S&P 500 Company Performance By State

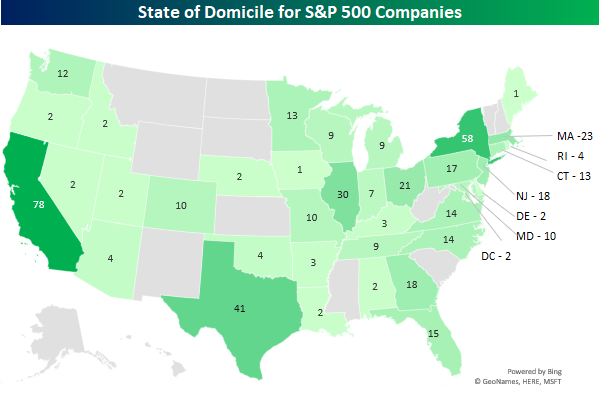

The map below provides a color-coded breakdown of the number of S&P 500 companies domiciled in each state across the USA. Not surprisingly, the biggest states in terms of population tend to have the largest number of S&P 500 companies headquartered in them. Leading the way, 78 companies are domiciled in California, followed by New York with 58, and Texas with 41. Meanwhile, there are 13 states which are home to no S&P 500 companies, including Alaska and Hawaii. In the case of those two states, the difference in time zone makes it understandable that no S&P 500 companies are headquartered there, but one would think a company with a name like Alaska Air would at least be located in Alaska, right? Illinois, which arguably has among the shakiest finances of any state, is home to 30 S&P 500 companies and that’s the fourth most even though it is only the sixth largest state. Among the biggest outliers, though, is Florida. Even though it has the third largest population of any state, only 15 S&P 500 companies call it home, ranking it all the way down at number ten.

(Click on image to enlarge)

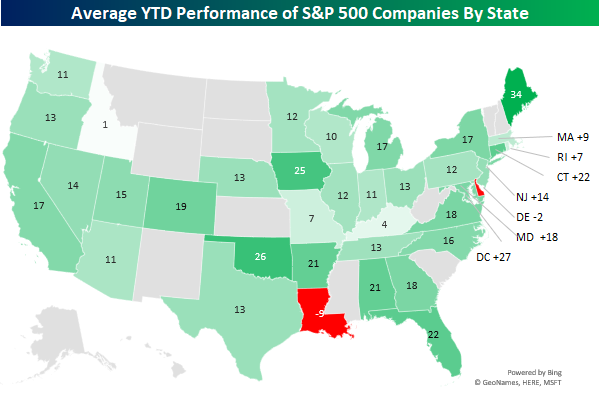

While the chart above shows the number of S&P 500 companies located in each state, the chart below shows the average YTD performance of the S&P 500 companies by state. Before going any further here, though, it is important to point out that these numbers can be a bit misleading since some states have a large number of companies while others just have one or two, thereby skewing the averages. With that in mind, Maine is the first state the sun touches each day, and it is also home to IDEXX Labs (IDXX) which is up 34% YTD, ranking it first of the 50 states. While Florida underperformed a bit in terms of the number of companies headquartered there, the average return of those companies is 22% YTD, ranking near the top in terms of states on the east coast.

Moving on to the midwest, the 30 companies headquartered in Illinois have underperformed the S&P 500 with an average gain of just 12% YTD. Further South, the fact that Louisiana (LA) is home to just two companies and one of them is Centurylink (CTL), which has declined 32% this year, makes it the state with the worst average return in the country. Right next door, Texas (TX) has a lot of exposure to the Energy sector among the 41 companies headquartered there and that has been a bit of a weight on its average YTD return of 13%. Finally, the dominance of Technology in California (CA) has the average stock headquartered in that state up 17% YTD as companies like Cadence (CDNS), Advanced Micro (AMD), and Facebook (FB) are all up over 40%.

Start a two-week free trial to Bespoke for full access to our research.

Disclaimer: To begin receiving both ...

more