S&P 500 Intrinsic Value Update - Friday, Nov. 27

I don’t think the market is grossly overpriced based on current conditions, I think debate comes into play when we are talking about 6 months from now…. where is the economy then? My bet is reality hits and things are lower. We are already seeing cracks in multi-family and commercial real estate. Drive-by any strip mall, I’m seeing new vacancies daily where small businesses have gone under. That will ripple larger in the coming months.

“Davidson” submits:

Dallas Fed 12 PCE Trimmed Mean Inflation 1.71% with previous months revised lower. Lower taxes & lower regulation with less government spending leads to lower inflation. The recent COVID-19 support provided by the government ease the economic consequences of the shutdown have not been inflationary as this has not been government spending but a form of transfer payments to individuals and businesses during a period of duress.

The key part in understanding how this ‘printing of money is inflationary’ concept held by many is individual behavior during a period of distress vs politicians trying to make a splash with constituents. The history of companies making significant profits when governments issue new currency to fund projects is well known. This type of spending often carries far less sensitivity to receiving good value for funds spent and history shows a pattern of inflation when this occurs. When the government issues currency to fund transfer payments, i.e. individuals who are incented to receive good value for funds spent, inflation remains in control. The lack of inflationary pressure currently is due to individuals getting good value for funds.

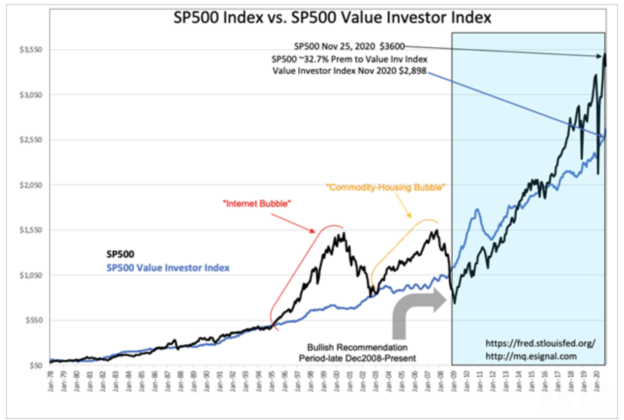

Lower inflation is associated with higher equity prices as earnings investors receive are less depreciated by inflation. Much higher inflation expected by many is not likely to emerge from the COVID-19 stimulus based on how it was executed. As this becomes apparent, equity prices are likely to rise even more in response. The SP500 is a ~33% premium to the Value Investor Index. Past two cycle peaks were 65%+ and 100%+ premiums. How high markets can become over-priced is not rooted in science. It is market psychology that is impossible to predict with any precision. Nonetheless, over-pricing is routinely justified by many far and wide, and as long as the economic cycle continues to trend higher nearly every over-priced situation is justified by someone with great expectations for future results. The best estimate is the SP500 is likely to rise to 65%+ premium or nearly 100% rise from current levels over the next 4yrs-5yrs.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests ...

more