S&P 500: Why Stocks Are Headed Higher From Here

Photo by Nikolay Pandev/E+ via Getty Images

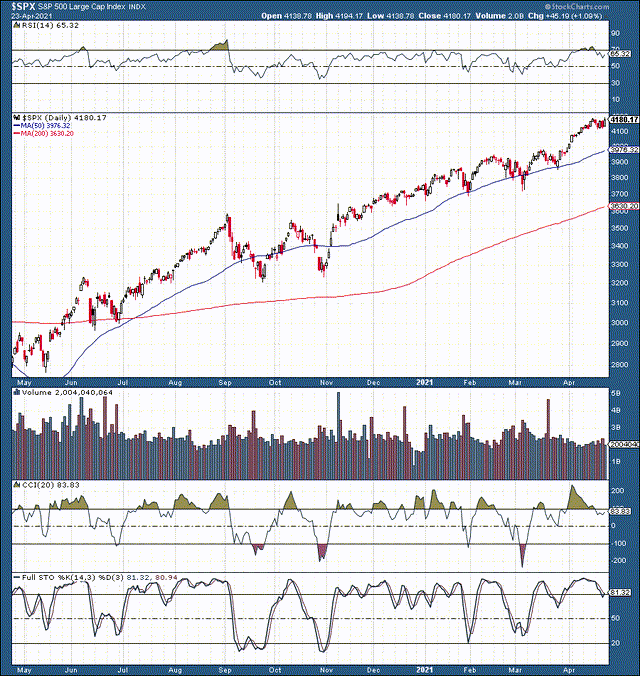

The S&P 500/SPX has appreciated by close to 50% over the last year.

Source: Stockcharts.com

However, despite these stellar gains, the market likely has a great deal of upside going forward. We are in a bull market, after all, one that is gaining momentum due to rising inflation and higher economic growth. Furthermore, better than expected economic data along with robust earnings results provide a very favorable backdrop for the SPX and stocks, in general, going forward. Moreover, the current ultra-easy monetary environment should serve as the primary catalyst to propel asset prices higher from here.

Let's Talk About the Fed

There seems to be a bit of a debate about when the Fed will begin to raise interest rates. The Fed-watch tool illustrates that there is about an 88% probability that the benchmark rate will remain at 0-0.25% throughout 2021, the bond market appears to be pricing in "zero rates" throughout 2022, and the Fed's consensus is that there will be no rate hike all the way through the end of 2023. In my view, the Fed knows best, and I do not expect to see any rate hikes in 2021, or in 2022, possibly in late 2023, or in 2024.

Yes, growth is coming back, but the economy just went through a significant shock, experienced a huge wave of unemployment, and is still in a relatively fragile state. Therefore, there is a distinct need for an extremely easy monetary policy, and zero rates coupled with asset purchases are likely to persist despite higher growth and rising inflation. Also, we need to consider future tax adjustments. Increases in corporate and individual taxes will likely put some pressure on growth, and the likeliest offset is a lower for longer interest rate environment.

Why this Bull Market Will Continue Higher

We are in a very strong bull market right now, and the market has numerous favorable short and intermediate-term catalysts that should continue to drive stock prices higher from here. The most prominent catalyst is the Fed's ultra-easy monetary stance, which is likely to persist for 2-3 years going forward. While an accommodative Fed may provide the most powerful intermediate-term catalyst, there are other factors that should help propel equities higher from here.

Corporate Earnings

Earnings season is heating up, and we've seen robust results out of big bellwether names. To kick things off, many quality banks beat earnings estimates by a notable margin. For instance, JPMorgan (JPM) beat its revenue estimates by around 8.5% and crushed its EPS expectations by about 45% in Q1. Goldman Sachs (GS) managed to outdo JPM with an 82% EPS beat, and a remarkable 41% beat on revenues.

Several other notable corporations that have beat earnings estimates thus far include: Coca-Cola (KO), IBM (IBM), J&J (JNJ), Procter & Gamble (PG), Netflix (NFLX), Verizon (VZ), Intel (INTC), AT&T (T), Danaher (DHR), Honeywell (HON), and others. In fact, most large-caps, and perhaps around 90% of all companies that have reported so far have announced better than anticipated earnings results. The rest of the earnings season is likely to be very constructive as well, and with higher growth flooding markets companies should continue to outperform analysts' expectations going forward.

Big names coming up include: Tesla (TSLA), Microsoft (MSFT), Visa (V), Alphabet (GOOG) (GOOGL), Eli Lilly (LLY), General Electric (GE), 3M (MMM), AMD (AMD), Apple (AAPL), Facebook (FB), Amazon (AMZN), Mastercard (MA), Alibaba (BABA), Exxon (XOM), AstraZeneca (AZN), and many others. Again, I expect most mega-cap bellwether names to continue to come in with strong beats throughout earnings season. In fact, I will be very surprised to see any of the above-mentioned names disappoint on earnings.

General Economic Data

Many key economic data points continue to come in better than expected, and the overall image is pointing to a likelihood for a notably higher growth environment. To get a better understanding of this let us look back at several crucial data points that were reported throughout April. Early in the month, we saw much stronger than expected ISM manufacturing PMI (64.7 vs 61.3 expected), ISM manufacturing employment (59.6 vs 53 expected), non-farm payrolls (916K vs 647k expected), ISM non-manufacturing PMI (63.7 vs 59 expected), JOLTs job openings (7.37M vs 7M expected).

Around mid-month we saw MoM core retail sales surge by 8.4% vs the expected 5% increase. Initial jobless claims dropped to 576K vs the anticipated 700K, the Philadelphia Fed manufacturing index came in at 50.2 vs the expected 42. Housing data was also largely positive and better than expected.

Oil Data

Crude oil data is particularly important, as it illustrates the demand dynamic in the oil market, which is closely correlated to the overall growth image in the economy. Early in the month, API weekly crude oil stock declined by 2.618 million barrels vs the expected 1.325 million barrel decline. Then crude oil inventories declined by 3.522 million barrels vs the anticipated 1.436 million barrel decline. Mid-month we saw another larger than expected drawdown in API weekly crude oil stock as well as crude oil inventories (3.6M vs 2.15M expected, and 5.9M vs 2.9M expected).

Inflation

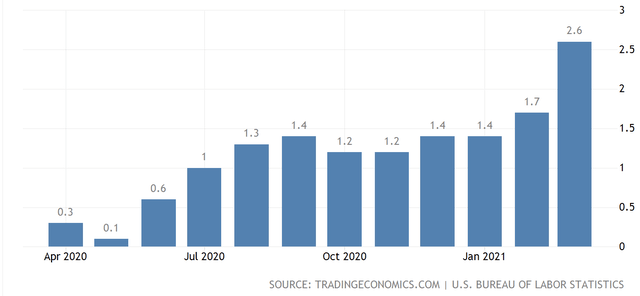

Inflation data is another extremely important piece of information that is not only suggestive of higher growth going forward but also implies that asset prices should continue to rise as well. We saw higher than anticipated rises in CPI as well PPI inflation this month. MoM PPI rose by 1% vs the anticipated 0.5%, and core CPI rose by 1.6% vs the expected 1.5% increase. Moreover, non-core CPI, which is a great gauge for inflation in my view, rose by a whopping 2.6% on a YoY basis. Inflation is very likely going to continue to increase, therefore general price appreciation, including in equities appears very likely. Another factor that is not discussed enough is that stocks may experience increased demand in a higher inflationary environment as investors search for investment vehicles capable of keeping up with inflation going forward.

CPI Inflation

Source: Tradingeconomics.com

This is the sharpest rise in inflation in over 3 years, and we will likely see inflation heat up even more form here.

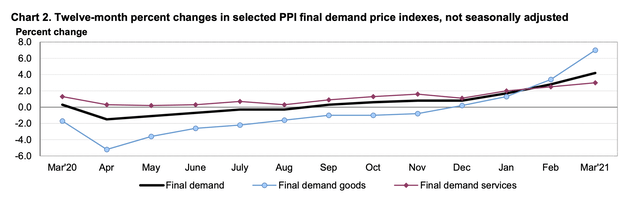

PPI Inflation

Source: bls.gov

In addition to consumer-oriented inflation, we are also seeing substantial increases in producer prices. Final demand goods at about 7% YoY is especially pronounced, and it illustrates that material costs are rising notably. In time we will very likely see the additional costs passed down to the consumer, thus we should see consumer inflation continue to rise going forward.

Why The Fed's Not Raising Rates

Amongst all this economic growth and rising inflation investors may be asking why the Fed is not raising rates or may believe the Fed should raise soon.

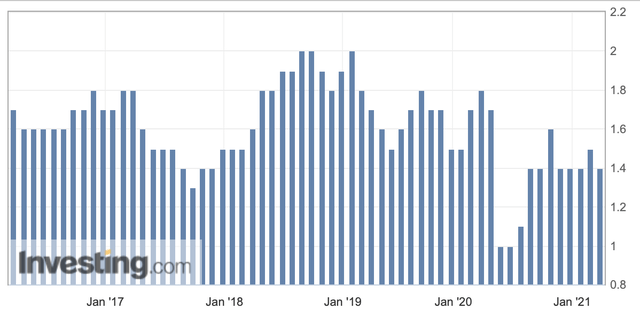

Core PCE Inflation

The Fed uses the core PCE as its preferred inflation gauge, and as we can see core PCE is quite subdued right now. In fact, we're looking at some of the lowest inflation in years according to the PCE. It's quite interesting that CPI inflation is at its highest point in over 3-years, while the PCE is so subdued. Even non-core PCE is at just 1.6%, a full basis point below non-core CPI's latest reading. Nevertheless, this disconnect is very favorable for risk assets in my view. Prices are rising, several inflation gauges are producing higher readings, yet the Fed's gauge of choice is clearly lagging, implying that the Federal reserve can continue with its lower for longer interest rate policy.

The Takeaway

Stocks, commodities, and risk assets, in general, could potentially rise much higher in this ultra-easy monetary environment. Moreover, there are numerous secondary catalysts such as the COVID-19 rebound effect, improving earnings, strong economic data, rising inflation, and higher growth in general. Naturally, there will be bumps and corrections along the way, but due to this uniquely bullish fundamental setup surrounding equities, we are very likely going to see S&P 500 5,000 sometime in the next 12-months in my view.

Disclosure: I am/we are long AMD, AMZN, AZN, BABA, FB, GE, GOOG, GS, JNJ, JPM, MA, MMM, MSFT, NFLX, TSLA, XOM.

Want the big picture? If you would like full articles, daily market ...

more