Slim Chance Of NVDA’s Growth Slowing Down

With 2017 International CES complete, investors are looking for hints that can help provide excellent fundamental knowledge about the future of a company. This year's biggest product innovations that placed the most interest towards consumers are virtual reality, autonomous vehicles, wireless functionality, and artificial intelligence. With such an exciting year in regards to innovative technology, investors can gauge whether some products will do well or not and apply it to its trading decisions. NASDAQ Composite (^IXIC) for the past five years has outperformed other indices and continues to show consistently substantial interest over the years. That is why new product innovations can potentially play a vital role in future performance. Technology and services are responsible for a remarkable amount of our GDP. Continued growth in jobs within the technology sector may indicate that the technology growth sector will not slow down anytime soon.

Artificial intelligence took the main stage and eclipsed all other innovations for CES this year. The spotlight on AI has illuminated how far technology has reached up to this point. The possibilities of new applications and integrations with AI are endless and can reign in a new Gartner Hype Cycle in the markets. It would make AI as the new innovative technology of our time. The previous Gartner Hype Cycle was during the 3D printing revolution. 3D Systems Corporation (NYSE: DDD) is a perfect example. One could just look at a weekly chart and see the massive incline following a decline with equal magnitude. With the market seeking a new sector to come on board, artificial intelligence seems to fit the category flawlessly.

(Click on image to enlarge)

With the possibility of Artificial Intelligence as the next new leading sector, investors should take a look at companies that are investing and inventing artificial intelligence technology and applications. A lot of enterprises are investing in the hardware to use. Some companies include Amazon.com and Whirlpool. However, I am most interested in NVIDIA Corporation (NasdaqGS: NVDA) as the best possible prospect which could have the most influence in regards to artificial intelligence beginning to emerge in the markets. Besides the exciting events that are currently unfolding, NVDA has an attractive fundamental background in which investors will inevitably be unable to neglect. NVDA's current revenue model consists of four segments; Graphics Processing Unit (GPU), Consumer Products Business (CPB), Professional Solutions Business (PSB), and Media and Communications Processor Business (MCP). Whether AI will act as a supplement or as a new segment of an existing component for revenue production remains unanswered.

Exceptional Fundamentals

It is hard not to like NVDA as a growth opportunity with its fundamentals. The closest competitors for NVDA are Intel Corporation (NasdaqGS: INTC) and Advanced Micro Devices, Inc (NasdaqCM: AMD) which as of lately has had an advantage regarding business growth. It is directly related to AMD and INTC investing in other revenue streams besides graphic chips. While NVDA so far has only focused on graphic chips caused them to fall behind its competitors. With NVDA's artificial intelligence rolling out, we could expect that NVDA is trying to branch out to other revenue streams as well to keep pace with its competitors. It can also be what the company needs to gain even more interest in the business's activities and can lead investors to consider them as a long-term investment.

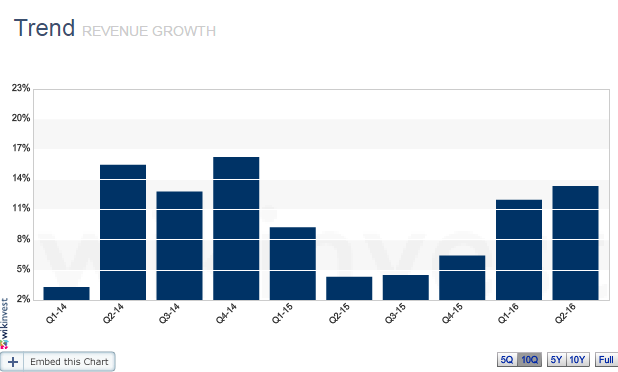

Although they are currently behind their competitors, its fundamentals are showing otherwise. Current revenue for 2016 is at $5.16 billion which is the median compared to others in the industry/sector. NVDA surpassed AMD regarding income. NVDA's revenue growth and net income growth are 9.2% and 7.6% respectively, showing massive growth compared to other high-end graphic chip producers.

(Click on image to enlarge)

Lack of Financing Investments

The balance sheet is a bit more complex which may be sending some mixed signals. Currently, its D/E ratio is less than one sitting at .694. Its interest rate coverage ratio is 17.9 which is high and above average compared to its competitors. Cash per share is at 8.90 which is also massively high which begs the question why are they not taking advantage of financing more investments?

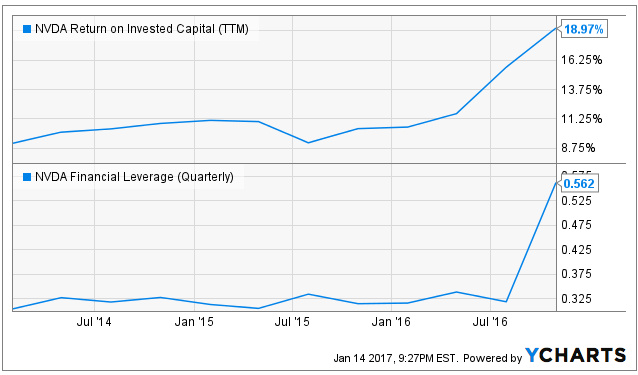

NVDA's ROE and ROA are 15.4% and 10.1% respectively showing impressive returns on its investments. With such impressive returns, I would expect NVDA to take advantage of financing more capital for investments since its D/E ratio, and interest rate coverage ratio illustrates a very safe financial standing which can weather extreme bearish markets and economic outlooks. The return on invested capital (ROIC) is at 18.97%, and NVDA is more than capable of taking on more financed debt so that they can make use of their financial leverage.

NVDA does have dividends with a current yield of .4% which is average and nothing special. Dividends are paid quarterly and have been consistent with paying dividends over the years without any disturbance. However, its payout ratio is only 14% making it an excellent candidate for a dividend price increase. Additionally, the payout has been decreasing due to EPS quarterly growth increasing 118.5%. I believe it is in NVDA's best interest to take on more financing with their investments to make use of its high ROE and ability to take on more debt without hurting the financial end of the business. Artificial intelligence seems to be the route NVDA wants to take so that they could branch out of their average revenue production model. While most of their income comes from PC gaming video cards, the company has now set their eyes on utilizing artificial intelligence for self-driving technology.

However, the payout has been decreasing due to EPS quarterly growth increasing and 118.5%. I believe it is in NVDA's best interest to take on more financing with their investments to make use of its high ROE and ability to take on more debt without hurting the financial end of the business. Artificial intelligence seems to be the route NVDA wants to take so that they could branch out of their regular revenue production model. While most of their income comes from PC gaming video cards, the company has now set their eyes on utilizing artificial intelligence for self-driving technology.

Currently, NVDA has created a supercomputer that uses the AI technology named "Drive PX 2", which allows NVDA to capture 1.8 million data points per second while simultaneously processing the information for the vehicle to avoid complex obstacles. This news should wake up any investor regarding figuring if growth will persist with NVDA. While the company is producing technology for self-driving cars, Alphabet Inc. (NasdaqGS: GOOG) and Apple Inc.(NasdaqGS: AAPL), is in the process of creating self-driving cars. It is evident to say that these companies will be using NVDA's technology which can drive NVDA's sales to new highs. With a significant percentage of earnings held back, and revenue growth to continue to rise, we can lean more towards expecting a dividend increase as well as aggressive investment strategies in the upcoming year. It is significant to NVDA if they want to continue to be on track to be a leader in artificial intelligence chip processing business.

Current Valuation is High but Has Merit

With NVDA growing at such a fast past in the last two years raises questions as to whether the company's current valuation is rather high. The issue that I am having is determining whether the expansive growth is overhyped or only continuing the sentiment as a good growth stock. The EV/EBITDA is currently at 69.8 and is high compared to its competitors. While this shows that NVDA is a bit expensive, it can also mean that they are growing at a faster pace than others within the same sector. The P/E is at 81.7 which is 83% higher than all its competitors, giving sentiment that the stock is trading way over its earnings price making it seem overvalued. To better determine how I should interpret the P/E data is by looking at the PEG ratio. I would like to see if its P/E ratio is trading at a discount to its growth rate making it deem-able as a bargain. To get a deeper evaluation on NVDA, I wanted to look at the PEG ratio (TTM) as well as the forward PEG of one year. The ratios respectively are .693 and 1.111 which are surprisingly decent compared to its P/E valuation.

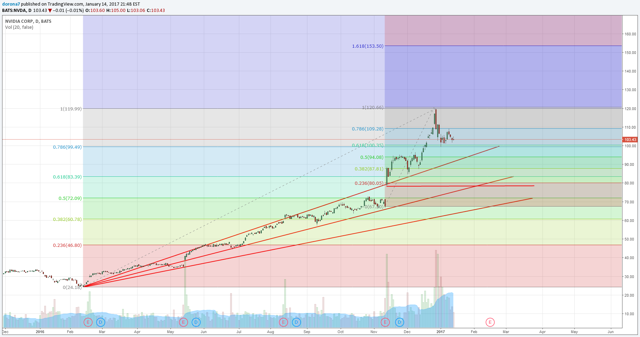

I believe the PEG ratio to be at a decent level compared to the type of growth it has seen in the past. Even though NVDA is justifying its current price levels, I still firmly believe that an investor should expect a pull back to better price levels before entering long-term. To accommodate some real price levels, I turned to the daily and weekly charts. After plotting Fibonacci retracements on the daily chart, I found one ideal price levels in which I consider to be a good place to buy. The price level is $84.00 which is lying above a gap fill below at the .618 retracement level.

(Click on image to enlarge)

I consider $72 to be an area where NVDA can begin to be regarded as a bearish stock if it can break below the .5 retracement level and through the gap level right at the round level number of $72 which makes it a great stop price level. I do see a more risky version of a price level to get in which is at $100 with stops near $99.49 area. Analyst's estimates for NVDA are showing an average target of $100 and a high price target of $129. The most important thing to follow is to make sure that NVDA's pull back is due mainly to market risk alone and not firm-specific, allowing an investor to continue to go off the evaluation alone on NVDA. If NVDA does stay its course, we can expect to see target prices around $130 to $145 which is less than what Fibonacci's are showing on the hourly chart.

Finishing Up

NVDA has a lot of room for growth and holds many cards on the table in regards to the multiple choices they have to increase revenue and all around the performance of the company. We can be confident that NVDA can take a few punches and bounce quickly from any brief market declines. Whether NVDA will increase dividend payouts or finance more investments is up in the air. We can see that NVDA's dividend growth has been on the rise with consistency in 2016 giving more credibility to the ability of another dividend price hike. The potential for a buyback is also a possibility in which investors should not neglect. Overall, I am beginning to see investors gain interest on NVDA, but I believe NVDA to be still a great opportunity that has more potential to move to the upside in 2017. Additionally, I feel that NVDA is still neglected by the majority and investors still have a good shot at getting good price levels in which they can manage long-term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.