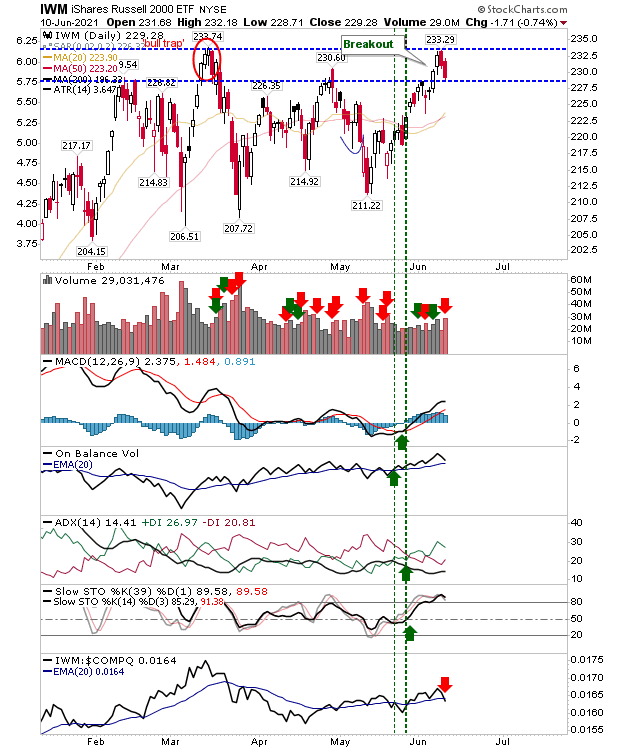

Small Caps Confirm Support With Test

A bit of a mixed bag with the Russell 2000, having enjoyed prior strength, now finds itself in the process of backtesting support - with the $229 level key. Volume rallied to mark distribution to go with a relative underperformance to the Nasdaq. Strength in the Russell 2000 is key for the broader averages but we need to see a bounce here if we are not to see a return to the prior trading range (of March-May).

The Nasdaq edged a little higher as it rides along former support turned resistance. Just as the Russell 2000 is at a decision stage, so is the Nasdaq where a strong gain will have the dual benefit of clearing both boundary resistance and negate the April 'bull trap'

The S&P edged a breakout on higher volume accumulation with technicals in good shape. The contrast between the gain in Large Caps, and the loss in Small Caps, helped reverse some of the relative underpeformance versus the Russell 2000 - but not enough to trigger a 'buy' signal.

With traders buying into defensive Large Caps we may be seeing some hesitancy to push growth stocks (Russell 2000) to new highs. However, this looks like a temporary pause and growth stocks will again take a leadership role in this rally.

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more