Steve Easterbrook: McDonald’s CEO Analysis

With more than 37,000 restaurants in over 100 countries, everyone recognizes the Golden Arches of McDonald’s (MCD). However, you might not be familiar with McDonald’s CEO Steve Easterbrook.

Easterbrook began working at McDonald’s in 1993 as a Financial Reporting Manager in London. In the last 25 years he has worked his way up. An overview of Easterbrook’s more recent rise to the top is below.

Steve Easterbrook’s Rise To CEO

- Prior to 2010 = President and CEO of McDonald’s UK & President Europe’s Northern Division

- August 24th, 2010 = McDonald’s Names Steve Easterbrook As Global Chief Brand Officer

- November 5th, 2010 = McDonald’s Names Steve Easterbrook As President of McDonald’s Europe

- August 16th, 2011 = Easterbrook Resigns To Join PizzaExpress as CEO

- April 12th, 2013 = McDonald’s Names Steve Easterbrook Global Chief Brand Officer

- March 20, 2014 = Easterbrook Assumes Oversight of Restaurant Solutions Group, Elected Senior Executive Vice President

You can see that it was not a linear progression, but Easterbrook has played an important role in the company for some time.

Easterbrook Named McDonald’s CEO

On January 28th, 2015 McDonald’s named Steve Easterbrook to replace Don Thompson as President and CEO, in addition to being added to the Board of Directors. In the statement McDonald’s had this to say about Easterbrook:

“Prior to this promotion, Easterbrook was Senior Executive Vice President and Chief Brand Officer, leading McDonald’s efforts to elevate its marketing, advance menu innovation, and create an infrastructure for its digital initiatives. An accomplished, McDonald’s veteran, Easterbrook previously served in key leadership roles across the company’s global business, including president of McDonald’s Europe.”

Easterbrook commented:

“I am honored to lead this great brand, and am committed to working with our franchisees, suppliers and employees to drive forward our strategic business priorities to better serve our customers.”

So let’s check in on how the business has done since that time:

Business Performance

Note that the 2014 numbers are prior to Easterbrook, provided for reference, and the 2018 numbers are estimates with three quarters of the year in the books.

There is an assortment of interesting tidbits in the above information. Under Easterbrook McDonald’s is transforming in a variety of ways.

You can see that the top line has been shrinking significantly, from $27.4 billion in 2014 down to an expectation closer to $21 billion for this year. The underlining reason for this has been the company’s long-term goal to have 95% of its locations owned by franchisees. That takes away sales that can be credited to the company, but significantly increases McDonald’s margins.

You can see this play out in the operating margin, increasing from 35% to 49%, and the net profit margin, increasing from 17.3% to 28.9%, in the table above (although the net profit margin is influenced to a degree by a lower tax rate as well).

Another large change has been the dramatic rise in debt – from $15 billion to $32 billion – along with a significant reduction in the share count – from 963 million down to 765 million. These two changes are no accident. McDonald’s decided to start borrowing significant sums, while rates were low, and retire huge blocks of stock. The share count is down significantly, 20% or so in the last four years, but this has drastically altered the balance sheet as well.

Still, as it stands today earnings-per-share are up meaningfully – up 62% in the last four years. Roughly 28% of this increase can be attributed to company-wide profit improvement while the rest is a result of the lower share count.

Finally, the dividend continues to grow, as it has for 42 consecutive years. However, this has been at a slower pace than earnings-per-share growth, which has allowed the payout ratio to drift lower – from 68% in 2014 down to 54% this year.

Overall McDonald’s the business has changed significantly, as margins improve in light of the refranchising model. The company has doubled the debt load in the last four years – perhaps questionable to some given the above average earnings multiple during this time – but looks a bit more prudent in other areas (a lower payout ratio is an example). Netted out, Easterbrook’s leadership on the business side has been impressive thus far.

Stock Performance

Of course business performance and shareholder results are two different things. Depending on valuation, shareholder returns can significantly under or out-perform the business side of the equation. For our purposes of examining shareholder results, we’ll consider 28% overall company-wide earnings growth and 62% earnings-per-share growth over the last four years.

On January 28th, 2015 McDonald’s share price closed at $88.78. As we write this, the share price sits at $185.04. In addition, McDonald’s has paid $15.07 in dividends. That equates to a total value of $200.11 or a 125% overall return (over 22% annually). Clearly shareholders have enjoyed exceptional returns while Easterbrook has been at the helm.

There are a couple of items should be kept in mind with these numbers. Not all of McDonald’s positive results are directly from the CEO, just as not all negatives can be attributed to one person. McDonald’s enjoys an exceptional history and has been operating in a very good environment over the last four years. A full business cycle may tell a more complete story.

Likewise, during Easterbrook’s tenure the valuation of shares has gone from about 18 times earnings all the way up to 24 times earnings. Earnings-per-share and dividends can account for about ~80% of the security’s total return, but the remaining ~45% has been a result of an increased valuation. Should this reverse course at some point, shareholder results can lag business performance.

Still, despite these important notes, its clear that the business and security have performed well during the last four years.

CEO Compensation

We could detail each component of CEO compensation, but it might be easier to show you examples. All of the following images are found in the company’s last Proxy Statement.

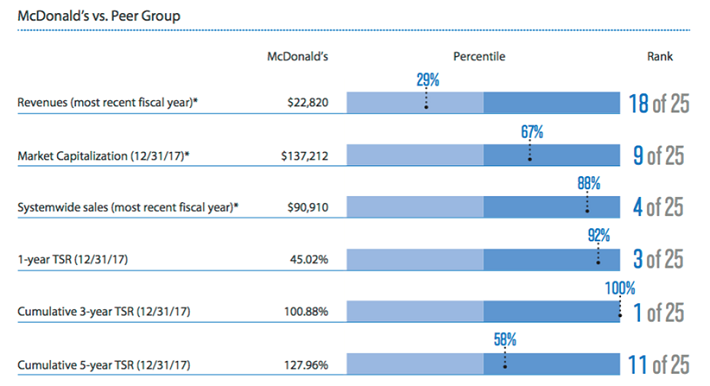

To establish Executive compensation, McDonald’s created a 24-company peer group consisting of names in the industry like Yum! Brands (YUM) and Wendy’s (WEN), along with other established “blue chip” firms like Johnson & Johnson (JNJ), Coca-Cola (KO), Walt Disney (DIS) and Nike (NKE).

Here’s how McDonald’s last compared itself against its peer group in a variety of areas:

Notably it was first in cumulative 3-year shareholder return, although as mentioned above this can be somewhat of a finicky metric.

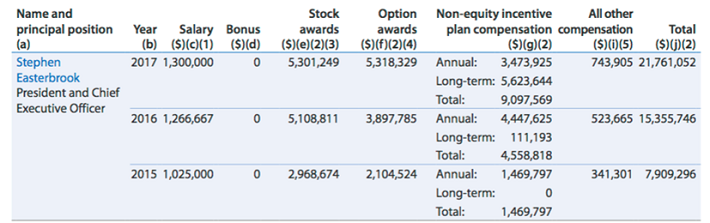

Here’s a look at Easterbrook’s total compensation for the last three years:

You can see that total compensation came in at $7.9 million, $15.4 million and $21.8 million in the 2015 through 2017 stretch. Stock and option awards largely drove this significant increase, with Easterbrook’s salary coming in at $1.025 million, $1.267 million and $1.3 million over the last three years.

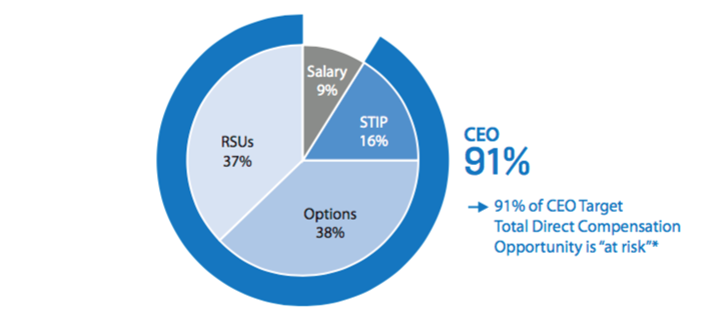

This can be further illustrated by the total amount of compensation that is “at risk:”

In addition, here you can see the number and amount of option awards Easterbrook currently holds:

Notably, McDonald’s has a requirement for Easterbrook to hold stock that has a value that is at least six times his base salary. This creates a strong ownership tie for the CEO, but it is not especially cumbersome given the level of base salary compared to stock options held.

The disparity between CEO pay and average worker pay (a new disclosure requirement) was significant last year. The total compensation for a median McDonald’s employee in 2017 (including part-time workers) was $7,017 compared to Easterbrook’s $21,761,052. That’s a ratio of 3,101:1.

Final Thoughts

Thus far McDonald’s has benefited significantly under the leadership of Easterbrook. In particular, the increased franchising efforts, implementation of key technology initiatives, and understanding of consumer preferences have been strong points. In turn, shareholder results have been spectacular in the last four years.

Still, we are cautious on a couple of fronts. Namely, doubling the debt load to repurchase shares at an above average valuation and indeed that influence of a lofty valuation moving forward. The business can handle the increased burden, but repeating the past four years would be a tall task from this point. Further, a large portion of Easterbrook’s compensation can be affected should McDonald’s business or share price pause in the year’s to come.

Overall Easterbrook’s influence on McDonald’s has been positive and we’re excited to see what the future holds.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more