Signs Of A Fake-Out Rally?

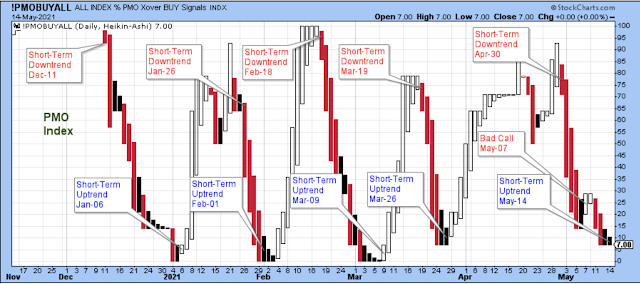

Last week, I said that a new short-term uptrend had started on Friday, May 7, but that was a bad call. However, a week later on Friday, May 14, a new short-term uptrend has started - although it is not yet confirmed by some of the important indicators. In other words, watch for signs that this is another fake-out rally.

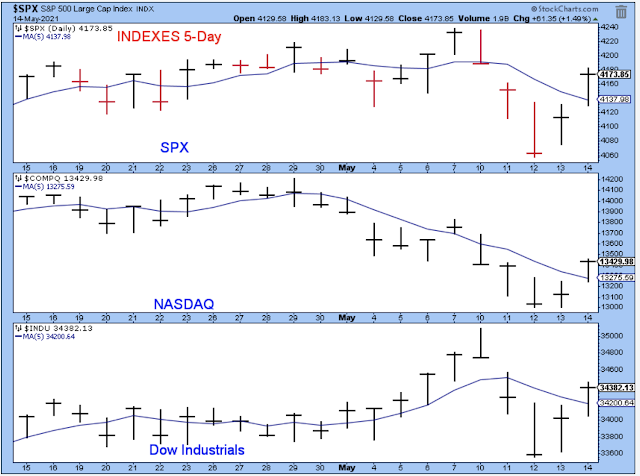

On Friday, May 14, the major indexes all closed above their five-day averages, which is the first requirement of a new uptrend.

Looking back to Friday, May 7, you can see strong, new high closes for the SPX and the Dow, but a weak doji close well below a new high for the Nasdaq. It is very difficult to believe a market is trending lower when two of the three averages are closing at new highs, but then again, such weakness in the third average is a bearish divergence. So, it was a judgment call.

I was very surprised by the negative reaction on Wednesday to the inflation report. I was expecting the market to be prepared for it. On CNBC, the point was made in the fall of 2020 that people were buying the post-COVID-19 stocks in anticipation of reopening, which implies higher prices, doesn't it? But it doesn't matter, my job as a trader is to just roll with whatever the market has to offer.

I was happy with the way I executed my trading plan during this past week (after being unhappy with myself a number of times during downdrafts earlier this year and last year). I just held onto positions unless they stopped me out, and fortunately only a couple triggered sells.

In the past, I would have moved aggressively to cash and waited for the next signal to buy, but I just don't have it in me anymore to trade so frequently and to get in and out of the market like that.

The triggered sells were in the home building group, and it surprised me that these stocks took such a hit. But now it is making more sense, considering my positions were extended a bit and the higher cost of materials, labor, and interest payments created a headwind for earnings. My guess, though, is that the selling in this group is temporary. Maybe people needed an excuse to take profits. I'll get back in if the relative strength of the group tells me to.

Back to the short-term trend, the number of new lows settled down on Friday, but it is still a bit too high, which means to me that the trend is not yet confirmed and it is too soon to be all in. The number of new lows on the Nasdaq should close well below the 50-level before the new uptrend is confirmed.

I'm including this chart to provide some perspective about how far the market has come from the election in early November of last year. It's quite the rally. I am hoping to continue to participate in the uptrend for as long as it lasts, and I am also hoping to be out when it falters. Additionally, I am not considering any purchase to be "long-term" with the market so extended, no matter how good the story or earnings in the stock.

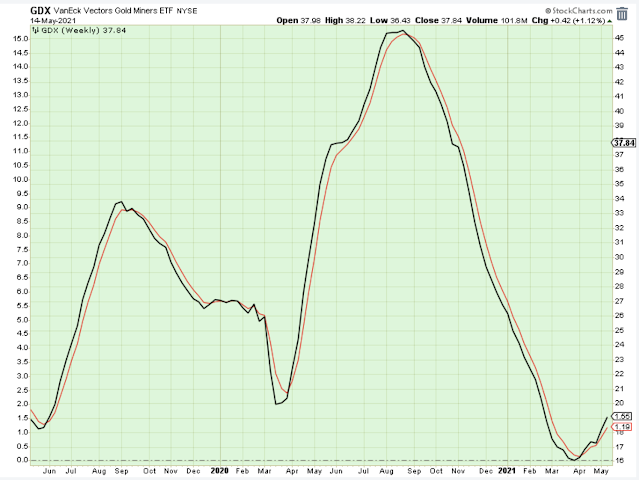

Gold mining is the only industry that I track that is turning up off of the lows like this. Everything else that is turning up is off extended trends. I like the miners again, but I am also ready to be stopped out of any position that isn't working.

Outlook Summary

- The short-term trend is up for stock prices as of May 14. This is where the change in trend began.

- Contrarian sentiment is unfavorable for stock prices as of Nov. 14.

- The economy is in expansion as of Sept. 19.

- The medium-term trend for treasury bonds is down as of Oct. 10 (prices lower, yields higher).

Disclaimer: I am not a registered investment adviser. My comments reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, sell, ...

more