SolarWinds Could Face Downdraft When Lockup Expires

April 17, 2019, concludes the 180-day lockup period of SolarWinds Corp. (SWI).

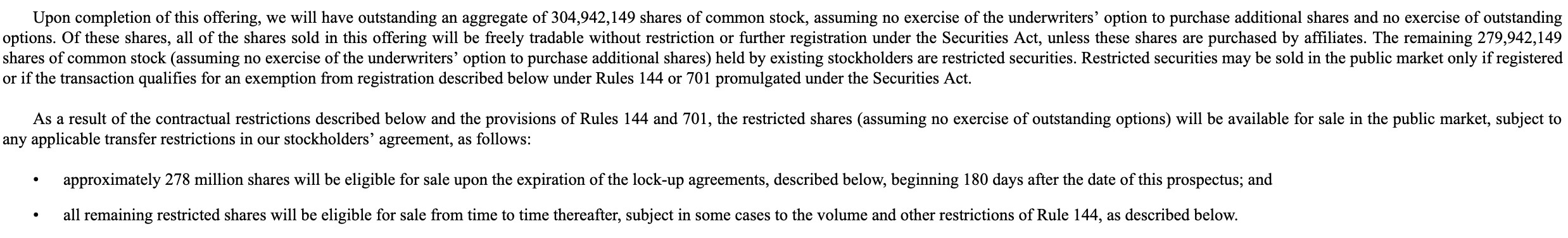

When the lockup period ends for SolarWinds Corp., its pre-IPO shareholders and company insiders will have the opportunity to sell approximately 278 million currently restricted shares. This number dwarfs the 25 million shares trading pursuant to the IPO. The potential for a sudden increase in stock traded on the secondary market could cause a sharp, short-term downturn in SWI's share price.

(Click on image to enlarge)

Currently, SWI trades in the $18 to $19 range, a return from IPO of nearly 25%.

Business Overview: IT Software Provider

Rather than being a solar energy company, SolarWinds offers IT management software to monitor and manage information technology infrastructures. Their products work across a wide array of systems and applications, and they operate in the cloud, on-site, or in hybrid infrastructures. SolarWinds also offers a suite of software for network management that operates in real-time for greater visibility and decision-making. The software has the capability to identify, diagnose, and solve network performance issues. Its AppOptics solution integrates server infrastructure monitoring, application performance, and custom metrics offered as a cloud-based solution. In addition, its software provides visibility into cloud infrastructure metrics, log data, tracing, applications, and web performance management.

(Click on image to enlarge)

(Source: Company Website)

SolarWinds offers products that third-party MSPs may use with their clients in providing IT services. This includes remote monitoring for servers, desktops, laptops, and mobile devices for many operating systems. Several SolarWinds products are offered as standalone offerings, such as archiving and email protections against malware and phishing. SolarWinds maintains its own in-house marketing and sales team. Clients include Accenture, Lockheed Martin, Chevron, Emerson, Nielsen, and NTT.

It was formerly called SolarWinds Parent Inc. and became SolarWinds Corporation in 2018. The company has approximately 2,500 employees and keeps its headquarters in Austin, Texas.

Company information sourced from the firm's S-1/A.

Financial Highlights

SolarWinds reported fourth-quarter financial highlights for the period ending December 31, 2018:

- Total revenue was $221.1 million versus $198.3 million for an increase of 11.5%. Total recurring revenue was $174.9 million versus $154.5 million for an increase of 13.2%.

- Net loss was $(14.74) million, representing an improvement from a net loss of $(39.7) million.

- Diluted earnings per share was $2.60 versus $(1.09) for the same quarter the previous year.

- Adjusted EBITDA was $111.9 million, which was a margin of 50.5%.

- Fourth-quarter free cash flow was $111.1 million for a significant 99% conversion rate.

- For the full fiscal year, adjusted EBITDA was $407.5 million, which was a margin of 48.7%.

- Free cash flow for the full fiscal year was a conversion rate of 91%.

Financial highlights sourced from the firm's website.

Management

CEO and President Kevin Thompson has been with SolarWinds since 2006 in various positions. Previous experience comes from positions at Red Hat, SAS, PricewaterhouseCoopers, and BlackLine. He is a Certified Public Accountant and has a bachelor’s degree from the University of Oklahoma.

CFO and EVP Barton Kalsu has been with SolarWinds since 2013. His previous experience includes positions at Red Hat, JPMorgan Chase, Arthur Andersen, and Andersen LLP. He earned a bachelor’s degree from the Oklahoma State University.

Management information and bios were sourced from the company website.

Competition: BMC Software, IBM, and Others

Competition for SolarWinds comes primarily from larger IT vendors and network management service providers, including BMC Software, IBM (IBM), CA Technologies, MicroFocus, and NetScout (NTCT). In addition, the company may encounter some competition from smaller, local service providers.

Early Market Performance

The underwriters priced the IPO at $15 per share. Its expected price range was originally $17 to $19, but the underwriters lowered that range to $15 to $17. The stock closed its first day at $15.03. The stock reached a high of $18.10 on December 12 then declined to a low of $12.35 on December 24. Share prices recovered to reach a high of $20.54 on March 18. Currently, shares trade around $18 to $19.

Conclusion

When the IPO lockup period for SolarWinds expires on April 17th, pre-IPO shareholders and company insiders will be able to sell approximately 278 million shares of currently restricted stock. This large number of currently restricted shares dwarfs the 15 million shares trading pursuant to the IPO. Any significant sales of these lockup restricted shares could cause a sharp, short-term downturn in SWI's share price.

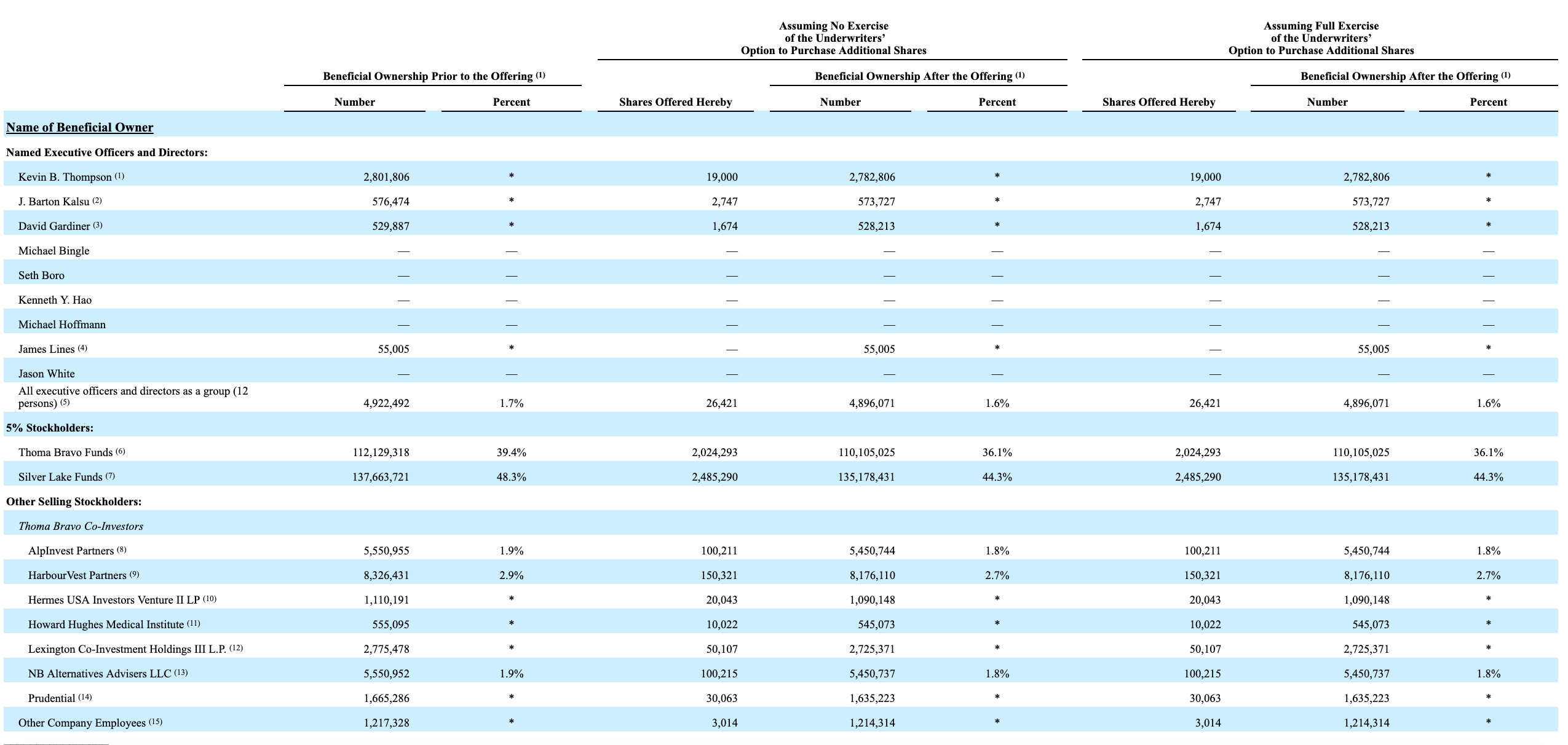

This group of pre-IPO shareholders and company insiders includes numerous individuals in leadership roles and nine corporate entities.

(Click on image to enlarge)

Aggressive, risk-tolerant investors should consider shorting shares of SWI ahead of Wednesday's IPO lockup expiration. Interested investors should cover short positions during the Thursday trading session (please note the market is closed Friday for the Good Friday holiday).

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this ...

more