Start Out With Passive Investing

Professionals in varied fields are often too busy to research, plan, and understand the best investment style. A common worry is the risk associated with equity markets. Yet this anxiety is primarily due to myth and inadequate knowledge.

To protect, add value, and grow their assets, both institutional and retail investors face a myriad of options. Investment institutions have access to unlimited research and high-quality advice, but individual investors do not have it so easy.

If these investors knew about “passive investing”, they would have less reason to worry. Passive investing is also known as index-based investing. An index is a basket of financial instruments — equity (stocks), debt (bonds), or commodities — designed by established, professional, independent index providers, such as S&P Dow Jones Indices (S&P DJI), that do not trade or create investment products but publish the index level and constituents.

Well-designed indices underlying passive investment allow a person with insufficient financial knowledge to participate confidently and easily in the market and its trends. And just as important, an index gives exposure to a diversified basket of investment instruments at low cost.

The structure of an index can be based on an asset class, geography, strategy, a theme, or some other concept. An index provides the advantages of diversification, avoiding the concentration risk of single stock or instrument exposure. It offers transparency and non-bias through its publicly available rules-based methodology: For example, it invests in the index basket exactly in the same proportion provided by the index. Further guiding investment strategies, the equity content of the index may from time to time be adjusted according to market trends and cycles.

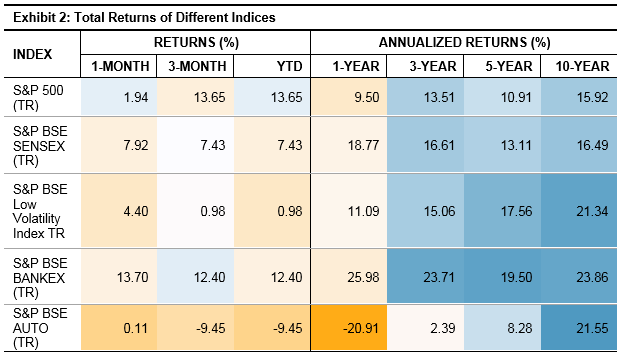

Trends of several indices over the last few years are shown in Exhibit 1. Investments in products based on such indices would be likely to follow similar trends. Index performance will also be varied based on the index design and methodology as shown in Exhibit 2.

Exhibit 1: Performance of Different Indices

Source: S&P Dow Jones Indices LLC. Data as of Apr. 19, 2019. Data has been based at 100. Past performance is no guarantee of future results. Chart is provided for illustrative purposes.

Source: S&P Dow Jones Indices LLC. Data as of Mar. 29, 2019. Past performance is no guarantee of future results. Table is provided for illustrative purposes.

Passive investment index funds and exchange-traded funds follow different indices for varied strategic purposes. Indices can track markets, such as the S&P BSE SENSEX for Indian markets or the S&P 500 for US markets. Other indices track sectors, such as the S&P BSE Bankex, the S&P BSE Energy, and the S&P BSE Finance. As well, Factor Indices are now making headway into global markets and India, with quality, momentum, value, and low volatility as a single factor or multi-factor variants. S&P DJI offers many different indices suited to varied conditions, characteristics, and risk-return features.

Passive investment by individual Indian investors was negligible a few years back but now constitutes over USD 12 billion. Globally markets have realized the potential of this strategy, with over USD 5 trillion assets invested passively.

The distinctive growth of assets through “passive” products is compelling impetus to consider passive investing as the first preference in an investment strategy.

Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information ...

more