S&P 500 Earnings Update & Economic Data Review - Saturday, April 10

The earnings per share (EPS) for all S&P 500 companies combined increased 4.4% this week, now at $183.33. This is a new all-time high and far surpasses the prior high of $176.85 in January 2020. The forward EPS has now increased 15.3% year to date.

4.2% of S&P 500 companies have now reported Q1 earnings. 81% of those companies have beaten estimates, and by a combined 5.9% above expectations. (I/B/E/S data from Refinitiv)

The S&P 500 increased +2.71% this week, for another all time high.

The price to earnings (PE) ratio ticked down to 22.5, since the increase in the EPS (+4.4%) was greater than the increase in price (+2.71%).

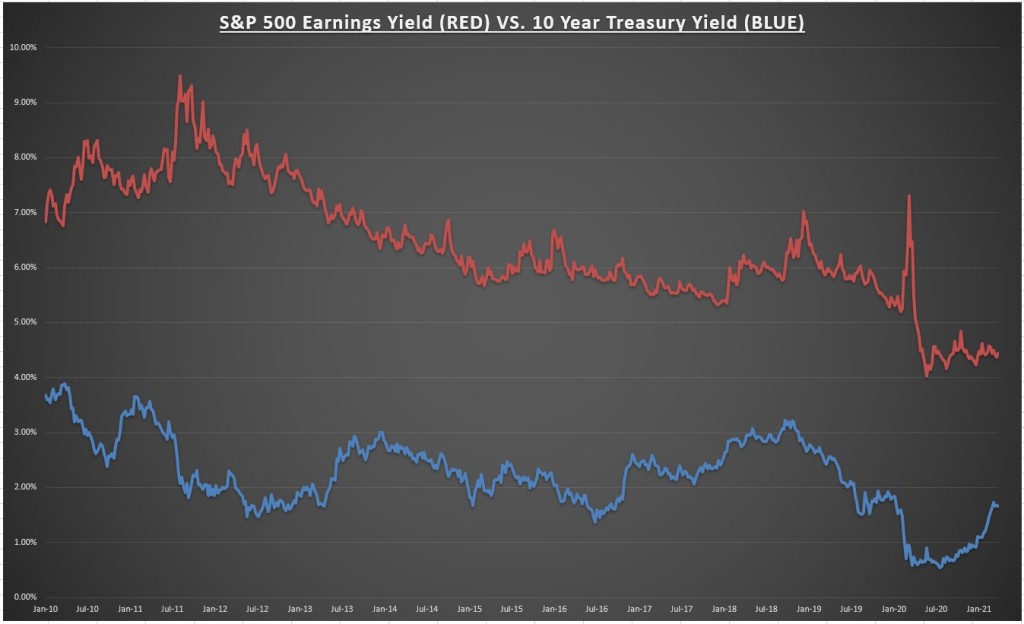

The earnings yield is now 4.44%, while the 10 year treasury yield is 1.67%. The equity risk premium (earnings yield minus treasury yield) is now 2.77%. Valuation in comparison to fixed income remains favorable for stocks.

Economic data review

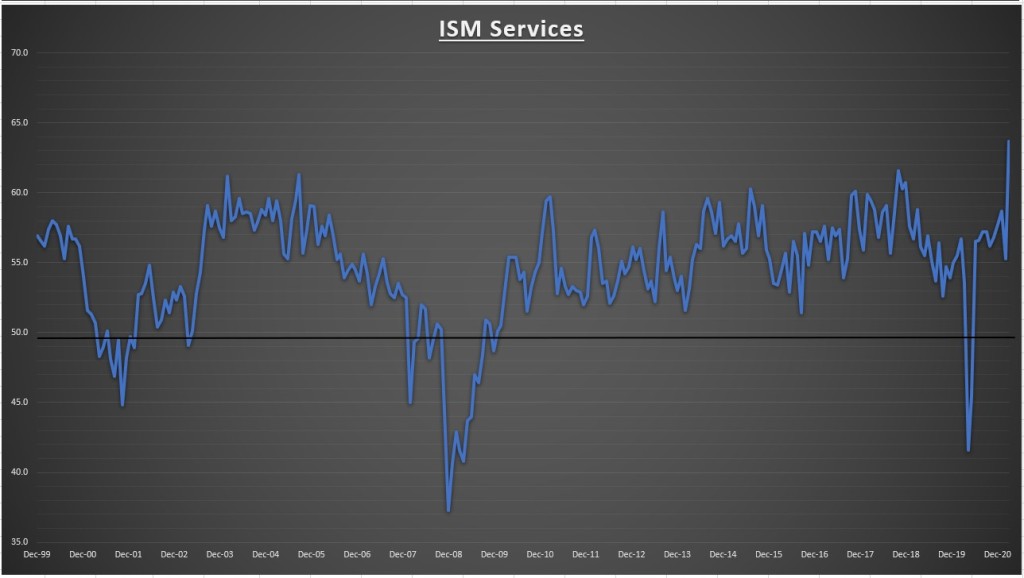

The ISM Services PMI came in at 63.7, an all-time high, well above expectations and February’s 55.3. All 18 services industries reported growth. Some key comments below:

“Respondents’ comments indicate that the lifting of coronavirus (COVID-19) pandemic-related restrictions has released pent-up demand for many of their respective companies’ services. Production-capacity constraints, material shortages, weather and challenges in logistics and human resources continue to cause supply chain disruption.”

“The past relationship between the Services PMI® and the overall economy indicates that the Services PMI® for March (63.7 percent) corresponds to a 5.1-percent increase in real gross domestic product (GDP) on an annualized basis.”

My weighted ISM – which combines the two based upon the approximate size the services & manufacturing sectors comprise of todays economy – is 64.0 for March, an all-time high. March’s number translates to an approximate annualized real GDP growth rate of 5.375%.

The Producer Price Index (PPI) increased 1.0% in March (street was expecting 0.5%) and is now up +4.3% annualized. This is the highest year-over-year increase since September 2011. Producer prices are generally seen as a leading indicator of inflation, since companies generally pass on those higher costs to consumers. So in this case a higher PPI is actually a bad thing. This shouldn’t come as a huge surprise, since both ISM reports clearly showed signs of higher input costs.

Notable earnings

NONE

Chart of the week

The stock market isn’t the economy. 2020 made that point crystal clear. But 2020 is over and 2021 is already breaking records on some key economic data points. I went back and looked at how the S&P 500 performed during years where real GDP grew 5% or more. The results were mixed.

Since 1930 there has been 23 years in which real GDP grew by 5% or more. The average return for the S&P 500 during those years was 10%, and the S&P 500 finished positive 65% of the time.

Compare this to the historical average. For all years (1930-2020), the average return for the S&P 500 is 11.5%, and the S&P 500 finished positive 73.6% of the time.

So the results during years of 5%+ economic growth are actually below average. Strong economic growth is something of a relic, seeing as its been almost 30 years since GDP grew 5%+. The last two years the economy grew as strong as its forecasted to grow in 2021, stock returns were subpar.

There are a couple reasons for this. The stock market is always forward looking. So strong future gains in the economy are often priced into the stock market in advance. The other reason is strong economic growth usually pushes interest rates higher, and higher rates can be a hindrance to future economic growth.

The point is, there are no guarantees of strong market returns even during economic booms. Investors should remain diversified and not take on more risk than one can handle. Enjoy the good times but don’t fall for the temptation to chase the market higher.

Summary

The economic momentum is just getting started, but with it comes inflation. The question is how high does inflation get, and for how long. If the Fed is right, and inflation remains moderate and temporary, we could be in what JP Morgan CEO Jamie Dimon called, a “Goldilocks” economic and market environment.

The good news is rates still have a long way to go before they become a threat to stocks on a valuation basis. In my humble opinion, the 10-year would have to get well above 3% for this market to look overvalued to me. But the market doesn’t move in a straight line. Reuters reported this week that more money came into stocks in the last 5 months, than the last 12 years combined. Personally, I feel much more comfortable investing when everyone is scared, so I wasn’t happy to read this.

Bottom line, earnings are great, the economy is heating up and the job market should improve dramatically in the months ahead, while valuation is still reasonable. We will get a correction at some point, but the ingredients for a prolonged bear market just aren’t there at the moment.

Next week we have 21 S&P 500 companies reporting Q1 earnings, including many of the big banks. I’ll be paying attention to JP Morgan (JPM) on Wednesday, and UnitedHealth Group (UNH) & Taiwan Semi (TSM) on Thursday. For economic data, we have a pretty packed week starting with Small Business optimism on Monday, the all important CPI report on Tuesday, Retail sales and Industrial production on Thursday.

Disclaimer: None.