Spinning There Wheels And Going Somewhere

Peloton instructor Leanne Hainsby (image via Peloton).

Peloton Versus Boeing

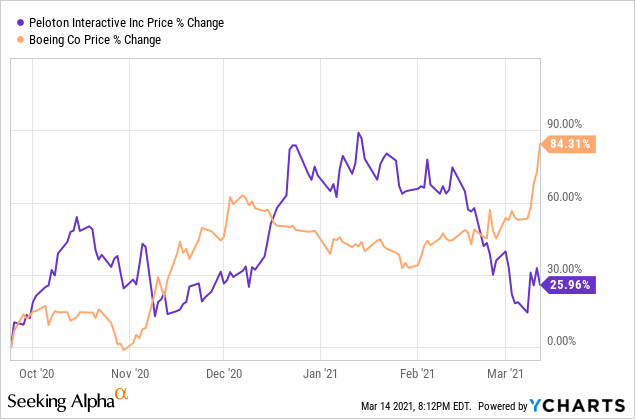

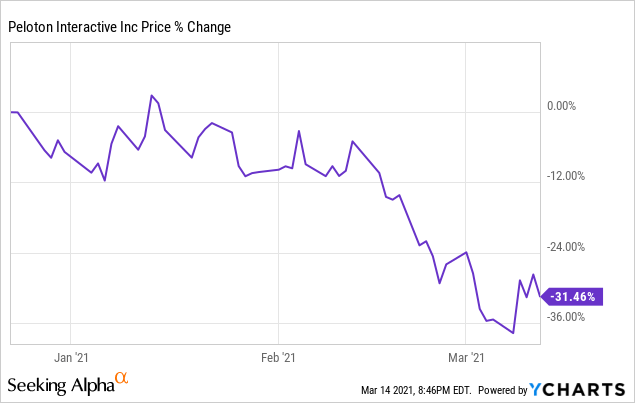

Like Boeing (BA), the subject of our post last Friday, Peloton (PTON) was one of our top names last September and is one of our top names again now. Unlike BA, though, PTON is way off its recent high.

Another difference between the two is that social data analysis supports our current bullishness on Peloton.

Social Data Is Still Bullish On Peloton Too

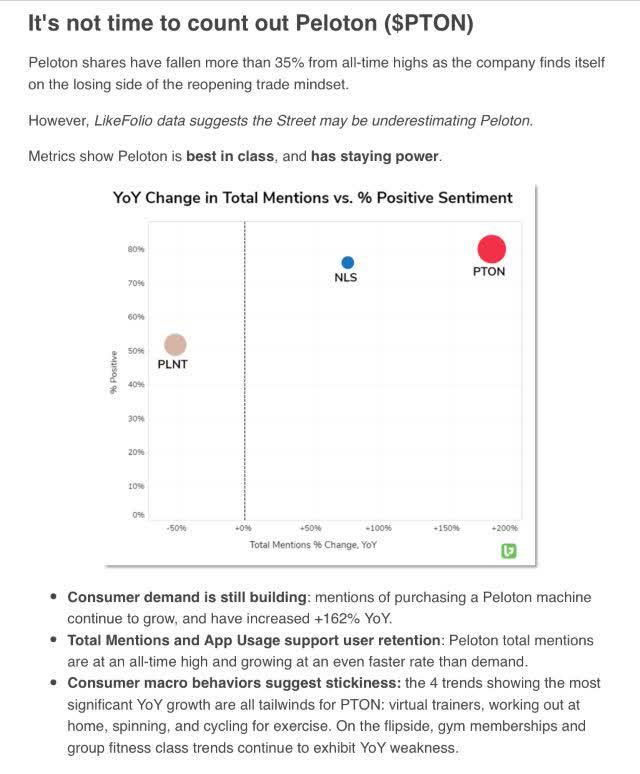

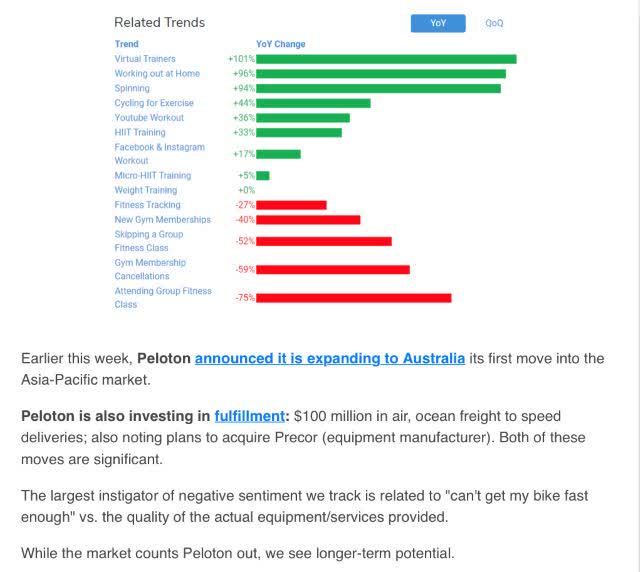

Our friends at LikeFolio look at social media mentions of sentiment and purchase intent regarding consumer brands. They use that to forecast sales for companies behind the brands. LikeFolio's most recent email alert on Peloton, screen captured below, suggested Wall Street may be underestimating the company's post-COVID prospects.

What If You Bought Peloton Near Its Peak?

When Peloton shares were above $160, we suggested longs lock in some gains by hedging. Since then, the shares have dropped 31%.

Let's look back at the hedges we presented then, and see how they've ameliorated the drop so far.

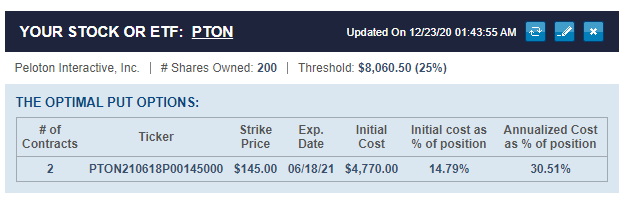

The December Optimal Put Hedge

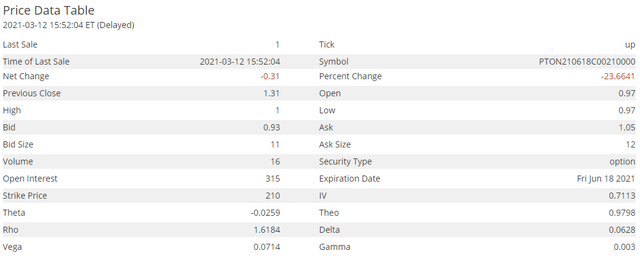

On December 22nd, this was the optimal put option contract to hedge 200 shares of Peloton against a >25% drop by mid-June.

Screen capture via the Portfolio Armor.

Note that the cost of the put protection was fairly high: $4,770 or 14.79% of position value (the app calculated it conservatively, using the ask price of the puts).

Let's look at how that hedge has reacted to the 31% drop.

How The Optimal Put Hedge Has Reacted

Here's an updated quote on those puts as of Friday's close (via CBOE):

How That Hedge Ameliorated Tesla's Drop

PTON closed at $162.76 on December 23rd. A shareholder who owned 200 shares of it and hedged with the puts above then had $32,552 in PTON shares plus $4,770 in puts, so the net position value was $32,552 + $4,770 = $37,322.

PTON closed at $111.55 on March 12th, down about 31% from its close on December 23rd. The investor's shares were worth $22,310, and the put options were worth $7,875, using the midpoint of the spread. So, the net position value as of Friday's close was $22,310 + $7,875 = $30,185. $30,185 represents a 19% drop from $37,322.

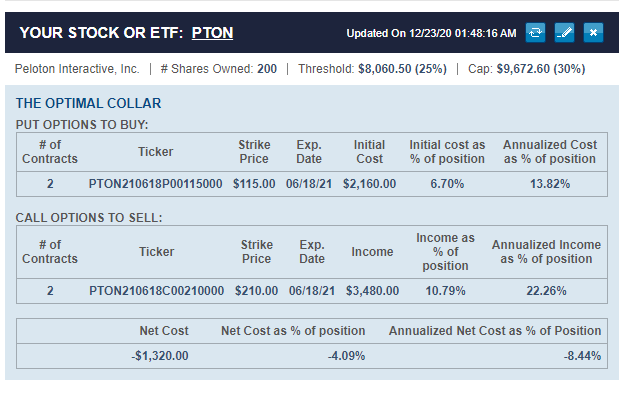

The December Optimal Collar Hedge

If you were willing to cap your upside at 30% over the same time frame, this was the optimal collar we presented in December to hedge your PTON shares against a >25% decline by mid-June.

Here the cost was negative, meaning you would have collected a net credit of $1,320, or 4.09% of position value, assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (i.e., buying the calls at the ask and selling the calls at the bid).

How That Optimal Collar Hedge Has Reacted

Below is an updated quote on the put leg of the collar (note that it's at a different strike than the first hedge):

And here's an updated quote on the call leg:

How That Hedge Ameliorated Tesla's Drop

Recall that PTON closed at $162.76 on December 23rd. A shareholder who owned 200 shares of it and hedged with the collar above then had $32,552 in PTON shares, $2,160 in puts, and if the investor wanted to buy-to-close the short call position, it would have cost him $3,480. So, the net position value on Jan 4th was ($32,552 + $2,160) - $3,480 = $31,232.

Since PTON closed at $111.55 on Friday, the investor's shares were worth $22,310, the put options were worth $3,610, and it would have cost $198 to buy-to-close his calls, using the midpoint of the spread in both cases. So: ($22,310 + $3,610) - $198 = $25,722. $25,722 represents a 17.6% drop from $31,232.

More Protection Than Promised In Both Cases

Although Peloton had dropped by more than 31% from December 23rd to March 12th and both hedges were designed to protect against a >25% drop, the optimal put hedged position was only down 19% and the optimal collar hedged position was down 17.6%. In both cases, the time value of the put options gave a bit more protection than promised since the hedges were structured to protect based on intrinsic value alone.

What Now?

That's up to you, and it will probably depend on whether you agree with Likefolio's and our current bullishness on Peloton. The nice thing about being hedged though is that it gives you options (no pun intended). A hedged shareholder doesn't have to worry so much about how much further Peloton might drop because his downside is strictly limited. You can exit now, for a smaller loss; you can buy-to-close the call leg of your collar to remove your upside cap if you're bullish; and if you're even more bullish, you can sell your appreciated puts and buy more Peloton shares. In any case, you have breathing room to let the dust settle and decide on your best course of action, without the anxiety of an unhedged investor.