Small Sentiment Shifts

The S&P 500 has returned to and held up around record highs in the past week, and bullish sentiment has risen hand in hand. AAII’s weekly survey of individual investor sentiment rose from 43.57% up to 46.08% this week. While still off the peak of 55.84% from mid-November, bullish sentiment remains elevated relative to other readings not only this year but throughout the history of the survey. Given the bear market and a lack of recovery in sentiment until after the election was over and concrete vaccine news made headlines in November, the average reading on bullish sentiment in 2020 was 33.87%. That compares to the historical average over the life of the survey of 37.95%.

Last week saw bearish sentiment make a new low as it fell down to 21.99%; the lowest reading since the first week of 2020. That reversed this week as bearish sentiment rose nearly 5 percentage points to 26.8%. Just as with bullish sentiment, even off of more extreme levels of the past few weeks, the current level of bearish sentiment is still low when compared to where bearish sentiment has been for most of the year. This year, bearish sentiment averaged a reading of 38.83%, 12 points above current levels. As shown in the second chart below, that is the highest yearly average of bearish sentiment since 2009, and before that, 2008 and 1990 are the only years that have averaged higher readings of bearish sentiment.

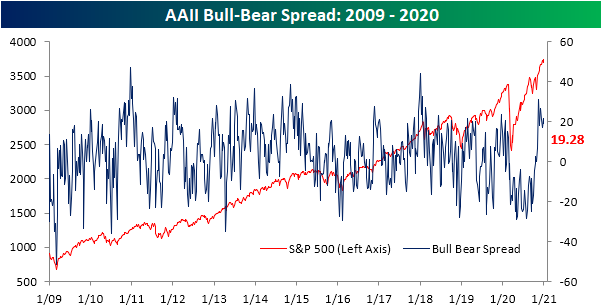

It is more of the same with the bull-bear spread. At 19.28, the sentiment still largely favors bulls though not to the same extreme as November. Current levels are not just well above those observed for most of the year, but also stand in the top decile of readings of the past five years’ range.

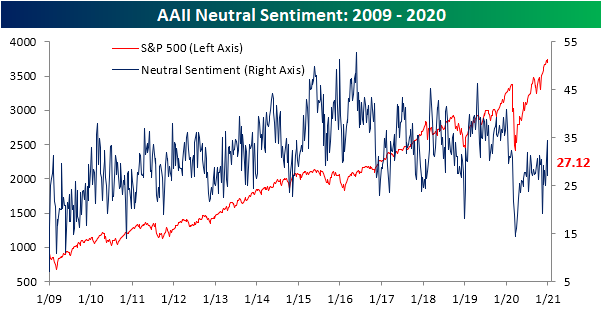

After rising back to levels not seen since the beginning of the year over the past couple of weeks, neutral sentiment saw a big drop this week of more than 7 percentage points rising from 34.4% to 27.12% which is just about in line with the average reading for 2020. That means that in the most recent week, investors appear to have become more polarized in their view of the markets, though, overall attitudes are more optimistic than pessimistic.

Click here to view Bespoke’s premium membership options for our best research ...

more