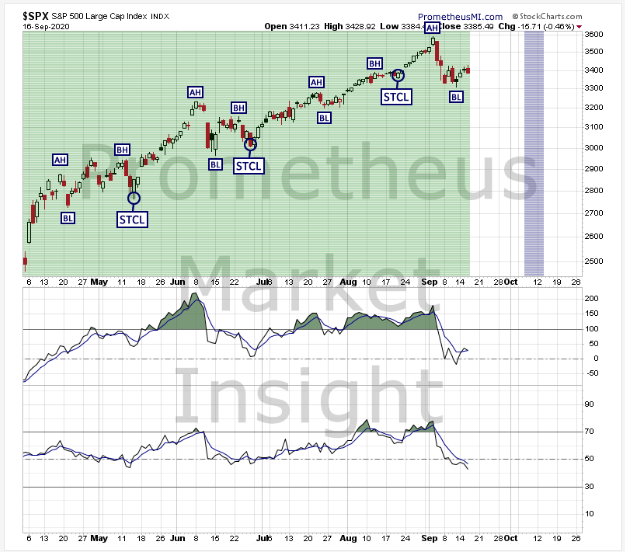

Short-Term Forecast For Wednesday, Sept. 16

The character of market behavior during the last 4 sessions indicates that the beta low (BL) of the current cycle likely formed on September 11. We are 4 sessions into the beta phase rally of the short-term cycle that began on August 20.

(Click on image to enlarge)

An extended beta phase rally that moves up to new highs would reconfirm the current bullish short-term trend and forecast additional gains. Alternatively, a quick reversal followed by an extended beta phase decline that moves well below the last short-term low at 3,310 would signal the likely transition to a bearish short-term trend.

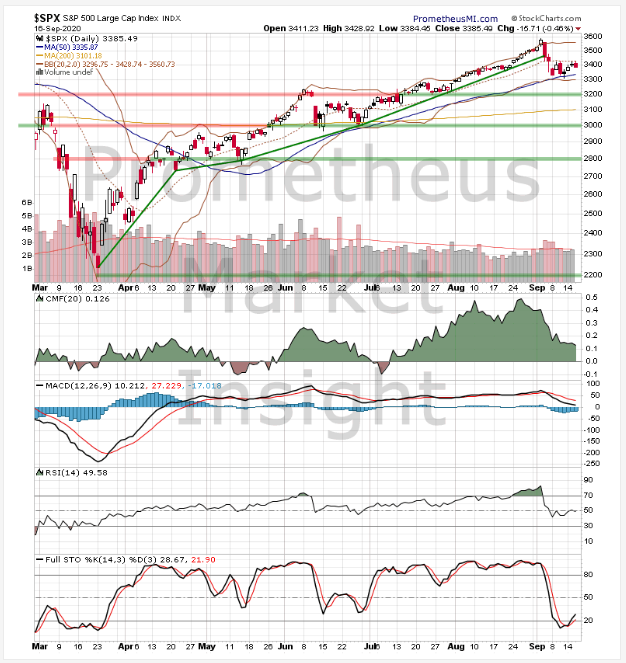

S&P 500 Index Daily Chart Analyses

The following technical and cycle analyses provide short-term forecasts for the S&P 500 index.

Technical Analysis

The index closed moderately lower today, moving down toward recent short-term lows below previous highs of the uptrend from March. Technical indicators are effectively neutral overall, suggesting that direction is in question.

(Click on image to enlarge)

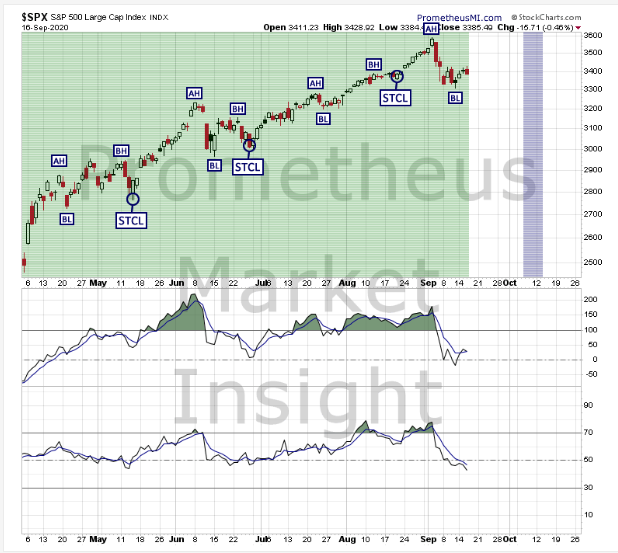

Cycle Analysis

The character of market behavior during the last 4 sessions indicates that the beta low (BL) likely formed on September 11. We are 4 sessions into the beta phase rally of the cycle following the short-term cycle low (STCL) on August 20. The beta low (BL) may have formed on September 11, although we would need to see additional strength to confirm that development. An extended beta phase rally that moves up to new highs would reconfirm the current bullish translation and forecast additional gains. Alternatively, a quick reversal followed by an extended beta phase decline that moves well below the last BL at 3,310 would signal the likely transition to a bearish translation. The window during which the next STCL is likely to occur is from September 30 to October 20, with our best estimate being in the October 7 to October 13 range.

- Last STCL: August 20, 2020

- Cycle Duration: 19 sessions

- Cycle Translation: Bullish

- Next STCL Window: September 30 to October 20; best estimate in the October 7 to October 13 range.

- Setup Status: No active setups.

- Trigger Status: No pending triggers.

- Signal Status: No active signals.

- Stop Level: None active.

(Click on image to enlarge)

Short-term Outlook

- Bullish Scenario: A close well above the middle of the Bollinger bands at 3,429 would predict a return to the previous short-term high at 3,581.

- Bearish Scenario: A close well below the 50-day moving average at 3,336 would reconfirm the downtrend from early September and forecast additional losses.

Both scenarios are equally likely.