVID-19 and stimulus measures. Further virus restrictions, as well as uncertainty surrounding Brexit, were also weighing down sentiment. As a result, London’s FTSE 100 fell 1.5%, while France’s CAC 40 and the German DAX dropped 0.9% and 0.3%, respectively. For the year, stocks across the pond registered a 3.8% deficit.