Should We Trust The Thrust (Again)?

As a rules-guided money manager, I scan hundreds of indicators each week. I look at market fundamentals such as monetary conditions, earnings, economic data, and inflation expectations. In addition, I look at a myriad of technical indicators as well as "external" indicators such as investor sentiment and valuations. I combine indicators and models to provide various signals and trading systems. In short, my thinking is that if I can stay in tune with the weight of the evidence from a vast array of indicators, market drivers, and models, I am less likely to get an important move in the market wrong. More importantly, such an approach is designed to remove as much emotion from the analysis as possible from the decision-making process.

One of the most important lessons I've learned over the past 34 years is that times change. Market drivers change. Rules change. Securities change. Costs change. And indicator effectiveness can change. It is for this reason that I constantly monitor whether important indicators are "working" as expected.

An example of an indicator's effectiveness failing would be the put-call ratio. Invented by the late Marty Zweig in the mid-1980's the P/C Ratio was a wonderful stock market indicator. At that time, hedging with options wasn't a "thing" and as such, looking at the percentage of puts being bought versus the percentage of calls provided an important message. However, as I mentioned above, times change. In this case, the advent of computers allowed significant advancements in the investing world and the use of options - for many and varied reasons - exploded over the years. The end result was the death of the P/C Ratio as an important stock market indicator.

However, I am happy to report that many stock market indicators remain tried and true in their ability help us stay on the right side of the market's prevailing cycle. One such group of indicators has been dubbed "breadth thrusts" by the renowned Ned Davis of Ned Davis Research Group.

The idea is that when the market surges (in either direction) and the market internals become extremely one-sided, a "thrust" signal occurs. And the cool part is that since the early 1970's such "thrust" signals have indicated that above-average returns in the stock market were likely for the next week, month, and six- and twelve-month periods.

Although the advent of high-speed trading, the use of ETFs, the elimination of the uptick rule, etc., have increased the occurrence of these signals, the effectiveness from a big-picture standpoint has remained impressive.

For this reason, I maintain a model that is comprised of six independent thrust indicators. The model components include a ratio of 10-day advances versus 10-day declines, 10-to-1 volume days, the percentage of stocks above/below their 10- and 50-day moving averages, a deviation-from-trend indicator, and a measure of 3-day price movement. All are as old as the hills - so there is nothing fancy happening here.

Each of the indicators provides its own signal and I view the hypothetical history of each to be quite strong. But I've found that when the majority of indicators in my combination Thrust Model are positive, it is a good idea to, in the words of Ned Davis, "trust the thrust."

The reason I decided to highlight this set of indicators here is that a fresh buy signal was given by the 10-day advances vs. declines indicator on 12-Feb. To be clear, my model has been on a buy signal since last spring. But since these indicators can be seen as an "all clear" signal for the ensuing 1-, 3-, 6-, and 12-month periods, I thought it was worth highlighting the new buy signal.

In looking at this indicator, we find that the history of the hypothetical signals is definitely worth noting. For example, one month after the signal was given, the S&P 500 would have been higher 81% of the time. Three months later, stocks were up 79% of the time. Six months: 85%. And one year later, the market was higher 98% of the time (49 out of 50), with the lone losing signal occurring in January 1987.

So, while there can be no denying that the stock market is overbought, that sentiment borders on exuberant, and absolute valuations are extreme, I'm of the mind that investors should remain optimistic about the intermediate-term prospects of the market. Sure, a correction of 5-10% could occur at any time - because history shows that these "garden variety" pullbacks occur with regularity.

But the point is that with a fresh "thrust" signal, an uber-friendly Fed, another couple trillion in stimulus coming, the economic data exceeding expectations, and vaccinations happening, I believe a "buy the dips" and "follow the leaders" strategy remains appropriate.

Now let's turn to the state of my favorite big-picture market models...

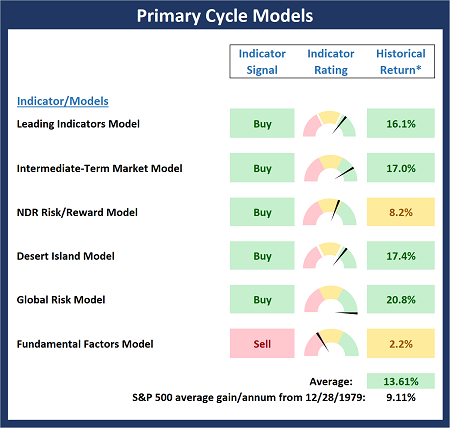

The Big-Picture Market Models

There are no obvious changes to report on the Primary Cycle board this week. However, the Risk/Reward Model did slip a bit, which makes sense given the state of the current environment. As such, a pullback/correction should not come as a surprise at some point in the not too distant future.

(Click on image to enlarge)

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

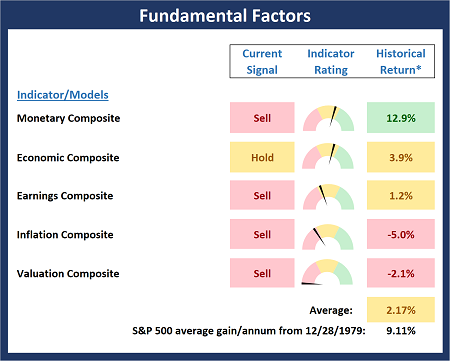

Fundamental Factor Models

There are also no changes to the Fundamental board again this week. As I have been saying, I believe the message from the Fundamental board suggests that the risk is elevated.

(Click on image to enlarge)

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

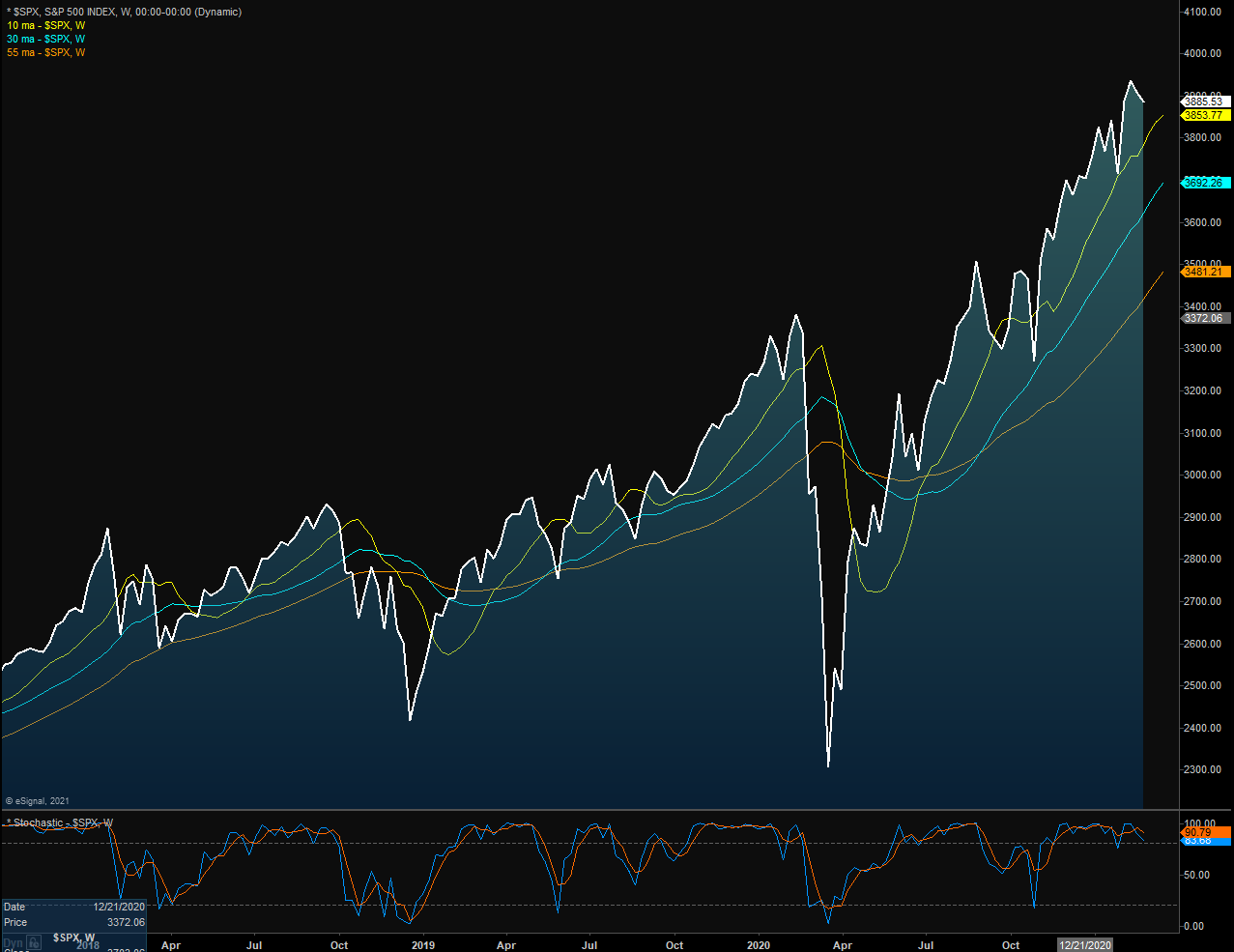

The Cyclical Market Cycle

Below is a weekly chart of the S&P 500 illustrating the current cycle, which we estimate began on March 24, 2020.

S&P 500 - Weekly

(Click on image to enlarge)

The Secular Market Cycle

Below is a monthly chart of the S&P 500 Index illustrating the current cycle, which we estimate began on March 9, 2009.

S&P 500 - Monthly

(Click on image to enlarge)

The opinions and forecasts expressed herein are those of Mr. David Moenning and may not actually come to pass. Mr. Moenning's opinions and viewpoints regarding the future of the markets should ...

more