Something New With Something Old: DIY DJIA

The growth of index funds has, in the main, helped to lower the costs and improve the performance of the average investor’s portfolio. Now, some are seeking to improve upon even the relatively low costs of conventional index funds via so-called “direct indexing”, by which investors purchase securities to match an index themselves, disintermediating the middlemen entirely. In fact, directly constructing a market-tracking portfolio might be easier than you think, and the concept is almost certainly much older than you realize.

Spoiler alert: this is really a post about replicating the 125-year old Dow Jones Industrial Average® near-perfectly, with a little more than $5,000. But, first, let’s consider replicating three possible benchmarks for U.S. equities, ordered by their increasing breadth: the S&P 500®, the S&P Composite 1500®, and the S&P U.S. Total Market Index (TMI).

In practice, an investment manager tracking any of these indices—particularly the S&P TMI—will likely only approximate the index’s holdings. Indeed, doing so while still delivering benchmark-like returns is one of the central skills of passive portfolio management. To illustrate, consider just two conditions that might be applied:

1. If a security is in the index, we must hold a non-zero position in that security.

2. Each position must consist of a whole number of shares.

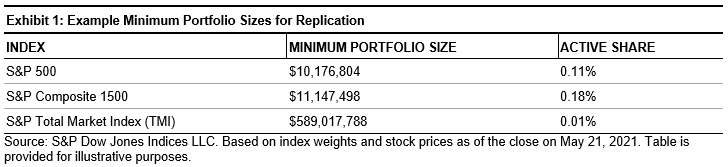

Conditions 1 and 2 effectively set a minimum size on the portfolio: if we need 1% weight in a stock priced at $100, for example, we need a portfolio of a least $10,000 (equal to the price, divided by the weight). Ranging across all constituents, the largest price-to-weight ratio gives us an indication of how large a portfolio must be to replicate the index fully. Based on this simple calculation, Exhibit 1 displays the minimum portfolio size to replicate each index, assuming that the stock with the highest ratio of price-to-weight has an allocation of exactly one share, and every other constituent is allocated the whole number of shares closest to the target weight. We also report the active share of the resulting portfolio versus its benchmark.

In this simplified estimation, around $10 million would seem a reasonable starting point for an index-tracking portfolio for the S&P 500 or the S&P Composite 1500. For the S&P TMI, considerably more might be needed.

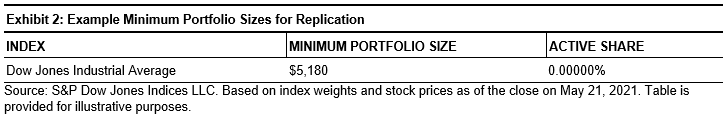

But what about the Dow Jones Industrial Average? By construction, the index comprises a representative set of 30 names designed to reflect the overall U.S. market, so we already start with a handily modest number of positions. And it has another helpful property: because the DJIA is price-weighted, the ratio of price-to-weight is the same for every stock!

In other words, there is a simple way to build a portfolio that meets conditions 1 and 2: buy exactly one share in each constituent. That would (as of May 21, 2021) require a grand total of only $5,180. And even better, ignoring any trading costs or rebalances, this portfolio will, by definition, exactly match the performance of the benchmark.

“Direct indexing”, perhaps using fractional shares and perhaps also employing the full capabilities of an expert portfolio manager, is an exciting new frontier in passive investing. But as the venerable Dow approaches its 125th anniversary, it may still have a role to play at the frontiers in making disciplined, diversified investing available at a lower cost for everyone.

Disclaimer: Copyright © 2021 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. Please ...

more