Sorting Out The Few Good BDCs From The Many Bad Ones

Years ago, an Air Force Academy classmate and a close friend went on a rant about how he disliked the widespread use of jargon and acronyms in the Air Force. To this day, my memory can’t unstick “ficknip” (flight navigation and control panel), and I haven’t used one for over 30 years.

The investing world is also full of jargon and Wall Street types, and the financial press, throw that stuff out like everyone is familiar. I work in the investment world and find myself regularly looking up new acronyms. I can’t change the world, or people trying to show how smart they are by throwing out obtuse jargon. What I want to do is to explain investment ideas in an understandable way.

Our acronym for today is BDC. It refers to Business Development Company, a special type of business that results in sometimes very attractive income stocks.

Business development companies operate under the Small Business Investment Incentive Act of 1980, which was an amendment to the Investment Company Act of 1940. The 1940 Act is the primary law governing investment products such as mutual funds, closed-end funds, and exchange-traded funds –ETFs.

The 1980 Act provided some exceptions to Investment Company Act rules. The purpose was to open a new source of financing for small to medium-size businesses that do not have access to the public debt and equity markets. In structure, a BDC is closely related to a closed-end fund. See my recent thoughts on select closed-end funds.

A BDC operates under a strict set of rules. First, a BDC can only make loans or equity investments in small to medium-sized corporations that meet the criteria of the law. The next rule is that a BDC can only have debt equal to the equity capital of the company. For example, a new BDC sells stock and has $500 million from the sale.

The company can then borrow another $500 million, bringing the company’s total investment capital to $1 billion. By law, a BDC cannot over-leverage itself. Finally, a BDC must payout at least 90% of net income as dividends to investors. If a BDC pays out 95%, it gets an additional tax break. BDCs are “pass-through” companies which means if they pay out the 90% of income they don’t pay corporate income tax.

The rules under which BDCs operate produce companies that have certain features. The companies in the sector are primarily in the lending business. They make high rate loans to companies that cannot qualify for traditional bank loans. The interest income is passed through as dividends to shareowners.

A BDC may also take equity positions in the client companies. These positions can be actual ownership or equity warrants that pay off if a client is bought out or goes public with an IPO. A BDC also provides management advice to portfolio companies. The typical BDC will have hundreds of portfolio investments, which produces a wealth of information concerning good business management practices.

There are about 50 publicly traded BDC stocks. To get started, here are three criteria that will speed up your evaluation:

- Dividend History. Bad BDCs eventually are forced to cut their dividends. Really bad ones do so regularly. Checking a BDC’s dividend payment history is the first step to narrow down the list.

- Share Price vs. Net Asset Value. This may be the opposite of what you think. For a BDC, having the stock trade at a discount to NAV is a danger signal. Successful BDCs trade at a premium to NAV. This is a benefit because a company can issue equity, getting new capital at a discount.

- Internal Management vs. External Management. BDCs with external managers charge up to twice the management fee percentage as do the companies with internal management structures. Unfortunately, the majority of BDCs are managed by outside firms. You should make sure you are getting good value from an externally managed BDC.

Here are three BDC stocks to get you started.

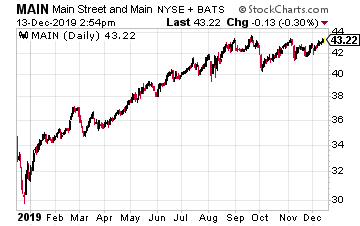

Main Street Capital (MAIN) is the BDC class leader. Main Street is internally managed and 75% premium to NAV. That large premium scares many investors away, fearful that the share price will pull back closer to the NAV.

MAIN has been on my Dividend Hunter recommendations list since mid-2014, and the stock has returned 11% per year since then.

This is a stock where the average yield has been around 6%. The driving force is the company’s eight years of dividend growth.

MAIN pays monthly dividends and currently yields 5.7%.

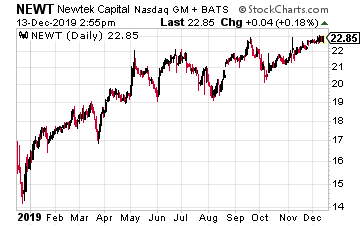

Newtek Business Services Corp. (NEWT) is an internally managed BDC that takes a different investment approach compared to its peers. Along with the usual portfolio of small business loans, NEWT also provides business services to its client companies.

These services, such as payroll, web hosting, insurance, and payment processing, bring in additional revenue. The services also let NEWT keep a very close eye on the business operations of the companies it invests in.

This BDC pays variable dividends through the year but is growing the dividend payouts on an annual basis.

The current yield is around 9%.

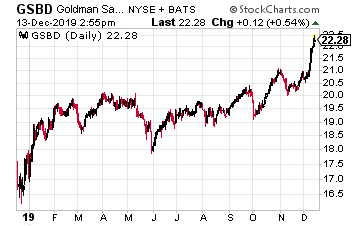

Goldman Sachs BDC (GSBD) is an externally managed BDC that recently merged with another Goldman Sachs managed BDC. The merger should result in an improved NAV and an increased dividend. GSBD currently trades at a 29% premium to NAV – a positive.

The dividend has been level since the company went public in March 2015. GSBC is a BDC and a high yield stock with prospects for near term share price growth and dividend increases.

The current yield is 8.2%.

have added a newly IPO’s BDC to the Recommendations list. This new to the market BDC meets all the positive criteria, with lots of growth potential.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more