Stock Buybacks In Vogue And Those Companies' Stocks Are Outperforming

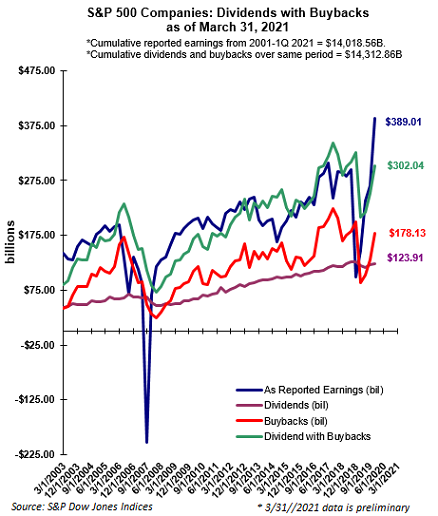

As the economy has recovered from the pandemic-induced recession, S&P 500 companies' reported earnings hit a record $389.01 billion for the first quarter ending March 31, 2021, as reported by S&P Dow Jones Indices. This exceeds the pre-pandemic high of $294.3 billion reached in the fourth quarter of 2019.

With this recovery seen in corporate earnings, companies have resumed dividend payments and dividend increases. Additionally, stock buybacks are once again back in vogue, reaching $178.13 billion in the first quarter, up from the pandemic low of $88.66 billion but below the pre-pandemic March 31, 2020 high of $198.7 billion.

Howard Silverblatt, Senior Index Analyst at S&P Dow Jones Indices, notes in the report, "Companies almost fully returned to the buyback market in Q1 2021 after their Q2 2020 COVID-19 inspired departure, as 335 issues did significant open-market purchases, up from 244 last quarter and 170 in Q2 2020. Given the strong and expected record level cash-flow from Q1 2021, the full return to pre-COVID-19 levels is expected later in the year."

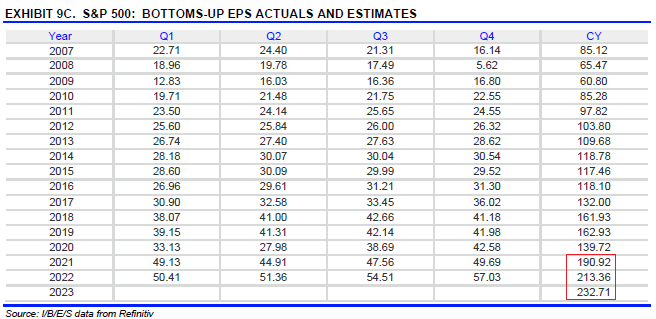

The improved earnings picture is evident in the table below, which shows consensus S&P 500 earnings estimates by I/B/E/S data from Refinitiv. For calendar year 2020, S&P 500 earnings were $136 per share and have been increasing nearly 40% to $190 per share in 2021. S&P 500 Earnings for 2022 are expected to increase another 12% to $213 per share.

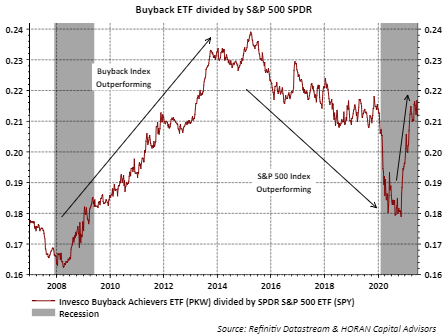

The resumption in buybacks and dividends along with a strong recovery in earnings growth has not gone unrecognized by some investors. Since the end of November last year, the Invesco Buyback Achievers Index (PKW) has outperformed the S&P 500 Index, as seen below.

The index includes U.S company stocks that have reduced their outstanding share count by 5% or more in the trailing 12 months. The index is reconstituted annually in January and rebalanced quarterly in January, April, July, and October.

In addition to the buyback focus of the Buyback Index, the stock selection criteria leads the final portfolio of stocks in PKW to have a value tilt. From a style perspective, large value comprises 19% of PKW's holdings versus 5% for large growth, mid-cap, and small-cap styles.

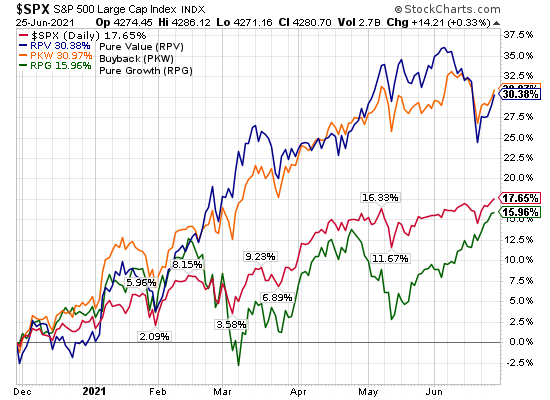

I wrote earlier this year about the significance of value outperforming growth in relation to a pickup in economic growth, and I believe value-oriented/economic-sensitive stocks continue to outperform the broader S&P 500 Index given the continued improvement in the economy.

This value outperformance is an indication that investors also expect sustained economic growth into the foreseeable future and are rewarding the economically-sensitive companies and sectors.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more