Square Earnings: Brilliant Execution And Long-Term Potential

Square (SQ) provided a double surprise to investors on Tuesday. The company was originally scheduled to report earnings on Wednesday but it had to release the numbers on Tuesday instead "due to early external access of the company’s quarterly financials" according to the press release.

Not only were the numbers released sooner than expected, but they were also surprisingly good considering the circumstances. Square is performing exceptionally well in a challenging period, and a log-term bullish thesis for Square looks healthier than ever.

Impressive Resiliency From The Seller Ecosystem

One of the main reasons for concern among investors in Square leading to the earnings report was the company's large exposure to small businesses and especially restaurants in the seller ecosystem. These kinds of businesses have been particularly affected by the pandemic during the second quarter, and this is arguably the main uncertainty factor weighting on Square stock.

But the company is doing a great job of providing the tools for sellers to adapt to a new environment and continue thriving under all kinds of challenges. Square is making it easier for sellers to develop an online presence with tools such as Square Online Checkout, which allows sellers to sell online without building their own website.

The company also launched On-Demand Delivery during the quarter, this is a platform that provides sellers with access to a platform of third-party delivery apps. Because of the scale advantages provided by Square, sellers using On-Demand Delivery retain better margins in comparison to directly using other third-party delivery services.

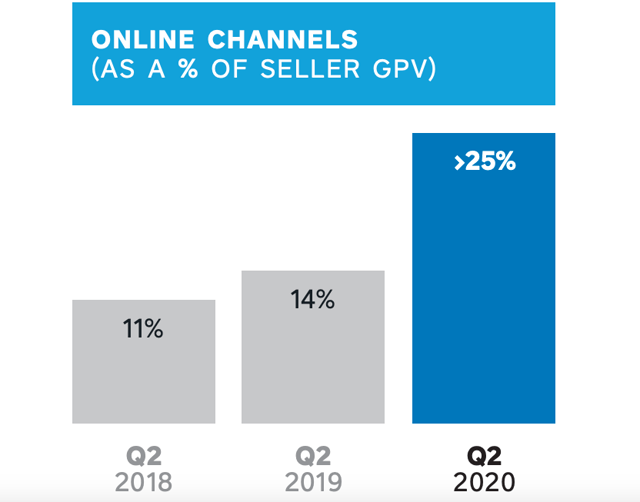

A key driver during the quarter was expanding online channels. Gross Payment Volume (Nasdaq: GVP) from online channels was up more than 50% year over year during the quarter, and it accounted for more than 25% of total seller GPV. As a comparison, only 11% of total GPV was coming from online in the second quarter of 2018.

Source: Square

The power of the ecosystem remains intact, one in three Online Store sellers onboarded in the second quarter were new to Square, and many of the new sellers who onboarded to Square Online Store also adopted other parts of the company's ecosystem, including in-person commerce.

Revenue from the seller ecosystem amounted to $723 million and gross profit was $316 million during the quarter, these numbers were down 17% and 9% year over year. Although GPV declined during the second quarter, management noted that the business improved sequentially each month in the quarter.

Seller acquisition was strong during the period, and the company registered an increase in gross profit from new sellers year over year. Cohorts of new Square sellers generated higher gross profit in their first five weeks after onboarding than seller cohorts who joined our platform during the same period a year ago, and this bodes well in terms of future performance when the economy goes back to more normal times.

Square seller's ecosystem faced tremendously challenging conditions in the second quarter of 2020, and the business is being resilient. The company is also proving to be of value to its sellers in a difficult environment, planting the seeds for sustained growth when the recession is over.

Cash App Is On Fire

Everybody was expecting a strong performance from Cash App during the quarter, and the numbers did not disappoint. Cash App produced $1.20 billion in revenue and $281 million in gross profit, growing 361% and 167% year over year. Excluding Bitcoin, Cash App revenue was $325 million, up 140% year over year.

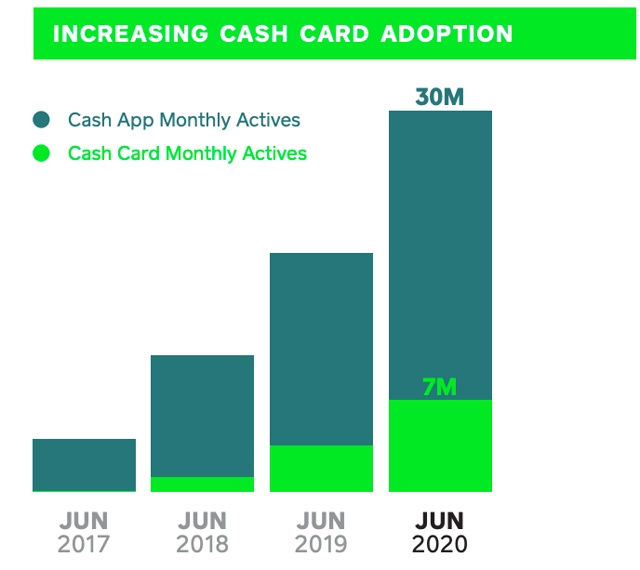

Cash App engagement also benefited from disbursements of the CARES Act stimulus programs and unemployment benefits, including a portion of customers who direct deposited these payments into their Cash App accounts. Cash App reached over 30 million monthly transacting active customers in June, with more than 7 million spending on Cash Card during June.

Source: Square

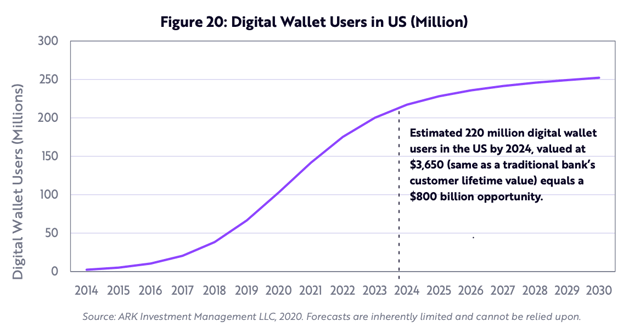

The analysts at ARK Investment Management calculate that digital wallets in the US could be an $800 billion opportunity by 2024. PayPal's (PYPL) Venmo and Cash App are the two leading players by a wide margin, and they are benefiting from strong network effects.

Source: ARK

Users attract each other to a leading digital wallet such as Cash App, meaning that the top players in this area tend to get stronger as they get bigger over time. The pandemic has accelerated the demand for digital wallets in a major way, and Square is in the right place to leverage this massive opportunity over the years to come.

The Bullish Thesis For Square Is Gaining Traction

Overall financial performance was more than healthy during the quarter. Excluding Caviar from the second quarter of 2019, total net revenue increased by 70% and gross profit grew 32% year over year. Not only were the numbers better than expected, but these numbers also show impressive resiliency from Square in a challenging period.

In terms of valuation, Square currently trades at a price to sales ratio around 11.6, which is in line with a price to sales ratio of 11.8 for PayPal. Big and more established players in the payments industry like Visa (V) and MasterCard (MA) carry higher prices to sales ratios of 17.4 and 18.6 respectively.

Granted, Square is much smaller and less profitable than other payments players, but the company is also growing much at a much faster speed, so the degree to which Square should trade at a valuation discount is a matter of debate.

In any case, it is fair to say that Square is not excessively valued at all for a company that has just delivered a 70% increase in revenue during one of the most challenging recessions in history.

When looking at the data from the second quarter of 2020, the main takeaway is that Square is executing remarkably well, adding value to its users, and producing solid growth for investors in a difficult environment. The long term bullish thesis in Square as solid as ever.

Disclosure: I am/we are long SQ, PYPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more