Smith & Wesson: Running Out Of Ammunition For 2017?

Earnings Summary

On December 1st, Smith and Wesson (SWHC) reported Fiscal 2Q17 earnings. We had forecast adjusted EPS of $0.58 on revenue of $230.5M. While Forward View was more accurate than the Wall Street consensus, our earnings and revenue estimates were still too low. Smith and Wesson’s sales rose over 62% y/y, with 106% growth in the company’s Outdoor Products & Accessories segment. Acquisitions fueled the massive Outdoor Products & Accessories expansion, but the almost 56% gain in Firearms segment revenue was driven by organic success. Gun enthusiasts were fearing a Clinton victory in November and went shopping before the election.

Gross margin for the quarter was 41.8%, up 260 bps y/y. Operating expenses fell 457 bps as a percentage of revenue, primarily due to the large sales increase. We can safely say that margins weren’t a problem in the quarter, enabling net income to climb 160% y/y to $32.5M.

Handgun sales continue to be the company’s strength, but long gun demand also rose almost 77% on a unit basis. Thus far in Fiscal 2017 long gun revenue is up 104.4% y/y. Handgun revenue has risen 44.7% y/y through the first half of the fiscal year. Smith and Wesson is obviously a top name in the sector, and the company’s guns have an outstanding reputation among shooters.

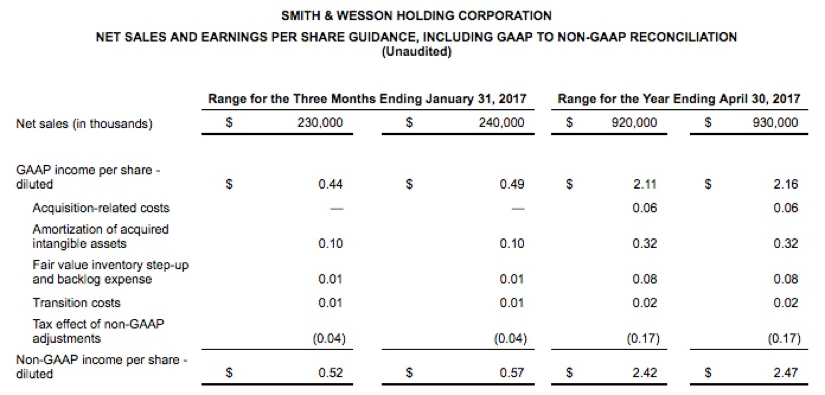

Guidance: Below expectations. The high end of sales guidance for 3Q17 and for FY17 touched our forecast and the Wall Street consensus, but EPS guidance was disappointing. The 3Q consensus revenue estimate was $238M, and the consensus adjusted EPS forecast was $0.59.1 On December 1st, however, Smith and Wesson offered the following guidance:

1Per Seeking Alpha data

Best & Worst News

Best News

Margins were especially strong in 2Q. We knew that sales would be absolutely incredible, but the question was exactly how many dollars would be spent to earn the revenue. The y/y improvement in gross margin shows that Smith and Wesson can efficiently run its businesses at near full production capacity. The boom in gun demand has been running along for months, so Smith and Wesson wasn’t simply clearing inventory in 2Q. In fact, the company’s inventory hit a record high in 2Q17, likely in anticipation of a fresh round of post-election panic buying. Fortunately or unfortunately, depending on your perspective, Trump instead sent Clinton into retirement. Moving $116.5M of inventory will be Smith and Wesson’s next objective, and they’ll need to do so without help from the man that firearms retailers call the best gun salesman ever: President Barack Obama. (Ironic, no?)

Black Friday gun background checks, however, broke a record. 185,713 transactions were completed by the FBI on Black Friday alone, at least temporarily disproving the thesis that a Trump win would dampen gun sales. (Perhaps fear-driven demand was replaced by celebratory purchases? That is our current thesis. If you have a better theory, call us.) The National Shooting Sports Foundation also reports that November background checks rose 16% y/y (adjusted) and that handgun checks spiked 12% y/y. Checks jumped 17% for rifles. December’s background check data will be exceedingly interesting, but even if gun demand does normalize, Smith and Wesson’s diversification efforts will help to reduce revenue volatility. In 2Q, the company closed $178.1M of acquisitions not related to gun manufacturing. (Crimson Trace does, however, make firearms accessories.) If you look at Vista Outdoor (NYSE: VSTO), you’ll see a template for Smith and Wesson’s future, following the further acquisitions we anticipate by 2020. (A fresh $32.3 deal was announced in November.)

Worst News

Currently, Smith and Wesson is still, well, Smith and Wesson with a few small operations tacked on. Vista Outdoor is an outdoor conglomerate with significant gun and ammunition businesses, however the company’s other activities are providing solid revenue and profits. In Vista Outdoor’s most recent quarter, Fiscal 2Q17, sales of products not directly related to guns totaled almost 47% of corporate revenue, and the businesses have been pleasantly profitable. For Smith and Wesson, non-firearms sales are less than 17% of revenue and these businesses are losing money. Thus, the company’s strength depends on the Firearms segment, and the firm cannot rely on support from selling diverse products. Should gun demand taper next year, as we still expect, Smith and Wesson will not be able to enjoy as much protection from declining gun sales as Vista Outdoor. That is a fact.

Smith and Wesson intentionally increased its inventory this year. On the 2Q earnings call, CEO James Debney stated, “Over time, as our production output and revenue has increased we are focused on increasing our inventory to optimize distribution of our product with independent retailers in support of our take market share strategy. This is especially important at this time of the year when we move towards the holiday season and distributor shows.”

That’s all fine and well, but the company might regret the decision to hold so much inventory with Trump about to take office. Guns won’t be hoarded like soup before a blizzard under President Trump because he’s a gun-carrying NRA member with no interest in gun control. After he’s done filling at least two, and potentially three or four, seats on the Supreme Court, we can safely say that any real gun control measures won’t be happening for a very long time. Long-term that’s good for Smith and Wesson, however it’s a short-term negative. Had Clinton won the election, firearms-buying could have reached a truly crazy pace. Guns would be the new gold under Clinton. That’s obviously an academic point now, though.

The Forward View

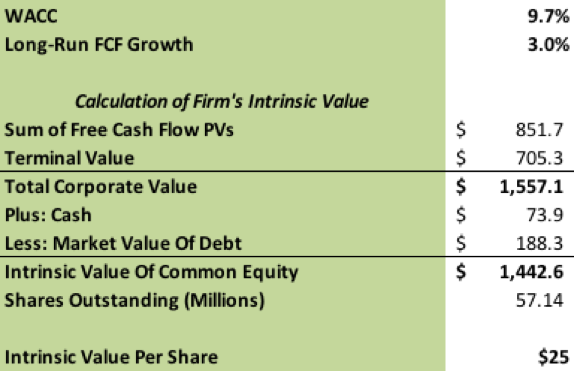

Forward View is reiterating our Buy rating on Smith and Wesson, but we’re trimming our target price to $25. (Our earnings estimates have been cut, too.) Why the $5 reduction in our target? Two reasons are key:

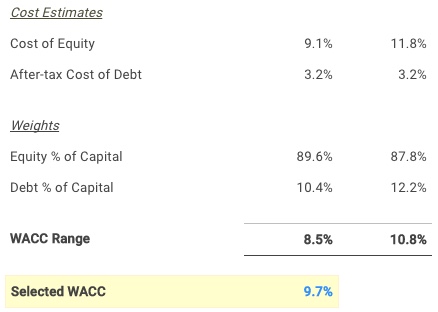

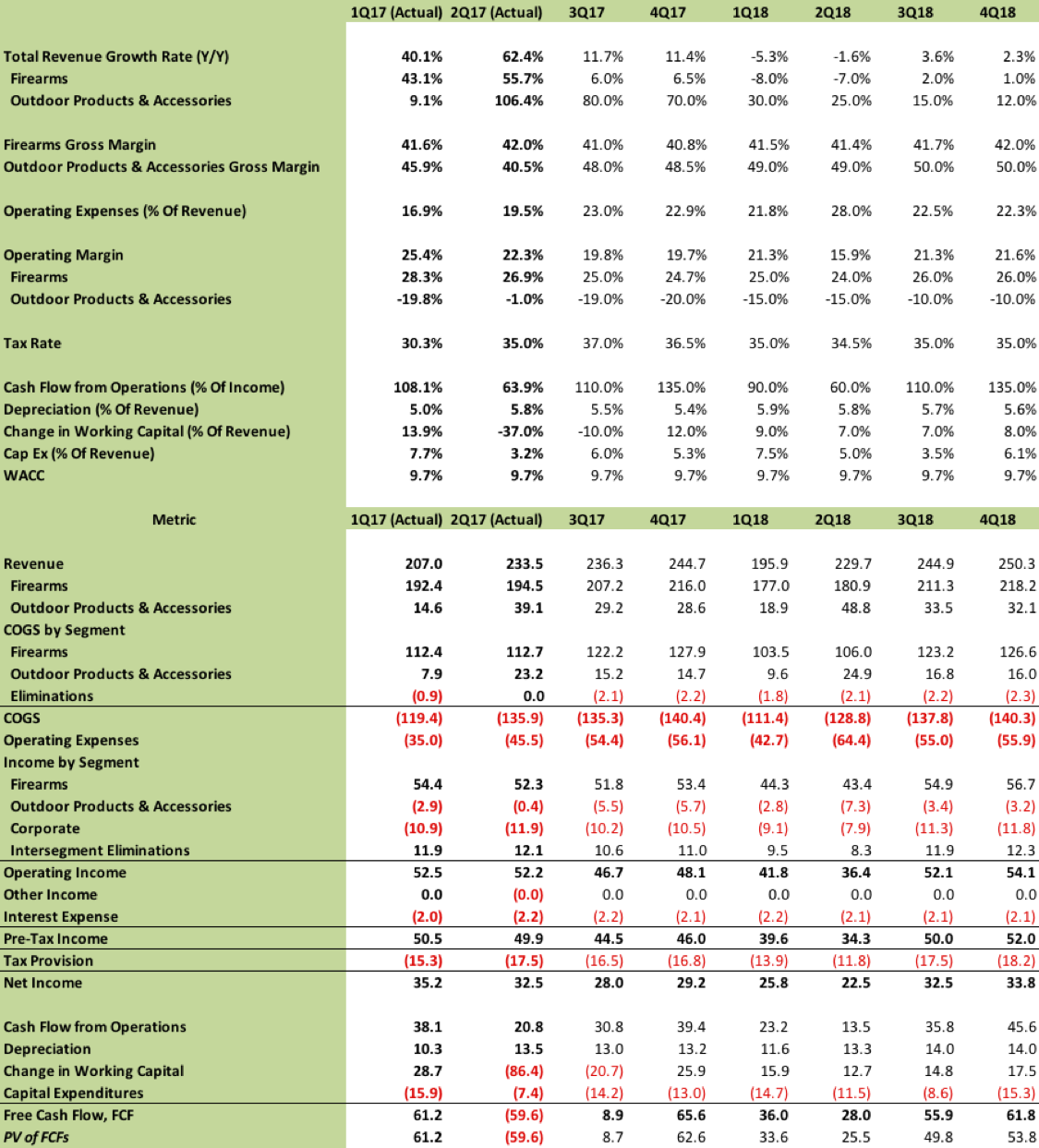

- As acquisitions continue, Smith and Wesson is likely to tap into the company’s new $500M credit facility. The fresh facility is more than twice as large as the old one. Smith and Wesson didn’t seek the financing just to create a press release. They’re going shopping! Increased leverage in the future, as we now forecast, pushes up the WACC/discount rate to 9.7%. That higher rate lowers the company’s DCF valuation.

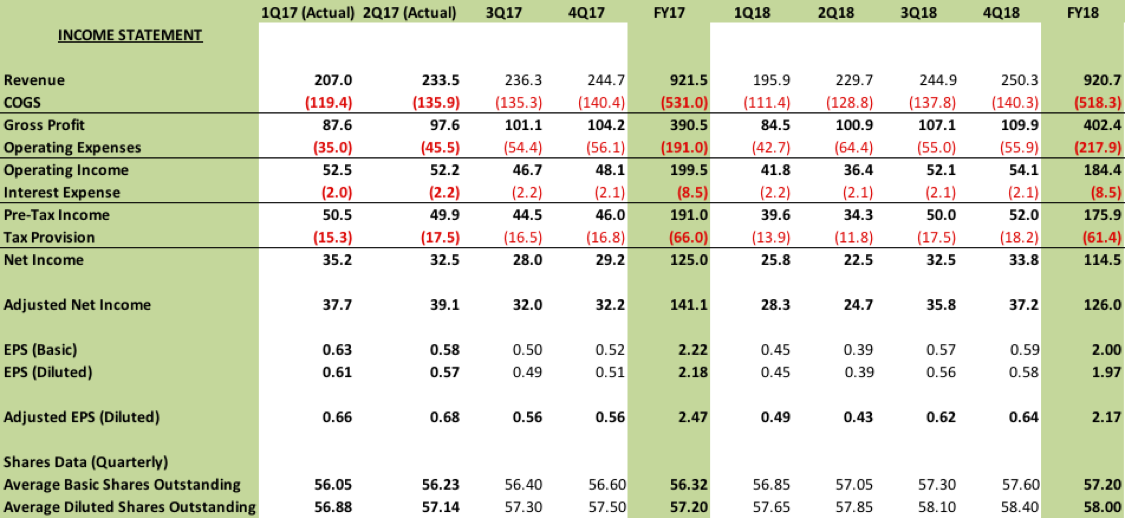

- Smith and Wesson’s fresh guidance is based on significantly lower margins than we saw in 2Q. We believe that the guidance is likely conservative, but any price increases the company enjoyed earlier in the year aren’t sustainable. Revenue is also likely to be slightly lower in FY18 than in FY17. Thus, our modeling must account for lower margins in the future.

Smith and Wesson remains a Buy at the current price, though. With a TTM P/E ratio at just over 9, vs. competitor Sturm Ruger’s (NYSE: RGR) P/E at almost 11.6, Smith and Wesson is the cheaper gun stock. Sturm Ruger is also entirely undiversified. If gun sales do drop dramatically, Smith and Wesson is somewhat insulated, and that level of resilience will be developing further in the coming year. Wall Street isn’t sure what to do with a growth stock that just became a value investment, but we do: Buy it. This is a great opportunity for long-term investors to build a position in a solid company. Don’t miss it.

Earnings Estimates & Valuation

Quantitative Analysis

Analyst Certification: I, Nathan Yates, certify that the views expressed in this publication accurately reflect my personal views about the subject companies and their securities. I ...

more